Do you know that the Best Private Investor of 2017 and at the same time Best Private Investor in the stock market was the trader under the DISCIPLINE nickname, who showed 204.3% of profitability (RUB 510,753.13 in absolute numbers)? Perhaps, he chose this nickname not by chance. Today we will speak about the importance of discipline in trading.

Read in this article:

- What the discipline is?

- Inherited strengths and weaknesses and how they influence the discipline.

- What the tilt is?

- Tilt features.

- Methods of tilt controlling.

- Why you cannot do it and how to learn to do it?

- How ATAS can help you?

- What to read and to do for strengthening the discipline?

What the discipline is?

Discipline is a conscious repetition of difficult or unpleasant actions for achieving goals.

Which means that in order to be disciplined you have to:

- have a goal;

- constantly do unpleasant things.

It sounds ironic, but, in fact, this is exactly how it happens in life.

Inherited strengths and weaknesses and how they influence the discipline.

Some people could be more disciplined than others, because all of them have different inherited qualities. Just out of curiosity, pass a test of your skills:

- Working memory – the ability to hold information in your head when solving difficult tasks.

- Emotion control – the ability to control yourself when you desperately want to break somebody’s head or, at least, a notebook.

- Planning/prioritization – the ability to evenly distribute your work during a day and do important things in the first place.

- Time control – the ability to come in time.

- Commitment to success – the ability to move towards your goal despite misfortunes and failures.

- Organization – the ability to find a place and time for everything.

If you have evident difficulties with something of the above, take into account your specific features when working with the discipline. Start from those areas where you have strengths. We will discuss only one skill in this article – emotion control. We will recommend you additional literature at the end of this article for working with other skills.

The ability to control emotions is the ability to control your temper and cope with sadness, disappointment, joy and anxiety. This skill is important for traders because unstable emotions result in losses. Inability to control emotions in trading, poker and betting is called the tilt.

What the tilt is?

Tilt is a behaviour in an unusual style, loss of control on emotions and overinvolvement. Tilt is a violation of the discipline, which you cannot always control by yourself. The term came into trading from poker. As a rule, you make big losses and break down namely due to the tilt.

- The first thing you need to think about is whether you have your trading style or trading system, which you follow. In case you haven’t, in a certain sense, you constantly trade in the state of tilt and cannot achieve a stable profit.

- The second thing you need to think about is what the trading strategy is and whether you understand why your trading strategy works. Mechanical trading is HFT (High Frequency Trading) or algorithmic trading, in which a human being doesn’t take part. If you trade with your hands, you need to understand why you open a trade namely at this level and why the price would move towards or against you. If you understand who dominates in the market (buyers or sellers) you take the right position. If you do not understand it, you trade ‘in the dark’, which is also a tilt.

Tilt features.

- Chaotic opening of trades because ‘you need to work’.

- Euphoria after profitable trades.

- A sharp wish to recover losses after several consecutive loss-making trades.

- Increase of contracts in loss-making trading.

- Averaging positions in loss-making trading.

- ‘Sticking’ in the terminal after loss-making trades.

- А repeated entry into a trade in the same point and direction, despite the previous exit by a stop loss.

- Holding a position in expectation of the break-even during a trading session or even several trading days.

- Conviction that you are right.

- Looking for a confirmation of your position on forums and news resources.

Methods of tilt controlling.

Let’s see now what Internet resources offer for tilt controlling:

- Abstract your mind from money.

- Keep your emotions under control.

- Find out what triggers the tilt and throw it away from your life.

- Accept and appreciate losses.

- Follow your strategy or trading system.

- Do not trade if you haven’t slept or eaten well or experienced a stress.

- Find yourself a teacher – the guru.

These advice seem proper but it is not quite clear how to implement them. That is why they cause irritation only.

Why you cannot do it and how to learn to do it?

The above methods of tilt controlling do not work because:

- you do not know how to implement them;

- you ignore them.

We will tell you right now how to implement, but you will have to deal with ‘how not to ignore’ by yourself.

First, general recommendations (you can skip this section if you are tired of general words):

- Make physical exercises. As soon as emotions start to congest you, make squats, do push-ups or jump rope. We advise it because emotions are changed with a change of the endocrine profile. Influence your body and your emotions will change.

- Eat healthy food. Do not eat fast food, fat food and sweets often. Nutrition, as well as physical exercise, influence the endocrine profile. In other words – your are what you eat. Eat healthy food if you want to be useful.

- Train your brain with mathematical problems 20 minutes a day.

- Register everything you do every 15 minutes on paper or electronically. First of all, you will find out that you waste a lot of time on useless things, such as social networks, soap operas, tea, sending mail, etc. Second, you will understand that you work much less than take rest, although it seems the other way round. If you didn’t register your actions, at least, during one day and ‘you know everything’ without doing it, it means that you are not ready to control your time.

10 rules for a disciplined trader.

Recommendations for traders. If you want them to work, do not just read them but implement:

- Write a clear trading plan for a day. It is important to write, because, when you write, your brain is focused on the current action:

- work from … until …;

- when I work I turn off the phone, TV and social networks;

- turn on music for trading or brain operation;

- open a trade when … (a checklist of required conditions);

- post a stop at …;

- post a take at …;

- if the price moves in my direction and buyers/sellers enter, I move the stop to …;

- if the price moves against me and buyers/sellers enter, I exit the trade immediately;

- I close the terminal until …, if I’ve made losses … times.

You executed an item, ticked the box and praised yourself.

- Stick your plan above the terminal. Check the plan before entering a trade. If you missed the opportunity – it is not your trade.

- Set achievable goals for a day. For example, not to make USD 1 thousand a day, but make losses not more than 5-10 ticks in each trade. Praise yourself when you achieved the goal. It is important to praise yourself, since you consolidate your success. It works the same way as it works with Pavlov’s dogs.

- Trade by your schedule only. For example, from 16:00 until 18:30. Put emphasis not on a number of trades, but on the schedule. It is your working day. Yes, it is a brief one because it is a hard work. You should start and end your working day on the schedule. Do not set the goal of a number of trades or money amount you want to make when you are still a beginner, since it creates tension and interferes with an adequate assessment of trading situations.

- Describe possible problems, which may appear during trading, and ways of their solution. Put this list beside the plan for a day and check it during trading. For example:

- My heartbeat rate went up to 130 – I stand up and do some breathing exercises. Nothing will happen with my open position during a couple of minutes if I use protective strategies.

- I am very disappointed because I already made two losses – I stand up and drink some water and make 10 squats.

- Punish yourself if you violated your rules – do not trade the next day.

- Stimulate yourself for following the rules – dessert, movie, a new t-shirt, a day-off, etc.

- Think about trading like about something quiet and pleasant.

- Set yourself in the right mood before trading. Meditate and read your mantras. For example, “I calculate my risks for each trade beforehand and completely accept the risk of losing a certain amount of money”.

- Keep the log of trades. Analyze your actions after a trading session. If you write down everything but do not analyze your mistakes, you will not achieve a stable success. If you do not write down your actions, you also will not achieve a stable success.

How ATAS can help you?

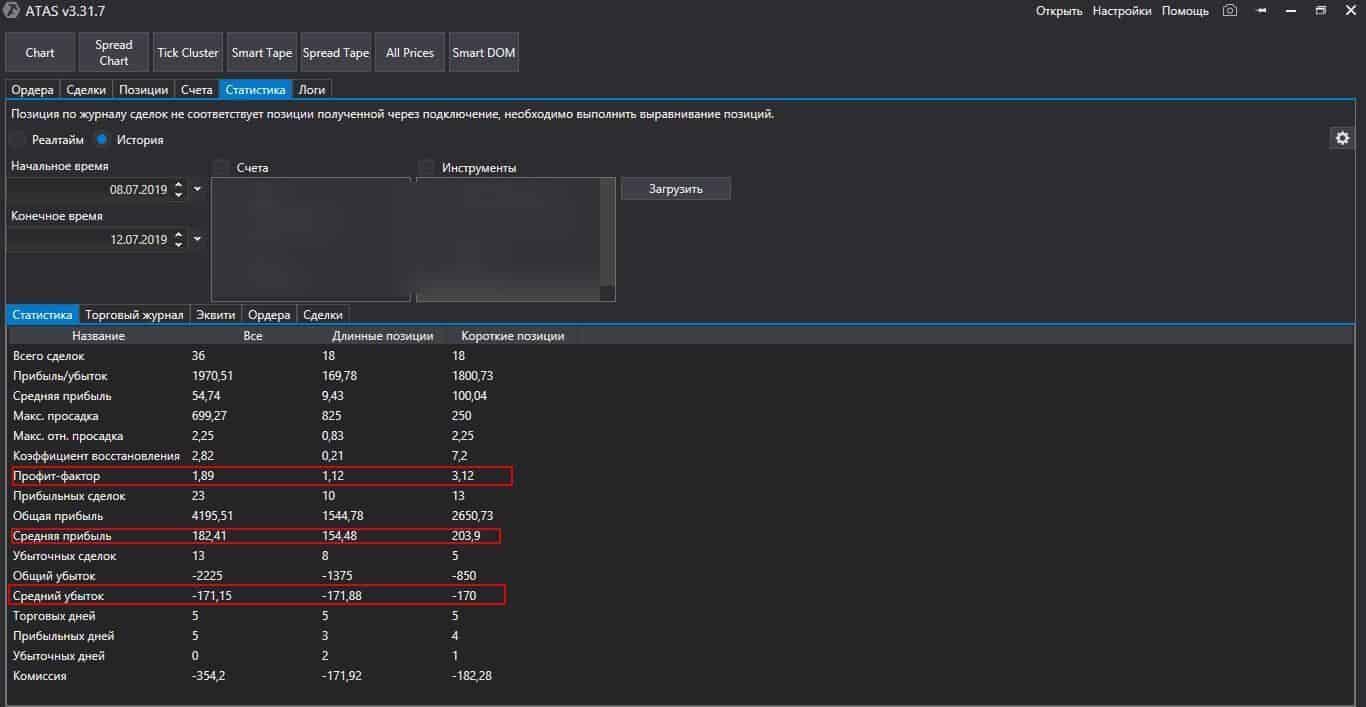

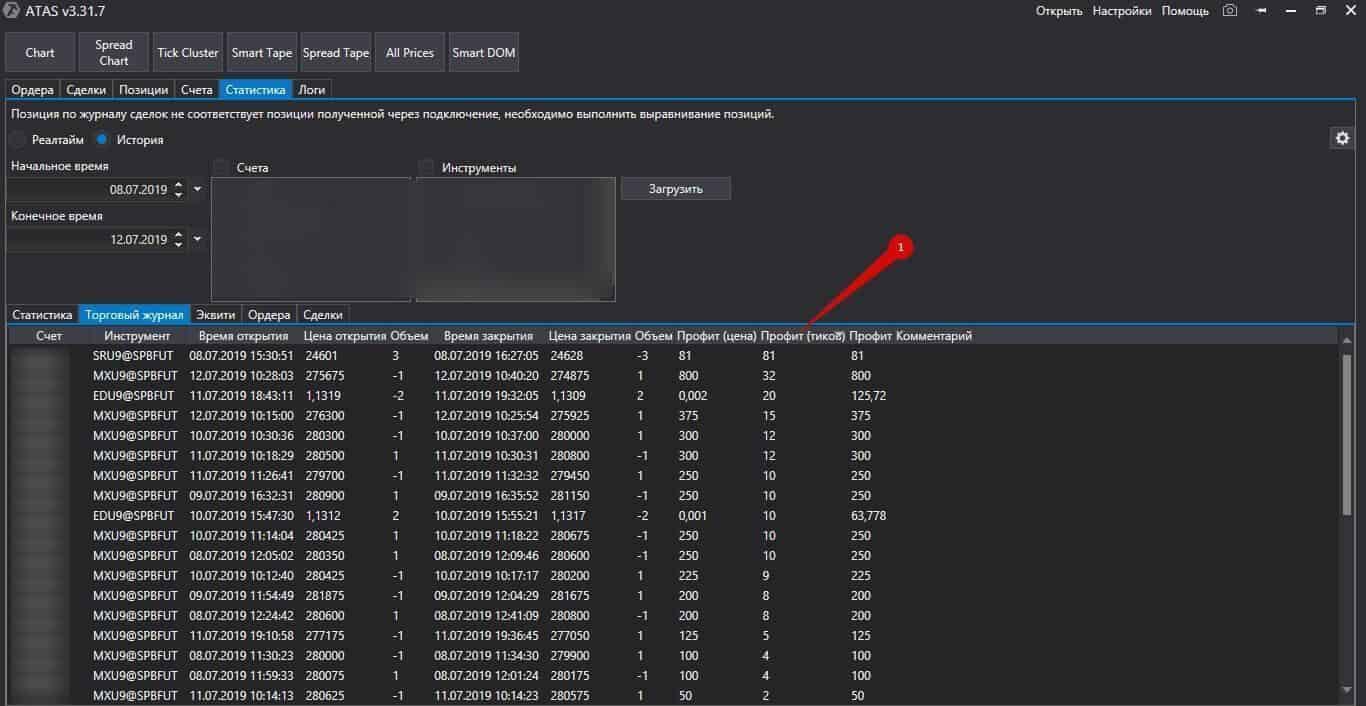

- The log of trades and orders. ATAS automatically keeps statistics of all trades. You can pull information for any period and thoroughly study the trades where you made profit and the trades where you made losses. Monitor the average profit and average loss attentively. If the average profit is higher than the average loss, you can make more mistakes and execute loss-making trades. We analyzed this calculation in the article about setups.

Sort the trades by profitability. Check how long you held your position.

Compare the data with loss-making trades. Keep statistics by the days of the week. It could be that you always make losses on Monday, since it is difficult for you to get back to the working mode.

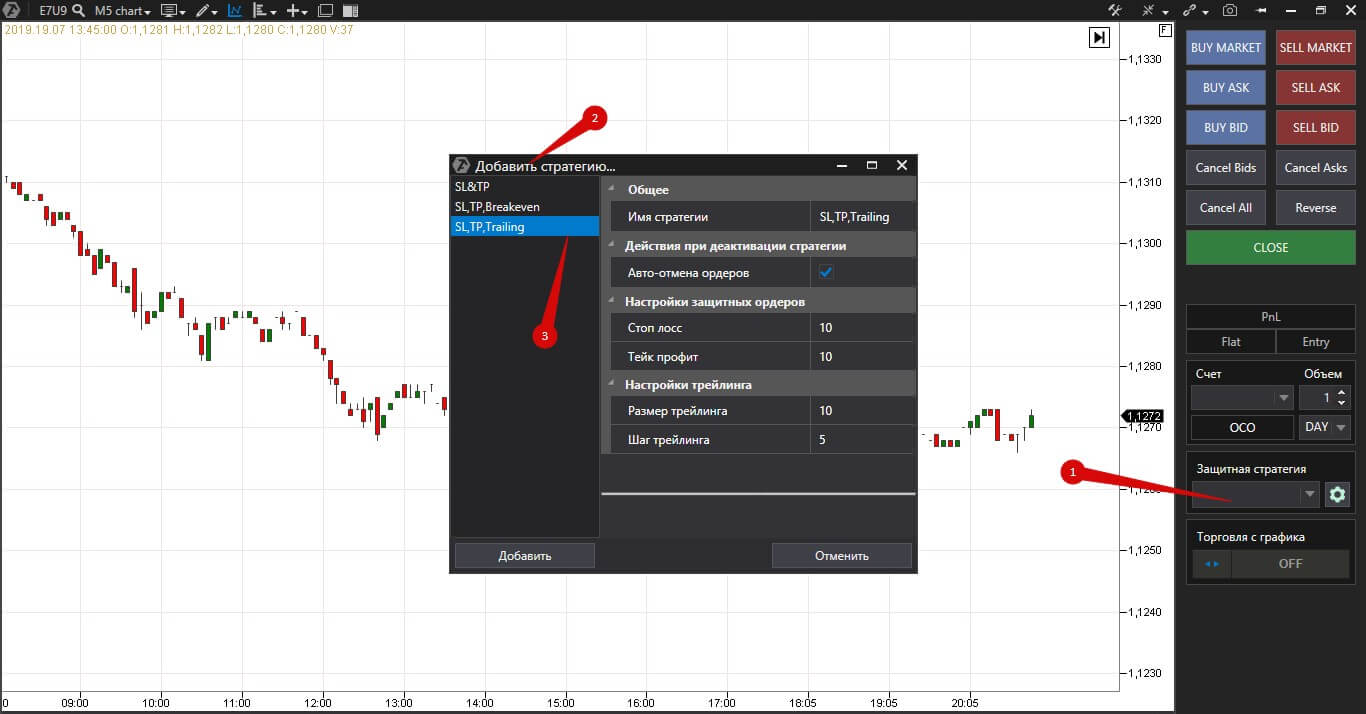

- Protective strategies – you can set different variants for different instruments in ATAS. For example, trailing stop and take profit.

- Сhart trader – a trading panel which displays losses and profit in the real-time mode. There are many discussions in the Internet about whether it is good or bad. You will close your position faster if you see a red minus, because the pain of losing money is visualized.

- Instruments and indicators, which allow tracing appearance of major orders: cluster search, big trades, Footprint, smart DOM and others. It might seem strange that we marked these indicators as the discipline instruments. However, if your trading strategy is based on going along with the managed money, you will not enter a trade without a signal from these indicators. You will not act out a fantasy or execute emotional trades, because the price moved in the direction you wished. There is a signal – there is a trade. There is no signal – there is no trade. This is how a disciplined trader works. Moreover, if you understand why this signal appeared, you are not just a disciplined trader, you move in the right direction to make a stable profit. Let’s check an example of a range chart (4) for a E-mini S&P 500 futures (ESU9).

As we already wrote many times in other articles, range charts are good in filtering out the market noise, because they are not connected with time. We use the cluster search indicator, which looks for asks and bids from 2,000 contracts and marks them with blue and lilac colour respectively. We also added the delta indicator to the chart, which shows aggressive behaviour of buyers or sellers in each bar.

We marked the candle, in which both major buyers and major sellers emerged, with point 1 – we get two signals from the cluster search indicator here. As a rule, such coincidences tell us about an absorption. The delta indicator will help to understand who absorbed whom in the end. The green candle with a long bottom shadow tells us that the buyers won. If you entered the long in point 1, maybe you would be taken out with a short stop – this is the probabilistic essence of trading. There is a risk in each trade. We marked this level with a black horizontal line in order to track the further price reaction when approaching it. It was possible to enter into a long position again at the testing level, marked with a red rectangle.

We see absorptions again in points 2 and 3. Sellers won in point 2. Buyers won in point 3, but their big efforts, which we see from a big delta, didn’t result in a significant price growth. We marked the delta divergence after the insignificant price growth in point 3 with a red arrow. It warns us about a reversal. Further, the cluster search shows the sellers entry only. The sellers ‘smelled blood’ of the buyers, who would exit by stops and move the price down.

It made sense to open a short position in point 2. It could have been closed in point 3 and then opened again after confirmation of the delta divergence. The levels, at which the managed money show activity, would help you to increase the discipline and not to open ‘strange’ trades.

What to read and to do for strengthening the discipline?

- Read ‘Smart but Scattered’ by Peg Dawson and Richard Guare. This book is just a depository not only for parents, but also for those who have difficulties with organization, goal setting and emotions.

- Pass testing and realise which your inherited qualities have problems and which you use rarely.

- Start keeping account of your working time on paper or electronically. Most probably, you will be unpleasantly surprised to see how you manage your time. The more you control your actions, the more organized and disciplined you become.

- Try ATAS for strengthening discipline in trading. Download the free version right now.

Did you like the article? Press the like button. And let the discipline always be your strong point!