Risk management. How to manage risks on the exchange

The risk management subject improperly stays in the shadow of discussions of trading systems and is of interest to beginner traders only to some degree, since the most important thing for them is the point of entry into the market.

It would have been better for traders and investors to consider the question ‘How to save the deposit?’ as the most important for them.

Such a change of focus of relation to financial markets would have helped to save many deposits. And the first question a trader should be interested in is ‘How to save?’ rather than ‘How to earn?’.

Namely risk management in trading is responsible for saving trader’s money. This article discusses everything important what you need to know about risk management:

- Basic principles.

- Classification of risks.

- How to build your own risk management system.

- Recommendations on risk management.

Basic principles

What is the risk management definition?

Risk management is a set of rules, the goal of which is to describe the selection and amount of acceptable losses and also trader’s actions in the event of their achievement.

Risk management in trading is one of three pillars, which support successful trading:

- Trading strategy.

- Capital management.

- Risk management.

Risk management is as important as the trading system and capital management. It goes without saying that it is too early to trade on a big deposit before risk management rules are not described.

Risk management problems, which a trader can face:

- lack of understanding of all risk types in risk management;

- lack of understanding how to develop own risk management system correctly;

- lack of understanding how to determine efficiency of own risk management.

Let’s consider each of these issues.

Classification of risks

Risk management principles should be simple and straightforward, so that it would be easier for a trader to make a correct decision in a stressful situation and so that he wouldn’t have to think long about what to do.

The following risks should be clearly described in the risk management strategy:

- Trade risk is the maximum risk for one trade or series of trades, acceptable in your risk management system. At the initial stage, a trader quite often trades with a minimum possible standard lot for accumulating statistics on the new strategy. While positive statistics is accumulated, the trade risk could be increased up to 0.25-0.5% of the deposit. Such an increase could take place periodically, say, once a month. The maximum recommended trade risk is 1% of the deposit. Such a small risk gives a trader time to adapt to the changing market and doesn’t put a strong psychological pressure and allows you to trade more quietly.

- Daily risk is the maximum risk of loss for one trading day, which is acceptable in your risk management system. The recommended daily risk is not more than 3-5% of the deposit. This risk allows a trader to stop if the day is unlucky, holds him back from the efforts to retrieve losses and protects from the force-majeure days, strong news and crisis beginning.

- Weekly risk is the maximum risk of losses for one week, which is acceptable in your risk management system. The recommended weekly risk is not more than 10% of the deposit. If the market changed and the system started to bring permanent losses, then, after reaching the level of the weekly risk, it is important to stop trading for several days, conduct error correction work and, perhaps, reduce the working lot.

- Monthly risk is the maximum risk of losses for one month, which is acceptable in your risk management system. The recommended monthly risk is not more than 20% of the deposit. This risk could be reached during an increased volatility in the market, which often occurs at the beginning of a crisis. Then you need to adapt your system to new volatility and wait until markets start to behave themselves more quietly.

- Maximum risk is the maximum risk of losses, which is acceptable in your risk management system. The recommended maximum risk is the maximum drawdown of not more than 30% of the deposit. This drawdown is the most comfortable one for a trader and potential investors, since it is psychologically difficult to experience deeper drawdowns and it may take months to recover from them. If the maximum drawdown is reached, you should stop trading and completely reconsider your trading system. After that you should start the process of testing and collection of statistics again on a minimum lot.

Example of the risk management system: Your deposit is USD 20,000. Then the following parameters would be present in your risk management system:

- trade risk – 1% = USD 200;

- daily risk – 5% = USD 1,000; stop trading on that day after reaching the threshold value;

- weekly risk – 10% = USD 2,000; stop trading till the end of the week after reaching it and conduct analysis of reasons;

- monthly risk – 20% = USD 4,000; stop trading till the end of the month after reaching it and conduct analysis of reasons;

- maximum risk – 30% = USD 6,000; stop trading under the current trading system after reaching it.

Such a risk management system would save 70% of your deposit, allow further improvement in trading and protect your state of mind from excessive load and emotional stress.

Controlled risks could give a trader a possibility to attract investors in the future, since the risk control is the most important thing that disturbs experienced investors. Preservation of funds is more important for an investor than profit.

5 steps to build a risk management system

Risk management and risk assessment methods are mathematical and statistical tasks. First, you need to collect statistical data in order to solve them.

Here are 5 steps you need to make for developing your own risk management system:

- Formalise the algorithm of your own trading system.

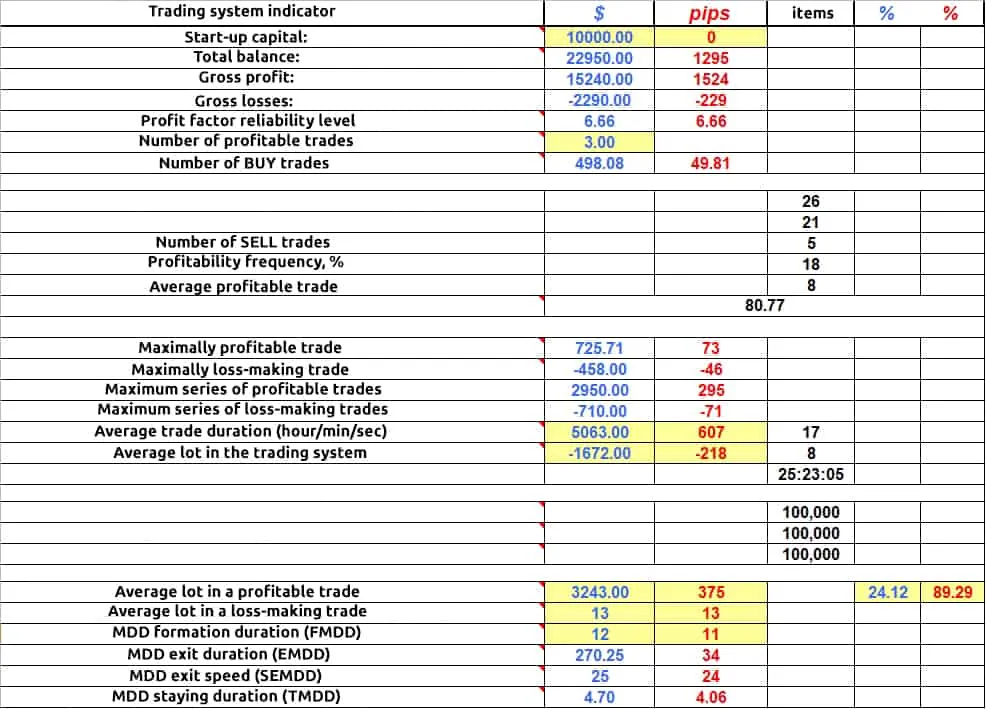

Conduct a test on historic data and test efficiency of your trading system operation. Also, this test would be a training of a better vision of the market entry and exit points. It is preferable to conduct a test for 6 months, so that it would have not less than 100 trades. You should enter the data in a table and conduct analysis of your trading system. You need to calculate an average profitable trade, average loss-making trade, mathematical expectation in dollars and ticks, maximum drawdown, profit factor, Sharpe ratio, build the capital curve, etc.

If the test is positive, we proceed to the next step.

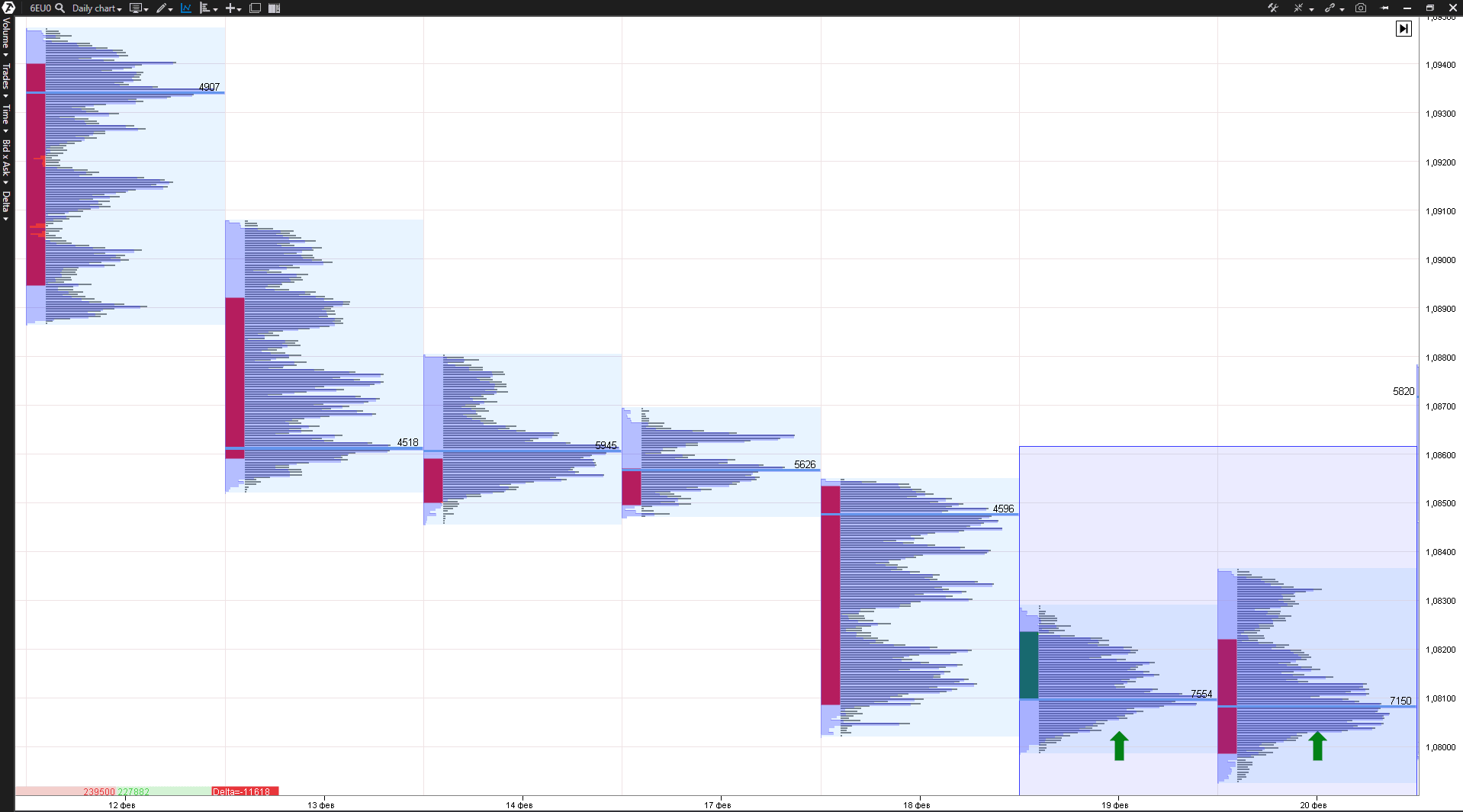

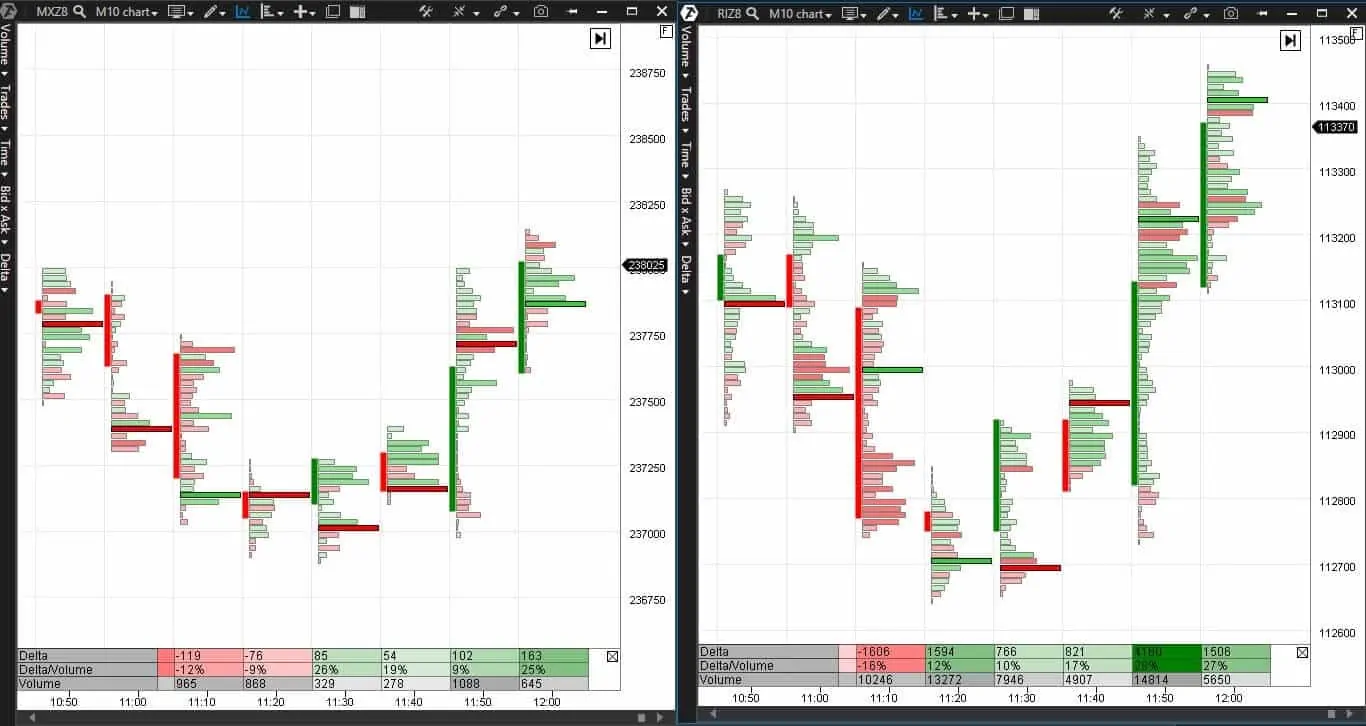

Start trading under the trading system with the minimum lot possible in order to collect statistical information in the ‘live’ market. If you use the trading ATAS platform, CME futures micro-contracts with the price of one tick from USD 1 would fit you perfectly. Thus, you can test your trading system without putting big funds at risk. Also, it is necessary to collect statistics for 6 months of trading, consisting of at least 100 trades, in order to conduct a trustworthy analysis of statistical results of real trading. All data should also be entered into the table and conduct analysis:

- If you have the real trading data, you should select a capital management system and calculate statistical trading indicators using the selected capital management system.

It is necessary to select the risk management system on the basis of the data of the trading system with capital management. You should formalise and note down the risk management algorithm. The data about the daily, weekly and monthly risks and the maximum drawdown cannot be pulled out from thin air. These data should be obtained from the real trading statistics calculations. Missing any of these steps could lead to a wrong selection of risks, premature trade stop or unjustified losses.

The risk management function is to protect a trader from tilt. This is just to remind you that tilt is such an emotional state when a trader ceases to make adequate decisions and his emotions start to influence trading. He executes emotional and non-systemic trades wishing to win back. Risk management should say ‘stop’ in such a situation. In order to protect yourself from unfavourable scenarios more efficiently, you should set control of the main risk management parameters on a programmatic basis, without participation of a human being.

Recommendations on risk management

These recommendations belong to three components of successful trading – trading system, capital management and risk management.

- Analyse relation of potential risk to potential profit. When building your trading system, try to follow a simple rule:

“Cut losses and let profits run”

The potential profit of your trades should be several times higher than the potential risk – only then you will be able to trade with stability and go out of drawdowns quickly. Always monitor data about the average profitable and loss-making trades under your trading system. Ideally, when the average profitable trade is higher than your average loss-making one, it shows that your potential profit is higher than your potential risk.

- Your possible losses should always be limited. Use the stop loss in ticks or dollars and for one trade or a series of trades. Limit losses programmatically, so that big losses wouldn’t break you down if something distracts you and some big movement takes place in the market.

Risk management should be flexible, Markets are not some stable and uniform template. It is a living and evolving organism, which has to be constantly studied and to which your trading should be adapted. Consequently, risk management should periodically be reviewed and recalculated on the basis of the trading statistical data. Risk management parameters may change if volatility changes.

VOLATILITY ↔ RISK ↔ PROFIT

All these chain elements depend on each other in direct proportion: if one of the indicators grows, the others follow it and vice versa. Consequently, you should trade volatile instruments in order to have a possibility to get profit at the same time controlling the price fluctuation amplitude in order to keep risk at the acceptable level. Post a stop loss outside the current volatility since it could be executed under the chaotic market movement. Your stop loss should always be adapted to the changing volatility of a financial instrument.

It is better to make risk management parameters more strict during the periods of high volatility, since it takes place more often during the periods of crisis phenomena in the world economy.

- Diversify your risks. Diversification in trading means trading various not correlated financial assets. If you execute several trades simultaneously with financial instruments, which have the similar dynamics (for example, currency pairs), increase your risks.

Example: you bought EUR/USD and GBP/USD futures and your risk for each trade is 1%. The correlation between these two instruments is very pronounced – about +0.90. It means that if the EUR/USD rate has increased by 1%, the GBP/USD rate would probably also increase by 0.90%. Availability of a long position both in EUR/USD and in GBP/USD is equal to opening 1 position and risk of 1.9% under it [1% + 1%* 0.9 = 1.9%], which may exceed parameters of your risk management.

Trade various markets and various instruments – it will help you to decrease risks. Never put all eggs in one basket.

- Take into account nonlinearity of going out of a drawdown. Avoid deep drawdowns since it is very difficult to go out of them due to nonlinearity of the growth of profit on capital, which should be earned to go out of a drawdown.

Example: If you experience a 50% drawdown, it means that you need a 100% capital growth to return back to the breakeven. On the other hand, if you lose 10%, you would need just 11.1% of the capital growth to return back to the breakeven.

Conclusions

Risk management is an important component of any trading system along with the algorithm of entry in and exit from a position and capital management.

For successful trading:

- If there is no risk management – there is no profitable and stable trading.

- Select the risk management system on the basis of statistical data, collected during trading with a minimum lot.

- Parameters of the risk management system are calculated indicators, which cannot be pulled out from thin air.

- The risk management system should be clearly formalised and described.

- Strictly follow the risk management system – it will protect your capital from expiration and you from emotional stresses.

- Use paid professional software for trading with a wide spectrum of the risk limitation strategies.

The trading ATAS platform will help you to set various risk management instruments, which correspond with your trading system.

Download the free test version right now.