What you should know about institutional investors

Institutional investors are various financial and credit institutions, which invest on behalf of their customers. Usually, they pool funds of various investors, work with them as with a joint portfolio and make long-term investments.

Institutional investors are only legal persons.

Activity of such market players is regulated by legislation and they publish a lot of reports.

What institutional investors are

There are 6 categories of institutional investors in the United States:

- pension funds;

- mutual funds or collective investment trusts;

- commercial banks;

- hedge funds;

- insurance companies;

- target funds.

Let’s consider each category in detail.

Pension funds. First of all, they have to preserve money, so that elderly people would have money when they already cannot work any more. That is why pension funds invest conservatively into very reliable companies, for example, into treasury notes or stocks of big and well-known companies.

However, the market situation changes and, nowadays, pension funds have to provide the growing yield by means of investing in more risky enterprises. Pension funds are the biggest institutional investors.

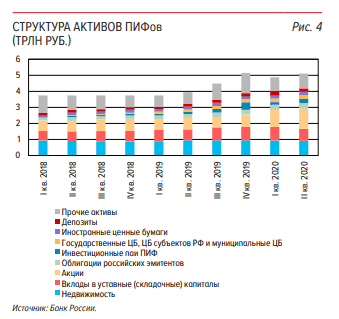

Mutual funds or collective investment trusts. Mutual funds are managed by professional managers. Any investor, even with a very small start-up capital, can invest in such funds. These are second biggest institutional investors after the pension funds. However, their number is much bigger than the number of pension and hedge funds.

Commercial banks. Their main activity is connected with deposits, lending and making payments. Besides, they may offer safe deposit box lease and cheque issue. Commercial banks invest funds of their depositors.

Hedge funds. As a rule, these institutional investors consist of a small number of wealthy investors and are managed by professionals. Their main goal is to make profit, that is why they trade various assets, including derivatives, and use credit leveraging. Hedge funds are restricted by a smaller number of the Securities and Exchange Commission (SEC) rules.

Quite often, successful traders and investors establish their own hedge funds. For example, Joel Greenblatt founded the Gotham Fund. Jack Schwager wrote an excellent book about hedge funds and their founders in 2012 – ‘Hedge Fund Market Wizards’.

As of 2020, there are more than 12,000 various hedge funds in the world and they manage more than USD 3.5 trillion.

Insurance companies have current obligations on insurance certificates, that is why they should invest conservatively into liquid instruments. Usually, they invest into treasury notes or big reliable company bonds in order to have a permanent fixed income.

Target funds are, usually, charity funds, which are formed by means of donations. Such funds are used for specific purposes, for example, target funds of big universities use the funds to pay stipends.

Reports of institutional investors

American institutional investors are often called ‘managed money’ because they buy and sell big securities packages, can move the market and, as a rule, know more than amateur investors. Moreover, they use expensive software and hire a lot of professional analysts.

The Securities and Exchange Commission (SEC) publishes various reports about activities of institutional investors, that is why private investors may repeat investments of ‘managed money’.

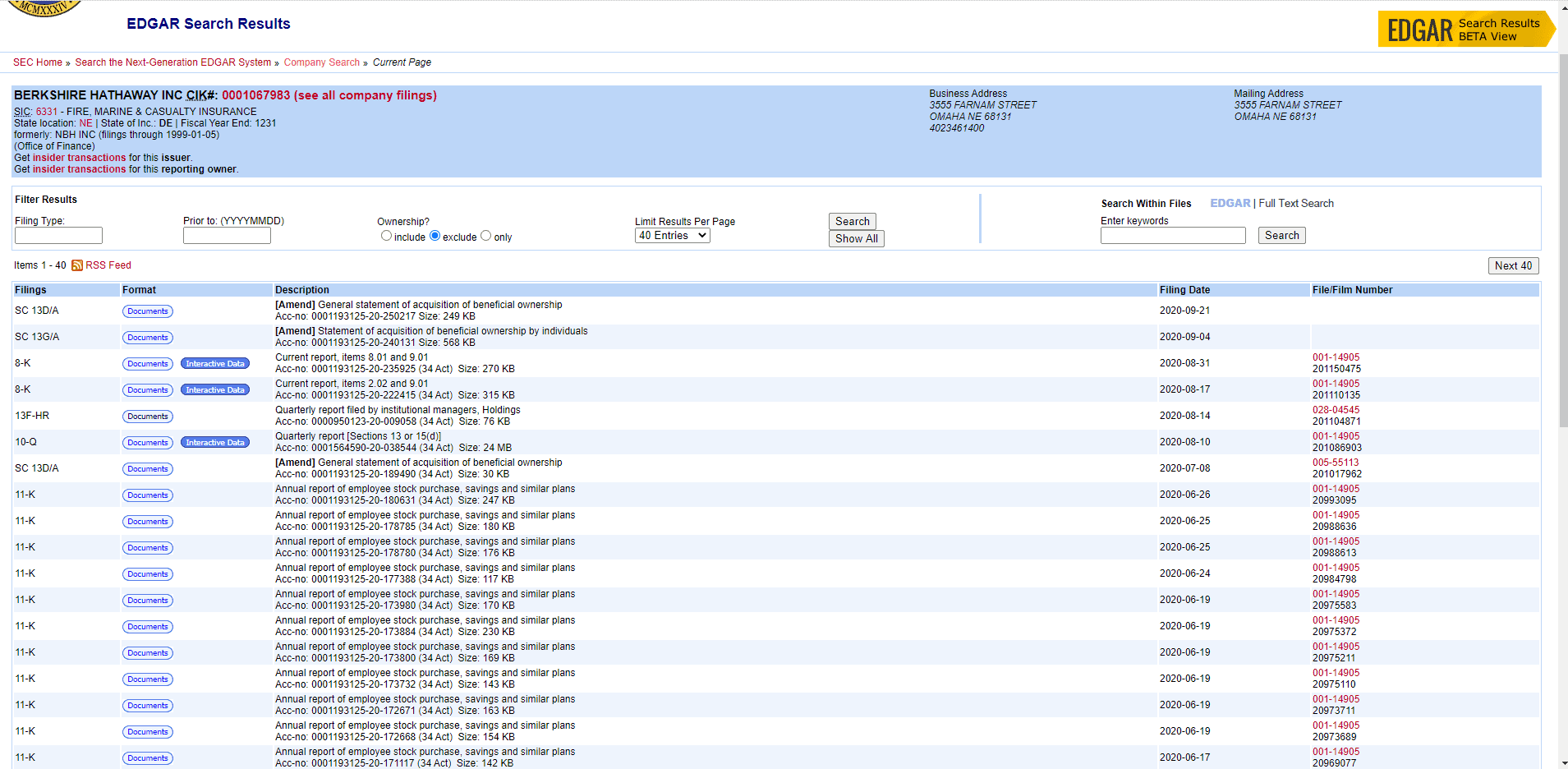

For example, if investments exceed USD 100 million, investors should disclose data in the SEC 13F form. See Picture 1.

However, all market players can get acquainted with these data with a several month delay, that is why it is not always efficient to use them.

The biggest institutional investors

Examples of institutional investors:

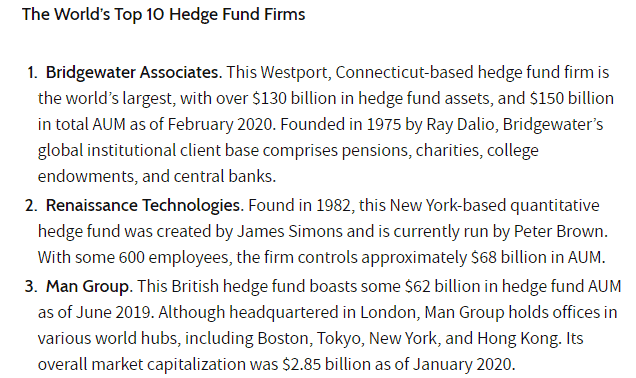

- Bridgewater Associates,

- Renaissance Technologies,

- Man Group.

These are three biggest hedge funds as of the beginning of 2020. The first two are American while the third one was founded in Great Britain, however offices of this fund are located in many countries. See Picture 2.

Some market operations could be carried out only by institutional investors – for example, swap trades and forward trades.

a

a

a

Where to find data about institutional investor positions

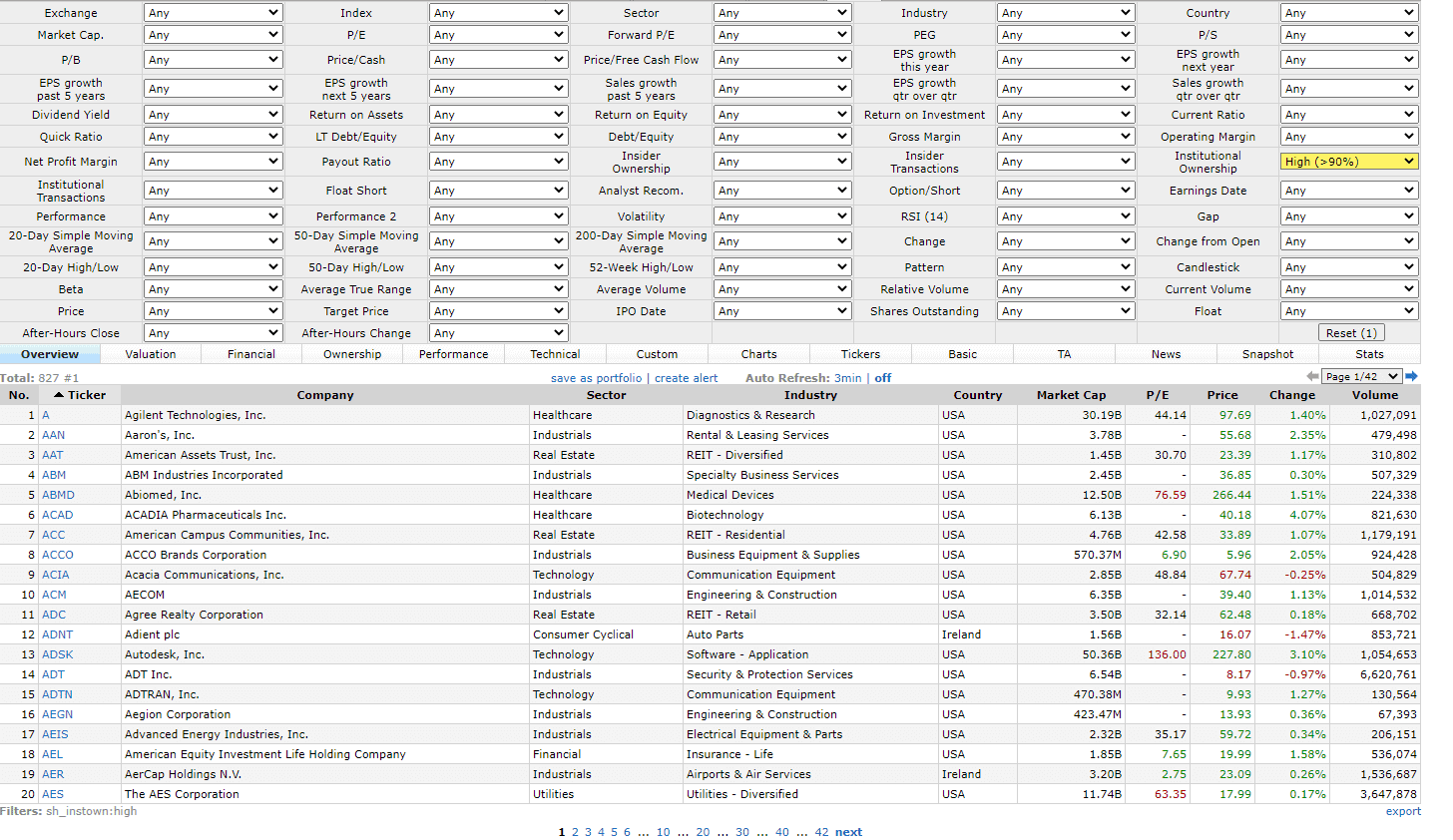

Data about the number of institutional investors in stocks of specific companies could be found in professional securities screeners. For example, on web site finviz

Institutional ownership could be used as the ‘managed money’ indicator in a specific instrument, because institutional investors may move the market in any direction. Accumulation or sell-out of markets by such big investors leads to significant trends.

Especially significant signals appear when specific stock goes against the market on high volumes. Markets with different numbers of institutional investors should be traded differently. These data could be used in your trading strategies or taken into account when making investments.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.