Causes of Bitcoin fall in 2022

Bitcoins were launched after the 2008 financial crisis. A mysterious creator developed today’s main cryptocurrency as an alternative to fiat money. The former is not controlled by central banks and governments. However, it was the actions of the authorities that could be the main cause of why the Bitcoin price dropped by two-thirds in 2022.

- High debt levels of the crypto market. Market participants used the opportunity of margin trading (trading leverage) in a very risky way — having a relatively small deposit at their disposal, they bought crypto assets for a much larger amount. As soon as the value of the asset decreased, the position was forcibly liquidated. Accordingly, a sell order entered the market. The general pressure of sellers increased like an avalanche.

- Low fundamental value of many projects. According to CoinGecko, over 3,000 “dead tokens” appeared in the world in 2022, which is 3.5 times more than in 2021. We are talking about tokens or coins with little or no value, or those that simply do not have a clear purpose. In most cases, they were developed anonymously in order to “get some hype”.

Consequences of Bitcoin Decline in 2022

As the price of Bitcoin declined, it was followed by a series of major bankruptcies and liquidations of positions on cryptocurrency exchanges. In addition to the bankruptcy of the FTX exchange, one can single out the collapse of the Terra project, which is associated with LUNA and UST tokens. It became the largest in the history of cryptocurrency in the summer of 2022. The SEC claims that Do Kwon, the founder of the Terra project, withdrew up to $80 million from Terra funds every month. In total, he personally withdrew up to 2.7 billion USD in LUNA and UST tokens.

What could happen in 2023

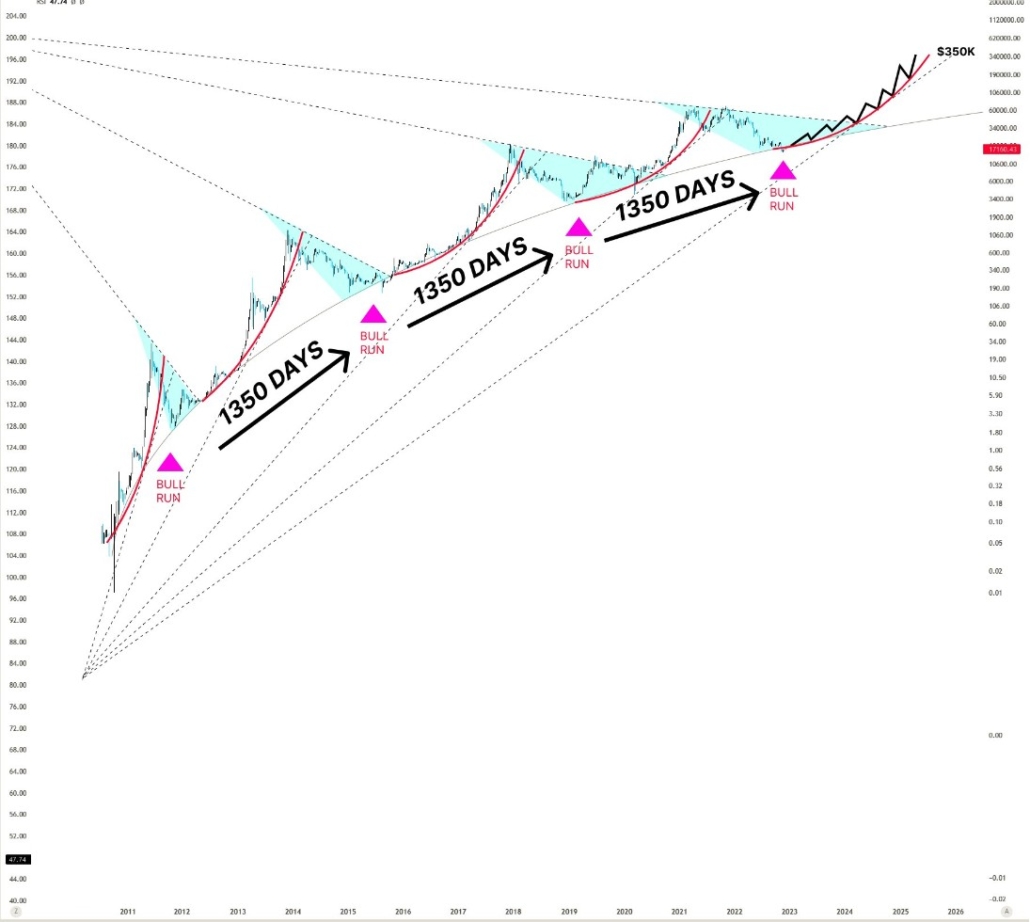

Analyzing the cyclical repetition of Bitcoin price movement, it can be noted that the stage of the so-called crypto winter averages about 1350 days.

Top 20 Forecasts for 2023 from Authoritative Sources

To add credibility to this article, we present twenty predictions from cryptocurrency market experts.

Conclusions

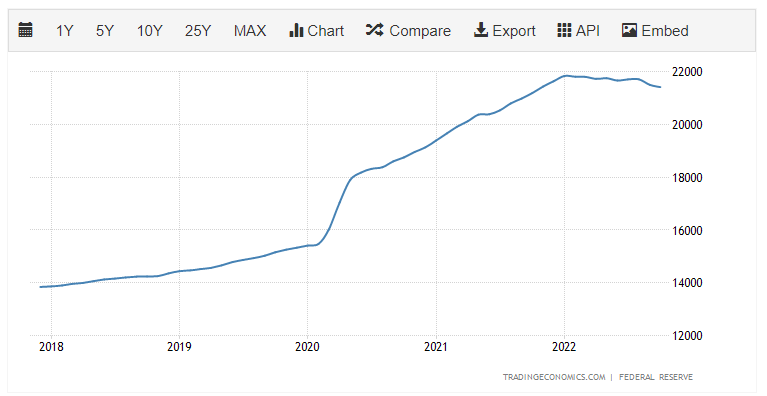

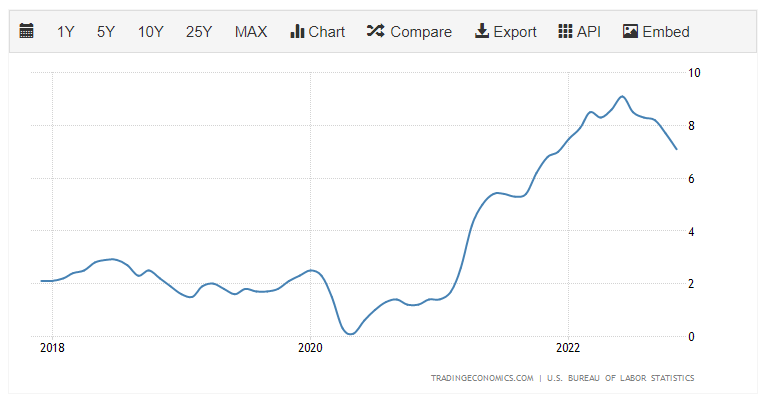

In our opinion, the following three conclusions can be drawn from 2022:- Bitcoin does not protect against inflation. Even though Bitcoin supply is limited to 21 million coins, the value of BTC dropped sharply in 2022, while inflation skyrocketed in major economies.

- Cryptocurrency market is highly influenced by margin positions. The decline in the price of cryptocurrencies leads to a cascade of bankruptcies and liquidations.

- Cryptocurrency market requires regulation. Despite the fact that cryptocurrencies were created as a decentralized system, not controlled by central banks, the actions of scammers make market regulation a more relevant issue. And 2023 may bring important news in this direction. Coinbase believes that in 2023 the SEC and CFTC may be able to clearly classify the top 100 cryptocurrencies.

- Download the ATAS trading and analytical platform. It allows you to connect to several cryptocurrency exchanges, including Binance.

- Do not risk money that you cannot afford to lose. Before you start trading, practice crypto trading in the Market Replay mode. Eliminate emotions, and act using facts that price and volume charts provide.

- Read our blog, subscribe to our Youtube channel — learn how to use the arsenal of ATAS instruments to gain a real advantage in the market and develop your own strategy.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.