- What diversification is?

- Why it could be ‘naive’?

- How to protect your investment portfolio against risks with the help of diversification?

What diversification is?

Diversification is a variety. It is a method of expanding a set of instruments and adding new services.

In simple words, to diversify is to introduce variety.

Goals of diversification:

- Profit increase.

- Risk decrease.

Diversification of investments

Diversification is carried out both by professional investors and by regular people, who plan their budgets and savings (portfolios). Both diversify their portfolios through several consecutive actions:

- By currencies – if there is a currency in the portfolio it makes sense to diversify it. It is not necessary to keep USD or EUR as a part of the portfolio – it could be CHF, JPY, CNY and currencies of the developing economies.

- By types of securities – depending on your attitude towards risk, divide the portfolio into bonds and stocks. If you are young and you have time to restore your capital, invest in high-risk instruments (such as active stocks). If you are close to the pension age and prefer to save rather than increase – invest the major share of your funds into bonds. There are other interesting products apart from stocks and bonds – for example, Mutual Investment Funds, Exchange-Traded Funds and structural banking products.

- By issuers and industries – select different industries and companies with different capitalization. It is better to stick to the Golden Mean here, because if you have more than 20 papers in the portfolio you ‘wash out’ the profit, and if you have less than 5 papers – you put your capital at risk.

Let’s consider diversification using an example. We build a portfolio from two parts – Russian and American stocks – and will see how a number of stocks influences the resulting yield. To make it simple, we will not take into account dividends and will identify the yield only by the market value of stock.

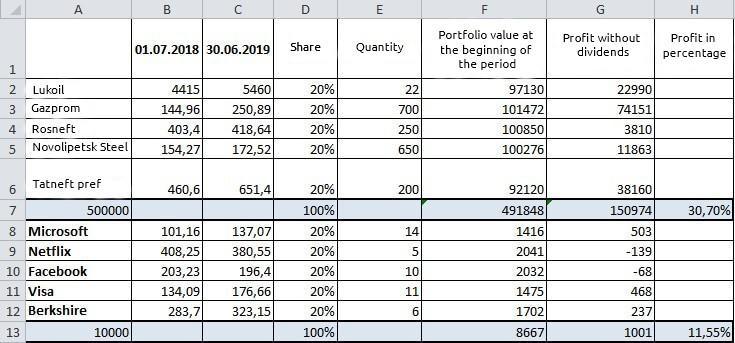

Our portfolio consists of 5 Russian and 5 American stocks. We invested about RUB 500 thousand into Russian stocks and about USD 10 thousand into American stocks. The yield and final cost are highlighted. In the first variant we took the same amount of each stock. Since the portfolio consists of two currencies, we calculated stock shares separately in each currency.

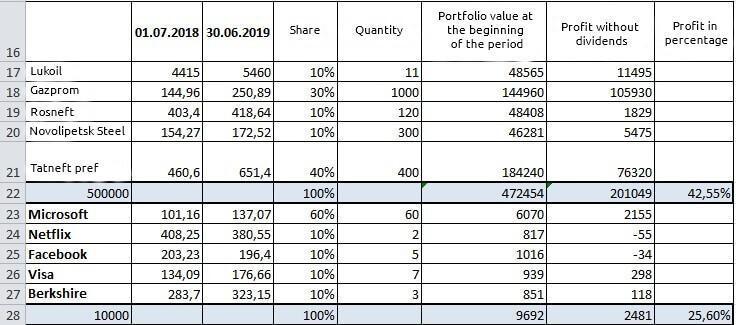

And now we change the stock shares in this portfolio.

We sharply increased the quantity of preferred shares of Tatneft and shares of Microsoft. The yield increased more than twice in the USD portfolio since we decreased diversification. When the market value of stock grows, an inefficient diversification could restrict the yield, because the main task of diversification is to protect the portfolio against risks. If we had had many shares of Netflix, we could have had losses at the end of the year.

Naive diversification

Our portfolio is built in accordance with the principle of ‘naive’ diversification, which means that we decided that if we have not 1 but 10 stocks in approximately equal shares, the deed is done. In reality it is not so.

A diversified portfolio should have securities of the issuers from different branches. And we have 4 issuers in the Russian part of the portfolio which belong to the oil and gas industry. Prices of stocks of companies from one industry, as a rule, move synchronously – either go up together (as it is in our example) or go down together.

Let’s try to convert the naive diversification into the efficient one.

- First, a significant part of our funds should be in the national currency, while the USD part of the portfolio takes a bigger part now.

- Second, it is necessary to add bonds into the portfolio as the most reliable and conservative instrument. Since a bond is an instrument with a fixed yield, you will understand the future cash flows.

- Third, it is necessary to select different industries – for example, oil and gas, IT, metallurgy, food and trade industries. We selected different industries in the American part of the portfolio, but we didn’t study reports of the companies and their financial ratios (we described how to do it in the article about the fundamental analysis).

Efficient diversification shouldn’t restrict the yield considerably – it should protect against risks.

Diversification of risks

There could be different types of risks:

- Systemic risks – for example, political events and wars. Systemic risks influence the market globally rather than separate industries.

- Specific risks – for example, an accident in a coal mine will influence the stock of a specific company.

- Loan risks – risk of the company bankruptcy.

- Interest risks – risks of changing securities prices due to a change of interest rates. This type of risk is very important for bonds.

- Country risks – bankruptcy risk at a country level. A country ceases to pay off debts.

Currency risks – risk of devaluation of assets due to a change in currency rates. For example, the Central Bank of the Russian Federation converted a part of investments into CNY, the rate of which falls down. Respectively, the value of investments also falls down.

Diversification reduces the influence of risks on the investment portfolio.

Diversification of economy

Diversification of economy is development of different economic areas. Economy is diversified so that a state wouldn’t depend on certain industries, for example, oil and gas or mining industry. You can judge by the export and GDP composition how economy is diversified.

For example, more than 50% of export in Russia falls on mineral products – mainly oil and natural gas.

Diversification of a company

Company diversification takes place through expanding a set of products, sales markets and acquisition of other companies. Diversification of production is carried out for increasing the company’s profitability.Example. The Virgin Group is considered to be one of the most diversified companies.

Let’s assess what types of diversification arrest your attention at once:

- Geographic – the company is present in different regions.

- Industrial – the company deals with entertainment, money and IT.

Taxation – different regions have different taxation and there are countries with more beneficial taxation schemes for businesses.

The general scheme of the company diversification may look as follows.

Summary

Diversification is usually used in the investment community in combination with such terms as economy, portfolio and risk.