How to know when a trend reversal is coming

The Forex, futures and stock markets, as well as any car highway, are not a straight line from point A to point B. There are certain signs in the financial market, like there are signs on transport routes. In trading, the signs are those signals, which point to changes of the movement direction or trend reversal beforehand. However, the availability of such signals in the market would not bring a trader much use if he doesn’t have high-technology software in his arsenal. The trading and analytical ATAS platform will help you not only to identify signals, which appear in the market, but also to correctly interpret them.

A trader, as well as a car driver, should pay special attention to the ‘signs’ which send signals about an upcoming change of the movement direction. Events may develop very fast both on the highway and in the financial markets. Sometimes, traders miss a signal about an upcoming reversal of the traded asset price movement due to poor attention.

Sometimes, this poor attention is caused by rather explainable reasons. Nevertheless, both the car of an inattentive driver and the capital of a trader, distracted by solving some unforeseeable life situations, are endangered. If you missed a ‘sign’, you may cause harm to your car or trading capital.

A car driver can rely on insurance, however, this is not the case with a trader. A trader needs to monitor the ‘signs’ attentively, not being distracted by ‘red Ferrari’. Otherwise, he will have to cover all incurred losses from his pocket.

In this article: What does lead to reversals in the market? How to foresee upcoming reversals? How to make money on reversals? How to protect yourself in the event of a mistake?

What does lead to reversals in the market?

Engineers, city planners and politicians take part in making decisions about construction of highways and approval of all its turns and bends on the way from point A to point B. Various interests of the participants of this process could result in unpredictability of the direction of this future highway.

The situation is similar with the direction of movement of the financial markets. When major players disagree with each other over the prospects of future development of certain market movements, the price behaviour becomes unpredictable.

You do not have to worry, when moving along the highway, about the reasons why the movement direction will soon change. You know for sure where to turn to at a certain moment – you just need to pay attention to the road signs. However, in the financial markets, a trader needs to monitor namely the reasons of a probable change of the price movement direction and the advanced instruments of the volume analysis of the ATAS platform will help you to do it.

How to foresee upcoming reversals?

A car can turn in two directions on a highway – the road signs will tell you in which one. Each trader knows that reversals of the market movements take place at completion of ascending or descending trends. Of course, this doesn’t mean that the backward movement takes place immediately. Signs of reversals of ascending or descending trends look similar with the only difference that they appear at opposite shadows of the Footprint chart. The picture below shows an example of the reversal of a descending trend:

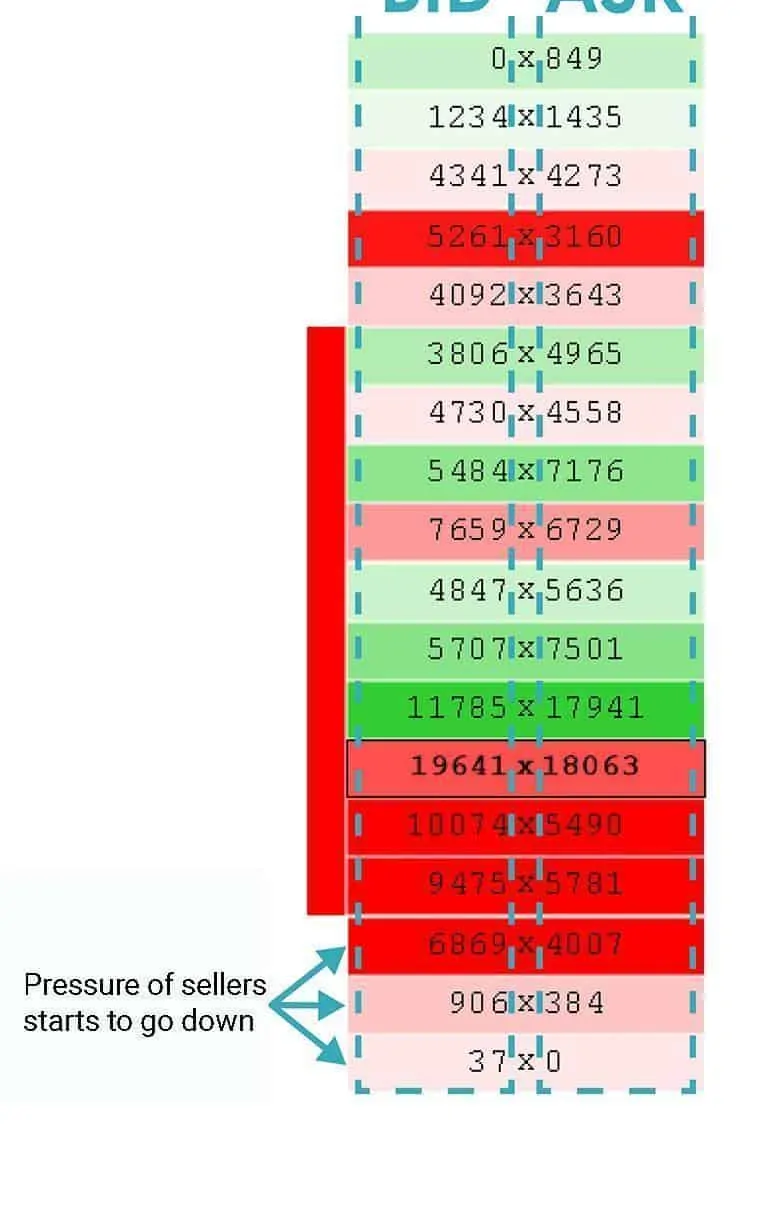

15-minute candle chart of an S&P futures mini-contract (ticker: ES). A reversal seems to be quite probable while the strength of sellers reduces.

When the sellers pressure on the asset price starts to go down and the upward price reversal seems rather probable, a trader may expect appearance of a falling bar, characterized with the reduction of quantity of the contracts executed at the Bid price in its lower shadow, in a Footprint chart. Three last prices at the bar in the left section of the picture are characterized with a fast reduction of the sellers pressure and only 37 contracts were executed at the very low of this bar at the Bid price.

The reversal signal would have looked diametrically opposite for an ascending trend and it would have been characterized with the reduction of a number of contracts executed at the Ask price in the upper shadow of the Footprint chart bar.

Both such reversal signals demonstrate the weakening of the current trend with the only difference that indicators of weakness are diametrically opposite in each case. The same is true for the actions, a trader would have undertaken if he would have had the open market positions. The signs of a reversal of the market movement would have pushed him to the closure of these positions in both cases.

Advanced instruments of the volume analysis of the ATAS platform allow a trader to see activity of the market participants inside each bar of the Footprint chart and undertake well-timed actions, which wouldn’t let his trading capital ‘to find itself on the periphery’.

How to make money on reversals?

It is impossible to overestimate the ability to identify an upcoming price movement. If you pay attention to the signals of an upcoming reversal, you will be able to avoid ‘collisions with other cars’ – the orders of market participants which continue to move in the current direction – and causing harm to your trading capital. But what’s next?

Make profit! The term ‘reversal’ in no case means a stop of the current movement. It means the beginning of the market movement in the opposite direction. That is why if the previous trend becomes weaker, it is necessary to think about making money when the market movement in the opposite direction would start to gain strength. A complete formation of the reversal will become your second opportunity to make money, which the market will provide you with.

How to protect yourself in the event of a mistake?

As soon as the reversal signs warned a trader about a necessity to close his positions, he can start assessing potential risk for executing a new trade in the opposite direction within clear rules of his trading system. Market indicators, which would constantly generate ideal trading signals, do not exist. That is why each trader strives for possessing an efficient strategy of exit from each trade he executes. In the event a trader posts an order trying to enter the market at a reversal, the posting of a protective stop loss order would be a wonderful idea.

Unlike the road signs, which are developed by the state services, you, as a trader, develop own ‘warning signs’ for the protection of your trading capital. And the modern technologies, implemented into the advanced instruments of the volume analysis of the ATAS platform, simplify this process. Your own ‘warning signs’ – trading signals – will help you not only to avoid financial losses but will promote growth of your profit, suggesting, for example, when it makes sense to increase the profitable position.