Stock exchange trading and technical analysis of financial charts are closely connected with indicators. The present article is about convenience and powerful functionality, which the ATAS platform provides when working with indicators.

Read in the article:- What indicators and their purposes are

- How indicators are displayed

- How to combine indicators in the price window

- How to combine indicators in the panels under the price window

- How to add one indicator to another

What indicators are

If we speak about technical analysis of financial markets, an indicator is a product of a mathematical formula, which uses the data of historical prices, volumes or (in case of futures markets) open interest. As a rule, this product can be added to a stock exchange chart in the form of lines, patterns or other visual objects.

Perhaps, the common goal of all indicators is to help traders to make correct decisions and protect them from incorrect ones.

They do it in different ways. Some indicators calculate average price values (for example, moving averages) in order to point to a trend direction and/or strength, while some focus on volatility (for example, ATR and Bollinger Bands) and other market characteristics, which can be described by formulas.

How indicators are displayed

In a majority of cases, indicators can be displayed in one of 2 ways:- in the price window (results of mathematical calculations are added to a candlestick / bar / cluster chart);

- in additional panels – usually, under the price chart window.

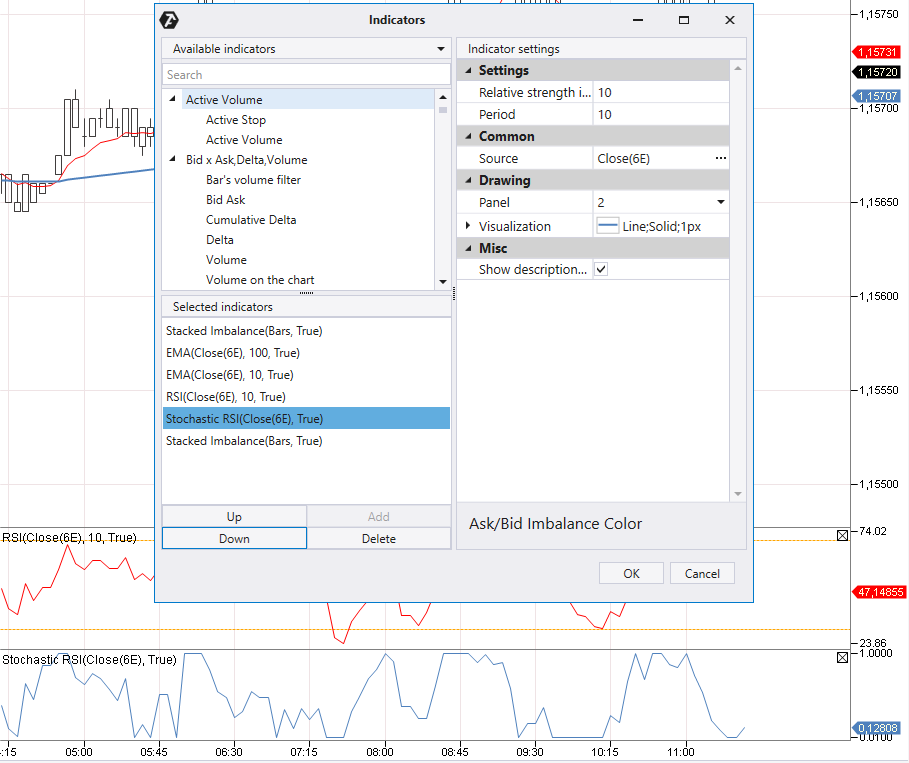

- blue line of the Exponential Moving Average (EMA) (100 – ‘slow’);

- red line of the Exponential Moving Average (EMA) (10 – ‘quick’);

- red and green ‘thick’ lines of the Imbalance indicator (Volume = 10);

- red ‘thin’ lines of the Imbalance indicator (Volume = 3).

- the blue line of the Stoch RSI oscillator;

- the red line of the RSI indicator.

- Chart – the indicator is displayed in the price chart window;

- Number (for example, 1 or 2) – the indicator is displayed in an additional panel under the price chart window.

How to combine indicators in the price chart

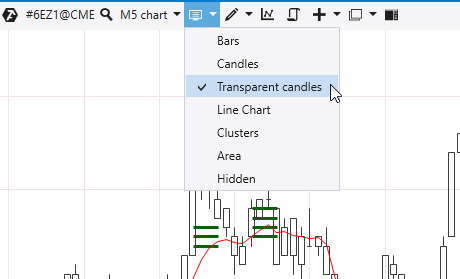

A trader / analyst quite often needs to add several indicators to the price chart. ATAS offers 3 tips to keep the chart user-friendly: Tip 1. Use different colors and line thickness for different indicators. For example, as it is done with moving averages for different periods in the example above. Tip 2. Use the Up / Down buttons to move indicators to the foreground / background. Some indicators include the function of moving them ‘under’ the candlestick chart. Tip 3. Use the possibility of making candles transparent so that the bright price colors will not make indicators ‘less visible’. Select the Transparent Candles menu item to turn on the candle transparency.

- set transparency / colors of candle outlines;

- set transparency / colors of candle fillings;

- set transparency / colors of indicator objects;

- set a chart background color (including gradient);

- completely turn off candles (selecting Hidden in the menu above).

How to combine indicators in a panel under the price chart

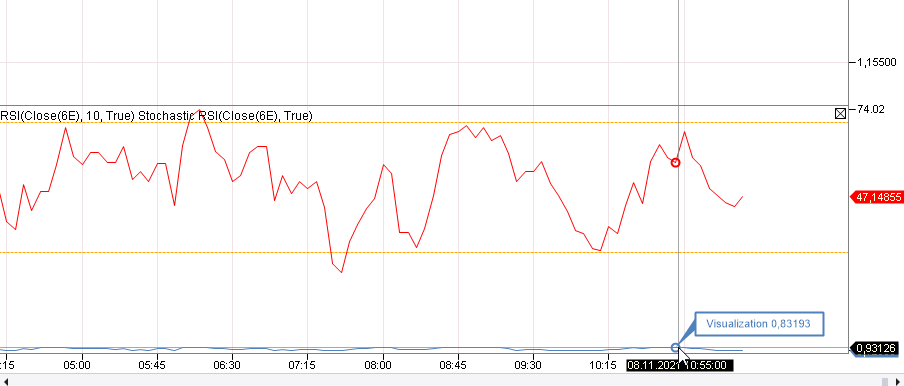

As it is shown in the example above, RSI (red line) is under Stoch RSI (blue line). Use the Up / Down buttons if you need to change their positions.

The red RSI line and blue Stochastic RSI line are displayed in the 1st panel. However, you can clearly see that the picture is not easy to read, since RSI fluctuates between 0 and 100, while Stochastic RSI – between 0 and 1. We even had to mouseover the blue line to see the value.

If indicator values were homogenous, we could have saved space and set their display in one panel.

How to add one indicator to another

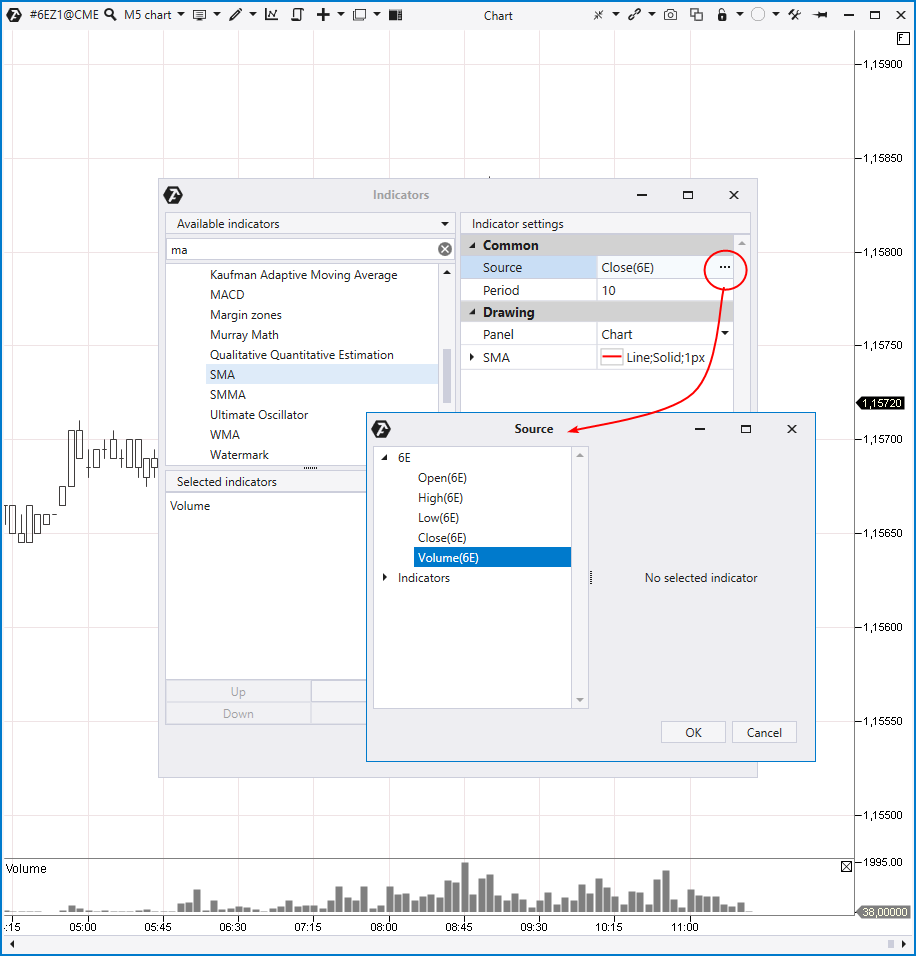

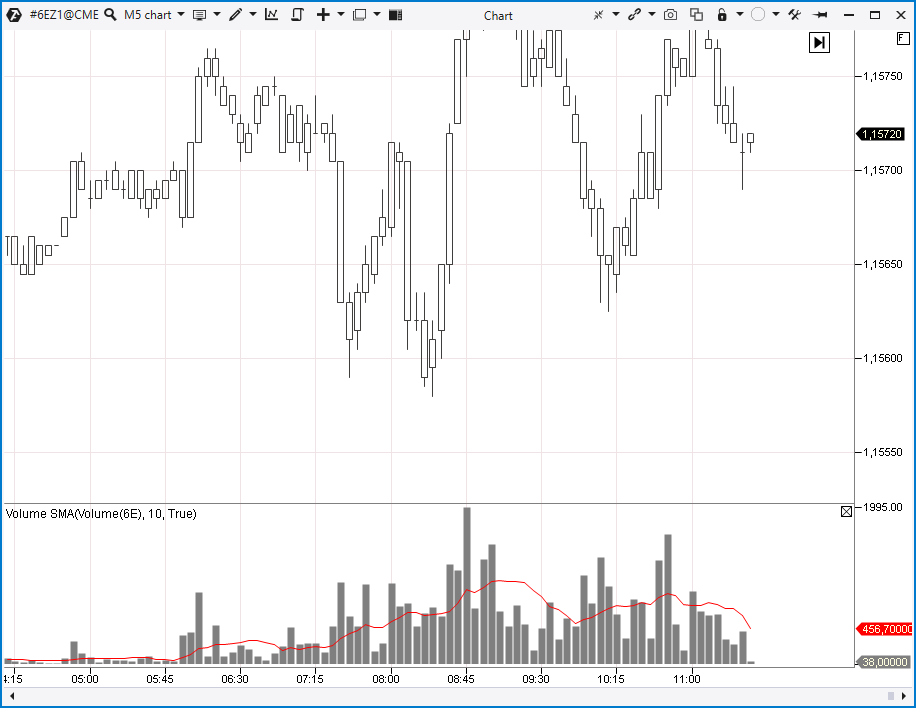

Sometimes, there is a need to use another indicator rather than the price history as the source data for the indicator formula. How to do it? Let’s use a popular example by adding a Simple Moving Average (SMA) to the Volume indicator. To do it, we:

Example

Below is a tick (5000) oil futures chart from the Moscow Exchange. The lower panel shows a combination of 2 RSI indicators and both have the Period = 10. However, one of them is classical, based on the price (red line), while calculation of the other is based on the Cumulative Delta (blue line).

Arrows 1 and 2 will help you to set RSI by the Cumulative Delta.

How to use it? Note that the blue line moves sharply up with respect to the red one at two peaks (marked with numbers 3 and 4). It can mean that the size of buys (Ask trades) is extremely big and doesn’t correspond to the price growth dynamics. Perhaps, this is sellers’ ‘stop loss activation’ and / or ‘bull entry into a trap’, which usually takes place at market peaks.

A similar situation (but a mirrored one) takes place at the market low marked with number 5. There are too many sells (Bid trades), but the price falls slower.

FAQ

What indicators does the ATAS platform have? There are around one hundred indicators and their number grows with every update. Indicators are split into groups. If you want to get an idea what indicators are available, we recommend that you read the Getting acquainted with indicators article. What indicators are the most useful ones? The best and most accurate indicators, which provide the 100% guarantee of a profit, unfortunately, do not exist. We recommend that you pay more attention not to popular ones, like MACD, for example, but to progressive instruments based on the order flow: Big Trades, Cluster Search, Speed of Tape and others. How to test a strategy, which is based on an indicator? To do it, you will need to know the C# programming language. We showed how to test your trading by the Super Trend indicator in this article. Tick history of data and flexible type / frame settings allow performing accurate tests using unique charts.Conclusions

Indicators allow traders / analysts to mark and find ‘support points’ in the infinite space of price and time. The ATAS platform provides maximum flexibility for working with indicators. Download the ATAS platform free of charge in order to assess its flexibility and power of available indicators in the markets you select.Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.