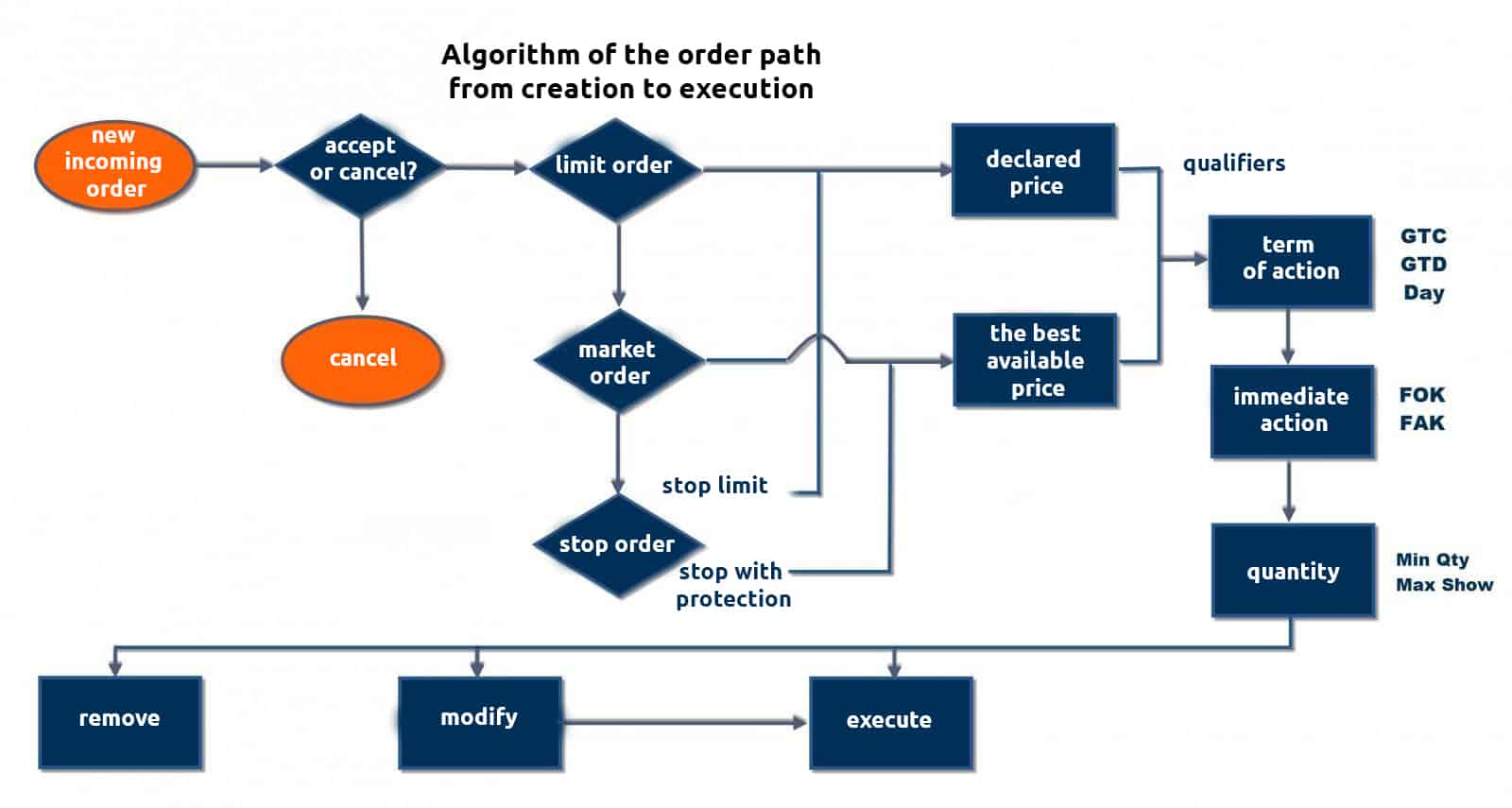

The present article contains a brief review of the existing procedure of the order execution on CME. This procedure depends on certain parameters initially set by a broker’s customer when forming orders. We will consider in this article what order types and qualifiers exist.

Order type identification

When a trader tries to post an order, it could be either accepted or rejected by the platform. If an order is rejected, it cannot be executed and a trader has a possibility to try to post it again. If an order is accepted, the trading platform identifies its type.

There are three order types: market, limit and stop orders. The limit order is executed at the price specified by a customer while the market one is executed at the best current available price. The stop order is accepted by the system but it is activated when the price reaches the level set by a customer.

After the stop order is activated it becomes the stop limit order, in other words, it becomes the limit order by definition or the stop order with protection, which activates as the market one.

At the next stage, the trading platform functions identify additional parameters, so-called order qualifiers. Order qualifiers are divided into three categories: qualifiers of the term of action, qualifiers of immediate action and quantitative qualifiers.

Qualifiers of the term of action

‘Good Till Cancel’ (GTC) is the order which stays active until it is cancelled or the trading instrument is expired.

‘Good Till Date’ (GTD) is the order which stays active in the system until the date set by a trader or until expiration of the trading instrument.

‘Day’ is the order which stays active during the day and is cancelled automatically at the end of the trading session.

Qualifiers of immediate action

Fill Or Kill (FOK) is the order which could be either executed in full or cancelled.

Fill And Kill (FAK) is the order which should be executed in the available volume and the remainder is immediately cancelled.

Quantitative qualifiers

MinQty (Minimum Quantity) is the order that is partially executed in the volume, the minimum of which is set by a trader, or is cancelled otherwise. After execution, the remainder of the order volume is placed in the order book.

MaxShow (Maximum Show) are the orders, in which only a part of the general volume of an order is accessible for the market at any moment of time. For example, a trade with a volume of 100 with the MaxShow Value qualifier of 10 means that the accessible volume for execution would be 10 at any moment of time. The volume, accessible for the market, would again be replenished by the MaxShow Value after partial execution of an order. This procedure would continue until the whole volume is exhausted.

Operations with the orders after their posting

In addition to the above, we have to consider three possible operations with the orders after posting them.

First, an order could be cancelled. Cancelled orders are removed from the system.

Second, there is a possibility to modify an order. The procedure of cancelling/replacing cancels the current order and replaces it with a new one. Parameters of the current orders could be changed in the new order during this process.

And finally, an order could be executed both completely and partially. In the event of partial execution, the non-executed remainder stays in the order book and its behaviour in the market is identified by the set parameters, which we discussed above in the present article.

Below is a schematic representation of the order’s life cycle for better understanding of the article: