Trading session opening time. Trader’s timetable

Trading sessions are periods of time when trades can be executed on the exchange. We wrote in the article about the exchange organizational structure that trading on the New York Stock Exchange is opened with the Opening Bell. So, a time period from the opening bell to the closing bell is a trading session.

If you wish to open a trade before a trading session starts, you will get an error message – ‘trades are closed’. You will get the same error message if you try to open a trade after a trading session ends.

We will tell you in this brief information article:

- When trading sessions are opened in Asia, Europe and America?

- Exact schedule of trading sessions.

- When the best time for trading starts.

- Where to check the trading session time in the ATAS terminal?

- The trading session indicator.

Trading sessions

As of today, there are several dozens of stock, commodity, futures, options and other combined exchanges. Each such an exchange has its schedule, which directly depends on geographical belonging to a specific country.

For example, a trading session on an exchange in Asia starts and ends before others. Then go European exchanges and, in the end, American and Pacific ones. And so on – as the Earth around the Sun.

Namely that is why a day is divided into four trading sessions in trading:

- Asian.

- European.

- American.

- Pacific.

The last one is the most quiet session since only Australia and New Zealand trade during this period, that is why the first three sessions are considered to be the main ones.

Influence of holidays on trading sessions

Availability of holidays and days off is also reflected in the schedule of trading sessions. Holidays could be very different in different countries that is why a day’s cycle could be broken due to the absence of one or another trading session.

For example, a number of Asian exchanges are closed when there are holidays in China. That is why an Asian trading session could be carried out without any volatility for the other markets.

Division of a day’s exchange cycle into three types of trading sessions (Asia, Europe and America) influences the volatility of instruments and price focus.

Thus, some commodity futures could have a low volatility during the Asian trading session, but the volatility may sharply increase when the European or American trading sessions are opened.

The picture below shows the WTI oil futures chart with specification of the Asian, European and American trading sessions.

Volatility was low during the Asian (coloured red) and European (coloured blue) sessions, however, it sharply increased and continued to fluctuate in a wide range during the American (coloured green) trading session.

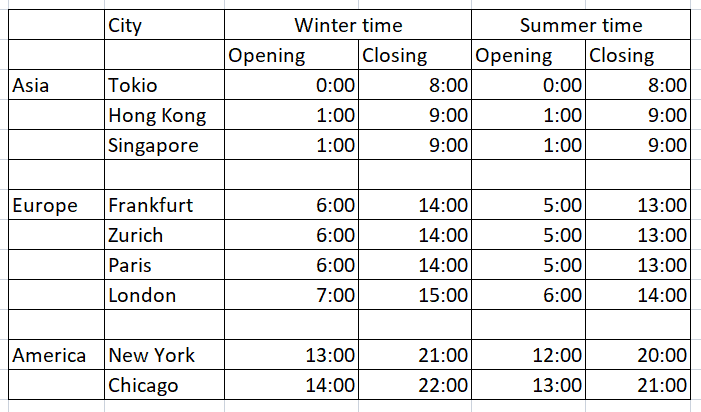

Trading session schedule

Two time standards are used in trading for the sake of convenience:

- GMT (Greenwich Mean Time).

- UTC (Coordinated Universal Time).

Schedule of the world trading sessions in GMT + 0:

Where to check the trading session time?

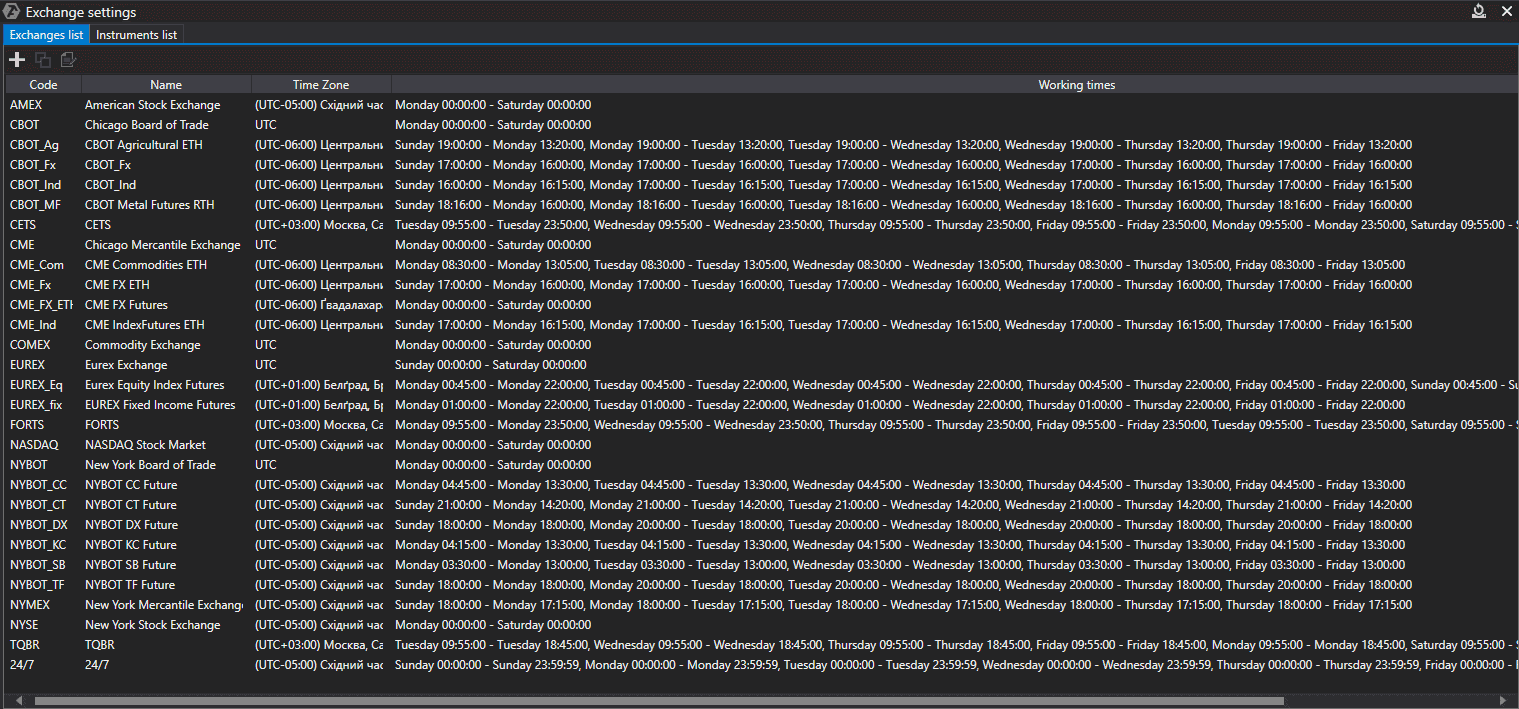

The ATAS platform already contains information about the schedule of work of the main trading platforms of the world in the UTC time standard.

To open the schedule:

- Go to the main window.

- Select the Settings menu item.

- Select the Trading Platforms section.

The trading session indicator

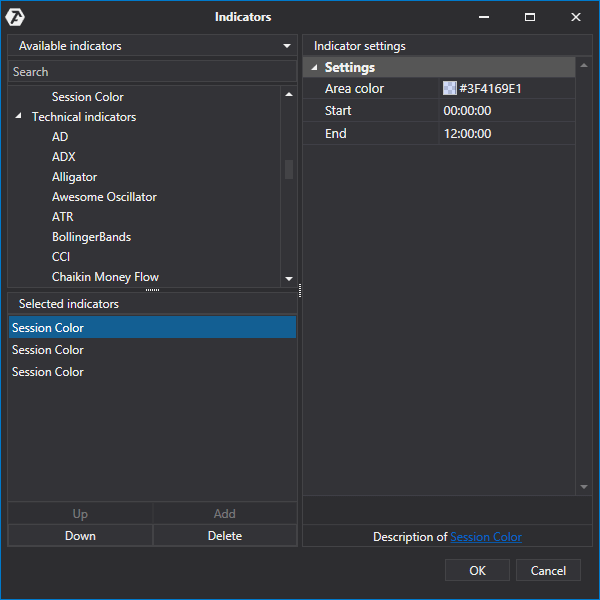

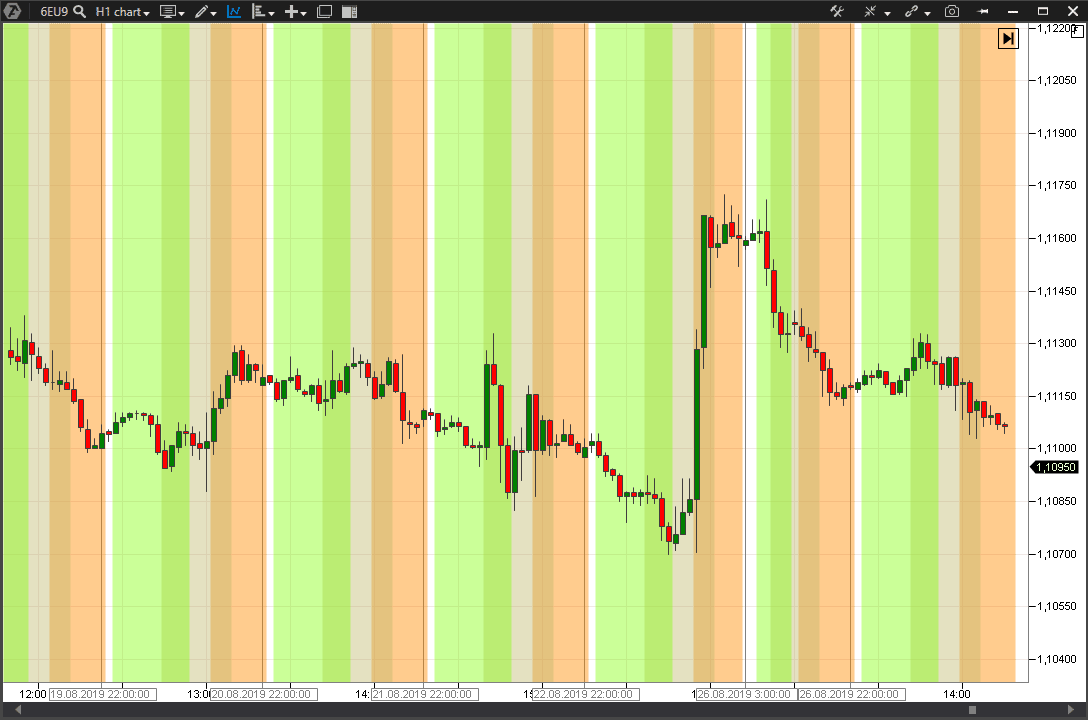

If your trading system is sensitive to the session time, you can add the trading session indicator to your chart for the visual comfort.

To do it, find the Session Color indicator in the Indicators section and add it to the list of used indicators. If required, add several Session Color indicators for individual display of each of the trading sessions.

The indicator settings allow to set the value of the start and end of a trading session and also the colour of its display.

The chart could be visually divided into zones, each of which will correspond with its trading session:

Summary

Which is the most efficient trading session?

If you trade day charts, the influence of trading sessions will be weak. That is why you may not include the session opening time in your trading system.

However, if you are an intraday trader, the most efficient trading would be the European session and the first part of the American session, when volatility increases. This is connected, first of all, with the increase of a number of market participants and respective growth of market volumes.