You cannot successfully invest in currencies without understanding the central bank policy. Quite often, those rises and falls, which traders observe in the EUR/USD chart, are forged within FRS and ECB months before actual realisation. It is also important to keep track of the world trade and policy state, which influence currency exchange rates in their own way. What are the incentives that help currencies to grow and which of them play against currencies? Let’s try to find out.

Content

- Key specific features of the currency market

- How central banks influence currency exchange rates

- Case 1. CB decreases interest rates

- Case 2. CB increases interest rates

- Increasing interest rates to fight devaluation

- Statistics, which influences exchange rates

- International policy and its influence on Forex

Start using ATAS for free with no time limits! Or activate the advanced tariff right now to access the full range of functionality.

Key specific features of the currency market

Forex market is the general name of the global system of various currency exchange channels. Its main characteristics are:

- Size. The general daily volume of Forex trading is around USD 6 trillion. It makes this market the largest and most liquid one in the world. Mainly, Forex is required for ensuring export-import and investment operations between the countries.

- Decentralization. There is no specific place in the world which we could call Forex. Forex is a network of hundreds of various channels of liquidity. Those quotations, which traders see in the order book, are collected, most often, from various channels.

- Main counter-agents and intermediaries. These are around two dozen of the largest world banks, such as JP Morgan Chase, Citi, Deutsche Bank, UBS and so on.

- A currency exchange rate is formed under the influence of changes in demand and supply as well as stock and other exchange asset prices. However, demand and supply factors are often different. In order to understand Forex you need to learn to look globally and understand macroeconomy of the processes.

How central banks influence currency exchange rates

Forex investors pay special attention to the monetary policy of central banks, which issue currencies. They play the role of Commanders-in-Chief in the currency battles. The US Federal Reserve Bank (FRS), European Central Bank (ECB), Bank of England and Bank of Japan are those ‘big shots’, actions of which hugely influence not only world currencies but also other markets – from the stock market to raw material market.

So, when do central banks interfere with the economy and start influencing the exchange rate? The matter is that the economy has a cyclic nature. In simple words: there is an economic boom when loans are accumulated and there is stagnation when it’s time to pay debts back.

Increasing and decreasing interest rates, a central bank may influence economic cycles by smoothing fluctuations and avoiding serious crises and ‘bubbles’. If worst comes to worst, a central bank may start emission in the form of quantitative easing in order to bring cheap liquidity to the market. These actions have a huge influence on the currency market.

In order to better understand how monetary cycles work, we recommend you to watch an educational video from the legendary manager of hedge funds on Wall Street Ray Dalio.

Since up to two thirds of all Forex operations include the US dollar, first of all, you should pay attention to the US FRS policy. Let’s analyse two cases to see what happens with USD when US FRS increases the interest rate and decreases it.

Case 1. CB decreases interest rates

Decrease of the CB interest rate is negative for the currency but positive for the real economy. FRS makes this step in order to support economic activity. The logic is simple – the lower the cost of loans the more actively counter-agents would borrow them and the higher investment and consumption activity would be.

So, why is the dollar under pressure when the interest rate is decreased?

- The dollar supply grows due to its faster turnaround and better accessibility of money and when supply grows at an equal demand, the value (exchange rate) falls;

- US Treasury Note interest rates fall, which stimulates capital outflow into more profitable assets in international markets. The vast amount of dollars come to the market, which puts pressure on the exchange rate;

- Very often, decrease of the rate is accompanied with the asset buyout program. The program is conducted by means of emission, which is always negative for the currency.

Let’s take an example – there was an economic boom in the United States in the 1990s. FRS gradually increased the interest rate from 1992 until 2000 in order to avoid overheating of the economy and also to fight inflation. The rate grew from 3% to 6.5% during that period, which also facilitated the constant dollar growth.

However, it became clear after the dotcom crash and development of crisis phenomena that the rate would start to fall. FRS initiated the rate reduction cycle, which was very clearly reflected in the chart. The dollar entered a large-scale reduction cycle.

Case 2. CB increases interest rates

The reverse effect would take place when the FRS interest rate grows

- The US Treasury Note yield grows, investors from all over the world sell assets in their national currencies and buy the dollar ones and demand on the dollar grows.

- Supply of the dollar in the economy goes down due to slowing down of economic activity and the exchange rate increases.

We observed this effect from 2014 until the beginning of 2019. FRS started a step-by-step preparation of markets for the rate growth, after the period of around zero values during and after the 2008-2009 crisis, as early as in 2013. The gradual rate growth resulted in the dollar growth by around 25% at the peak in 2017.

At the peak of the 2020 crisis, we observe a new reversal of the FRS policy to a long-term zero rate retention, which already started to weaken the dollar. There are good chances that low interest rates will stay at least until 2023, which means that the dollar will be under pressure during this period. The chart above shows signs of the emerging reversal of the trend from the flat one to the bearish one.

Increasing interest rates to fight devaluation

Quite often, central banks intentionally increase the rate in order to stop the national currency devaluation and avoid a surge of inflation. Influence on the rate could be very strong.

A bright example of it is the Bank of Russia policy in times of the sharp rouble devaluation in the second half of 2014. CB increased the rate from 8% to 17% just in a couple of months, by which it increased the attractiveness of rouble assets and, in the end, stopped the speculative blow at the currency, which devalued by then more than 2 times. The rouble weakening in further years wasn’t that sharp any more and was caused by economic factors rather than speculative destabilization.

Expectation management policy

However, the central bank decisions on interest rates do not always have an immediate effect. It might happen for several reasons.

- Central banks decrease and increase rates synchronously, since the majority of the recent years’ crises have a global nature.

- The CB management conducts the policy of investor expectation management. It prepares markets through verbal interventions. Investors monitor speeches of all influential bank managers and study their meeting minutes. That is why, shifts in rates are rarely a surprise and movement starts beforehand in the Forex market.

- Thirdly, the rate is also influenced by other economic factors, which should be considered in the aggregate.

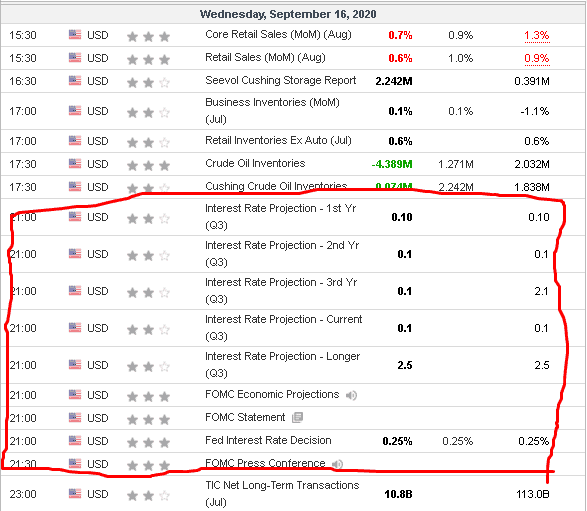

You can track all shifts with the help of one of the economic calendars on financial web-sites. The example below shows that, apart from the announcement of the US FRS decision on the interest rate, equally important information could be published. These long-term plans on the rate and statements of the officials on the monetary policy would form the dollar exchange rate in the future only in the aggregate.

Statistics, which influences exchange rates

The calendar of economic statistics will help Forex investors not only to track interest rates and trade on news. There are a number of other events, which you absolutely need to control in order to form an aggregate picture and to forecast the CB policy.

- Payment balance. Growth of the positive surplus of the payment balance means that the inflow of foreign currency in the country is higher than the outflow, which results in the local currency growth. For example, Japan historically is a country with a positive payment balance. It helps the Japanese yen to be historically one of the strongest world currencies.

- Inflation. As a rule, inflation below the forecast is interpreted as a negative bearish factor for the currency. It means that the central bank may keep the rate low and continue to print money without a danger to propel prices. The growth of inflation above target values for CB (it is around 2% for the US and EU) may lead to the currency growth on the rate increase expectations.

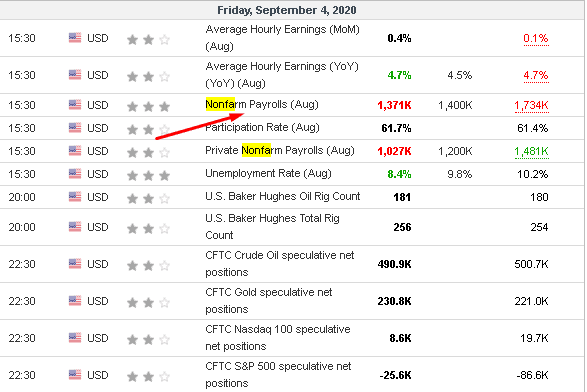

- Population employment. Many central banks consider unemployment a key targeted parameter along with inflation. The higher the unemployment, the more chances that the interest rate would be low are. And vice versa. It is useful to track the US monthly report on creation of working places (Nonfarm Payrolls), which is always published at the beginning of every month.

4. GDP and general economic activity. The faster the economic growth, the higher the probability of the CB rate increase is. On the other hand, a strong economic growth attracts more investments into the country by itself, which is also positive for the local currency.

All these data could also be successfully tracked with the help of the economic statistics calendar.

International policy and its influence on Forex

You may observe quite often how political decisions influence the exchange rate. One of the recent examples is the trading war between the United States and China.

The United States, trying to compensate for the huge negative balance in trading, requires Beijing to increase purchases of American goods. Otherwise, Washington threatens to introduce huge protective tariffs, which would hurt the Chinese exports to the United States. As a result, the Chinese yuan fell since the beginning of 2018 from 6.3 to 7.1. In the course of deescalation of the conflict, the Chinese currency again started to become stronger due to, this time, purely economic factors.

Second example. The EU countries agreed on July 21, 2020, to establish a gigantic economy assistance fund in the amount of EUR 1.8 trillion, EUR 750 billion of which would be used by the program of recovery after the coronavirus pandemic. The tricky part of the fund is that it will be financed by debts, borrowed on behalf of the EU as a single state for the first time ever. The EU credit rating is very high, that is why the interest rates would be close to zero.

The major part of the assistance would go to the most economically vulnerable countries of the region – such as Italy, Spain and Greece. Earlier, namely debt risks of the South European countries put pressure on the euro due to the risk of their default or disintegration. After the key problem was solved by means of the richer countries, investors received a signal that Europe is ready for a deeper integration and the rich would pay for the poor. As a result, the euro exchange rate jumped up despite low interest rates in the eurozone.

To sum up, we will note that understanding of the central bank policy and knowledge of the macroeconomy will be useful for investors not only to trade in the Forex market. Decrease or increase of interest rates exerts a complex influence on all financial markets, however, we will discuss this subject in more detail in one of our future articles.