Shakeout and Upthrust patterns

This is another article on the topic of VSA and cluster analysis. Earlier we have considered:

- Bag Holding and End of Rising market patterns;

- No Demand and No Supply patterns;

- Buying and selling climax patterns.

In each previous article, we have grouped two patterns that are in many ways “mirror images” of each other.

Shakeout and Upthrust are grouped together in today’s article. Some might argue that the “mirror image” of Upthrust is Spring. A reasonable point. However, there is no Spring pattern in the classic VSA terminology. Although Volume Spread Analysis creator Tom Williams was aware of the term Spring, he never used it himself.

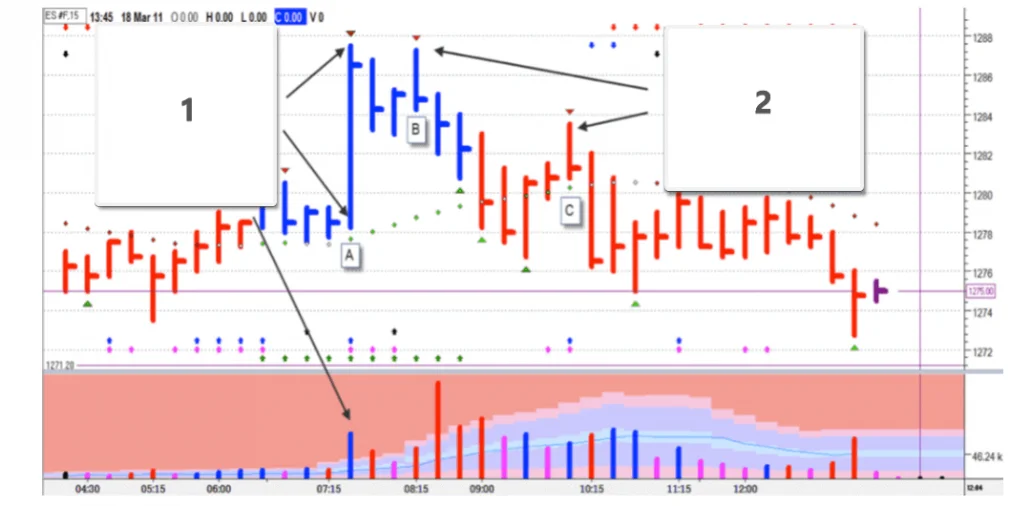

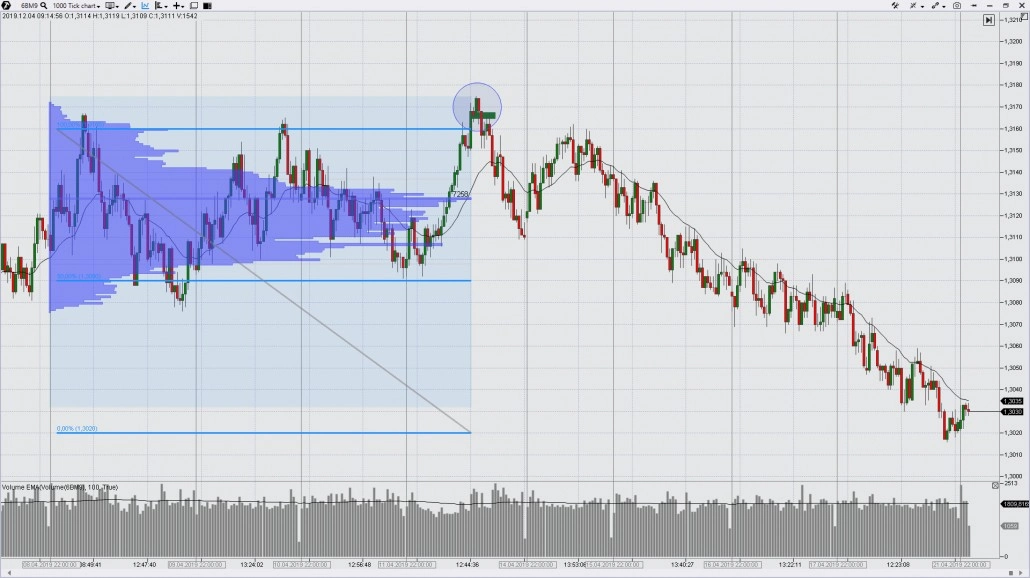

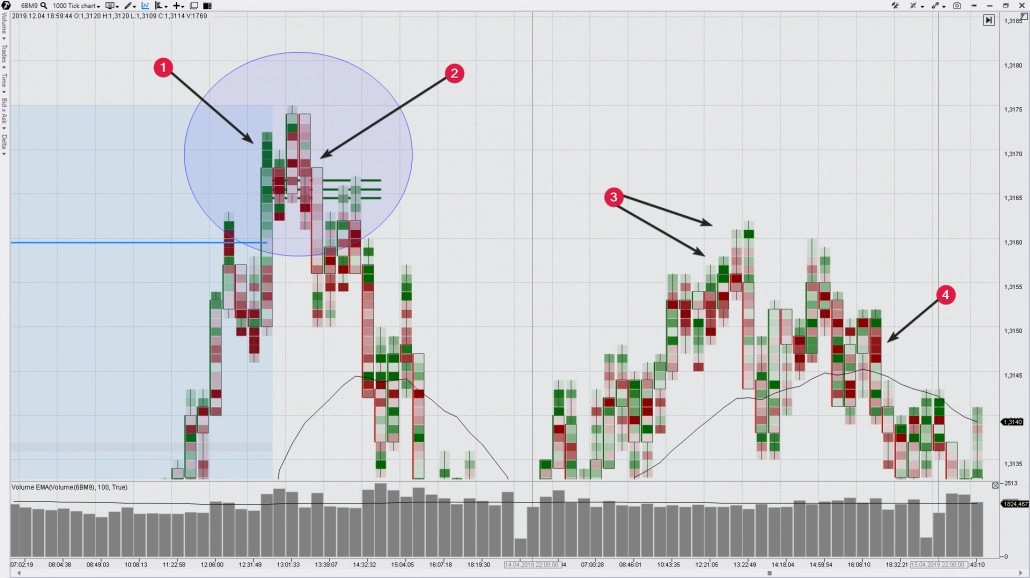

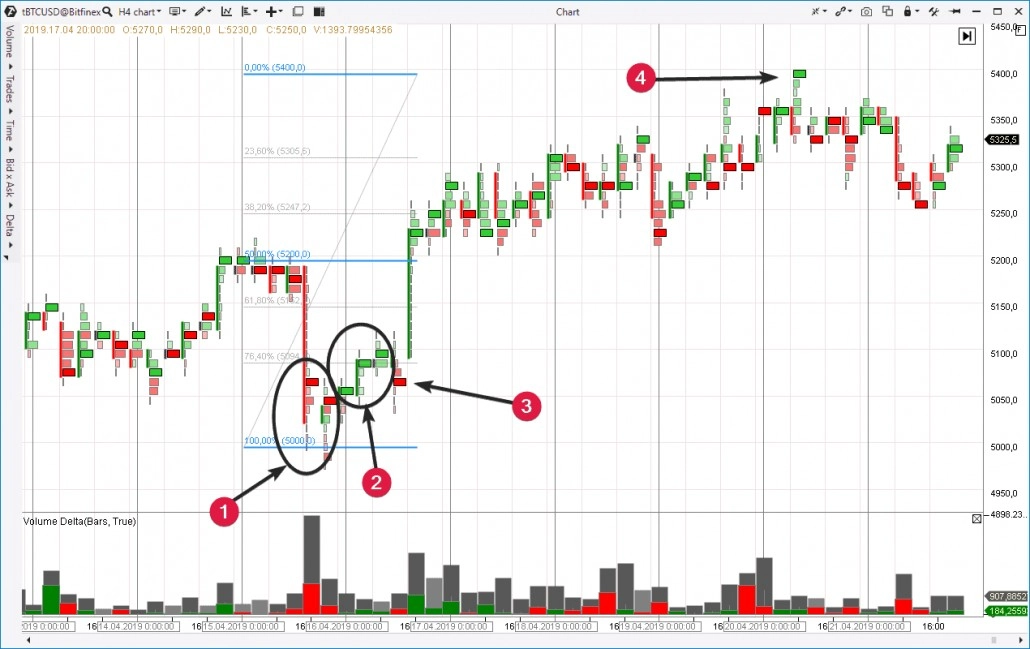

For the sake of purity of approach, we chose Shakeout, which has similar features to Upthrust, only in “upside down” form:

- both signals reflect market manipulations of major players;

- they are aimed at taking as many stop losses as possible from traders, who opened positions at the right side of the market;

- they are aimed to carry traders, who do not have positions, in the wrong direction.

Read today: