Let’s frankly admit that there is no ideal indicator for an entry into an exchange trade. If it were, there wouldn’t be hundreds and thousands of other indicators for an entry.

To have a stable profitability each trader should have:

- Trading system.

- Properly studied instruments.

- Capital management rules.

The indicators you comfortably work with belong to the trading system. However, unfortunately, they are not magic pills which would make you rich in no time.

Indicators are assistants, which show a trader what takes place in the market at a certain price level. To work successfully with any indicator a trader needs to:

- Understand the indicator working scheme.

- Monitor the market’s reaction after the indicator came into action or enter a trade immediately (if the indicator signal is used as a trigger).

We will explain in this article how you can use signals of several indicators of the cluster and technical analysis. After that, each trader could find his own indicator for an entry, which fits him best of all.

Looking for the managed money traces in the charts

Many successful traders wrote books about how important it is to monitor the managed money. For example, Larry Williams and Tom Williams. The following indicators will help you to detect the managed money in ATAS:

- Smart Tape;

- OI Analyzer;

- Big Trades;

- Profiles;

- Deltas;

- Footprint.

Let’s consider them one by one.

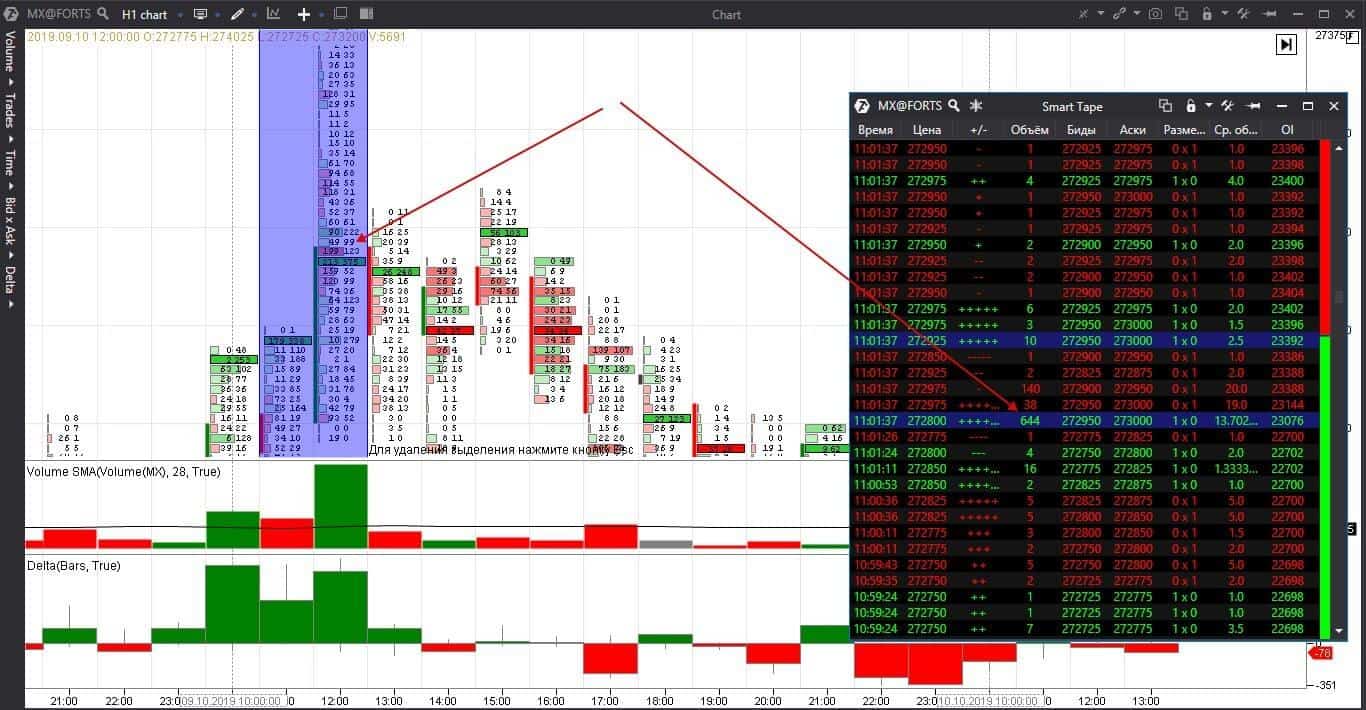

Working with the Smart Tape module

Smart tape is not an indicator but a module for analyzing the flow of just executed trades. Smart Tape shows trades in real time.

The Tape could be filtered out by a number of lots and the sound signal for a major trade could be set.

The ‘major trade’ concept will be different for each instrument. Moreover, major lots would be different for one and the same instrument on different weekdays and seasons. You can select the size on a trial basis monitoring the market. The indicator could be used independently or in combination with the Smart DOM or charts.

Let’s consider an example in the hourly Moscow Exchange stock index futures (MX) chart.

We use the Tape in the historical mode since we can see namely what trades took place during a selected period of time in the past. A major buy in 644 lots is marked with an arrow on the Tape. Note that this amount is not seen in the Footprint since the lot could be ‘spread’ over several price levels.

It is believed that the managed money accumulate positions with limit orders. We support this opinion. Look, if very big green clusters appeared in the chart, it might have been a local buying climax. Then, it is not a surprise that the price started to go down in several hours.

Using the OI Analyzer indicator

Let’s consider OI analyzer for the Moscow Exchange. The OI (Open Interest) data is provided in real time only by the Moscow Exchange that is why you can use OI delta only on FORTS.

This indicator shows whether the buyers and sellers:

- open new positions and increase the money amount in the market;

- or close old positions and remove money from the market.

Apart from the ATAS indicator, there is a possibility to add the OI change into the Tape. Thus, you can immediately see not only big trades in the Tape but also whether these are new contracts or not.

New money is an interest to the instrument, increase of volatility and possibility to make money. The indicator works independently and perfectly supplements the Smart Tape.

We will not discuss the OI Analyzer in detail in this article since we did it in a separate article.

Working with the Big Trades indicator

Big Trades takes data from the Tape and filters them out with the help of a smart algorithm. It is not necessary for beginner traders to study the details, they can use the autofilter. Only 7 recent days are processed since there are huge amounts of data in the Tape. The indicator could be used independently.

Let’s consider an example in the 5-minute Baidu (a Chinese company) stock chart.

We use the Big Trades indicator with the autofilter. It is a convenient option since you do not have to set anything and the indicator itself marks the candles with the highest activity.

The market opened with a down gap on November 13. Perhaps, some traders started to close long positions that is why we see big sells at the beginning of the day. The indicator shows us these sells with big red squares.

The market consolidated in the middle of the day. And sellers renewed their activity only at the end of the trading session – we again see big red squares. Taking into account the gap and downtrend, we could have opened short positions by the Big Trades indicator and make a profit.

How to work with the Cluster Search indicator

Cluster search is an indicator that allows detecting such price levels at which trades were executed by the set criteria. For example, a certain volume was traded. The indicator could be used independently.

Let’s have a look at the 10-minute Apple stock chart.

We added two Cluster Search indicators. The first one looks for bids from 100,000 items and marks them with violet squares. The bigger the square, the more stock was traded. The second indicator looks for asks from 100,000 items and marks them with bright-green squares.

Trades opened with an up gap on November 15. We marked the price level with the maximum volume of buys with a black horizontal line. The price tested the gap and consolidated above it. We see in points 2 and 3 that big buys go on. Despite the sells in point 3 the price doesn’t fall and even continues to grow together with the volume growth. Cluster Search shows that the buyers are strong during the whole day.

Looking for aggression, ‘shadow directors’ and reversals

If you use ATAS, it is logical to work with all the advantages of the platform and especially with the cluster analysis. It is interesting to trade reversals because the level of profit is several times higher than the level of risk. A trader can make mistakes in more than 50% of trades and still make a profit if R:R>1:3 (the risk-reward ratio is 1 to 3).

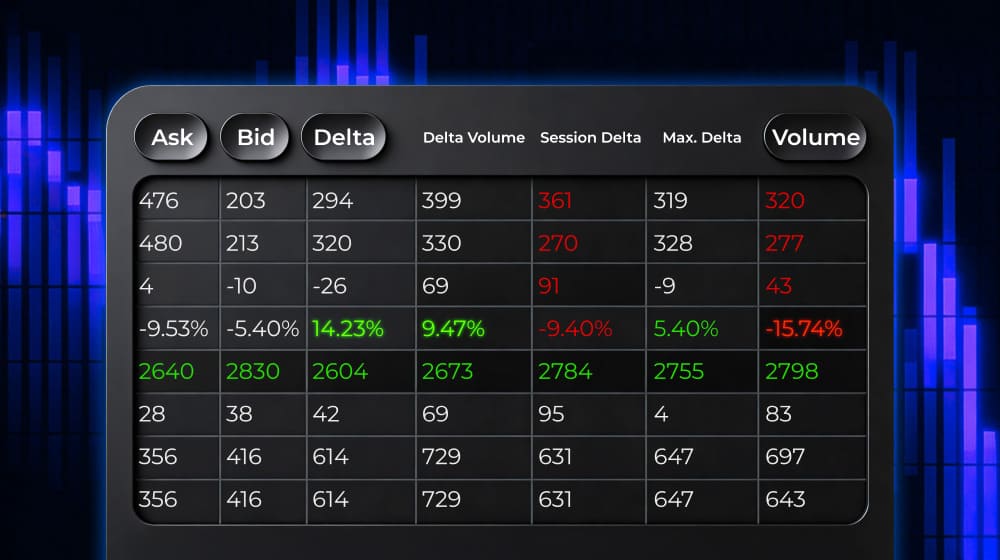

How to use the Delta?

Delta is an indicator that shows aggressive market orders. If it is green, it means that there were more market buys than market sells. If the Delta is red, there were more market sells than market buys.

It is important to remember that there should be a limit order from the other side of the market order. And quite often limit orders play the role of the ‘shadow directors’. By using them, the managed money accumulate positions, absorb market orders and stop the price movement. Reversals often take place after the aggressive and focused movement has stopped. These could be both trend and local reversals.

How the Footprint works?

Footprint is not an indicator. Figuratively speaking, it is a ‘skeleton’ of each bar. Using the Footprint the traders see what took place at each price level in a bar. That is why the use of the Footprint could give much more valuable information than application of other indicators.

Let’s have a look at how the Footprint works with the Delta in the 50-tick E-mini Euro futures chart.

We see absorption in point 1 – a huge volume of market sell orders which cannot move the price down. The limit buy orders absorbed aggressive market sell orders and stopped the price decrease.

A reversal, which is accompanied by absorption, is an ideal situation, since, if the price cannot move lower, it, most probably, will move higher.

Absorption is clearly seen in the Footprint or Smart DOM. The ‘passion’ of the buyers decreases in point 2 and the price rolls back. However, note that there are less sellers here than in point 1. Such trading situations are called a test (testing). We marked the Delta and price divergence with red and green arrows.

How to trade a fair value?

According to the Peter Steidlmayer’s theory, the price moves from one balance to another. A focused trend movement emerges between the balances. The balance areas are bell-shaped. The Volume Profile helps to find balance areas and trade breakouts or retracements.

Let’s consider an example in the 3000-tick USD/RUB currency pair futures chart.

We added the ‘Market Profile’ drawing instrument to the chart in the form of the TPO and Delta and Weis Wave indicators. The Value Area is marked with orange and black horizontal lines.

The price broke the fair value area but the sellers’ pressure didn’t last long. We see the Delta and Weis Wave divergence at the day’s low, which warn us that the price, most probably, would reverse and go back to the fair value area. A big volume and considerable efforts are required for the price to move away from the balance area. If this doesn’t happen, the price, most probably, would return back to the balance area.

The next day, the price opens within the limits of the value area of the previous day and tests the low in point 2. The price tried to break the previous day’s high several times during the trading session but failed. We see a false breakout in point 3.

You can work with the Market Profile on different time periods.

Trading certain setups

We used the Weis Wave indicator in the previous example. Weis was the follower of Richard Wyckoff. Tom Williams, who also was a follower of Richard Wyckoff, developed such an approach for traders as VSA (Volume Spread Analysis). By using VSA traders can trade certain setups, about which we wrote a series of articles (here’s the link to the first article).

Let’s consider an example in the 3000-tick RTS Index futures chart.

We added the Delta, Weis Wave and Initial Balance indicators to the chart. The IB indicator works properly in the regular markets which have an exact time of the beginning of a trading session. When working in the global markets, it is more efficient to set the beginning of a trading session depending on the activity of traders. We wrote about this indicator in the article about the Market Profile.

We can see signs of the market weakness in point 1. The number of buyers at the day’s high decreases and the bar closure is not at the very top. The next two bars are internal and they confirm the weakness because we can see sells by the delta. We can make a preliminary conclusion that a breakout failed since a fight takes place at the level of the initial balance high. A short position could be opened after the price consolidated below this level.

The situation is opposite in point 2. We can see the weakness of sellers. The sellers failed to push the price even lower and it reverses after a wide bar with the closure at the very bottom. If a trader had open short positions, the delta divergence confirms that he may consider closing his position.

The buyers take some time off in point 3 but the price low in point 4 is higher than the previous low, which means that there are no new sellers. It is possible to open a long position.

In order to trade certain setups, it is necessary to:

- define clear rules of opening trades;

- train to be able to detect them;

- check setup efficiency on the demo account.

Conclusions

Every trader has his own set of favourite indicators for opening trades. Indicators are similar but circumstances of their application are different. There are no similar markets and traders.

Look for your own trading style and those indicators which would more efficiently point to an entry point. Read our blog and visit our YouTube channel (we already have more than 5 thousand subscribers). We try to help you to become a consistently successful trader.