What is a correction

This term appeared in the stock markets of the 20th century, it was used to describe a short-term decline in the price of an overheated stock. Over time, the term spread to other markets. It is also used by technical analysts for intermediate upward corrections during an active downtrend. Correction is a rather eloquent term, if you think about it. The market itself seems to recognize that a news release caused a stir and prices rose to extreme values, and therefore they need to get back to normal. In other words, adjust.

- А→В: an impulse movement that initiates a trend;

- В→С: a correction;

- С→D: a trend resumption.

When to enter a position

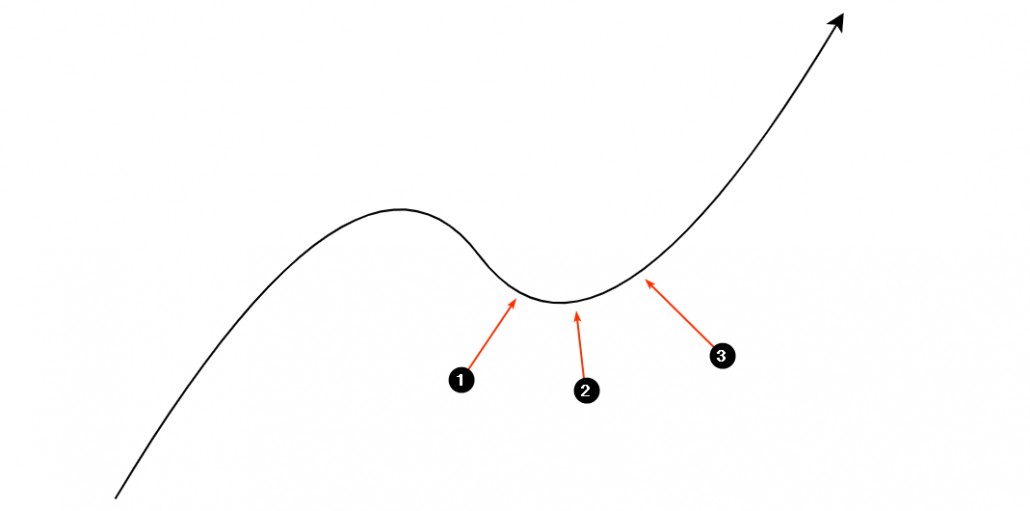

The diagram below shows completely different types of entering a long position considering the end of a correction and the resumption of an uptrend.

Modern ways of identifying the end of a correction

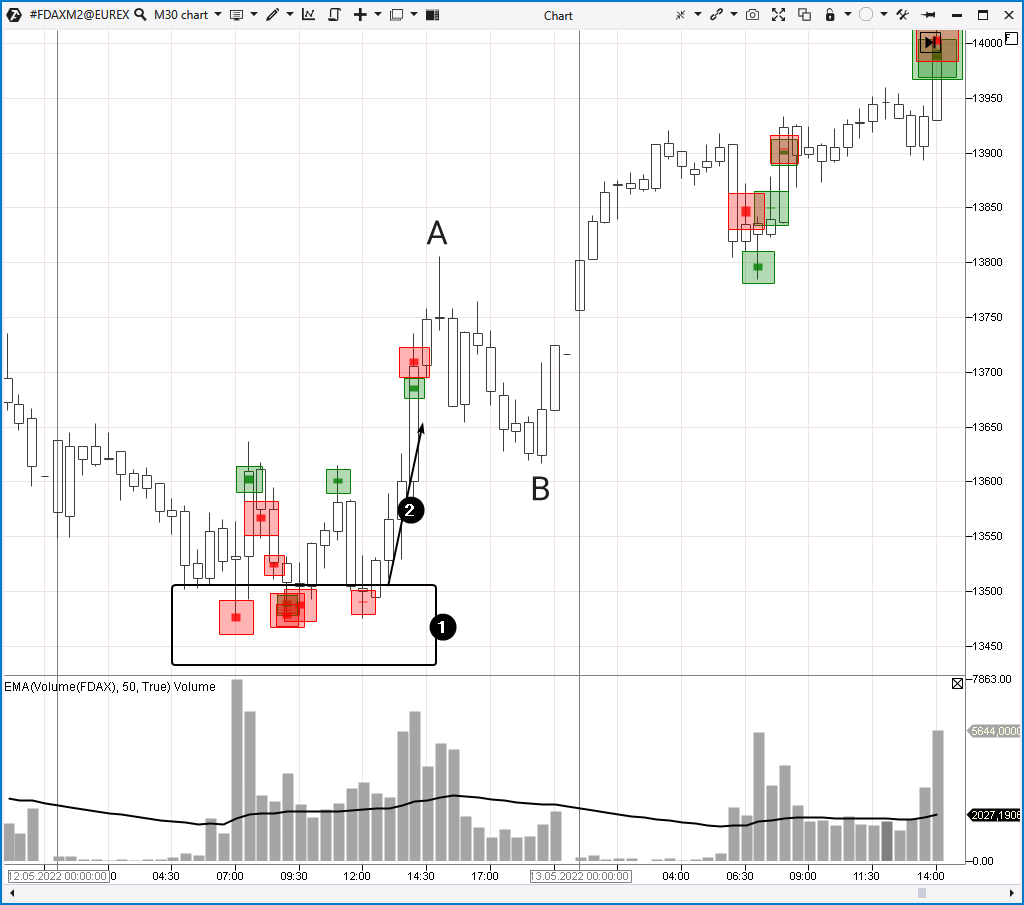

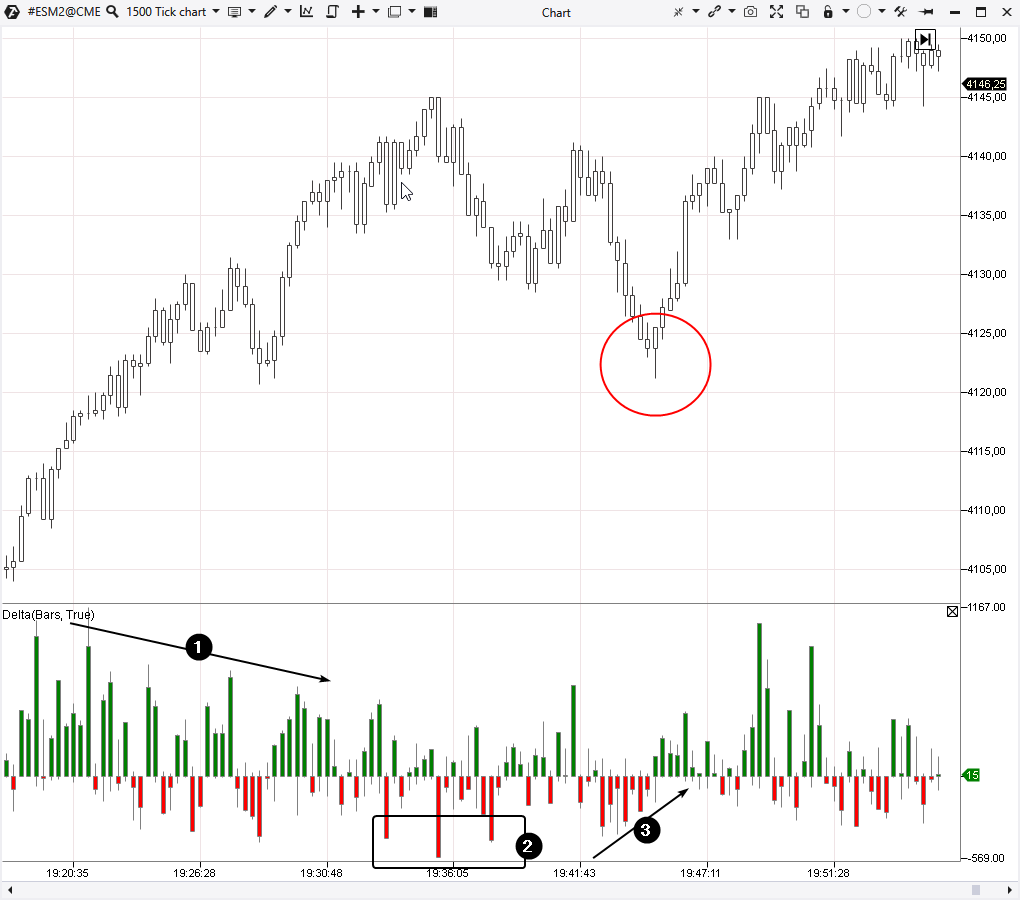

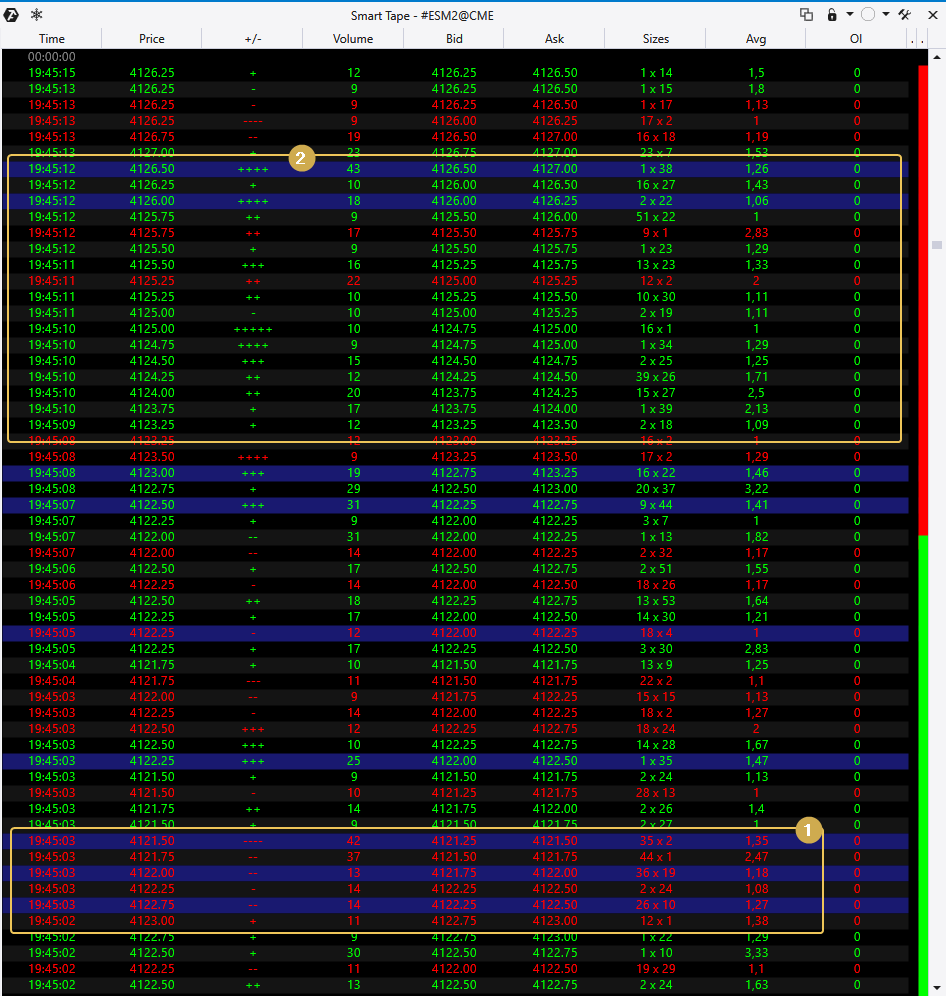

To identify/confirm the end of a correction more accurately, use professional volume analysis indicators provided by the ATAS trading and analytical platform (download the platform for free). In the following part of the article, we will show some examples to give an understanding of how to use these indicators. Settings may be different depending on the market/timeframe.Example 1. DAX Index futures

The Big Trades indicator has been added to the 30-minute chart that displays high volume trades.

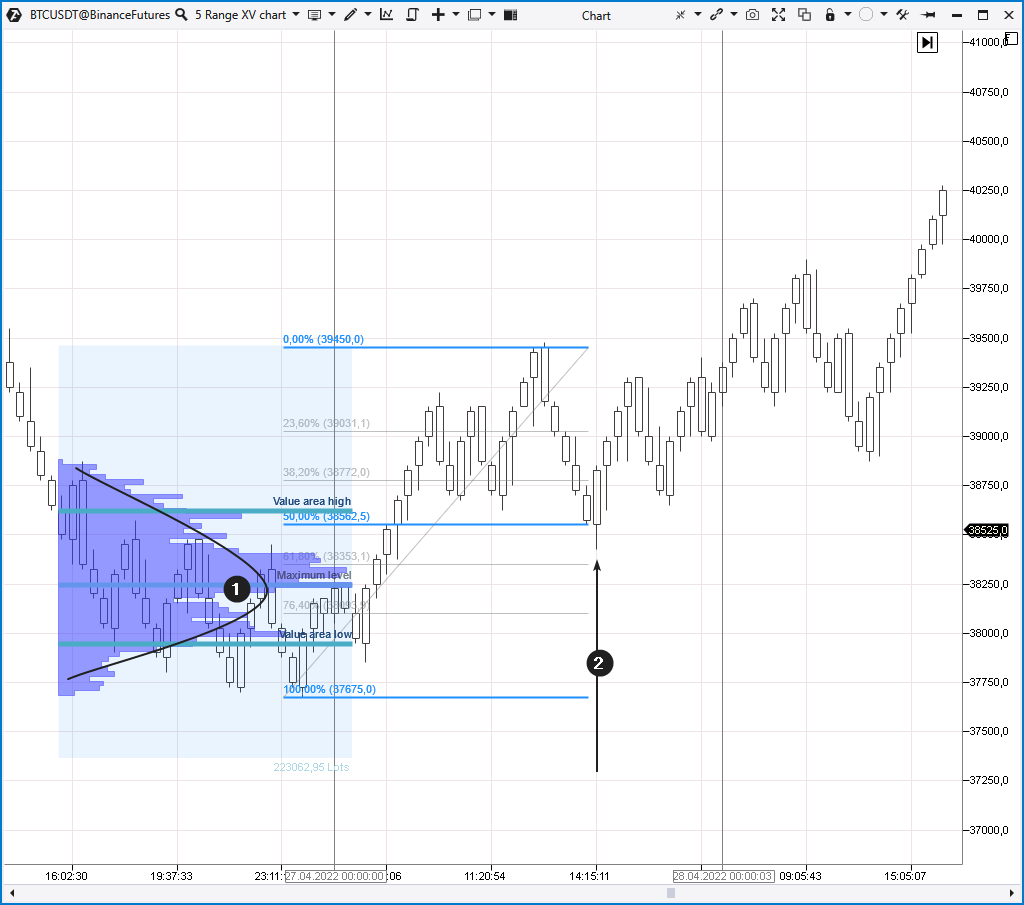

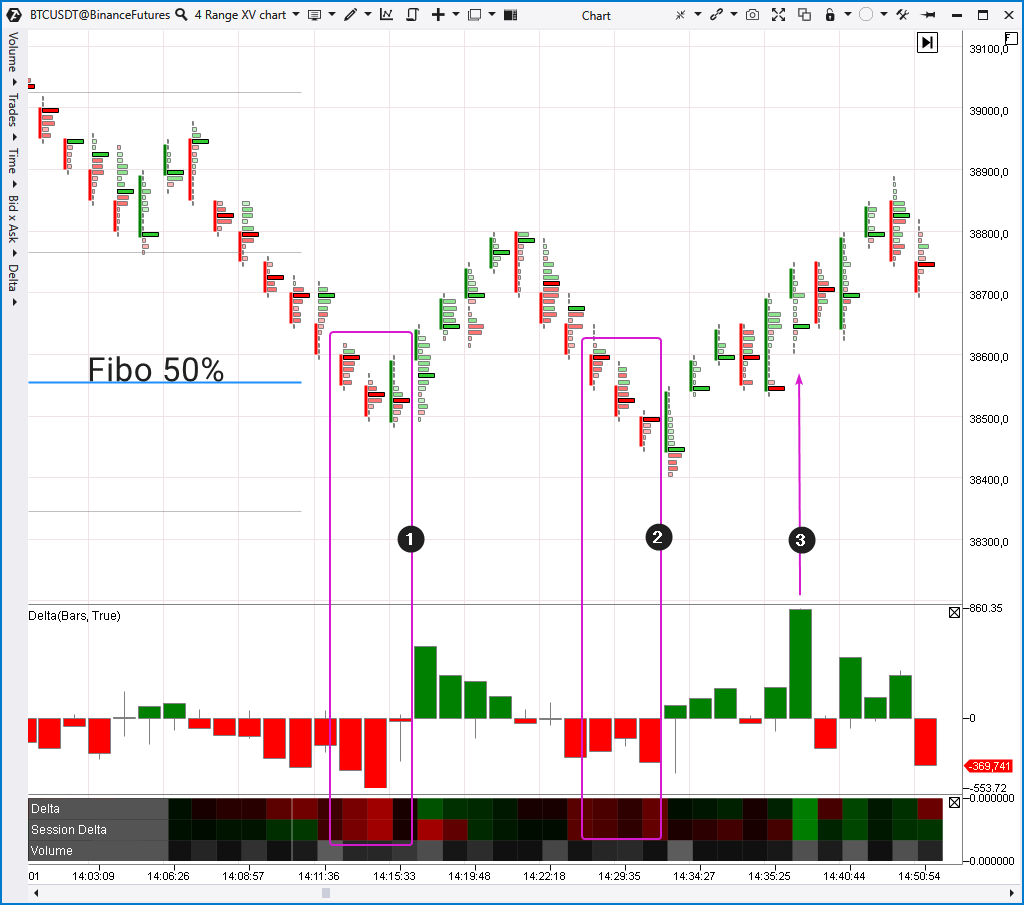

Example 3. Bitcoin futures on a cryptocurrency exchange

The last example is on the Range XV chart. This is a non-standard type of chart that can be used as a signal to enter a position considering that the correction is over.

- A selling climax of a local scale. The Delta indicator shows large spikes in market selling volumes followed by a price rise (a sign of a reversal).

- The selling pressure is decreasing, it is easy to notice because the red bars on the Delta indicator have become smaller.

When to exit a position

Although the article is devoted to finding the end of a correction, which is directly related to opening a position, it is impossible not to mention when to close the position. In fact, this is a question that does not have the only correct answer. There are some recommendations:- use a trailing stop technique. It can be easily implemented with the help of protective strategies in the ATAS platform;

- close the position completely or partially when important support and resistance levels are reached;

- use a mathematical take profit. For example, if your stop = 100, then your take = 250.

How to start trading

We hope that the information presented in the article was useful for you. As we have already mentioned in the article about Trend Trading Strategy, it is important for traders to trade in the direction of a trend. But since the price does not change in a straight line (otherwise it would be too easy to make money), entering a position with the trend often comes down to identifying the signals that indicate the end of a correction. The methods, which were briefly described above, are designed to help you identify the end of a correction more accurately and enter the position with greater confidence. Try out volume analysis tools to see how useful they are for identifying the end of a correction on your charts. Find out what setup is the best for you. Download the free version of ATAS right now! Try a powerful cluster chart analysis tool for stock, futures and crypto markets.Conclusions

Trend trading increases the chances of success in the long run. If you want to join the current market trend, look for signs that indicate the end of a correction. It can be a daunting task, but professional volume indicators make it easier. Download ATAS. There are four good reasons for that:- It’s free and you can continue using the program even after the 14-day trial period.

- You will be able to analyze the end of a correction in the stock, futures and crypto markets.

- There is a demo account built into the ATAS platform, so you can practice trading without risking your real capital.

- The platform offers many benefits for traders who want to trade with easy-to-use cluster charts and useful indicators.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.