Types of frames in the ATAS platform: application. Part 1.

Traditional price charts (timeframes) use fixed time periods. Is it the only reasonable way to build charts? Should we consider charts that ignore the course of time? In this article, we will consider some alternative types of frames of the ATAS platform. Charts, represented by these frames, are built on the basis of volume and volatility.

In this article:

- How did time charts appear?

- Why did alternative charts appear?

- What is a frame?

- Delta chart.

- Tick chart.

- Reversal chart.

- Range chart.

- Do the alternative frames present the Grail?

How did time charts appear?

Exchanges didn’t have necessary means for providing data in real time in the past. Of course, there was the time-and-sales tape, but it wasn’t accessible for all. Even if each of the market participants would have had access to it, there wasn’t any software, like the ATAS platform, at that time for fast interpretation of exchange information and immediate creation of charts.

So-called chartists drew charts by hand on the graph paper. Maximum what they used at the time was a slide rule. Moreover, traders of the past had access only to the end of the day market data, consequently, they could draw only day charts.

Which means that traders had to wait for closing the current trading day in order to renew the charts and start analyzing them. At those times they didn’t even dream about that diversity of graphical and digital means of presentation of the flow of market information, which traders have today.

The use of only day charts was connected not only with technical restrictions. It was also connected with the cycle nature of data, presented by a day timeframe. Each trading day is a complete cycle. Conditionally, it consists of three phases:

- the period of opening the market, when traders react to the news received during the night;

- the period of the market dullness at noon;

- the period of closing the market, when major funds can accumulate their positions.

Namely that is why it makes sense to compare trading days between themselves. The idea of using timeframes became generally accepted since fixed time intervals are used when building day charts.

Why did alternative charts appear?

With the development of information technologies and appearance of the advanced trading and analytical ATAS platform, the modern traders have access to various graphical methods of presentation of the market information, including frames, which exclude time parameters when building charts. Let’s consider their specific features.

What is a frame?

Maybe, for some of you, a frame is not so familiar as the timeframe term. We introduced a generalizing term ‘frame’, since not all the charts in the ATAS platform are based on time. Simply speaking, it means that bars could be built in the platform not only on the basis of time, but also on the basis of some other parameter. In the general case, this other parameter could be volume or a volatility derivative.

Frames, based on time (timeframes):

Seconds, minutes, hours, day and so on.

Frames, based on volume:

Volume, Delta, Order Flow and Cumulative Trades.

Frames, based on volatility:

Tick, reversal, range, BTK and Renko.

An event, required for creation of a new bar, lies in the basis of differences between these three categories. Bar building may take different time, when using frames, that is why it would be incorrect to call all types of frames timeframes.

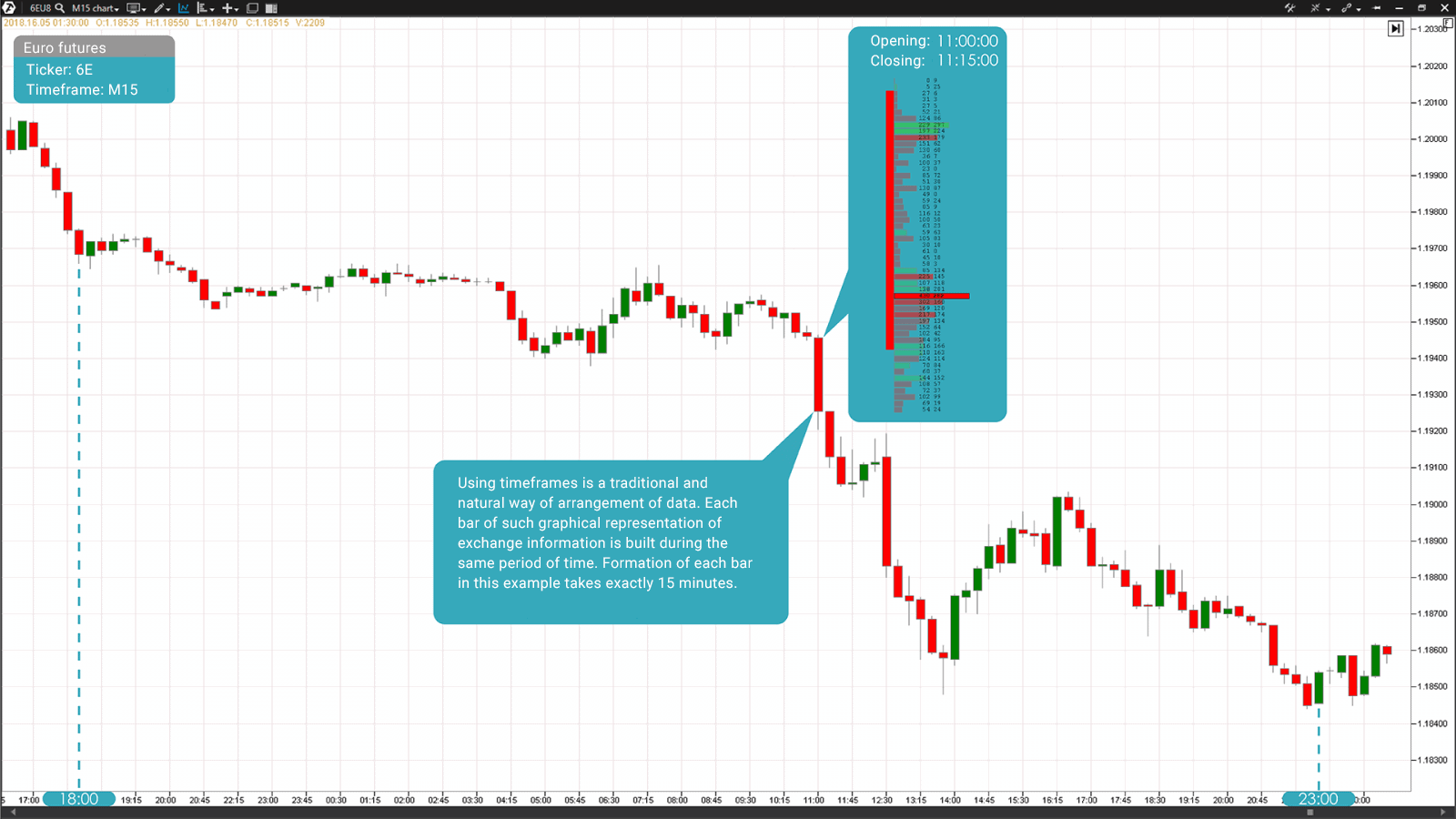

Using timeframes, no doubt, is a traditional and natural way of arrangement of market data. Each bar of such graphical representation of exchange information is built during the same period of time. This method of analysis of market activity is the most familiar and comfortable for many traders.

15-minute timeframe of a EUR futures contract (ticker: 6E) for the period from May 14 until May 15, 2018.

Nevertheless, it is useful even for experienced traders to check efficiency of new trading methods from time to time. Besides, your professional development is possible only when you learn something new about the market and the ATAS platform can become your reliable assistant in it. It will give you access to a wide spectrum of both standard timeframes and alternative types of frames.

The volume market analysis is in the center of attention of a big number of traders. That is why it is not surprising that there are charts, which are formed on the basis of the trading volume data. Volume is the fuel for market movements. Using such charts of the ATAS platform, you are able to see what distance the market covered using the same amount of fuel. That is why, the use of a constant volume value, when building this type of charts, is justified for the majority of traders. Moreover, unlike the range chart, the frames, which are based on the volume, allow analyzing patterns, as it is in the case with timeframes. The traded volume of each bar, built on the basis of volume, is, in fact, a constant value, while price and time are variables.

Delta chart.

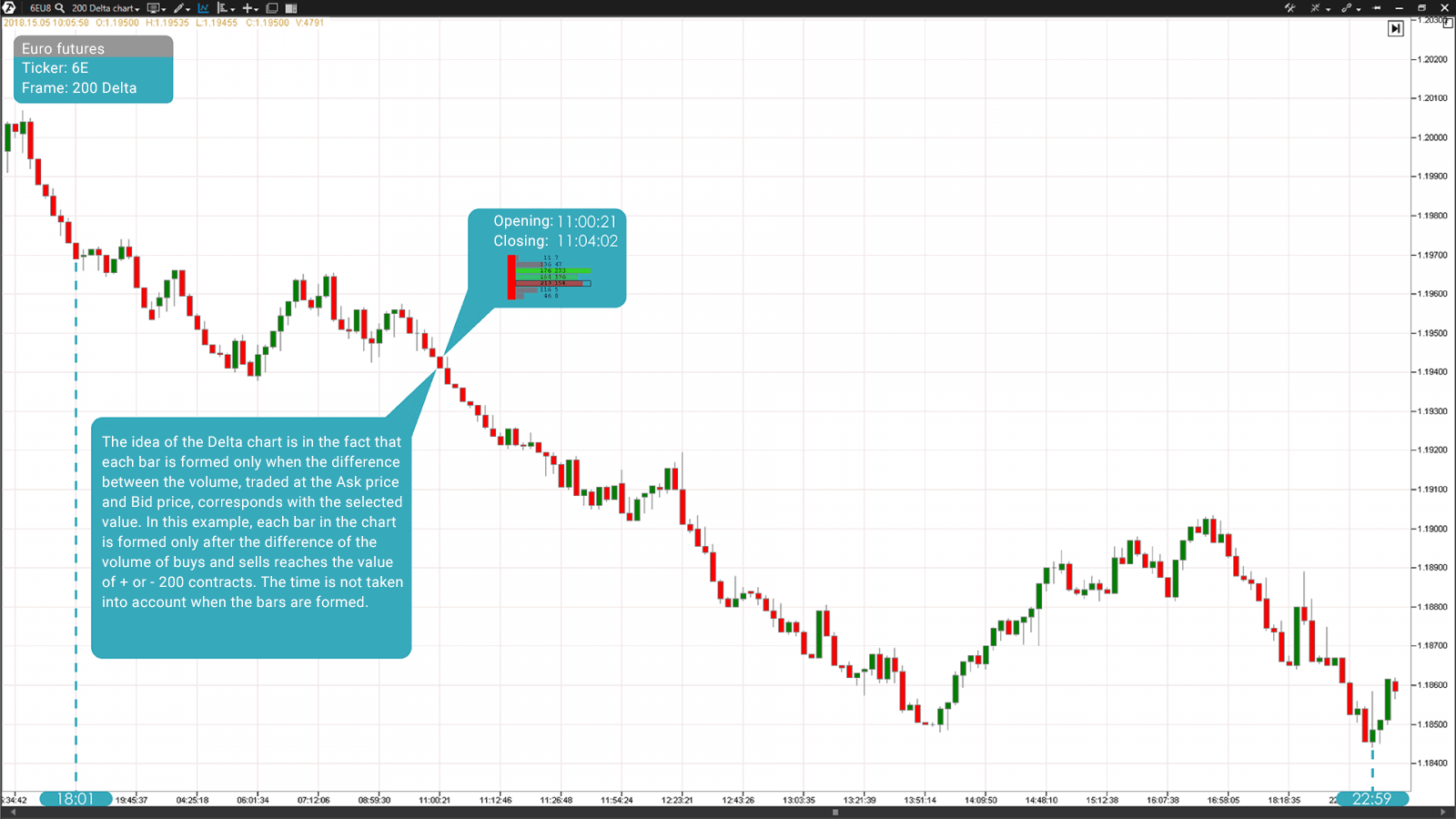

The Delta Chart is a frame built by the Delta value. It uses the Delta value, specified by a trader, for building new bars. When the Delta reaches this value, the formation of the previous bar ends and formation of the next bar starts. Delta is the difference between the volume, traded at the Ask price, and the volume, traded at the Bid price.

The Delta value is zero when a bar opens. And now imagine that a trade for 50 contracts is executed at the Ask price. The Delta value increases by 50 (0+50=+50) in the result of this trade. The second trade for 30 contracts is executed in the market at the Bid price immediately after that. It would result in decreasing the Delta by 30. The total Delta change after two trades would be 0+50-30=+20.

The Delta chart could help us to get information about what volume was executed and how it got into the market. This frame opens a completely new dimension of the market analysis. The Delta chart allows tracking the order flow, removes unnecessary market noise and ensures a more accurate forecasting of market reversals. And, what is the most important, this frame demonstrates a predominant strength of sellers or buyers, which helps a trader to catch big movements.

The Delta Chart of a EUR futures contract (ticker: 6E) with the value of 200 contracts for the period from May 14 until May 15, 2018.

You can read in detail about application of this frame type in trading in our articles: Strategy of using the footprint through the example of gold, Strategy of using the footprint through the example of WTI oil and Strategy of using the footprint through the example of E-mini S&P 500.

Frames, based on volatility, envisage bar building on the basis of actual price movement. The main idea of volatility frames lies in the fact that the time is not considered as a parameter when creating bars. A new bar would not be built until a certain movement takes place, in accordance with the criteria of the frame selected by you, in the market.

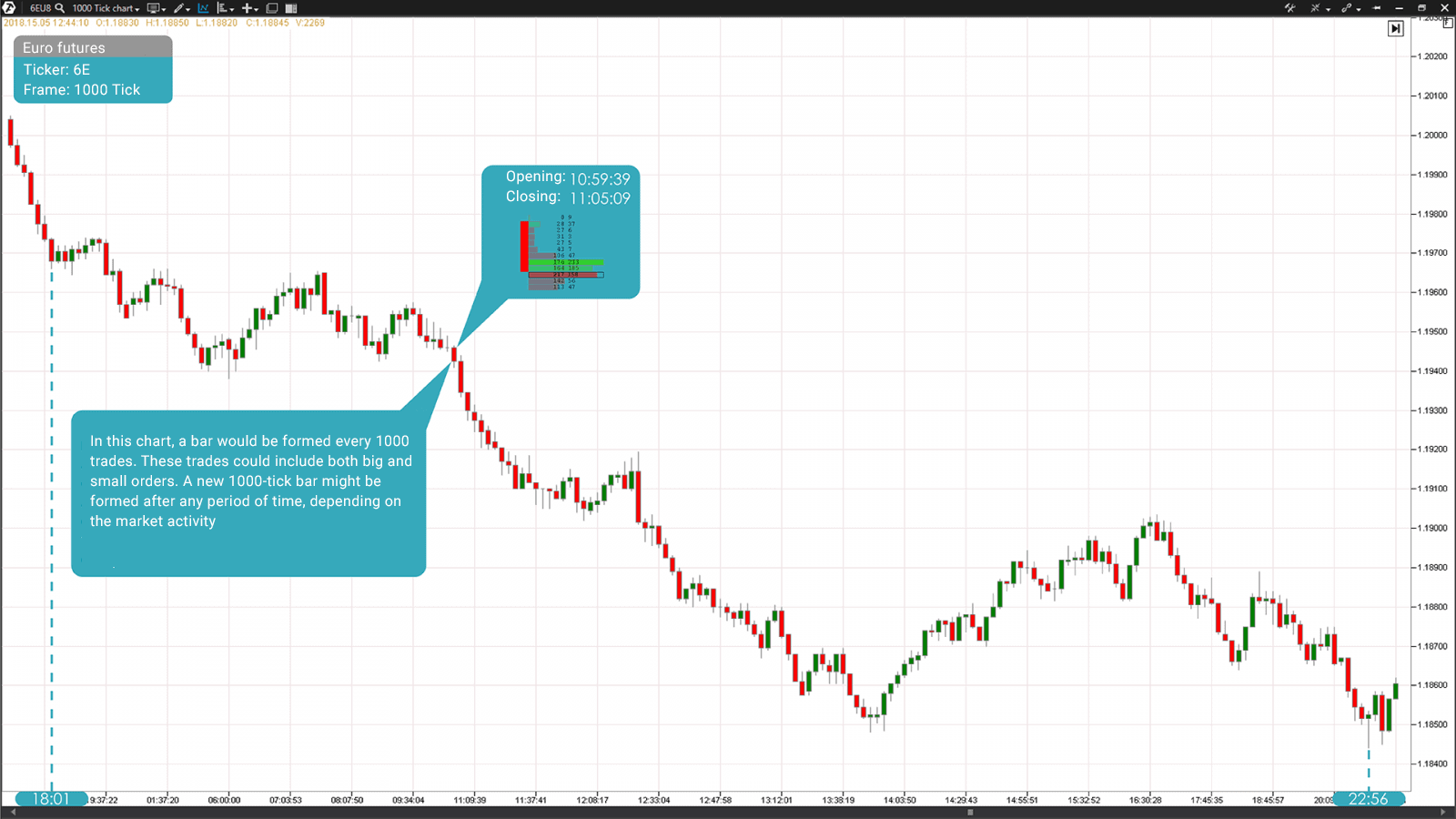

Tick chart.

The Tick Chart is built on the basis of a certain number of ticks in a bar. The most popular values for building tick charts are: 89, 144, 233, 377, 610 and 1000. For example, if you take a value of 1000, as it is shown in the picture below, one bar would be formed every 1000 trades. These trades could include both small and big orders. Each trade is calculated once, independent of the order size. A new 1000-tick bar might be formed after any period of time, depending on the market activity.

The Tick Chart of a EUR futures contract (ticker: 6E) with the value of 1000 ticks during the period from May 14 until May 15, 2018.

Thus, a chart with a uniform distribution of trades by bars is built. This chart type provides a higher degree of the market breakdown than time charts. It is especially interesting in a combination with volume indicators for assessment of the volume structure, identification of activity of major players and analysis of the price reaction to this activity.

You can read in more detail about application of this frame type in the Strategy of using the footprint through the example of Russell 2000 E-mini article.

Reversal chart.

The Reversal Chart allows controlling the price action and does not take time into account when building bars. The price should pass a certain distance for the reversal bar (do not confuse it with the market reversal) formation, after which the price pulls back for a certain value.

There are two parameters in settings of this type of the chart:

- Probe — is a minimum bar size, after which the pullback may be counted;

- Value — is the pullback size, after which one bar ends and a new bar starts.

Let’s consider an example. We take the value 5 and probe 10. This would mean that the pullback should be 5 points and the probe – not less than 10 points for such a bar formation. Moreover, the time period of the bar formation makes no difference.

The Reversal Chart of a EUR futures contract (ticker: 6E) with the value of 10/5 for the period from May 14 until May 15, 2018.

When building a chart this way, pay attention to the distribution of volume in a bar. In what part of the bar a volume node (a block with the maximum volume) is concentrated and what the reaction to this volume was: an overdrive on volume or bounce from it. For this, the reversal chart should be used in combination with the cluster chart display.

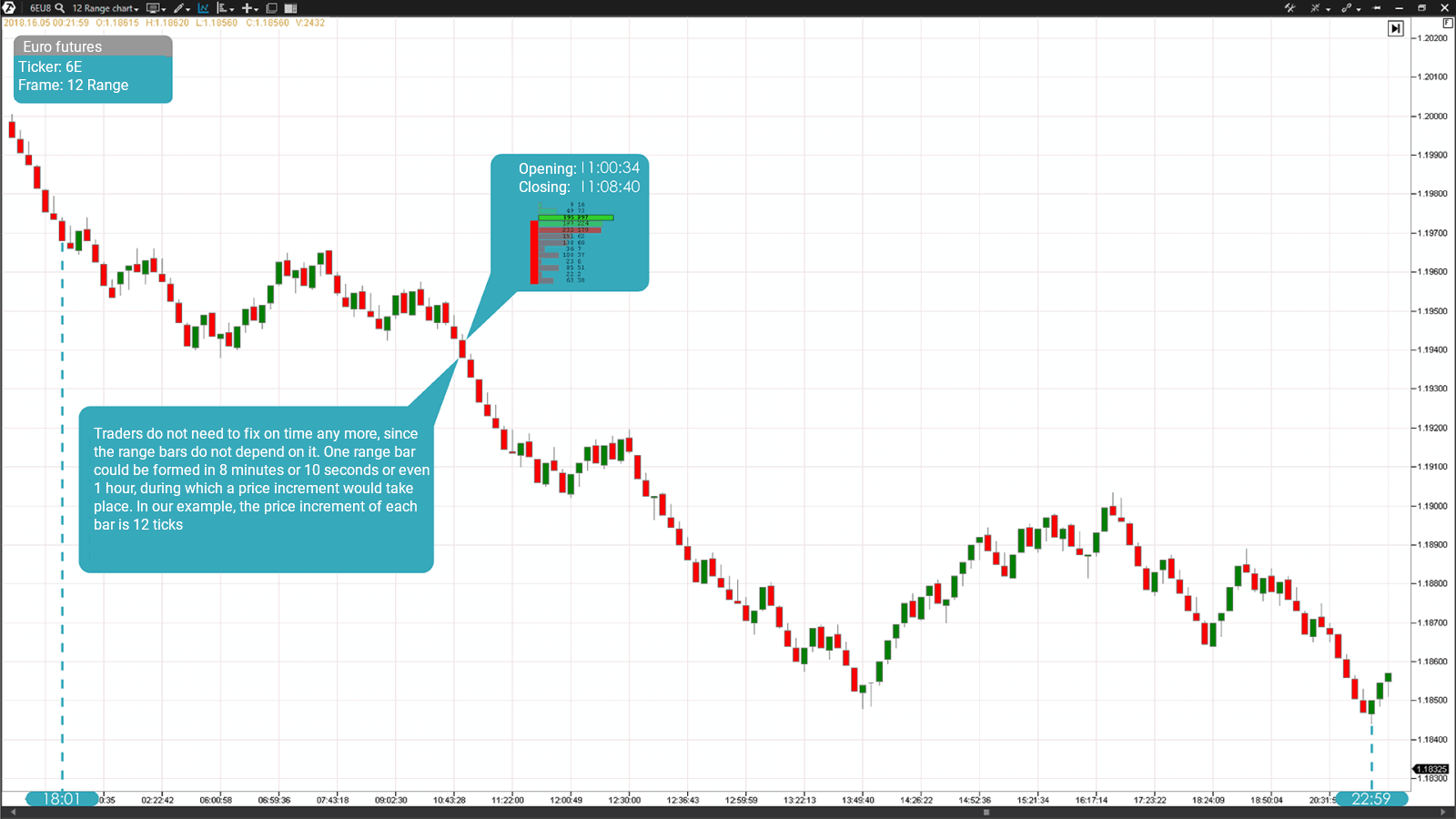

Range chart.

The Range Chart was developed by a Brazilian trader Vincent Nicolellis in 1995. In this article we will consider the classical range chart of the ATAS platform, although the platform also has its various modifications: RangeX, RangeXV, RangeUS and RangeZ. The main task of the range chart is to get rid of the so-called market noise, in other words, insignificant price fluctuations, which have no value and only complicate the market analysis.

The range chart forms the bars on the basis of a certain value of the price increment and not time period. In this case, you can select the range chart with the value of 12 in the ATAS platform instead of the 5-minute chart. This would mean that each new bar would be built only after the price passes 12 ticks up or down. The range chart completely excludes the time parameter and is focused on the price action only. No matter how much time has passed, new range bars are not formed and the range chart does not move if the price movement doesn’t exceed the set value.

The Range Chart of a EUR futures contract (ticker: 6E) with the value of 12 for the period from May 14 until May 15, 2018.

The range chart advantage is in the fact that less bars would be formed during periods of market consolidation, which means that the market noise would be eliminated. Thus, the range chart allows traders to analyze the market volatility. Namely for this reason some traders use range charts as filters for non-trend markets.

Although the range chart description sounds like a dream of a trader who trades by price action, it is necessary to note that the range bars are useless for the candle analysis, since each range bar, after reaching the extreme value, is always closed at the high or low. Namely due to this specific feature the majority of candle patterns do not work in the range charts.

Do the alternative frames present the grail?

The answer is no. Alternative frames are just another way of graphical representation of market information. Their study is similar to the study of a new indicator. The ideal indicator doesn’t exist as well as the ideal frame type doesn’t exist. All of them work differently, consequently, it is necessary to learn how to use them correctly. That is why, if you decided to use the charts, which are not based on time, in your trading, be very careful. The alternative frames do not have a time parameter and it means that they are built in a special way.

Besides, you should also remember that the majority of existing trading methods use time charts. However, this doesn’t mean that all these methods cease to be efficient without time charts. Some of them might even increase trading efficiency due to the use of frames that eliminate the market noise. However, the only way to check it would be testing your trading method on the frame types in the ATAS platform.

No doubt, the alternative frames, described in this article, are very valuable for intraday trading. As we already mentioned, the use of day charts also makes sense, since each bar or candle reflects the whole trading cycle of one particular day. However, this logic doesn’t work for intraday charts. Consequently, the alternative frame types appear to be the most useful for intraday trading.