A successful trader Douglas E. Zalesky was a member of the Chicago Mercantile Exchange (CME) for more than 20 years and successfully traded stock indices and bond futures. According to Douglass, 90% of a trader’s success depends on the discipline.

A trader Ilnur Mukhametzyanov took part in the Best Private Investor competition of the Moscow Exchange in 2017 and won the first place in all markets. Do you know what nickname he chose for participation?

More famous traders, authors of bestsellers and experts of the stock, currency and futures markets speak about importance of discipline. That is why this article is devoted to a trader’s diary and how a trader’s diary can improve your discipline.

Types of a trader’s diary

- on paper – kept by hand;

- audio – traders record their thoughts and decision on a dictaphone;

- video – traders organize video recording of their actions during a day. A famous market psychologist Brett Steenbarger described one case in his publications of one loss-making trader who made a positive breakthrough in his results when he started video recording of his actions, which he analyzed afterwards;

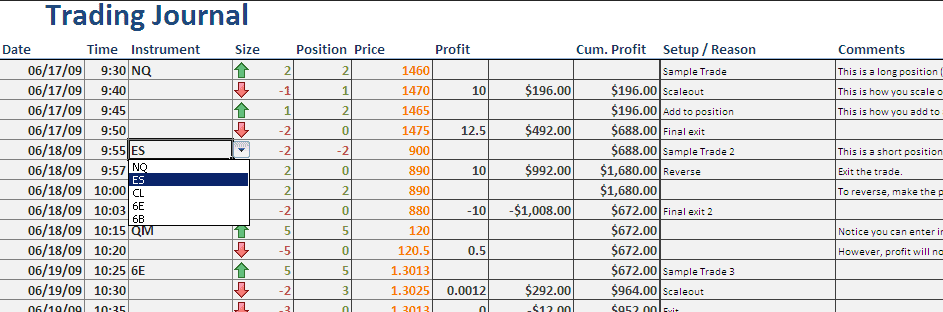

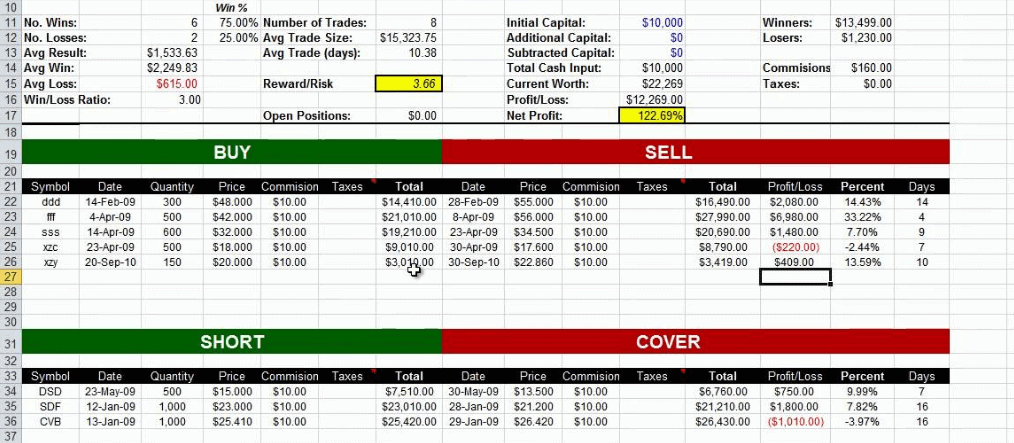

- excel tables of a free format (examples are shown below);

- specialized software and online services. For example, Piratetrade, Marketstat, OT-stat, StockTickr, myfxbook and others. Google will serve you;

- built-in statistics in trading terminals; keeping diaries directly in charts; hiring an assistant to keep your diary.

If you know other ways to keep your diary, please, write about it in the comments.

What trader’s diary type to select

What trader’s diary type to select is a personal preference of any trader. We recommend to use the built-in functionality in the trading ATAS platform as a basis (more details will follow a bit later).

Download ATAS free of charge right now

However, whether you choose to keep a diary with the help of a pen and paper, computer, audio or video screencast – a diary should help you to achieve two goals:

- detect mistakes both in the trading system and in inaccuracies of following the trading system;

- develop methods to avoid making such mistakes in future.

The ideas, discussed here, could be used as a basis for beginning of work over your trader’s diary. Be creative and adapt them to your style. In fact, there is no the only one correct or incorrect way to keep a trader’s diary.

What to start with

Perhaps, it might seem a bit surprising, but the first thing you should do before starting your diary is to take a sheet of paper and write your answers to the following questions:

- What would you have done if you would have had an unlimited quantity of money? Is it true that trading is the best thing you can do?

- What would be with you in 20 years if you do not learn skills you need to become a successful trader or investor?

- What do you need trading for? Why do you want to become a trader, taking into account four main ways to make money (employee, entrepreneur, business owner and investor)?

Spend some time reflecting about your answers and reasons that lie in their basis. It might seem a strange exercise, but you really need to start from a holistic approach and move from the general to specific, if you plan to achieve success as a trader on a long run.

Advantages of a trader’s diary

- systematization of trading. Before your trading is systemized it is gambling, which is not good;

- improvement of the trading system. You are the most objective when you have a confidence in your trading settings and well thought over methodology. You keep making notes and write down conditions of your trades and soon you will see that your trading improves;

- a better discipline. Your diary is an indispensable assistant, which purpose is to get rid of mess and spontaneity. When you enter a trade – how you respond to the price movement towards you or against you, why you decided to exit, when you did it and so on. Having analyzed the answers you can identify useful habits and get rid of bad ones.

Templates for trading diaries

Do you know that the first cases of keeping trading diaries were registered in Sumer on stones that date back to about 3600 BC? Accounting on clay tablets emerged there since 3200 BC. Can you imagine how long it took a Sumer scalper, who kept a trading diary, to carve a stone?

Fortunately, the progress moved far ahead. We prepared several examples of how Excel tables could be organized for simple trading analysis. They will help you to make the first step.

We hope this gives you an idea.

What conclusions can trading diaries help you to make?

1. Best markets for trading.

Use your diary to note the track of efficiency of your trading in different markets. If oil futures scalping brings more profit than the gold futures trading, maybe it is worth concentrating on the black gold rather than on the yellow one?

2. Best timeframes for trading.

You might realize after several weeks of keeping a trading diary that some of smaller time periods were not as profitable as the hourly period. In some cases these scalps make only losses during a week. What’s then? To filter out the trading system, introduce corrections in the setup or reduce the number of contracts for trading in smaller timeframes in order to minimize losses and increase the profit.

3. Personal progress.

You might realize after several weeks of keeping a trading diary that some of smaller time periods were not as profitable as the hourly period. In some cases these scalps make only losses during a week. What’s then? To filter out the trading system, introduce corrections in the setup or reduce the number of contracts for trading in smaller timeframes in order to minimize losses and increase the profit.

4. Best plans.

It is easier to plan trading when the market is closed, since you are not subject to emotional influence of jumping prices in the right part of the chart. A trading diary is the best place to register your plans for the next trading session. Later you can analyze your plans – how successful they turned out to be, where you made mistakes and how to avoid them in future.

And how did your trading diary help you? Please, share your experience in comments.

Questions in the end of a trading day

Honestly answer the following questions in your trading diary at the end of a trading day:

- Did I follow my trading system for entering a trade?

- How did I perform stop loss rules? How did I exit from trades?

- Why didn’t I follow my system (if this was the case)?

- How can I improve myself and/or my system?

Look through your trades during a day and praise yourself if you were disciplined and followed your rules. Market psychologists mark importance of an award for self-discipline.

Disadvantages of a trading diary

- Keeping your diary day after day could be boring. Besides, keeping a diary by hand increases a risk of human error.

- Time consuming. You would have a wish to stop keeping your diary when you missed a beautiful point of entry into a position while you were writing down the result of the previous trade.

- You might lose a paper diary and forget a password to its online version.

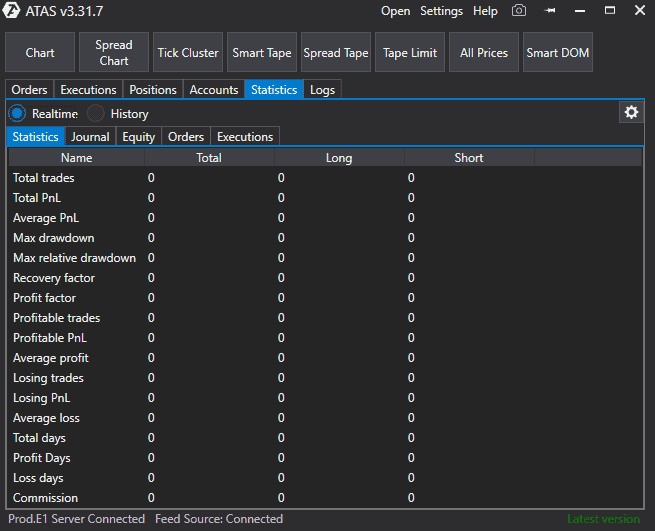

However, you are a lucky one if you use the trading ATAS platform. The built-in statistics module automatically registers the whole trading activity and provides its results in the form, which is convenient for analysis. The module is included both in the main ATAS version and in ATAS-Crypto (in a slightly changed format).

Click the Statistics tab in the main window of the ATAS platform to get access to the statistics functionality.

Advantages of the ATAS built-in trader’s diary

- Realtime/History switch allows analyzing trading for a specific period of time;

- The Statistics tab automatically calculates parameters for analysis of trading results;

- The Trading Diary tab registers details of each trade, such as time and price of opening/closing, volume, final result and others;

- The Equity tab builds profitability charts with consideration of all trades, which are parts of the selection;

- The Orders tab contains information about orders, submitted during a selected period;

- The Trades tab contains information about executed orders for a selected period.

You can learn more details about using the Statistics module watching this video on our YouTube channel.

Summary

Money to spare likes good care. If you want to increase the discipline of your trading in the financial markets, improve your own trading strategy and realize yourself and your place on the exchange – keep a trader’s diary.

The mental baggage from childhood can prevent you from succeeding in the markets. You have to identify your weaknesses and work to change. Keep a trading diary – write down your reasons for entering and exiting every trade. Look for repetitive patterns of success and failure. Alexander Elder.