- What hedging is.

- What options are.

- Examples of stock hedging.

- How options hedging works.

- Where risk hedging with options is applied.

- Advantages of options over a stop loss.

- Conclusions.

What hedging is

Hedging protects an investor’s portfolio against losses. However, hedging also reduces investor’s yield. Consequently, hedging is not a strategy for making money, but a strategy for protecting against losses. In order for hedging to work, two investments should have a negative correlation, so that when one investment went down in value, the other would bring a profit.What options are

Options are financial derivatives based on the underlying asset price. The cost of operations with options is identified by a premium (we will describe how the premium works in the example below). There are 2 types of options:- PUT – this type gives the right to sell an underlying asset at a certain price at a certain moment of time;

- CALL – this type gives the right to buy an underlying asset at a certain price at a certain moment of time.

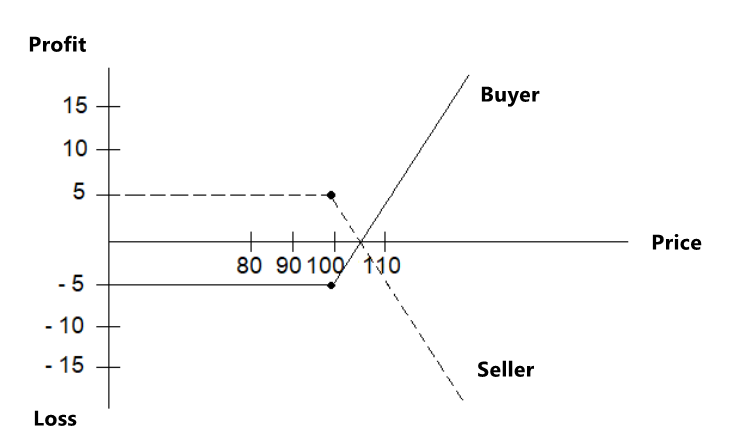

- takes an unlimited profit if the price moves above USD 105;

- has the breakeven point at the level of USD 105;

- is at a loss if the stock is traded below USD 105. However, this loss is limited to USD 5 (the premium).

- is at an unlimited loss if the price moves above USD 105;

- has the breakeven point at the level of USD 105;

- takes a fixed profit in the amount of USD 5 if the stock is traded below USD 105.

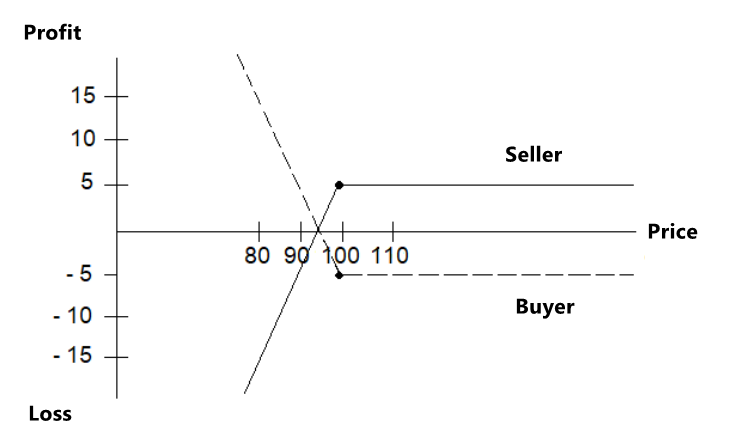

- takes a profit if the price moves below USD 95 (the only limit is USD 0 per a stock);

- has the breakeven point at the level of USD 95;

- is at a loss if the stock is traded above USD 95. However, this loss is limited to USD 5 (the premium).

- is at a loss if the price moves below USD 95. The bigger a fall, the bigger a loss is;

- has the breakeven point at the level of USD 95;

- takes a profit in USD 5 if the stock is traded above USD 105.

How options hedging works

In order to understand how hedging with options works, let’s consider buying an option like buying insurance. In the modern world, we can buy insurance practically for everything: health, house, car, etc. The same is true for the financial market. Acting in the style of an insurance company, an option (whether CALL or PUT) seller agrees to take the risk of an event, which, in his opinion, has a low probability of occurrence. He gets a fixed remuneration for this in the form of a premium, while the option buyer gets a possibility to have a sound sleep at night. This comparison of options with the insurance business helps to understand the motives, which the options contract buyers and sellers are guided by, better.Where risk hedging with options is applied

Since financial markets are inextricably linked with risks, hedging (insurance against risks) is widely used. From the point of view of an underlying asset, it can be:- hedging stocks with options;

- hedging futures with options;

- commodity options;

- interest rate options;

- stock market index options;

- options on physicals.

- European – the settlement is done on the date, specified in the contract;

- American – the settlement can be done at any moment before the options expiration date.

- Quasi-American – the parties perform their obligations after certain periods of time (one contract can describe one or more periods).

Advantages of options over a stop loss

Why not use a simple stop loss instead of an option? An option has several advantages:- Stability. If a stop loss can be activated when volatility increases, which will lead to the position closing with a loss, the options structure can withstand and even make a profit.

- The set terms of mutual settlements. It can be an advantage in some cases.

- Absence of slippage, which often occurs when stop losses are activated.

- In some cases, lower expenditures of conducting operations.

- 9 popular strategies of trading options.

- 5 examples of hedging.

- Difference of a futures contract from an options contract.

Conclusions

Risk hedging with options is applied in order to limit possible losses, which originate from possessing an underlying asset. An investor buys an option with that goal in mind as if he buys insurance against an unfavourable price movement. A majority of people would say that it is stupid not to buy home insurance. The matter is that it is difficult even to imagine that your house is destroyed or burnt in front of your eyes without insurance. This is not the kind of risk you can afford to take. Does it make sense to hedge your portfolio in financial markets? Aaron Brown, the AQR Chief Risk Manager, recommends: “Take risks you are ready to have. Avoid risks you cannot afford”. If you cannot cope with the worst scenario emotionally or financially, you need to study the ways to either reduce this risk or insure against it (as a variant, with the help of options).Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.