“October: This is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August and February.”

Mark Twain

When beginner traders ask “how to speculate on the Moscow Exchange” and “how to trade on the Moscow Exchange”, in fact, they pursue the goal of making money. And it is in spite of the fact that speculation and well-considered trading are, in essence, opposite processes. We are not advocates of gambling and this article speaks about why trading on the Moscow Exchange is a well-considered decision and not gambling.

- how the Moscow Exchange emerged;

- what sections are available on the Moscow Exchange;

- what are opening and closing auctions;

- why the Moscow Exchange is good for a trader if compared with CME and FOREX;

- how the ATAS platform offers an advantage for trading in the Moscow Exchange forward market;

- how to make RUB 1.5 million on the Moscow Exchange in 2 months.

HOW THE MOSCOW EXCHANGE EMERGED

The Moscow Exchange started in 1992. The Moscow Interbank Currency Exchange (MICEX) opened that year. The MICEX group and Russian Trading System (RTS) group merged into the present Moscow Exchange in December 2011.As of the beginning of 2018, the Moscow Exchange takes:

- 2nd place among all world exchanges in bond trading;

- 5th place in derivatives trading;

- 25th place in trading turnover.

The Group includes a depository and clearing center. The depository keeps records of security owners and stores certificates. The clearing center makes settlements.

WHAT MARKETS THE MOSCOW EXCHANGE CONSISTS OF

After signing a contract with a broker, a trader can start trading on the Moscow Exchange. There are several markets depending on what is traded:- Currency market

- Stock market

- Forward market

- Monetary market

- Commodity market

Let us consider the basic markets – currency, forward and stock – in more detail.

Currency market of the Moscow Exchange.

Main currencies are USD and EUR. 68% of all USD-RUB trades in the Russian currency market take place on the Moscow Exchange. This indicator is even higher for EUR – 78%. They trade British Pound Sterling (BPS), Swiss franc (CHF), Hong Kong dollar (HKD), Chinese yuan (CNY), Belarusian ruble (BYN), Kazakhstani tenge (KZT), Turkish lira (TRY), gold and silver for Russian rubles (RUB). EUR and GBP could also be bought for USD. You can find a more detailed information on the web site of the Exchange. Parameters of the currency market:- Trading time: 10:00 – 23:50.

- Withdrawal of funds. Two variants are offered for those who withdraw the bought currency to bank accounts – today (TOD) and tomorrow (TOM).

- Restrictions and charges. A minimum lot is 1000 units. Exchange commissions, broker commissions, which depend on turnover and additional commission for trades of up to 50 lots.

- Credit leverage. Brokers provide a credit leverage of up to 1:8 for extra payment when trades are postponed to the next day.

The average daily volume of currency trading on the Moscow Exchange was USD 20 billion in September 2018. As a comparison, this is the cost of 50 airbus A380 aircraft or GDP of Iceland for the year 2016.

The Moscow Exchange – the stock market

As such, it could be divided into two major sections:- the stock and stock shares market. Stocks of Russian and foreign companies and investment shares are traded here.

- the bond market

Parameters of the stock market:

- trading time: 10:00-18:39:59.

- Settlements and delivery on municipal and corporate bonds take place immediately – this mode is called T0. Settlements and delivery on federal loan bonds (FLB) take place the next day – this mode is called T+1. The final settlement and delivery on stock and stock shares take place the second day after the trade – this mode is called T+2. Partial depositing takes place at the moment of trade execution and the major part of the payment is written off on the second day. Brokers make a decision about the size of credit leverage for various securities.

- Restrictions and charges: exchange commissions, broker commissions, which depend on turnover, depository charges and payment for marginal lending.

- Credit leverage. Brokers provide credit leverage for extra payment.

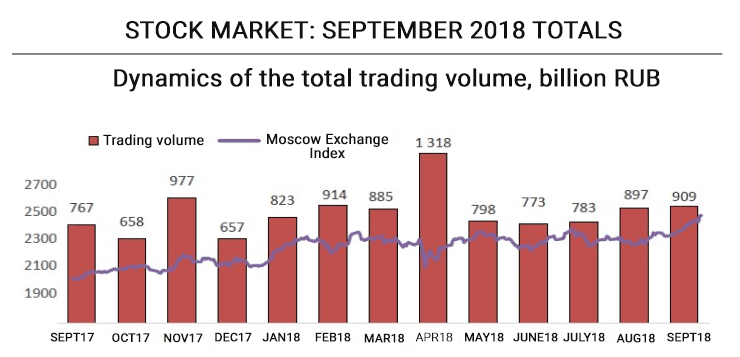

The average daily trading volume was USD 2 billion in September 2018. As a comparison, this is the GDP of such a European state as San Marino.

FORTS forward market of the Moscow Exchange

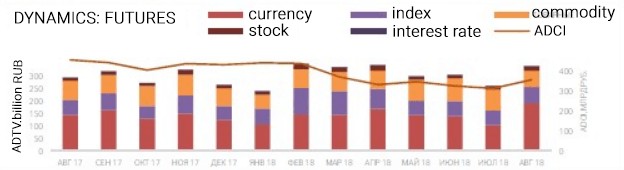

Futures, options and spreads are traded here. These financial instruments are connected with underlying assets, among which: RTS index, MICEX index, Russian volatility index, sector indices, stock, federal loan bonds, foreign currency, three-month MosPrime interest rate and commodities (oil, gold, etc.). Market parameters:- trading time: 10:00-23:50;

- restrictions and charges: fixed exchange and broker commissions;

- credit leverage: in case of futures contracts trading we do not pay the total value but only 10-12% of the guarantee collateral. Using own funds one can buy 8-10 times more contracts without loans.

Detailed information about the forward market is on the web site of the exchange.

The average daily trading volume in the forward market of the Moscow Exchange was USD 5.7 billion in September 2018. As a comparison, this is the GDP of Barbados for the year 2017.

TRADING SESSIONS. OPENING AUCTION AND CLOSING AUCTION

Trading session is a period during which participants are trading.The forward market is traded from 10:00 to 23:49:59. The Moscow Exchange stock market works less. It opens at 10:00 and closes at 18:39:59. The opening auction works from 09:50 to 10:00 and the opening price of stock is determined in this auction. The opening auction emerged on June 1, 2015, for reducing price manipulations and increase of efficient operation of the Exchange. Market and limit orders are collected during these 10 minutes and their effective price is calculated. A detailed algorithm of the effective price calculation can be found on the web site of the Moscow Exchange: https://www.moex.com/s1648. The opening auction works for all stock, investment shares and FLB. The closing auction is carried out for all stock, investment shares, Eurobonds and FLB from 18:40:01 until 18:50. A representative closing price is determined during the auction. The representative closing price is formed by a special algorithm of the Moscow Exchange. The algorithm excludes artificial overpricing or underpricing through filing a major order at the last minute. You can find more details on the web site of the Moscow Exchange: https://www.moex.com/s1709.

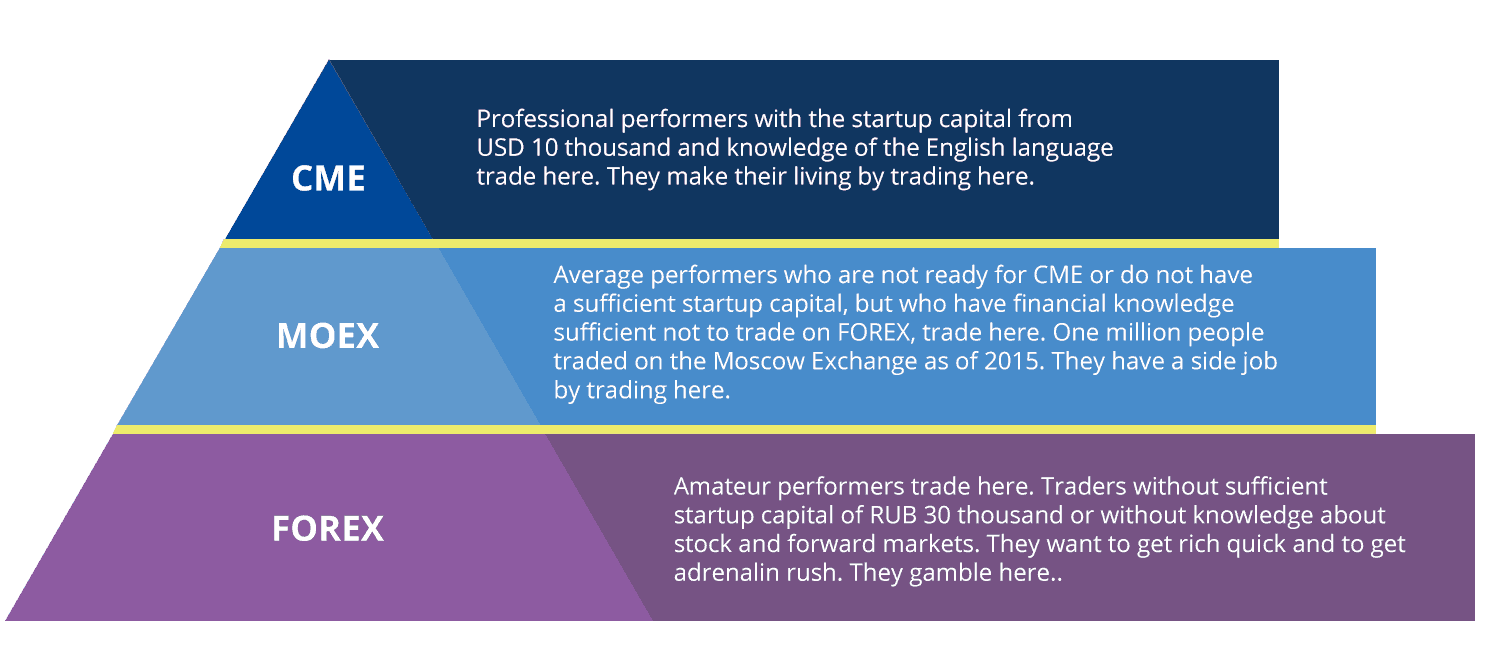

MOSCOW EXCHANGE COMPARED TO CME

CME – Chicago Mercantile Exchange – is the world biggest futures trading platform with the turnover of more than 4 million contracts for the year 2017.

- E-mini S&P 500 is a futures contract on the stock index with the average daily turnover for October 2018 being 2.3 million contracts. The guarantee collateral under this contract is USD 6,000 while for day traders it is USD 500.

- 10-Year T-Note is a futures contract on bonds with the average daily turnover for October 2018 being 2 million contracts. The guarantee collateral under this contract is USD 1,050 while for day traders it is USD 450.

- Crude Oil futures contract on oil with the average daily turnover for October 2018 being 1.1 million contracts. The guarantee collateral under this contract is USD 3,100 while for day traders it is USD 550.

- high cost of contracts. Risks are higher. On MOEX, the cost starts from RUB 3,800 for a futures contract on VTB bank shares (VBZ8) and up to RUB 240,000 for a futures contract on the MICEX index (MXZ8). On CME, the cost starts from USD 60,000 for a WTI (Crude oil) futures contract.

- high cost of the guarantee collateral. Traders need more money to start trading. The guarantee collateral on MOEX starts from RUB 600 for a futures contract on VTB bank shares (VBZ8) and goes up to RUB 26,500 for a futures contract on the MICEX index (MXZ8). The guarantee collateral on CME starts from USD 1,000 while for day trading it starts from USD 450.

- many foreign brokers. But not many brokers that work with Russian traders.

- no information about the open interest in the online mode – these data are broadcast by the Moscow Exchange only.

MOSCOW EXCHANGE COMPARED TO FOREX

FOREX (Foreign Exchange) is an over-the-counter market of interbank currency exchange by free prices. In Russia (and throughout the post-Soviet space) this concept is strongly associated with speculative currency trading with the use of credit leverage through banks or dealing centers. Activity of FOREX companies is regulated by law and the main principles are specified in the Law “On Securities Market” and “Basic Standard of Transactions in the Financial Market for Conducting FOREX-dealer Activity”. Clients of the companies, which provide access to FOREX trading, can use such an instrument for trading as CFD – Contract For Difference. This is a contract for a difference between the current and future price of the underlying asset. Underlying assets are currencies, indices, metals, interest rates, cryptocurrencies and commodities. In comparison with the Moscow Exchange, on FOREX:- The companies set CFD prices for clients independently, for them there are no centralized conditions.

- There is no centralized counterparty that regulates and controls fulfilment of commitments.

- A trader every time trades against a company and not against another trader.

- Spreads change depending on a dealer’s wish and not on the market situation.

- There is no information about the volume and open interest, since it is not a centralized exchange.

- Many dishonest brokers.

- One can start trading with a minimum capital of RUB 1,300

- A wide choice of currency pairs, commodities, indices – 45 currency pairs, 10 CFD on commodities, 5 CFD on indices and 5 CFD on cryptocurrencies .

- Information about currency trading is provided to many people, but the quality of this information is not objective. More often, it emphasizes advantages of the company, which advertises itself.

If we depict CME, MOEX and FOREX as a pyramid, it will look like as follows:

HOW THE ATAS PLATFORM PROVIDES AN ADVANTAGE FOR TRADING IN THE MOSCOW EXCHANGE FORWARD MARKET

Do you want to try online-trading on the Moscow Exchange? Most probably, your broker would offer you such a software as QUIK for conducting transactions. This software is rather inconvenient for trading and its interface is outdated. That is why traders on the Moscow Exchange prefer to trade using special trading and analytical platforms, which give a wide selection of instruments for analysis and convenient interface. ATAS is such a platform. The ATAS trading and analytical platform has:- 68 indicators;

- 25 variants of footprint display;

- 15 variants of adjustable charts.

What do we need all this for?

We chose two indicators, which are not available in Quik, MT and other platforms, to give you a practical answer to this question:

- OI Analyzer

- Big Trades

Let us consider in detail how these unique instruments, which use real data from the Moscow Exchange, help to understand the market and make a correct trading decision.

OPEN INTEREST ANALYZER

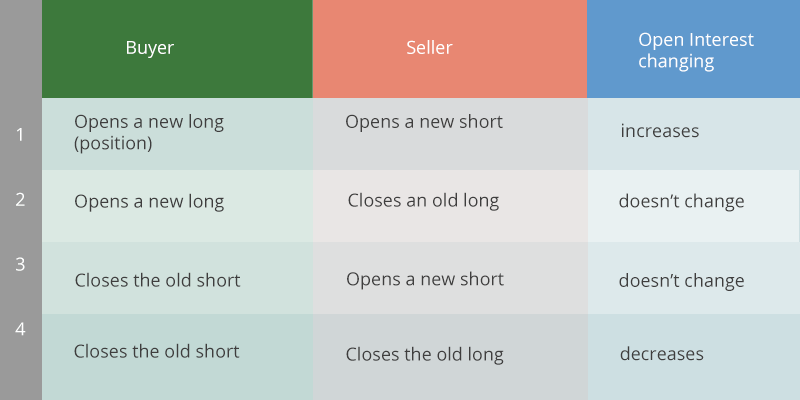

OI analyzer works only in the Moscow Exchange forward market. It combines two market indicators – Bid/Ask and Open Interest.Open Interest is a general number of open (unsold) short and long contract positions that all participants of trading have. OI works only for futures and is broadcast online only by the Moscow Exchange. The Chicago Exchange shows OI following the results of a trading session and Forex does not show OI.

Why OI works for futures only? Stock, bonds and shares are issued in a certain quantity at issuance. This quantity is not changed without additional issuance. Futures contracts emerge in process of emergence of one trader’s wish to sell and another trader’s wish to buy. A number of open, unfulfilled futures contracts changes day by day. An open contract or inflow of new money to the forward market emerges at the moment of a transaction between a new buyer and new seller.

- Open interest differs from volume, since the volume takes into account a general number of contracts (or value of such contracts), which changed owners during a certain period of time.

- Open interest differs from delta, since the delta shows predominance of buyers or sellers.

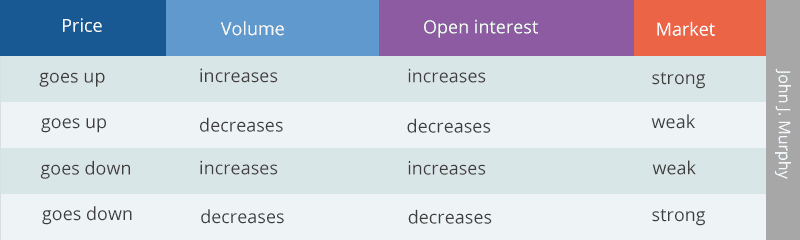

OI analyzer shows: who opens contracts and which way. New buyers and sellers open transactions or old buyers and sellers close longs and shorts.

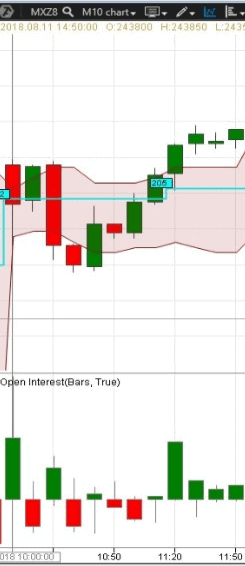

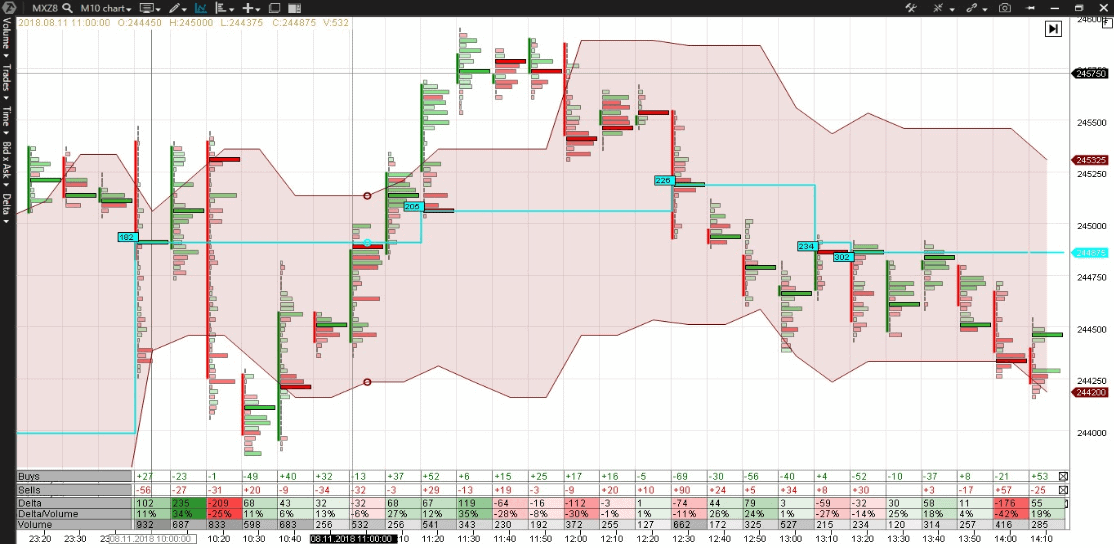

Let us check whether it is possible to understand where the MICEX index (MXZ8) would move further if we use only the open interest. What would be at 12:00?

OI analyzer will help us to understand the market situation.

Traders actively opened new long positions in the index on MICEX (MXZ8) from 11:40 until 12:00, however, the price did not go up. Limit orders for selling did not let it go up and served as a ceiling, which the price could not break. The ceiling withstood. Sellers became more active from 12:10 – they opened new short positions, increasing the OI analyzer sell. Unfortunate buyers rushed to close out-of-the-money longs, decreasing the OI analyzer buy and pushed the price down even more.

Such an assumption about what actually happened looks very trustworthy.

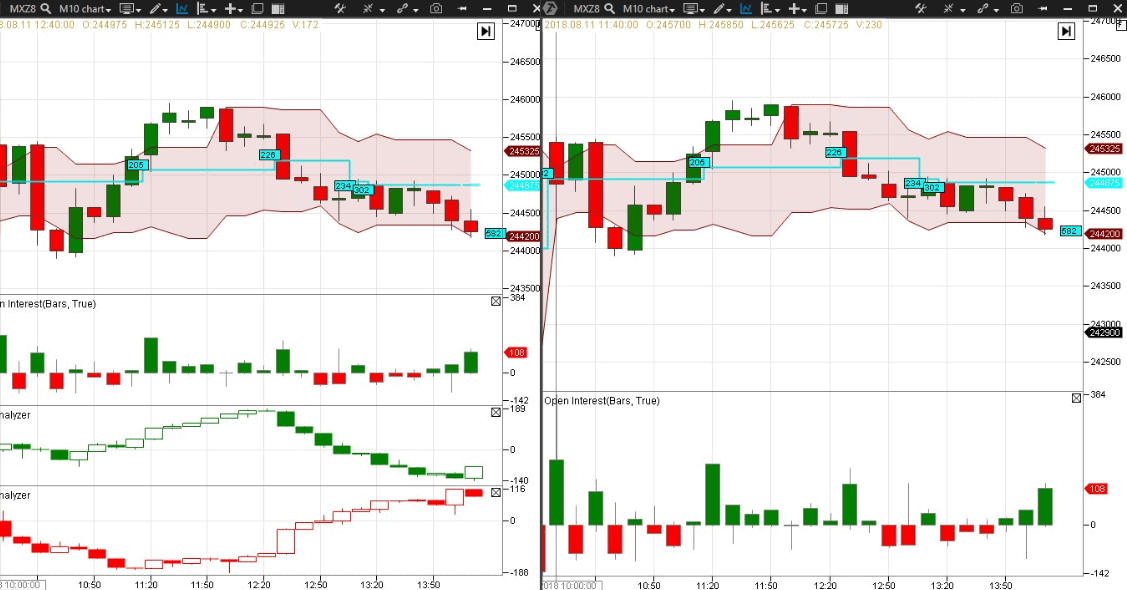

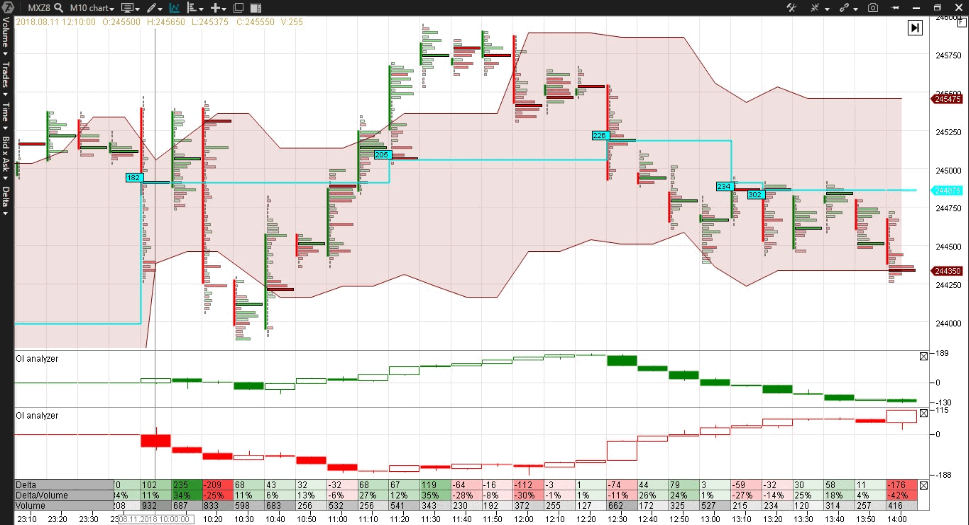

As well, you can adjust various types of display of the OI analyzer in ATAS – this is handy when analyzing a footprint.

What are these instruments?

Dynamic levels – shows movement of maximum volumes and Value Area in real time.

Cluster statistic – shows statistics, adjusted by a trader, for each bar in the cluster mode. The cluster display of a futures contract on MICEX index (MXZ8) and OI analyzer, Dynamic levels and Cluster statistic indicators make the market situation clear:

- at 10:20 we can see closing of old short contracts, and not an effort to push the price down;

- the market comes to balance at 10:30 – a bell-shaped form of the bar testifies to it;

- the buyers take the price under control at 10:40 and open new long positions. The sellers close old short contracts;

- the sellers become active again at 11:40 and they tempt those buyers into a trap who do not understand why the price does not go up when they are buying so actively. The price is beyond VAH.

Try ATAS free of charge and try to read dynamics of the fight between buyers and sellers from the chart as it is evolving right before your eyes.

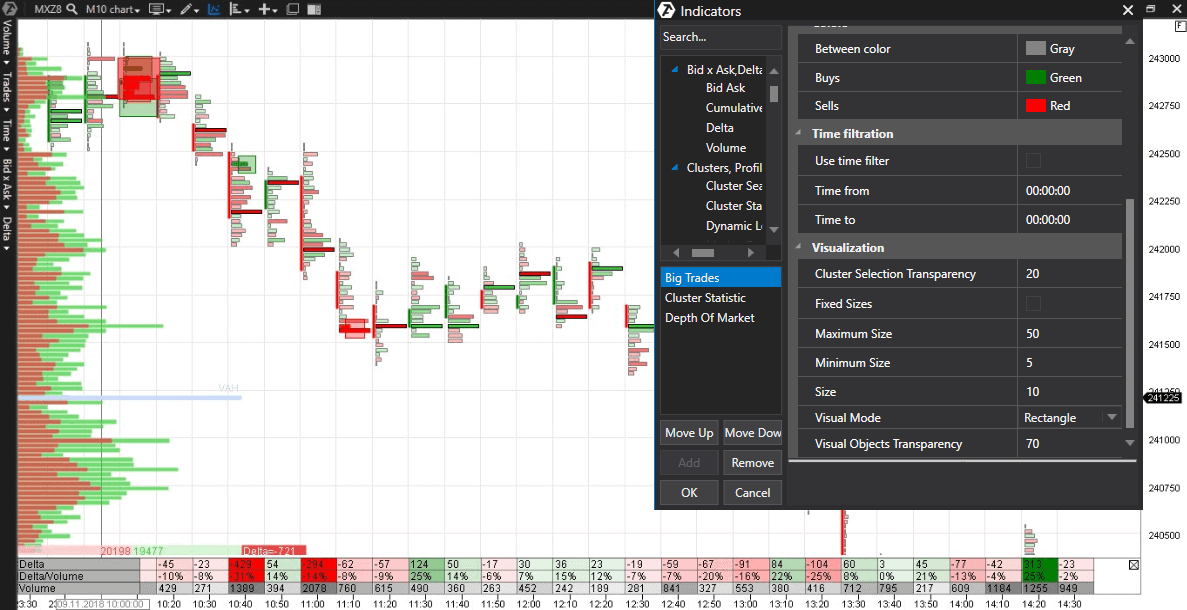

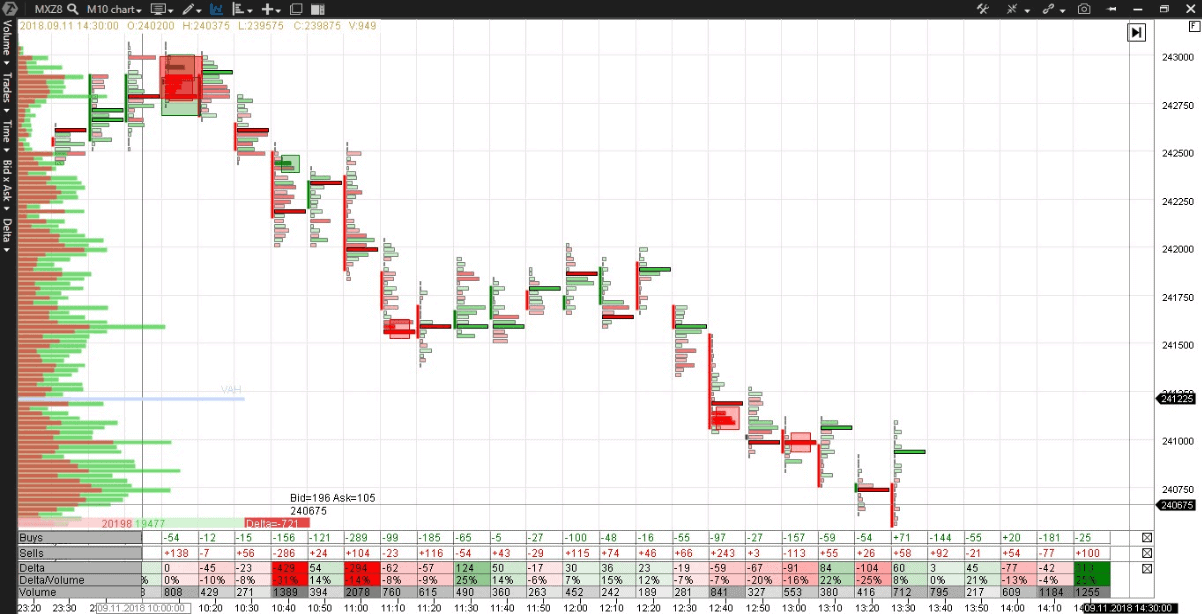

Big Trades Indicator

Big trades is the second unique indicator from a vast ATAS arsenal, which we will consider in this article. This indicator monitors and displays aggressive market transactions fixed immediately in big volume. The settings allow selection of filters not only by volume, but also by delta, bids, asks and time.

HOW TO MAKE RUB 1.5 MILLION ON THE MOSCOW EXCHANGE IN 2 MONTHS

The Moscow Exchange is a serious centralized platform for traders. It does not promise wealth in no time what some crafty advertisers of FOREX centers do.That is why you will need to try hard to get RUB 1.5 million from the Moscow Exchange. This refers to a popular competition – The Best Private Investor. The Moscow Exchange holds this competition annually from 2003. In this competition, actual traders compete to make high yield during two months from October 21 until December 21. There are 8 nominations in total – the best active trader of 2018, the best RTS index futures trader and others. The grand prize is RUB 1.5 million.

In order to take part in this competition, you need to submit your application through your broker and to have minimum RUB 100 thousand on your trading account. More than 3 thousand traders participated in this competition in 2018. Do you want to take part in the next competition? You need a competitive advantage in order to execute trades faster and to analyze more accurately. Master the ATAS platform. This trading and analytical platform has everything required to increase your chances for success in the next competition. The competition web site is www.investor.moex.com.

Summary

- The Moscow Exchange organizes and regulates trades, controls pricing and does not allow price manipulation.

- They invest and speculate in the stock, currency and forward sections of the Moscow Exchange.

- One can trade in the Moscow Exchange forward market with the capital of RUB 10-30 thousand.

- The Moscow Exchange will become a step forward on the way to CME. You can gain experience here with lower risks and losses.

“But there is only one side of the stock market; and it is not the bull side or the bear side, but the right side.” Edwin LeFevre