Financial market structure

Market is the place where buyers and sellers agree on exchange of commodities under certain conditions. Since the commodities could be sold via Internet, phone or mail in the modern world, markets should not be strictly located geographically.

As a rule, in order to identify the market structure, it is important to understand whether there is competition and how strong it is.

The are two types of the market structure depending on competition:

- perfect – is an ideal place where the demand and supply laws rule and where manufacturers and sellers cannot influence prices. Commodities are similar with the similar quality in the perfect market, that is why it makes no difference from what seller to buy them. There are very many sellers and buyers and all of them can freely trade and buy in the market. There are no ideal markets in real life (although the markets of popular exchange instruments, such as, for example, S&P index futures, are very close to perfect ones), that is why they are studied from the theoretical point of view.

- imperfect – is a market where manufacturers could influence prices through changing the manufactured quantity or quality of commodities. There are no common prices on commodities here, because goods are not similar. Moreover, there could be less manufacturers than buyers. Monopoly and oligopoly are examples of imperfect markets.

Financial markets are the basis of the economy. Free money funds are mobilised in them and distributed between economic sectors. Mechanisms of investment attraction and protection are developed in the financial markets. Thus, the money flows into the economy, which supports economic growth and financial development.

The capital is redistributed among the countries in the world financial market, which promotes reduction of international settlement expenditures.

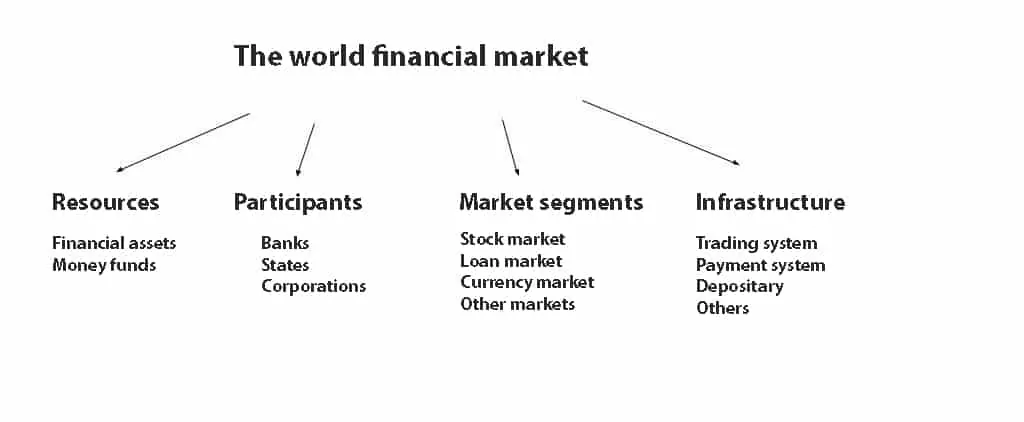

The world financial market structure may look as follows:

In order to understand how the financial market structure is identified, it is necessary to remember that buyers and sellers, who want to buy or sell financial instruments, interact in the market.

Trades with financial instruments take place in the markets in accordance with the rules and on organised trading platforms – exchanges (exchange structure). Rules are different for different assets, that is why there are different financial markets. For example, they could be classified on the regional basis, period or conditions of the financial instrument circulation. Most commonly, the division is done by the asset types.

The financial market structure includes (by the asset types):

- loan market – it provides the needs of various economies in the loan capital;

- stock market – it ensures circular movement of financial resources in the economy through the issue and circulation of securities;

- currency market – it allows trading foreign currencies for easing export and import. It is a short-term capital market, where traders may conduct speculative trades or hedge open currency positions;

- insurance market – it could be conventionally divided into life insurance and other insurance products;

- precious metal market.

By periods of circulation, the financial markets are divided into:

- money or short-term;

- capital or long-term.

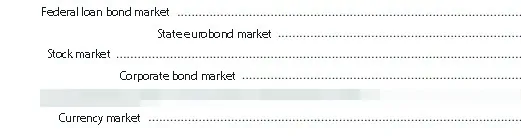

Let’s consider the structure of the RF financial market through the example of the markets, which RF CB provides in its bulletins.

Structure of the securities market

The securities market is an important part of the financial market where the capital is redistributed between investors and issuers. Issuers issue securities to raise investments, which are necessary for development.

The securities market structure includes:

- issuers;

- investors;

- information and analytical agencies;

- brokers and dealers, depositaries and other financial institutions.

The scheme of the securities market structure looks as follows (through the example of the Moscow Exchange):

Apart from exchange financial markets, there are over-the-counter markets. For example, Forex is an over-the-counter currency market.

The main factors that identify the market structure:

- dynamics of the world prices on raw materials and metals;

- state of world economies;

- monetary policy of major states;

- investment share in the GDP.

Why is it important to know the market structure?

The answer is rather simple – you need to understand how prices change and what they depend on if you want to trade.

For example, futures contracts, which usually change 4 times a year, are traded in the forward market. The contract change or their expiration is a very important issue for a trader. If a trader doesn’t take into account these data in his strategy, he could make huge losses, for example, when WTI oil futures moved to the negative zone on the eve of expiration. The Moscow Exchange closed trading this futures contract in those March days of 2020 and traders were not able to win the losses back.

Another example – the stock value falls after dividend payment by the percent of paid dividend (this phenomenon is called ‘ex-dividend’). That is why a trader will not be able to make money on buying stock immediately before the date of closure of the stockholder register and fast selling after dividend payment.

Yet another example – it makes sense to speculate with currencies and stocks in different manners, since different factors fundamentally influence values of these financial assets. Stocks grow or fall depending on the company’s financial indicators and reports. The currency value changes depending on political and economic news.

That is why stocks are especially volatile when annual or quarterly financial reports are published. And currency pairs become especially volatile when employment statistics or other economic data are published.

Summary

The modern financial market structure is a chain of connected segments, which accumulate capital and form investment resources. Financial markets can work only when there are supply and demand in capital.