- you have no idea what a cryptocurrency is – 0.1% probability;

- you have cryptocurrency – 50% probability;

- you want to have more cryptocurrency – 99.9% probability.

Close to reality? Then this article is for you. It is about how to make cryptocurrency. We prepared this overview of some methods to make cryptocurrency in order for you to have more coins in your digital wallet.

However, how urgent is this subject after the crypto-boom of December 2017 – beginning of 2018?

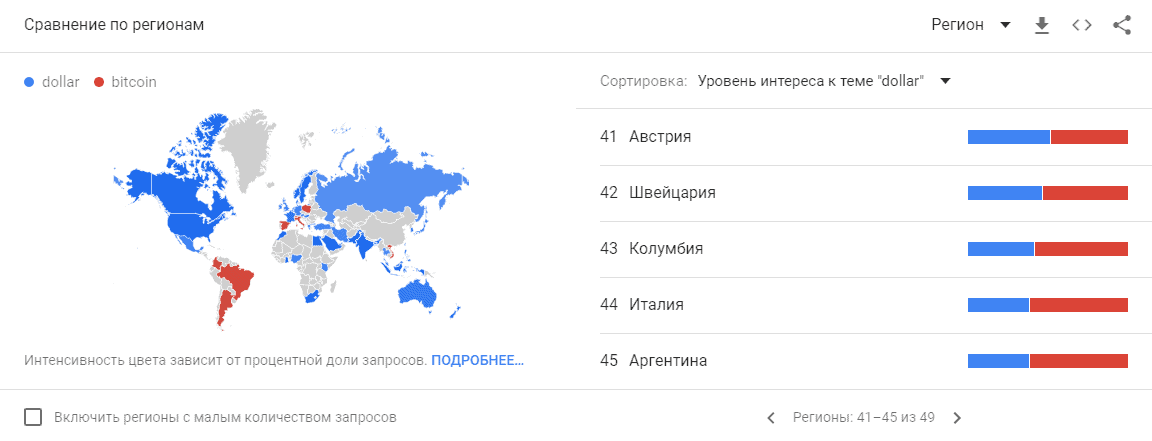

We are prepared to assume that it is urgent. The block-chain technology develops and the use of cryptocurrencies, as a way of payment for goods and services in the era of digital globalization, will be in demand in the long run. At the moment of writing this article (the fall of 2018), the dollar is behind the bitcoin in request frequency in a number of countries (such as Russia, Switzerland and Italy). According to Google Trends, the bitcoin already overcomes the dollar in the Latin American countries.

“I invested into the bitcoin, because I believe in its potential. Its ability to change the world of payments inspires.”

Lionel Messi, Mike Tyson, Ashton Kutcher, Paris Hilton and other celebrities invested into cryptocurrencies. So, how is it possible to make bitcoins?

Cryptocurrency is a digital money. Some methods are similar to making usual (fiat) money. Some methods are specific. But you will not find a fast and easy way to make a lot of cryptocurrency, because it is difficult to make money. For it is money.

10 ways to make cryptocurrency

Let us consider the most popular ways to make cryptocurrency.1. To buy a mining farm.

A mining farm is a tool for mining cryptocurrencies.The price of simple mining farms starts from several hundreds of dollars. The cost of the most expensive ones goes to infinity. For example, a mining farm in the Chinese city named Ordos takes 8 buildings, consists of 25 thousand of processor units, which conduct mining 24 hours a day with a powerful cooling system. This farm consumes electric power on USD 39 thousand a day.

Is it possible to mine bitcoins at home? In principle, yes. According to approximate calculations, a properly adjusted ASIC farm, which costs USD 300, will mine cryptocurrency on USD 1 per day. Taking into account sharp cryptocurrency cost hikes, the farm payback period could be from 6 months to 2-3 years. Any person can decide by him- or herself whether to put at home a noisy box, which requires fast and uninterrupted Internet access and consumes a lot of electrical power.

2. Cloud mining.

If you do not plan to turn one of your house rooms into a server room, this way is a better choice. A standard cryptocurrency mining envisages that you rent computing capacities of a big farm, which is physically located far away. Such services are provided by genesismining.com, hashing24.com, hashflare.com and nicehash.com.And how much? To see whether it is worth powder and shot, there are calculators for calculating mining profitability and here are some of them:

- com/cryptocurrency

- com/ru/bitcoin/

Let’s see. You can buy a 5 year bitcoin mining contract for USD 285 at Genesis Mining. Under a contract you get 1TH/s of hash-power. With this power you can count on 0.23 milli-bitcoin or USD 1.5 a day (taking into account technical servicing fees). In other words, the contract will pay back in 190 days and you will be receiving profit into your wallet during the rest of 5 years (5 years minus 190 days). This is in case the mining service will not stop, for there have been cases of fraud in this market (as it was with HashOcean and Bitcoin Cloud Services).

3. Blogging.

The Steemit blog platform encourages its participants paying them rewards in the form of tokens. Thus, one can make cryptocurrency publishing articles in a Steemit blog. Or just leaving comments to somebody else’s publications. As you understand, this is not the way to become wealthy.4. Faucet web sites.

These are the web sites, which give cryptocurrencies away free of charge. Once an hour or oftener. Yes, absolutely free. Even such things happen in the crypto-world. These faucet web sites are very popular and, attracting visitors by free coins, they make money on advertising, partnership programs and some other ways. Learn more visiting one of the following web sites: freebitco.in, ethereumfaucet.info, freecardano.com.5. Airdrops.

The original term means dropping something from an aircraft. This dropping takes place when a new cryptocurrency is introduced and a team of developers attracts attention of the society to this event through giving away new coins. Usually, some simple action is required for this – to install some software on your computer or to open a wallet. To be aware of events in the Airdrop world, visit Aidropalert.com and airdroptracker.co.6. Bounty companies.

Similar to Airdrops, but with a big inclination into the social marketing. You can make cryptocurrency if you have a popular blog, vlog or social network account with a big number of subscribers. Taking part in a bounty company, you, as a rule, distribute advertising information among your subscribers and get reward for this. As an example, one of the bounty platforms: bounty0x.io.7. Micro-tasks.

Micro task web sites allow users getting cryptocurrency as a payment for fulfillment of small tasks. The tasks may vary from writing or editing articles and polling to viewing videos, clicking ads banners, etc.You cannot make much cryptocurrency this way, but it is a good introduction into the technology. Micro tasks give you a possibility to learn how to use your wallet, send and receive cryptocurrency and interact with the block-chain with a low risk. An example of a micro task web site: btcclicks.com. Also, Earn.com is worth looking at.

8. Fitness.

Probably, the most unusual way to make cryptocurrency. The sweatco.in web site gives away coins in exchange of steps you make when walking. The more you walk, the more coins you get. Unfortunately (or, maybe, fortunately?), this service is available in some countries only.9. Freelance.

This way of making cryptocurrencies is for programmers, SEO specialists, content managers, translators and designers. A standard freelance exchange, but they pay for executed orders in cryptocurrencies. Examples: ethlance.com, xbtfreelancer.com and coinality.com.10. Making cryptocurrency on a cryptocurrency exchange.

This is an interesting way of making coins for two reasons:- First, prospects. Trading cryptocurrencies by a profitable strategy, you can achieve operation with big amounts, which are impossible to achieve if you, for example, click ads banners on a micro task web site.

- Second, the risk of fraud is rather low.

Trading on an exchange as a way to make cryptocurrency

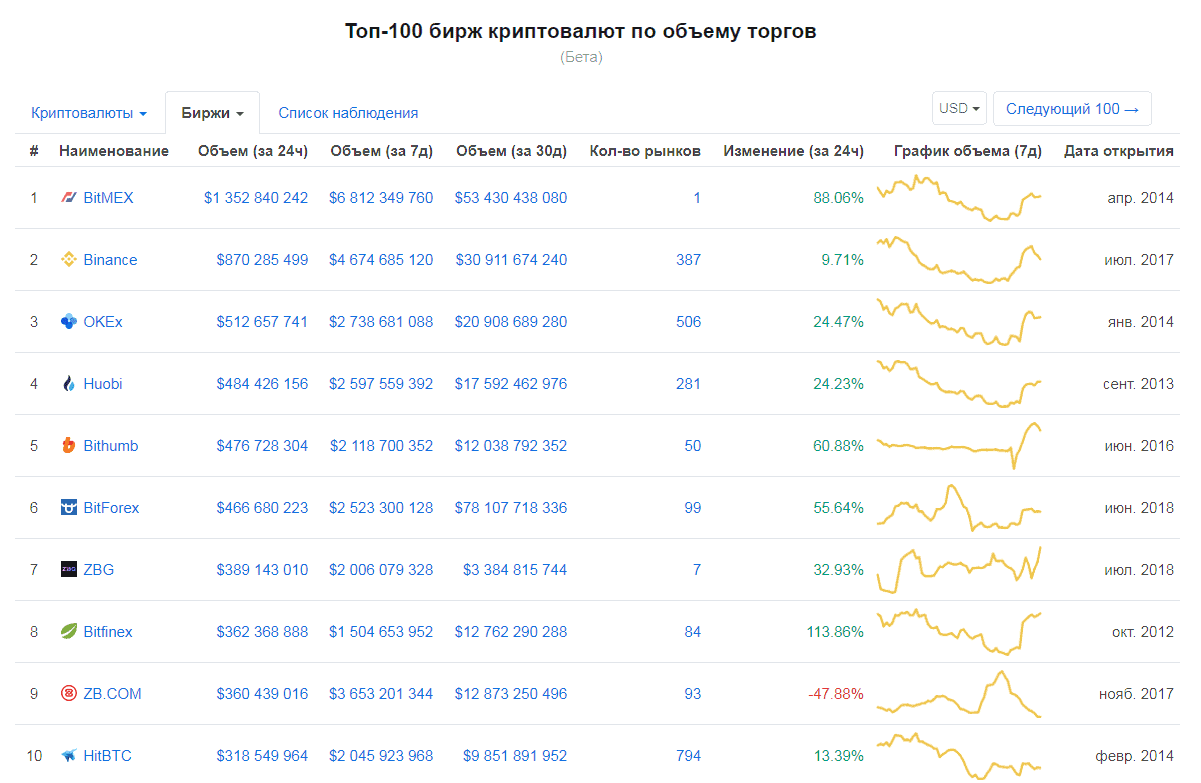

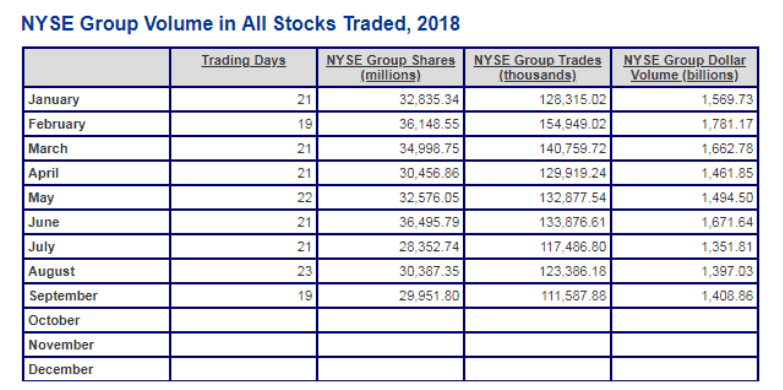

To buy a cryptocurrency, you might use online exchange shops. However, the rate in such shops is often unfavorable. The cryptocurrency exchanges offer the best rate. On these exchanges you can exchange ETH (Ethereum) to BTC (Bitcoin) or buy LTC (Litecoin) for USD.This exchange type is very new. Most of the cryptocurrency exchanges are only 2-3 years old. But the crypto-sphere rapidly develops and trading volumes on these exchanges are hundreds of millions in the US Dollar equivalent. The trading volume on BitMEX is already more than 1 billion (according to coinmarketcap.com).

And although the current amplitudes of coin prices cannot be compared with ones at the end of 2017, nevertheless, the difference between high and low is up to 10% on a regular trading day. Why should one lose such an opportunity?

A choice of a cryptocurrency exchange, taking into account their multitude and diversity, is a topic for a number of articles, that is why we will just outline specific features of several main platforms.

Exchanges for making cryptocurrencies.

BitMEX is the leader among cryptocurrency exchanges with respect to the volume.- a specific feature lies in the fact that the trading is conducted on the XBTUSD futures. This is a derivative on the underlying asset, which is the bitcoin price;

- high liquidity;

- the exchange offers traders the service of a powerful credit leverage 1:100;

- due to a big number of participants, the orders are executed with a significant time lag during the periods of high volatility;

- the Russian language interface;

- the exchange does not work with fiat money (USD, EUR, etc.);

- the minimum account replenishment amount is BTC 0.0001;

- a complex settlement system.

Binance

- does not allow opening short positions;

- offers 2 types of the interface: standard and advanced;

- the Russian language is supported in the interface, however, the support itself practically does not speak Russian at all;

- there is no possibility to trade with a leverage;

- software for Windows and iOS are available;

- the exchange does not work with fiat money (USD, EUR, etc.).

Bitfinex

- the exchange works with fiat money (USD, EUR, etc.), however, it requires passing the account verification procedure. You would need to send documents and wait for response;

- the minimum amount of your account replenishment is the equivalent of USD 10 thousand. This restriction was introduced by the exchange in order to provide high quality services to its clients. There is a younger brother – Ethfinex – for those who cannot make a 10K deposit;

- convenient and well thought-over interface;

- commission fees are higher than average;

- the leverage is 3.3 to 1;

- there is a possibility to open a fund account and lend your coins to traders for a fee. As if you lend coins at interest.

Poloniex

- the exchange has roots in the USA;

- there is no the Russian language interface;

- commission fees are below average;

- convenient interface.

In general, making money on cryptocurrency exchanges is real and safe. All exchanges support the majority of popular coins, care about safety of their clients’ funds and update anti-hacking security systems.

However, there are a couple of things in terms of usability, which produce certain difficulties in making cryptocurrencies:

- inconveniences in the event of active trading. We mean complex procedures of posting orders (by market, limits and stops);

- visualization of information about the course of exchange trading (primitive charts with poor customization, order book and tape data, etc.).

This platform is designed for analyzing the market and trading namely in the cryptocurrency sphere. ATAS Crypto has built-in connectors, which provide connection to the following exchanges:

- BitMEX

- Binance

- Bitfinex

- Bittrex

- Poloniex

- Bitstamp

- Liqui

The list of connectors is constantly renewed. Check by yourself: not a single cryptocurrency exchange provides such functions as ATAS Crypto does.

Here is just one useful function of ATAS Crypto: automatic order posting. Let us make an experiment in order to demonstrate its practical value. We open a long and protect it with a stop loss by two ways:

- through the BitMEX cryptocurrency exchange interface;

- through the ATAS platform.

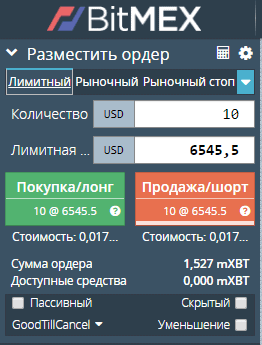

Way 1. Trading through BitMEX. The picture below shows a standard form of posting an order on the BitMEX exchange.

- to fill in the Quantity and Limit Price fields;

- press Buy;

- switch to the Market Stop tab;

- fill it the Quantity and Stop Price fields;

- press Sell Stop.

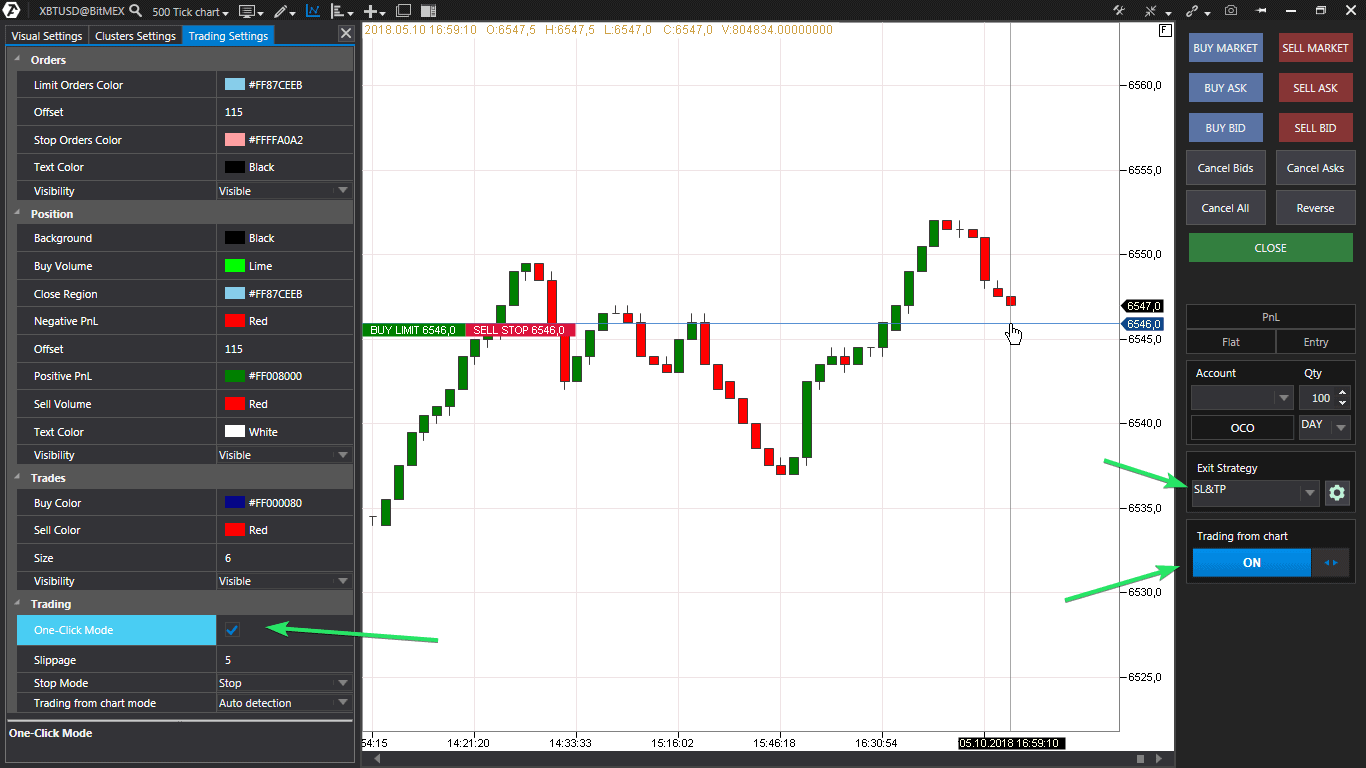

It is obvious that this routine procedure not only gives space for misprints and unwanted incidents, but also increases the risk. The danger lies in a pause between posting a limit order and posting a protective stop. If during this pause the price rapidly moves against you, your limit order will be executed, but there will be no protective stop. It has not been posted yet. And the size of the loss will depend on your luck. And the financial market is not the place where you are always lucky. Way 2. Trading through the ATAS platform. One click is enough to open a long and protect it with a stop loss! However, this requires making a couple of simple settings beforehand:

- To set a protective strategy through activating automatic stop loss posting. (A detailed instruction – a knowledge base link);

- To allow trading from the chart in one click. (A detailed instruction – a knowledge base link).

Nevertheless, however perfect this trading and analytical platform is, it cannot protect you from a fatal loss due to a human factor.

1 way to lose all your money on a cryptocurrency exchange

ATAS allows you monitoring all trend phases: from its emergence to its culmination. However, if a trader (deliberately or out of ignorance) opens and holds a position against the main tendency – a probability of evaporation of his deposit tends to 100%.Internet is full of sad stories about enthusiasts, who invested dozens and hundreds of thousands of dollars of their savings into cryptocurrencies. And they failed. The reason is – they traded against the trend.

Being on its peak in winter 2017-2018, the chart repeatedly sent signals about bearish moods in the market, however, a blind hope to make big money fast brought these people to the bottom of the ladder.

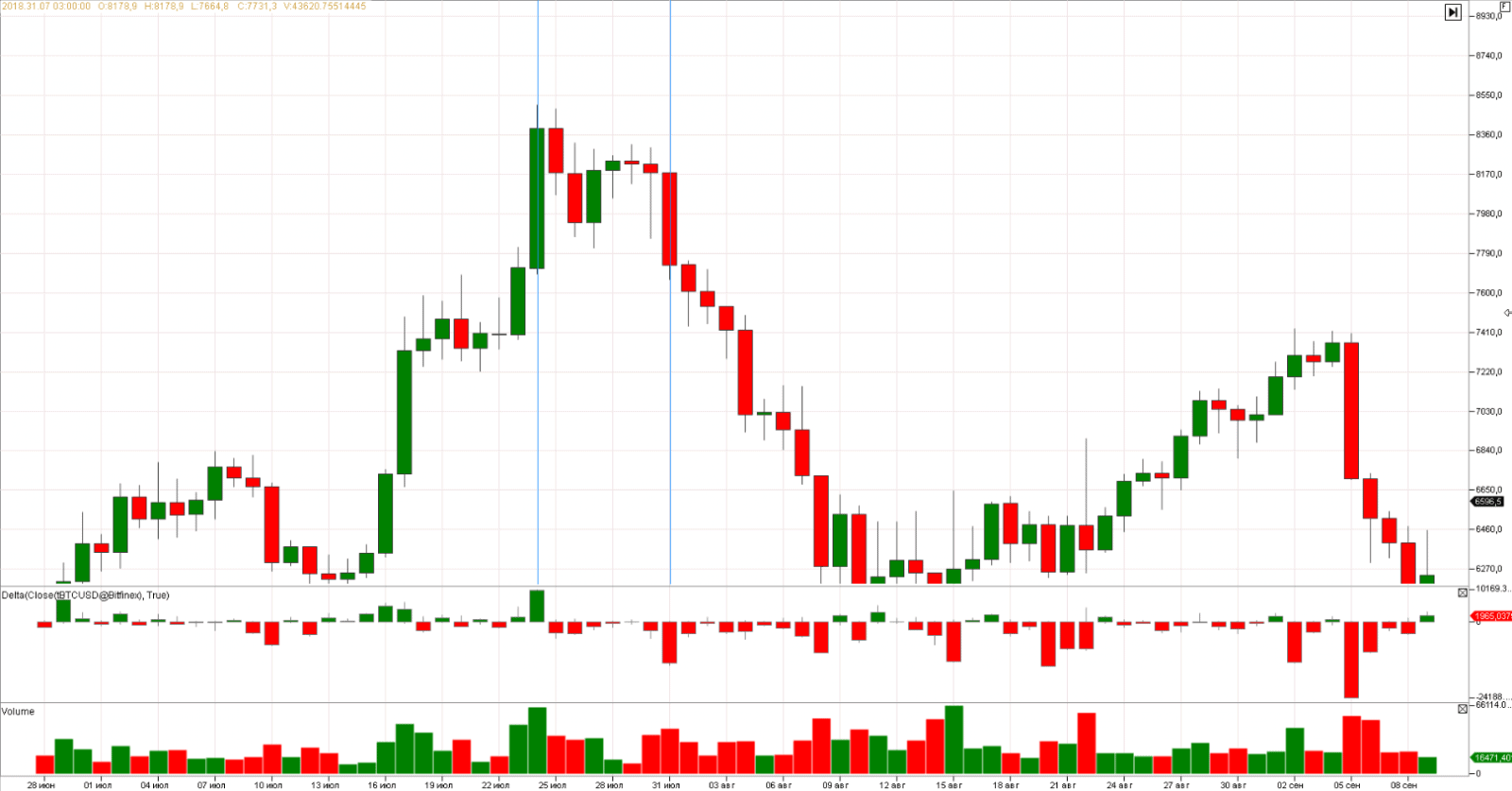

How do signals of the trend changing from bullish to bearish look like? Let us analyze the bitcoin price chart with the help of ATAS.

- July 24. A significant splash of the buying volume against the price increase. This situation is natural for a massive euphoria. The market is filled with FOMO (Fear Of Missing Out) buyers. They believe that the cost, having broken the 8 thousand price level, will skyrocket. However, if this day had real strength, why does the price go down during the next 2 days and does not continue to increase? And who did sell bitcoins to massive buyers? Perhaps, the professionals who knew the real value of the coin and its near term prospects.

- July 31 confirms this point. The price goes below the minimum of July 24. The Delta shows the strength of a professional trader who stopped the process of accumulating shorts, removed the support from the market and pushed the price down, trapping emotional buyers. Only a few beginner traders have a power to accept losses and close their positions with a loss. The majority prefer to hope for a comeback and hold their positions against the trend until they are forcedly liquidated.

A similar basic scenario of the trend turnaround takes place, with some variants, practically at each significant peak of the market. An ability to recognize it, ignore rumors and forecasts of experts in the mainstream media, ability to act in accordance with own analysis on the basis of facts collected from the chart – these are the qualities of the professional traders who make money on cryptocurrency exchanges. The ATAS Crypto is their true and reliable helping hand.