In this article we will tell you what to start from and how to make your first steps on the exchange.

Part 1. Exchange types. Pros and cons of trading on different exchanges.

Part 2. Currency futures. Everything a beginner should know.

Part 3. What you need for trading futures and stock on the Moscow Exchange.

Part 4. How a beginner can start trading on the Chicago Mercantile Exchange.

Part 5. Three reasons to trade in stock markets.

Part 6. Conclusions.

Exchange types. Pros and cons of trading on different exchanges

| Classification of exchanges by the type of exchange commodity |

| Commodity (oil, sugar, cotton, pork bellies, etc.) |

| Stock (shares, bonds, derivatives, etc.) |

| Currency (dollars, euro, rubles, liras, etc.) |

| Cryptocurrency (bitcoins, ethereum, etc.) |

| Universal (for example, Chicago Board of Trade) |

| Specialized (for example, London Metal Exchange) |

There are state, private and mixed exchanges by principle of organization. For example, the Moscow Exchange is a Public Joint-Stock Company and its stock is traded on the exchange itself.

There are more than 200 stock exchanges in the world. There are also national exchanges, inaccessible for non-residents. There are exotic exchanges – for example, there is an exchange in Laos, which trades stock of 4 companies only. There is an exchange on Fiji where computer equipment is not used – they make records on a special board.

The world largest stock exchange is NYSE (The New York Stock Exchange https://www.nyse.com/).

PAO Moscow Exchange (https://www.moex.com/) holds the 25th place of honour.

World largest stock exchanges, ranked by stock circulation in 2017.

| Exchange | Country | Capitalization, USD bln | Number of public companies | Trading volume, USD bln | |

| 1. | ICE&NYSE | United States | 22.081 | 2.286 | 14.535 |

| 2. | Nasdaq OMX | United States | 10.039 | 3.933 | 12.136 |

| 3. | Shenzhen SE | China | 3.622 | 2.089 | 9.112 |

| 4. | Shanghai SE | China | 5.090 | 1.396 | 7.563 |

| 5. | Japan Exchange | Japan | 6.223 | 3.604 | 5.813 |

| 6. | LSE Group | Great Britain | 4.290 | 2.498 | 2.330 |

| 7. | HKEx | Hong Kong | 4.226 | 2.118 | 1.957 |

| 8. | Euronext | European Union | 4.371 | 1.255 | 1.943 |

| 9. | Korea Exchange | Korea | 1.731 | 2.134 | 1.920 |

| 10. | Deutsche Boerse | Germany | 2.245 | 499 | 1.482 |

| … | … | … | … | … | … |

| 25. | Moscow Exchange | Russia | 619 | 234 | 144 |

Moscow Exchange (https://www.moex.com/) holds the 5th place of honour.

World largest exchanges that trade derivatives, ranked by the number of contracts in 2017.

| Exchange | Country | Number of traded contracts, mln. | |

| 1 | CME Group | United States | 4.089 |

| 2 | NSE India | India | 2.482 |

| 3 | BM&FBOVESPA | Brasil | 1.638 |

| 4 | Deutsche Boerse | Germany | 1.597 |

| 5 | Moscow Exchange | Russia | 1.585 |

| 6 | CBOE | United States | 1.274 |

| 7 | NasdaqOMX | United States | 1.101 |

| 8 | Korea Exchange | Korea | 1.015 |

| 9 | ICE&NYSE | United States | 742 |

| 10 | BSE India | India | 608 |

Currency futures. Everything a beginner should know

You can trade something tangible, for example, shares, bonds, currencies and even cryptocurrencies. One thousand dollars under your pillow or one hundred Sberbank shares in your bank safe pleasantly warm your soul.However, you can also trade intangible financial instruments or derivatives. When trading derivatives you just have the right to buy an underlying asset in future at the price, which is fixed today. Anything could be an underlying asset: currency, commodity, interest rates, indices and even weather.

The most simple and popular derivative is a futures contract.

A futures contract is an exchange contract for buying or selling an asset on a certain day in future at the price, which is fixed today. For example, two farmers can fix the price, at which one would sell wheat to the other after the harvest, in spring.

The goals of using futures are:

- getting a speculative profit, that is, buy low and sell high;

- insuring (hedging) changes of the cost of the underlying asset in future. For example, a manufacturer executed a contract for shipment of rubber boots to the US in 3 months with the payment in USD. One USD is RUB 68.5 today. If its value goes up to RUB 70, the manufacturer will make additional RUB 1.5 (70-68.5) for each pair of rubber boots. But if a dollar costs 65 rubles in three months, the manufacturer will lose RUB 3.5 (68.5-65) for each pair. Manufacturers like stability, that is why, their financial services sell USD/RUB futures, insuring risks but depriving themselves of additional profit. If the dollar grows, the manufacturer makes profit on selling boots, but will lose on the futures and vice versa.

There are two types of futures:

- delivery futures, which envisage delivery of an underlying asset on expiration of the contract;

- settlement futures, which envisage financial settlement on expiration of the contract without delivery of the underlying asset.

Both types of futures contracts are rather popular in the markets – for example, there could be both delivery and settlement futures on commodities and stock, however, there could be only settlement futures on interest rates or weather, since nobody can deliver weather. Traders prefer settlement futures since their goal is a speculative income, since nobody wants to store barrels of oil or piles of cotton at home.

There is no need to pay for the underlying asset in order to execute a futures contract. You just need to provide a guarantee collateral, which is just a small part of the current price of the underlying asset (it is 8-12% on the Moscow Exchange). Both futures seller and buyer should provide this collateral.

Main platform for trading futures in Russia is the forward market FORTS of the Moscow Exchange.

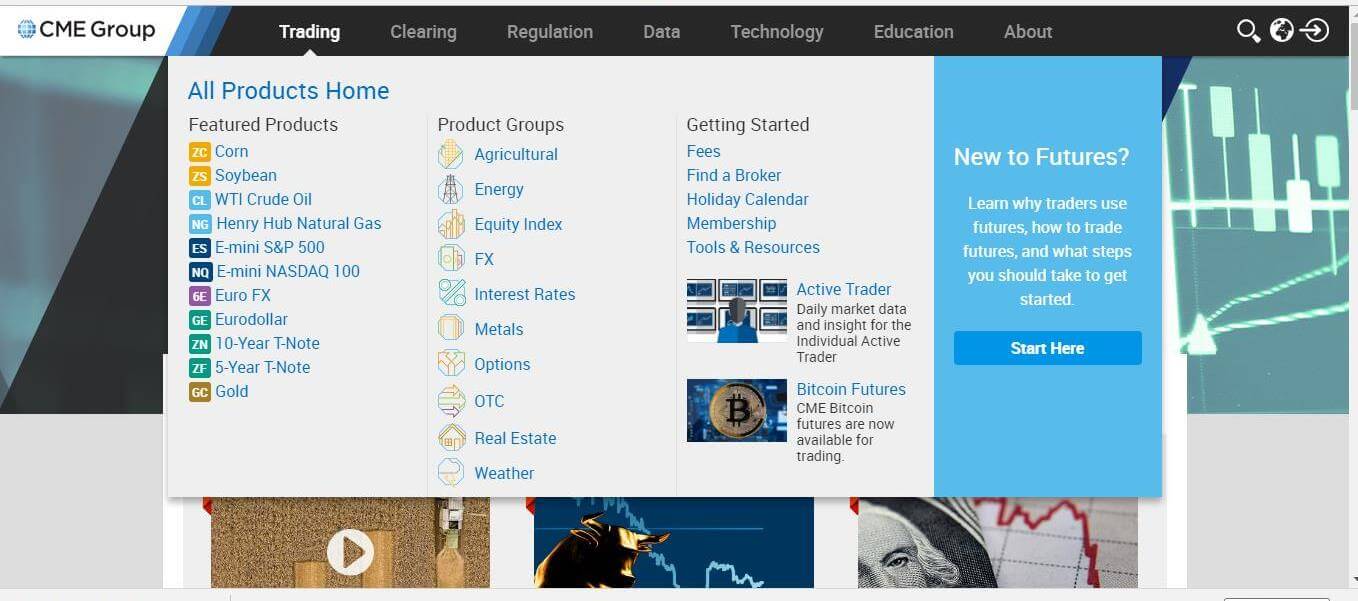

The main world platform for trading futures is the Chicago Mercantile Exchange (CME). They trade more than 90 futures on CME and more than 50 of them are on the world currencies: EUR, CHF, GBP, JPY and others.

- Low guarantee collateral (guarantee collateral of a EUR/USD futures on MOEX is RUB 3,238, while the underlying asset cost is USD 1,164; guarantee collateral of a EUR/USD futures on CME is USD 2,300 for intraday trading of 500 contracts, while the underlying asset cost is USD 125,000);

- Possibility of active trading without a big initial capital. Nearly all brokers offer a credit leverage of 1:250 for intraday trading, which means that you can have USD 2,000 on your account only to trade the amount of up to USD 500,000;

- High liquidity, which means that you can sell or buy futures immediately.

What you need to know for trading futures and stock on the Moscow Exchange

As of today, the majority of exchanges carry out trading with the help of unified systems of electronic trading, which allows trading without leaving home. However, pursuant to the legislation, a common person cannot trade on the exchange directly, he needs to use services of an intermediary – a broker.The procedure of beginning to trade is nearly the same in all cases: you need to select a brokerage firm, open an account and start trading.

Each exchange provides a list of its brokers:

https://www.moex.com/en/ – PAO Moscow Exchange;

https://investcab.ru/ru/inmarket/connect/ – Saint-Petersburg Exhange;

https://www.cmegroup.com/tools-information/find-a-broker.html#pageNum=1 – Chicago Mercantile Exchange.

You should select a broker based on the following parameters:

- Working experience;

- Licence availability;

- Risk insurance and responsibility;

- Low service and commission tariffs;

- Minimum deposit amount;

- Availability of several trading terminals with different technical functions;

- Variety of trading instruments;

- Availability and working hours of the support service, which you can easily contact;

- Speed and convenience of cash withdrawal;

- Small print traps and pitfalls in contracts.

How a beginner can start trading on the Chicago Mercantile Exchange

Trading on foreign exchanges (for Russian people) is connected with significant difficulties and expenditures than trading on Russian exchanges (costs of contracts and guarantee collateral are much higher). There are several variants:

- Use services of a foreign broker. Only several firms (for example, Interactive Broker) work with the Russian Federation (support and documentation are in English). It will be impossible to visit the brokerage firm office personally. Minimum cash deposit starts from USD 10,000.

- Use services of a Russian broker that provides access to foreign exchanges (NYSE, LSE, CME and others). The broker does not provide access to the whole list of traded instruments, that is why you have to make sure beforehand that those futures that you want to trade are in the list of the instruments the broker offers.

- Use services of a Russian broker who has access to the Saint-Petersburg Exchange, where foreign company stocks are trades. You should understand that the stock liquidity and number of companies on the Saint-Petersburg Exchange are lower that on foreign exchanges.

Three reasons to trade in stock markets

Conclusions

“Heuristics are simplified rules of thumb that make things simple and easy to implement. But their main advantage is that the user knows that they are not perfect, just expedient”. Nassim Nicholas Taleb.In this article we considered basic issues regarding stock exchange types, futures contracts and specific features of trading on CME and MOEX.

In conclusion, we will list some simplified practical rules for beginner traders:

- Watch this video about what makes people traders https://www.youtube.com/channel/UCblJh019D_VZVnkpvpOgcWA ;

- Choose financial instruments, markets and a broker;

- Choose software https://orderflowtrading.net/;

- Try the demo version first;

- Keep your trading diary and regularly analyze your achievements and mistakes;

- Execute a contract with your broker and transfer money to actual account;

- Trade, have fun and remember that “luck on closer inspection turns out to be a result of huge work and detailed preparation” (Bodo Schafer).