In this article:

- Logic of the algorithm operation.

- Example of use.

Logic of the Threshold Pro Rata Algorithm operation

The Threshold Pro Rata Algorithm is a modified Pro Rata algorithm. It provides priority to that limit order, which was posted the first at the best price level. Such an order is called a top order in the CME Group terminology.

After the algorithm identified a top order, the aggressive orders that come to the market are allocated with this top order as a matter of priority and in the maximum size, envisaged for a specific instrument.

Also, the following requirement is set in the Pro Rata algorithm: the size of a limit order should not be less than a certain (threshold) value in order to get allocation in the Pro Rata cycle.

The Threshold Pro Rata Algorithm is used in the markets of such trading instruments as a corn option, soy flour option, wheat option, etc.

Application of the algorithm through the example of the corn option contract

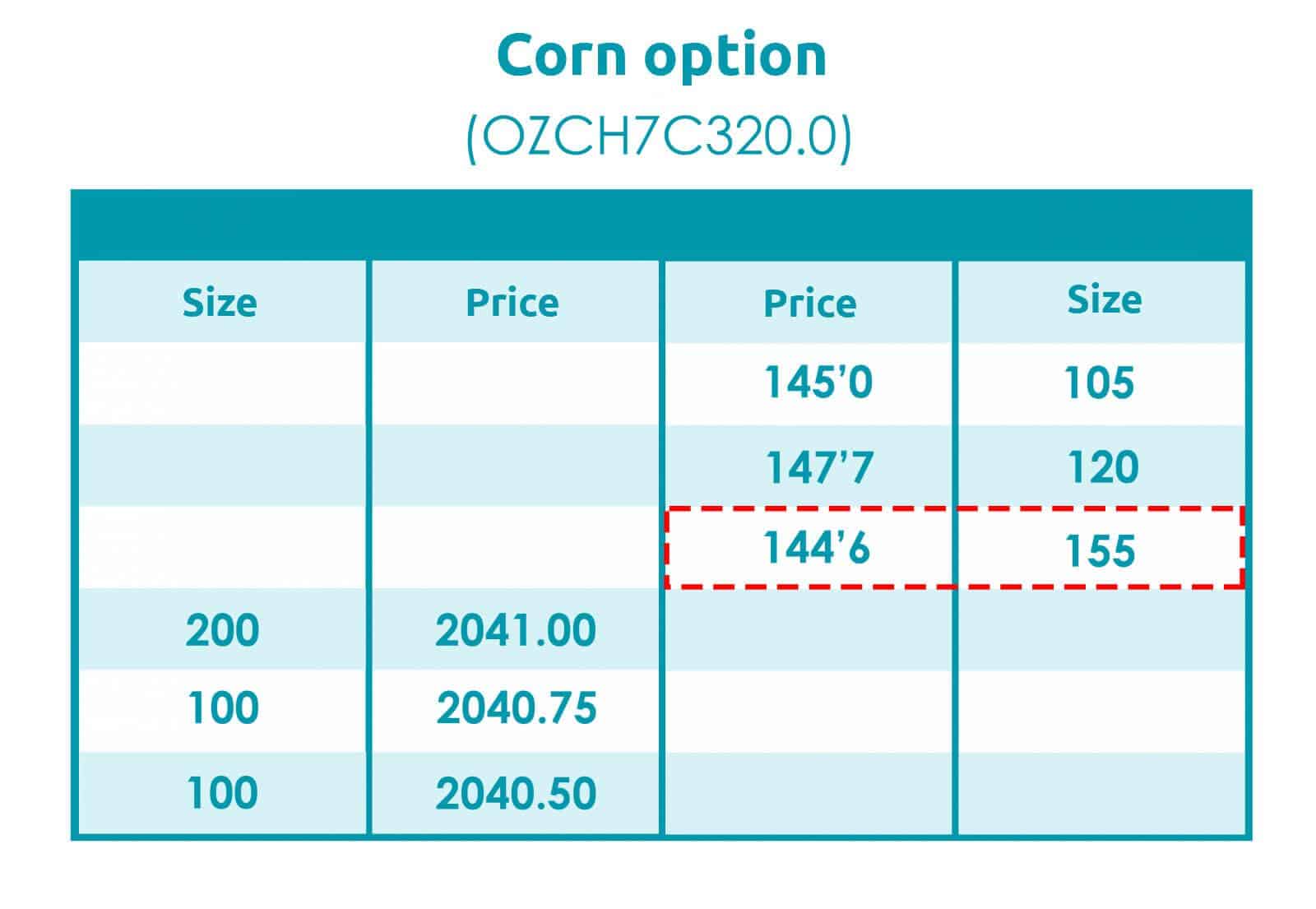

Now let’s consider the algorithm operation through the example of the corn option contract with the OZCH7C320.0 ticker.

Let’s assume that the latest price, at which the instrument of our consideration was traded, is 144’6.

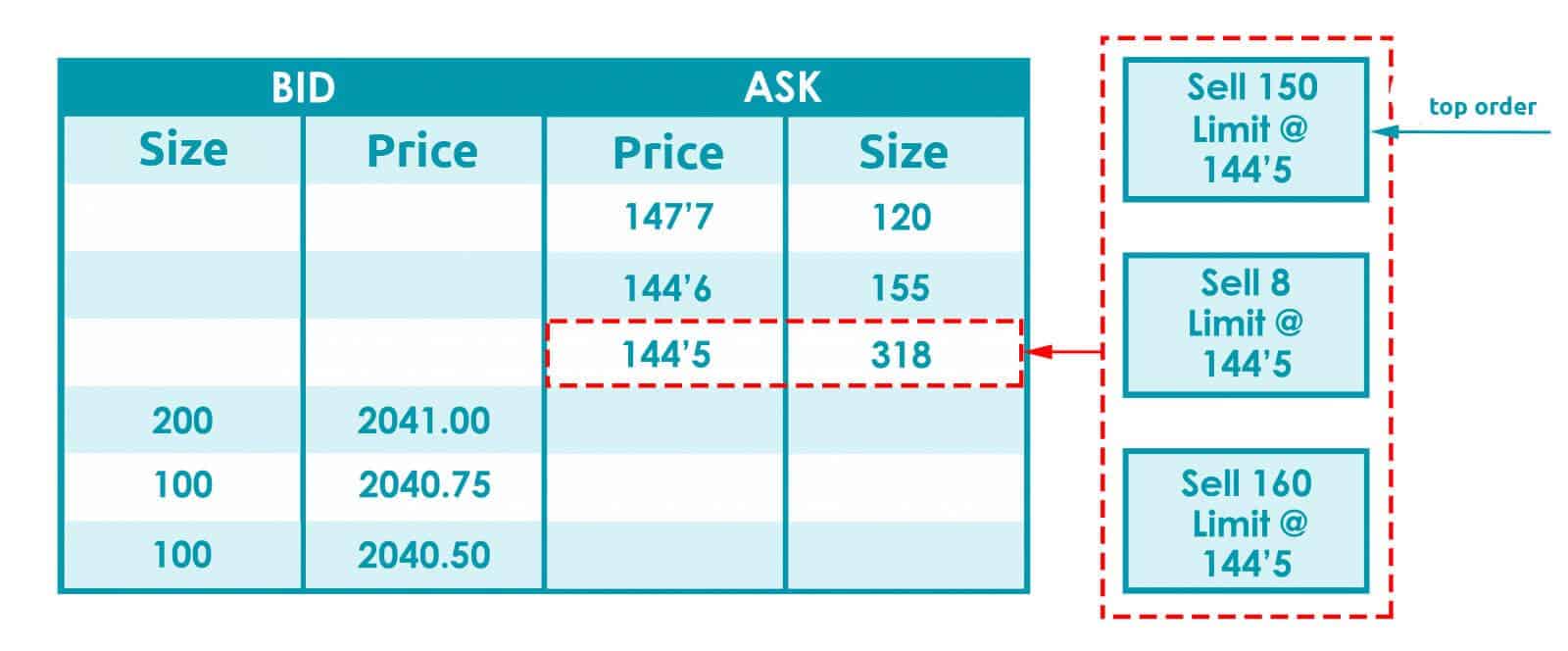

After that, three sell limit orders at the price of 144’5 come to the market. First, Sell Limit for 150 contracts, then Sell Limit for 8 contracts and the final one is Sell Limit for 160 contracts. The first order will be identified by the algorithm as the TOP order and, consequently, it will receive the highest priority.

Now we will consider in detail what would happen at a new level of limit sellers of 144’5 of the general amount of 318 (150+8+160).

The key parameters of the order matching for the corn option are the following:

- The top order is allocated in the amount of 100%, provided its size is not less than 10 contracts (if the top order size is below the threshold value, the algorithm will not allocate it) and not more than 100 contracts (if the top order size exceeds 100 contracts, the order is allocated partially in the amount of the maximum value set in the algorithm).

- Pro Rata envisages the minimum allocation equal to 1.

The order with the MZO identifier was the first one to be posted in the order book at the best price level of 144’5 and that is why it gets the highest priority.

Imagine now that an aggressive buy order – Buy 200 Limit @ 144’5 – entered the market.

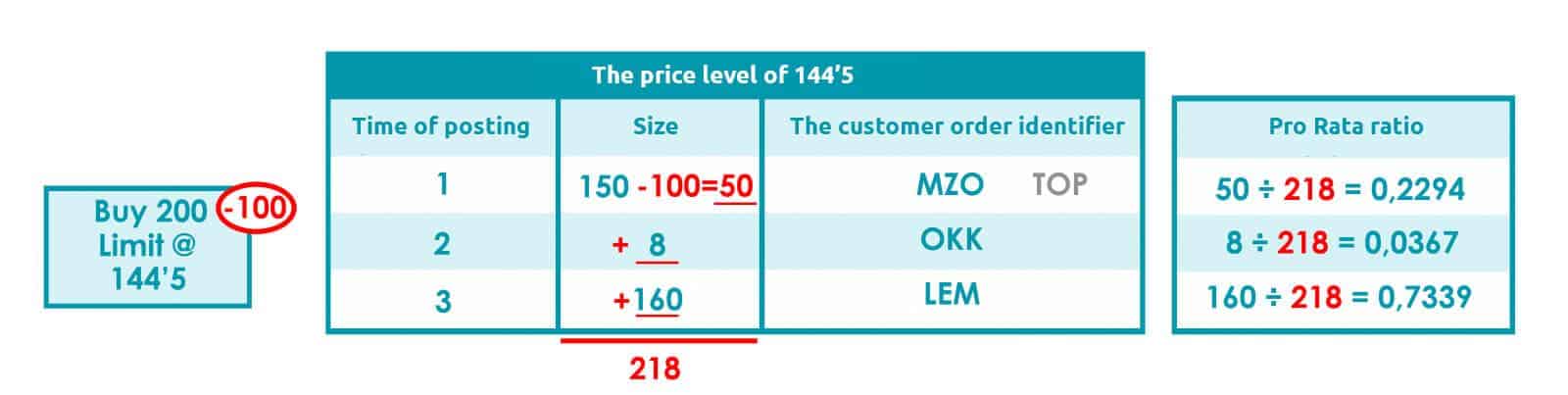

The MZO order will be allocated in the amount of 100 contracts since 100 is the maximum, which is envisaged by the algorithm for this instrument.

The size of each of the limit orders in the Pro Rata cycle is divided into the general size of all orders, which is located at the best price level of our consideration, for finding Pro Rata ratios.

After which the received ratios are multiplied by the general size of all orders. The results are rounded. The residue of the volume of the aggressive order in the amount of 100 contracts is distributed among the limit orders by the Pro Rata algorithm. As a result, the LEM order is allocated in the amount of 73 contracts, MZO – 22 contracts and OKK – 3 contracts.

So, as a result we have 2 contracts which haven’t been allocated. The FIFO algorithm comes into action at this stage. Since the MZO order was posted the first, allocation of the residue will take place namely with it.

We hope that the present article has been interesting for you and you managed to understand how this CME Group order matching algorithm operates. In our next article, we will analyze the logic of operation of the Threshold Pro Rata algorithm with the use of the Lead Market Maker (LMM) stimulation program. If something is still unclear to you and you have questions, please, ask them in the comments. Best of luck!