The market inertia: hyperactivity and trade by the trend

What the market inertia is

Inertia is the ability to keep the current state. This ability is inherent for all objects in the world surrounding us.

If a man is sitting, he needs to apply some muscular efforts to stand up. It is natural for a man to keep his current state: sit, lie or stand.

Since the market consists of a big number of people, it has the same qualities. The market has the property of inertia.

One more reason for the market inertia is its size. The bigger the physical object, the higher inertia it has. A heavy truck needs a big distance to stop.

Since big objects have big inertia, much energy is required to stop them and reverse.

Millions of participants trade in the financial markets and some of them are huge in themselves:

- Major world banks, which manage trillions of dollars.

- Major producers of the exchange traded commodities (gold, oil, natural gas, wheat, corn, soybean and so on).

- Market makers. Organizations that support liquidity of exchange instruments.

- Investment and hedge funds, which manage billions of dollars.

All these organizations have inertia due to their sizes. In order to get a significant profit from the managed capital, they need to trade in big volumes. It is impossible to buy or sell a very big volume of some exchange instrument at one moment of time. The current market liquidity sets limits. That is why major market participants have to accumulate their positions and exit from the market gradually.

For example, a train picks up the speed slowly. And when it starts to slow down, it will pass some distance due to its big mass and inertia. It is very difficult to stop the train short.

The market has similar properties. If an impulse started in the market, there is a probability of its continuation. Stable trends may emerge in the market in view of this specific feature. The market may also reverse gradually.

How to use the market inertia in trading

The market inertia could cause stable trends. Before the market reverses, a trader may succeed in entering a position by the trend and make profit.

That is why, if you want to use the market inertia in trading, you should tade by the trend.

The classical Dow theory identifies three types of the trend:

- long-term;

- middle-term;

- short-term.

Depending on your working time-frame, there could be middle-term and long-term trends.

For example:

- Long-term – H4.

- Middle-term – M30.

- Short-term – M5.

or

- Long-term – D.

- Middle-term – H4.

- Short-term – H1.

You can identify the trend using any classical technical indicator (for example, moving average). If all trends coincide, you can trade. If the market situation is uncertain, it is better to wait. Trades in direction of 3 trends have a bigger profit potential and less risks.

Useful indicators of the trading and analytical ATAS platform may help you to find entry points in the trend direction. Let’s consider one of them – Speed Of Tape.

The Speed Of Tape indicator will help you to use the market inertia for making profit

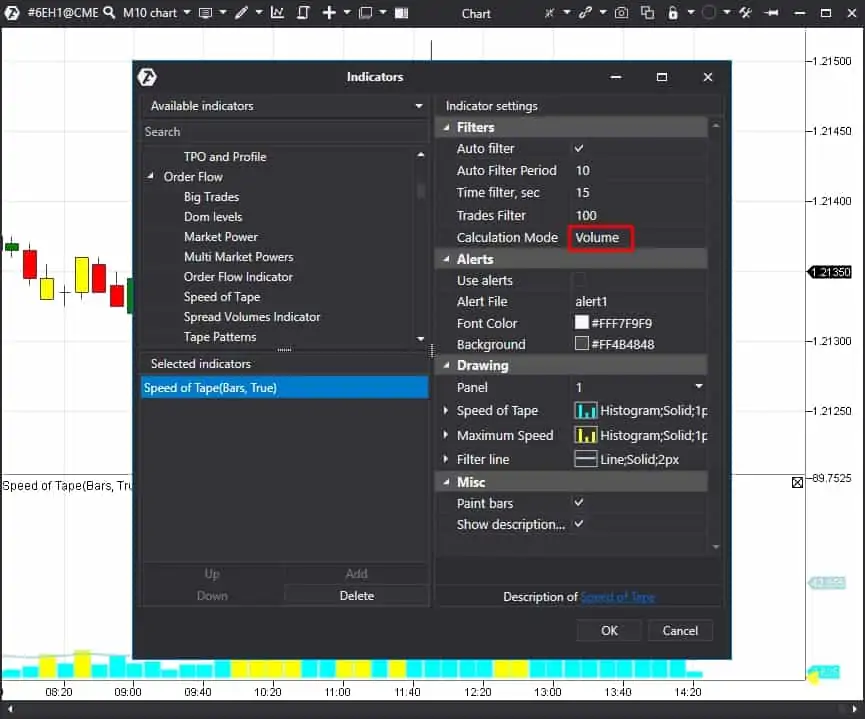

The Speed Of Tape indicator analyses the Smart Tape. The indicator marks the bar with colour where the Smart Tape moves faster. Analysis may be conducted by:

- ticks,

- volume,

- sell trades,

- buy trades;

- delta.

Every instrument has its own specific movement feature of the Smart Tape. That is why the indicator should be adjusted for every instrument.

The Speed Of Tape indicator shows special market points, at which the Smart Tape acceleration took place. It means that, perhaps, an impulse was sent to the market. And this bar could be the beginning of a short-term movement. And since the market has inertia, the impulse may continue.

If we analyse the Smart Tape and small time-frame like M10 or M5, the impulse can be small but sufficient for making profit. That is why the trader’s task is to find impulses by the trend and stay in them as long as possible.

Let’s consider several examples.

Example of a buy trade

We will use the Speed Of Tape indicator with Volume settings for our analysis:

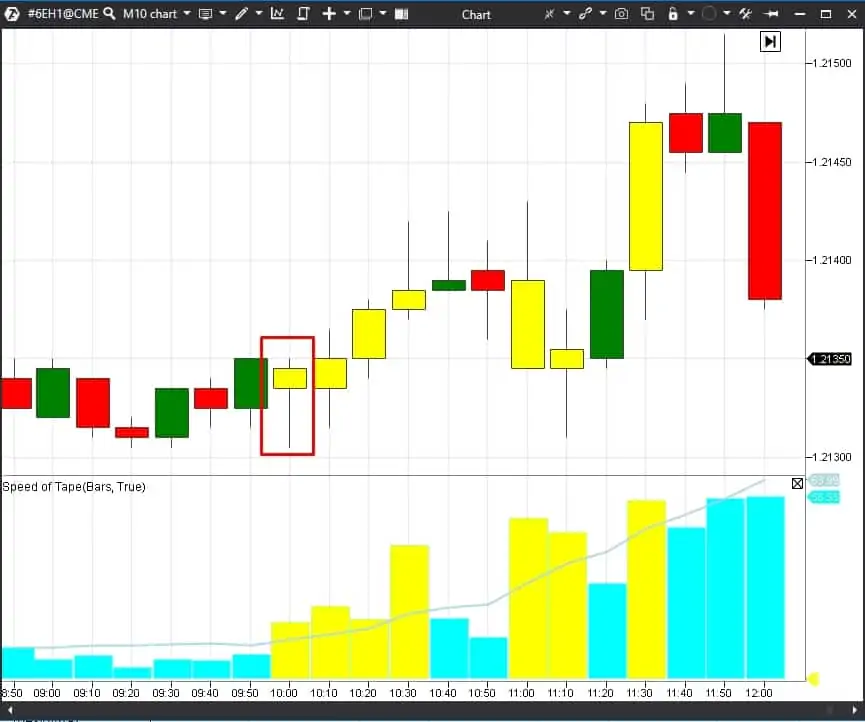

We will start looking for the impulse beginning using the EUR/USD futures (6E). We will use the non-standard M10 time-frame in order to reduce the number of false alerts.

We look for the first candle, marked by the Speed Of Tape, at the beginning of a European session. If this candle looks into the direction of 3 trends, you may consider this point as the first impulse. There is a probability that this impulse will continue. You can enter the market immediately after such a candle closes.

You can limit losses in several ways:

- after the candle’s low;

- calculate a technical stop loss based on historical data;

- post it after the closest levels, which can hold the price.

Since the impulse might be small, it is better to accompany this trade from the start, moving the stop loss after the new candle lows or footprint volume nodes, which are formed in growing candles.

Example of a sell trade

Let’s consider a sell trade.

All three trends look down. The first impulse after the beginning of a European session is our entry point. The Speed Of Tape indicator clearly shows hyperactivity of exchange traders. The Tape accelerates and a big volume flows into the market. This volume pushes the price in a certain direction. Our task is to take a small portion of the possible trend. It is done through accompanying this trade with a stop loss after the highs of new candles. The probability of movement toward a profit is high.

There could be several entry points on one instrument during a day. You can get more entry points if you trade several instruments simultaneously.

Conclusions. What to do in practice

The market has inertia due to its size. You can use the market inertia for making profit. To do it:

- Determine the long-term, middle-term and short-term trends. It is easier for the market to move in their direction.

- Trade in the direction of 3 trends. The profit potential will be higher.

- Use the Speed Of Tape indicator to find market impulses during a day.

Move together with the market. It may bring you profit.

Similar articles:

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.