What Does FOMO Mean in Cryptocurrency Trading?

FOMO, or “Fear of Missing Out,” is a psychological effect characterized by anxiety and the fear of missing significant events, profitable trades, or valuable opportunities. The term was first used in the early 2000s by marketer Dan Herman, who studied consumer behavior and noticed that many people experience a strong fear of missing out on something important or meaningful.

The FOMO Effect Is Part of Our Nature

Humans have an inherent desire to be part of significant events and to avoid missed opportunities, which is also evident in trading. In the book “Extraordinary Popular Delusions and the Madness of Crowds” written by Charles Mackay in 1841, several historical examples of mass delusions and economic bubbles are presented, which can be considered manifestations of FOMO:- Tulipomania. A speculative bubble in the Netherlands in the 1630s, where prices of tulip bulbs reached astronomical heights before sharply crashing. People invested huge sums in buying tulips, fearing to miss out on earning profits in the booming market.

- South Sea Bubble. In the early 18th century in Britain, the South Sea Company’s stock experienced rapid growth due to speculations and promises of huge profits from trading with South America. This led to a mass frenzy and subsequent market collapse when it became clear that the promised profits would not materialize.

- Mississippi Bubble. In early 18th century France, financier John Law created the Mississippi Company, which gained a monopoly on trade with French colonies in North America. Massive issuance of shares and subsequent speculation led to soaring prices, followed by a catastrophic collapse.

Example of FOMO in the Cryptocurrency Market

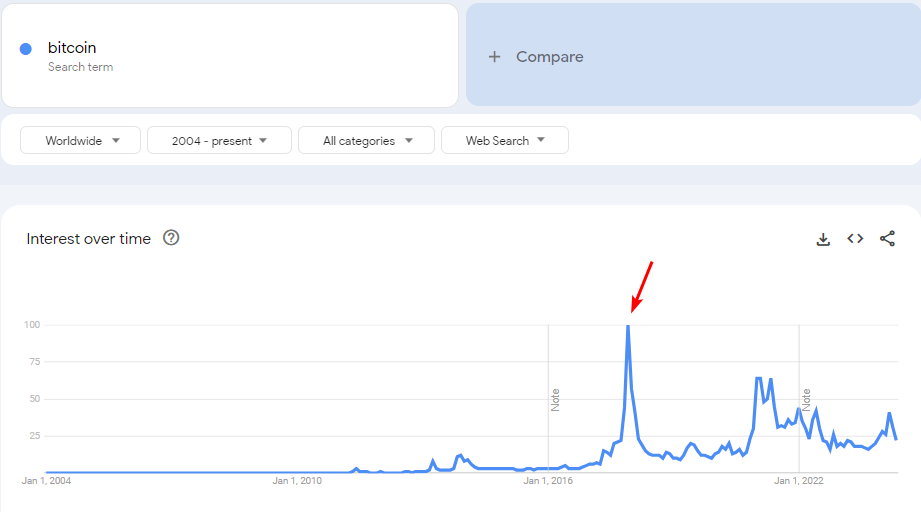

It is visible on Google Trends that the peak of global interest in Bitcoin was recorded in December 2017.

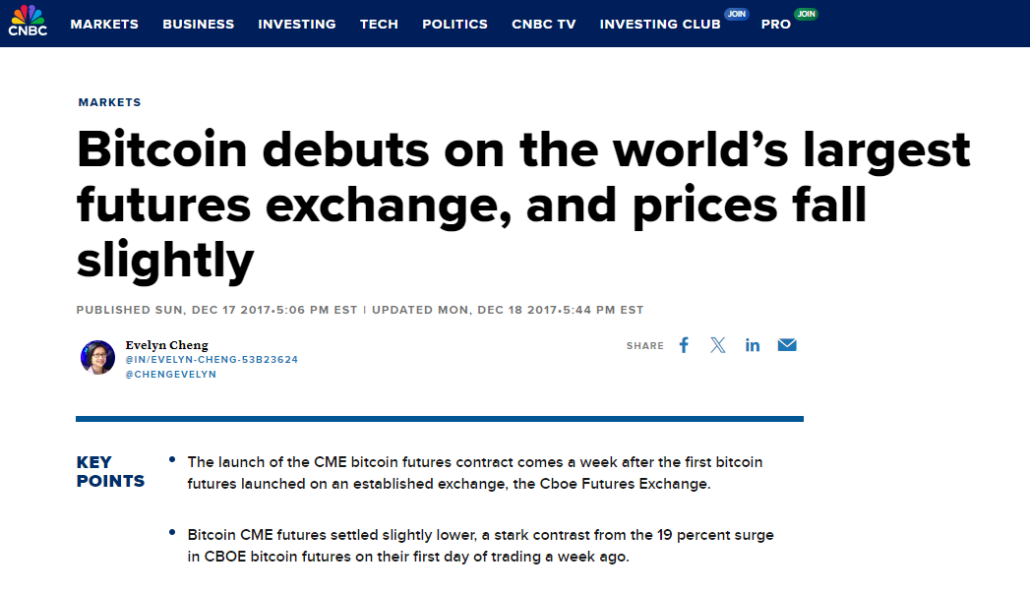

During that period, Bitcoin was gaining widespread attention due to the CME Group exchange’s decision to introduce futures trading for Bitcoin The surging Bitcoin prices attracted new investors who drove the prices even higher, fueling the interest of others. Many market participants were afraid of missing out on the opportunity to invest in Bitcoin, which was rapidly rising:

How FOMO Manifests in Trading

FOMO in trading manifests through various forms of emotional and behavioral pressure. There are several typical situations in which traders may experience FOMO.Impulsive buying and selling

Traders may make decisions based on short-term market fluctuations, fearing to miss out on potential profits. This often leads to buying at the peak and selling at the bottom, which contradicts the fundamental principles of successful trading. Example: FOMO effect related to Bitcoin ETF approval in 2024 Rumors that the SEC (U.S. stock market regulator) would approve applications for launching Bitcoin ETFs were a significant driver of BTC/USD growth in 2023. The crypto community viewed the ETF approval positively, expecting it to attract institutional investors and increase demand for Bitcoin.

Following the Crowd

Seeing other market participants making profits on a particular stock or cryptocurrency, traders may start copying their actions without careful analysis, which can lead to losses. Example. FOMO effect related to the short squeeze of GameStop (NYSE: GME) stocks. It all started with discussions on the r/WallStreetBets subreddit, where users noticed that GameStop stocks were heavily undervalued and had become the target of a significant number of short positions by major hedge funds. Forum participants decided to buy up GME stocks massively to trigger a “short squeeze” — a situation where stock prices rapidly rise, forcing traders with short positions to buy stocks to cover their obligations, which drives up the price even more. In January 2021, GameStop stocks began to rapidly rise in price (marked as 1 on the chart). This caused:- mass panic among large investors holding short positions,

- a frenzy among retail investors eager not to miss out on quick profits. The price of GME stocks surged from around $20 to nearly $350 within a few days. This incredible growth triggered a wave of FOMO, urging even those who had never traded stocks before to invest in GME, fearing they might miss the “opportunity of a lifetime.”

Other Consequences of the FOMO Effect:

Inability to stick to a trading plan Under the influence of FOMO, traders often stray from their previously developed strategies and plans, trying to chase every opportunity. This ultimately leads to chaotic actions with negative impacts. Emotional burnout The constant anxiety and pressure from the fear of missing out can lead to emotional burnout and deteriorate a trader’s psychological well-being.5 Tips to Overcome FOMO

A deep understanding of FOMO and its manifestations is key to learning how to control your emotions and make more rational decisions in cryptocurrency or stock trading. Here are 5 principles to help overcome the FOMO effect:1. Let go of the past

Constantly regretting missed opportunities prevents rational decision-making. Remember, the market offers new opportunities every day. Focus on current trends rather than what could have happened if you had bought Bitcoin at $1. For example, if you did not buy Tesla shares in 2010, it does not mean there are no promising investments now. Staying emotionally detached is crucial to build resilience against FOMO in trading.2. Buy when others sell, and sell when others buy

Follow Warren Buffett’s principle: “Be greedy when others are fearful, and fearful when others are greedy.” This counter-cyclical strategy enables you to take advantage of market fluctuations. During periods of panic, when most investors are selling, you can buy assets at lower prices. For example, in March 2020, when markets crashed due to the pandemic, it was a great opportunity to purchase stocks at discounted prices. However, it is essential to consider risks and take precautions to:- avoid buying shares of a company on the brink of bankruptcy;

- avoid investing in a fraudulent cryptocurrency project;

- avoid “catching falling knives“;

- avoid becoming a victim of trading against the trend.

3. Set clear goals

Define your financial goals and investment time horizons. This will help you stay focused and avoid impulsive decisions. For example, if your goal is to save for retirement in 20 years, short-term market fluctuations should not worry you. The same applies to a “buy and hold” strategy for the cryptocurrency market. Clearly outline your goals, such as: “increase capital by 50% in 2 years” or “generate an additional income of 15% annually.” Having well-defined long-term goals makes it easier to ignore short-term FOMO spikes in the markets.4. If you have no trading ideas — wait

Sometimes doing nothing is the best option. Trading for the sake of trading often leads to losses. If you are not confident in a trade, why open it? Famous investor Peter Lynch said, “You don’t need to trade a lot to make money. It is important to make fewer, but better trades.” This is especially relevant in volatile FOMO markets, where emotions play a significant role.5. Strategy is the key

Develop and adhere to your strategy based on:- a clear trading advantage;

- your risk profile, time horizon, and financial goals.

How to Use FOMO in Cryptocurrency Trading

Follow these tips:

Study Volume Analysis

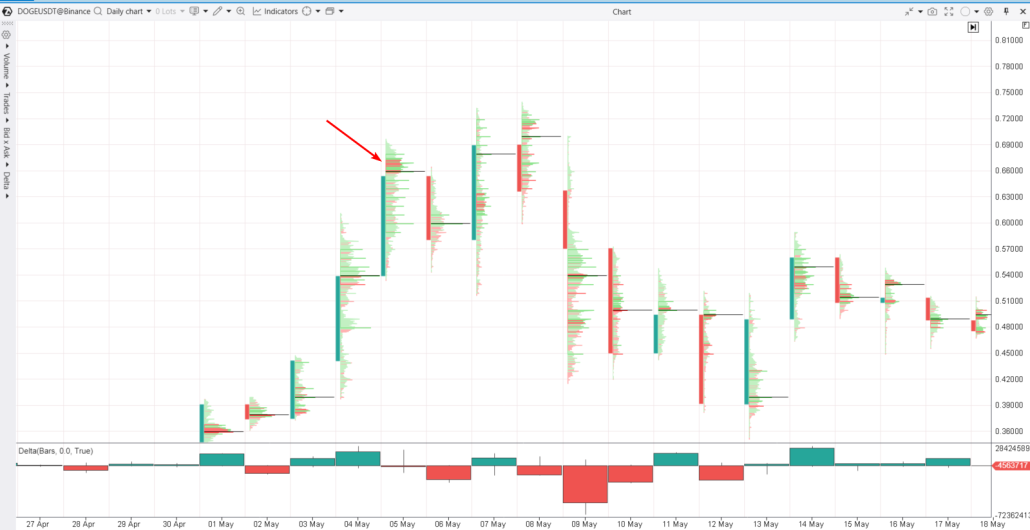

Volume analysis allows you to assess the balance and imbalance of supply and demand, helping you form your own viewpoint based on chart facts rather than media publications. The best way to do this is by studying cluster charts. Example from 2021: FOMO at Dogecoin’s historical peak Once again, in May 2021, Google Trends showed a peak in interest in the rapidly rising price of the meme currency Doge, supported by Elon Musk.

- the next day, on May 6th, the price closed lower;

- an attempt to surpass the 0.66 level on May 7th and 8th was unsuccessful.

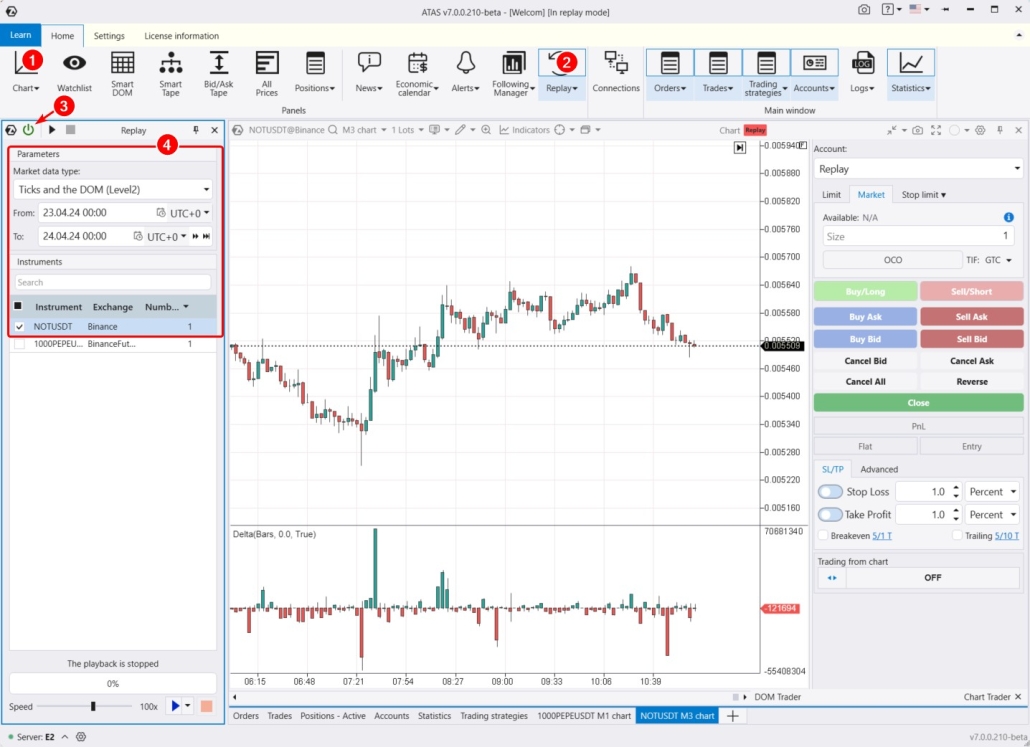

Practice Before Trading

To avoid falling victim to FOMO syndrome, eliminate emotions through numerous practice sessions on a stock exchange simulator. This risk-free method helps automate the trading decision-making process to eliminate doubts, fear, and panic when trading on a real account. To do this, download the ATAS platform for free, install, and launch it, and then:

- adjust the playback speed, and pause;

- test your strategies, monitor signals from over 400 indicators;

- of course, use Chart Trader and other features to trade crypto and other assets on the built-in demo Replay account;

- use drawing objects, for example, mark support and resistance levels;

- use various chart types (e.g., non-standard Range XV);

- use exit strategies;

- analyze volumes in the Level II order book, for instance, using the DOM Levels indicator;

- use numerous other advanced features of the ATAS platform to become a trader from scratch.

FAQ

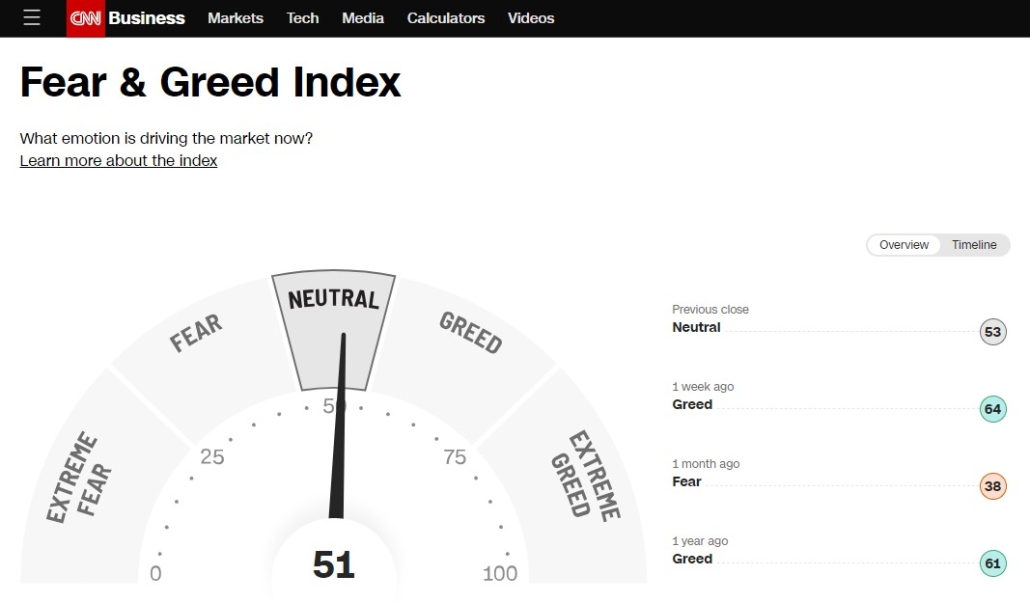

Is there a FOMO indicator?

Various resources provide their versions of the Greed & Fear Index for stock and cryptocurrency markets. However, the simplest and most universal FOMO indicator can be considered the basic vertical volume indicator. The logic is quite simple: if trading activity per unit of time is high, it indicates a high probability that the FOMO effect is influencing the market.

What is FUD in trading?

FUD (Fear, Uncertainty, and Doubt) in trading is a manipulative tactic aimed at influencing market perception by spreading negative, misleading, or dubious information. This can lead to panic selling and a decrease in asset prices, creating opportunities to buy at lower prices.Is it normal to experience FOMO?

Feeling FOMO is a natural reaction in today’s information-saturated world. However, it is crucial to manage this feeling and not let it drive your important decisions. While FOMO can motivate you to stay active and seek new opportunities, it can also lead to impulsive actions and risks.How to overcome FOMO?

If you recognize that FOMO is a psychological issue for you, acknowledging it is the first step. Apply the five tips mentioned earlier or seek help from a professional.What triggers FOMO?

Market volatility, a series of winning trades, consecutive losses, news and rumors, social media, and statements from influential people.Pros and Cons of Trading in Fomo-Driven Markets

Pros of trading

- High volatility. This offers opportunities for quick profits. Traders who can react swiftly and accurately assess the market can benefit from short-term price movements.

- Increased liquidity. During periods of heightened interest in certain assets, liquidity increases, even in less popular markets. This makes it easier to buy and sell assets without significantly affecting their price.

- Use of technical analysis tools. Even though market participants may exhibit irrationality in decision-making, tools like volume analysis and chart patterns remain effective.

- Learning and skill development. FOMO markets are often widely covered in the media, attracting new participants who may pursue trading careers. Experienced traders can improve their skills in analysis, risk management, and quick decision-making in a dynamic market environment.

Cons of trading

- High risks. Sharp price fluctuations can lead to significant losses, especially for inexperienced traders who succumb to emotional pressure.

- Emotional stress. The constant fear of missing out and anxiety over making the wrong decision can cause severe emotional strain, negatively impacting a trader’s mental health.

- Manipulation risks. High-FOMO markets are vulnerable to manipulation by large players or scammers who exploit the frenzy for personal gain. This can create artificial price spikes and drops, adding extra risks for traders.

- Lack of long-term stability. Prices often drop after periods of frenzy, making long-term investing in such markets extremely challenging and risky.

- Overlooking fundamental analysis. Relying on rumors and neglecting fundamental analysis can lead to misjudging asset values, resulting in losses.

Conclusions

A deep understanding of FOMO and its effects is crucial for making well-informed and rational trading decisions. This results in:- greater emotional resilience;

- a more insightful interpretation of price behavior based on assumptions about the prevailing sentiments among market participants.

- Check out the Learn section in the main menu of the ATAS platform for educational materials.

- Explore ATAS tools like professional-grade cluster charts, the Smart DOM order book, Smart Tape, useful indicators, and more.

- Your trading advantage may be based on technical analysis, volume analysis.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.