Check, mate and profit on the exchange. Examples.

Trading is a business, science and game. This activity is multifaceted and, as well as any other money making activity, should be viewed from different angles for deeper understanding of what you do.

Today we will consider trading from the chess point of view. It might seem that it is not correct to compare these two games, since the chess is a game with full information and trading is a game of probabilities. However, they have interesting things in common.

In this article:

- trading from the point of view of methods of training of chess masters;

- how these methods could be applied in trading;

- a chart example.

First, any chess player always notes down his moves during a game

It is necessary in order to:

- have a possibility to see his previous actions during a game and monitor the opponent’s reaction;

- develop discipline, thinking sequence and systematic approach;

- work on mistakes when the game is over. Analysis of the whole game would allow detecting your own and opponent’s weak points. This could and should be used in future to get an advantage.

A trader should use these points when he opens trades. However, the trader’s opponent is not an individual but:

- the whole market;

- and, quite often, his character, nature and emotions.

That is why, noting down trading actions and following own trading algorithm are very important components of the exchange player’s success.

Second, any chess player should develop own skills

Various advice of experienced grandmasters say that a chess player should, with the course of time, add new openings, try to analyze situations he never found himself in and play with a stronger opponent.

These advice bring a person out of the comfort zone and might produce negative results during a certain period of time. However, the longer a chess player studies new methods, the stronger he becomes. Those things that were unpleasant to him during his study will soon become unpleasant to his opponents.

The situation in trading is a bit different, since the practical check of your idea of the future market development requires money resources.

But you should not reject self-development, since the market is volatile and those strategies that bring you profit for a long time might stop working on one ‘sunny’ day. Then you start making losses, which would grow very fast, since psychological aspects would add to technical ones.

That is why, to avoid such a situation, test your ideas on demo accounts, which would help you to develop and to keep your wallet safe. Fear not to implement your new ideas after you developed them.

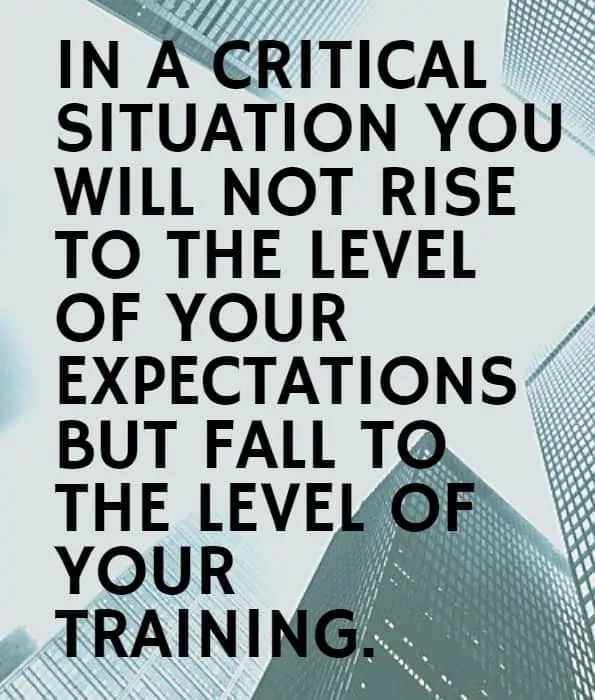

Third, any professional chess player gives attention to his psychological stability.

Long, exhausting and many hours long games can unsettle anyone, after which a chess player can be less capable of analyzing variants or can make a mistake, which could be fatal. That is why, some chess players note down their emotions during a game and analyze them together with their moves. It is required to avoid the impact of anger, tiredness, irritability, fear or disrespect to the opponent on the course of thinking during a game.

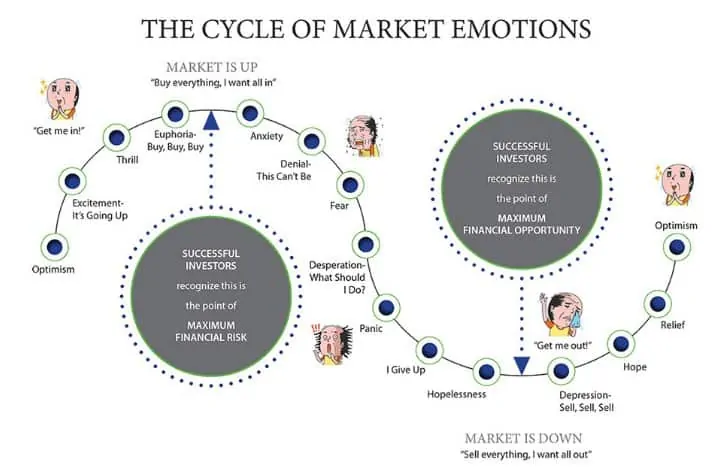

Psychology for a trader is even more important, since the market is an embodiment of all human emotions. A trader just needs to work on his emotions, since any emotional action can make him bankrupt. At the same time, inaction and lack of confidence would also influence both profitability and psychological stability.

The fight with demons, who make you act impulsively, sometimes is more important than any rational strategy, since emotions are primary. And if you fail to extinguish your negative urges of fear and greed, the negative results will not be long in coming.

Example.

Let us make a comparison between chess and trading. The term ‘gambit’ means sacrifice of, usually, a pawn for a faster development of a game.

Let us assume that you are engaged in intraday futures trading on the Moscow Exchange. Your main platform is oil futures, and the additional one is USD/RUB currency pair futures.

So, you discover on April 24, 2019, that the Brent oil market fluctuates within the range between the high and low of the previous day and your ‘black gold’ position has a small loss. At the same time, the currency market revived and demonstrates a solid growth of the dollar. Then you close the oil position with a small loss (sacrifice a pawn – a small part of your capital) and develop the currency activity.

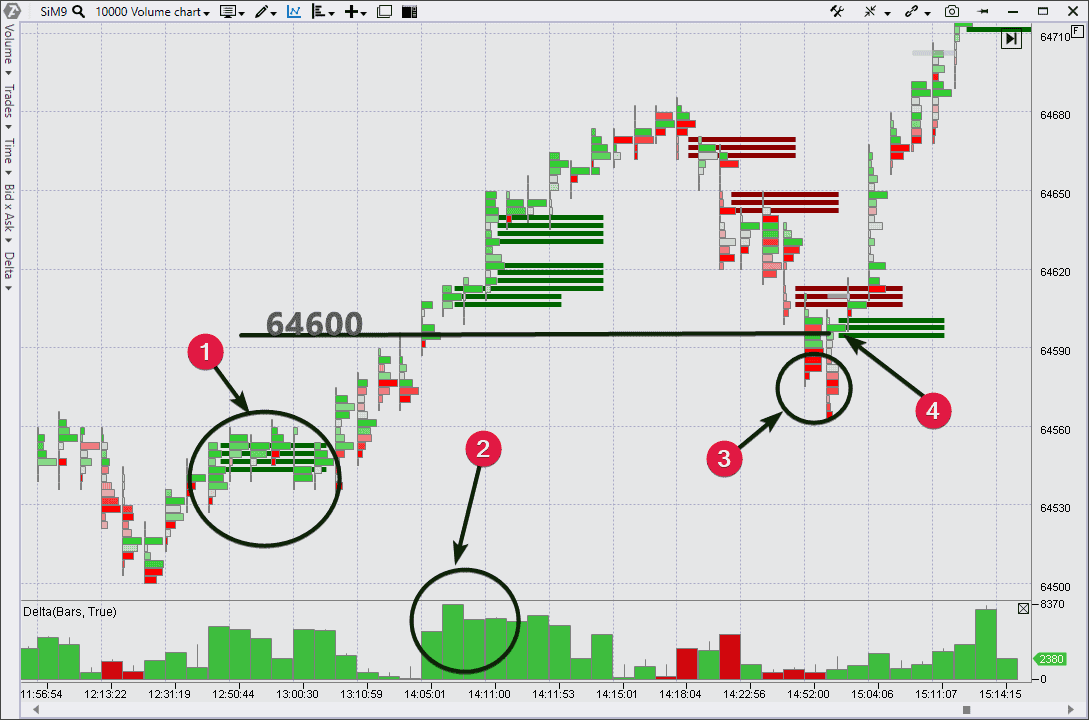

Here is the USDRUB futures chart of that day. It is a cluster Volume Chart, where one bar is 10 thousand traded contracts. Delta and Stacked Imbalance indicators are set in the chart.

You decide to connect to the growth on pullback after a bullish breakout.

- Bulls effort – preparation for breakout of the level of 64,600;

- Breakout. The buyers’ effort is clearly seen on the delta;

- Breakout testing – activation of too close stops of buyers under a ‘reliable’ support of 64,600;

- Imbalance sends a signal about a new wave of buys. You enter into a long position, activating a positive dynamics of your portfolio.

Summary

Trading, as well as chess, is a game ‘in the long run’. And, as any other long run game, it envisages a scrupulous and systematic work. Remember it and you’ll be fine.