How to benefit from seriality in trade

Before we start discussing a profit increase, let’s agree on what seriality in trading is.

Seriality is a property of similar trades to alternately bring different results.

For example, a trader trades in accordance with the Cactus in the Desert strategy:

- The first 4 trades were profitable. It is a series of profitable trades.

- The next 3 trades were loss-making. It is a series of loss-making trades.

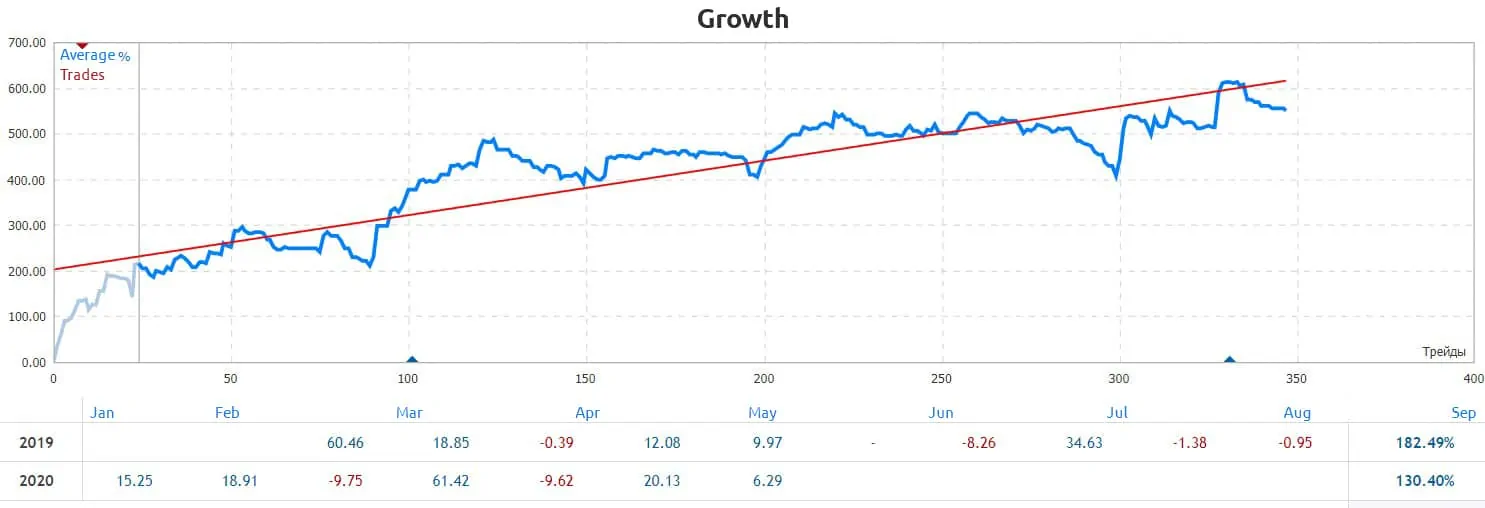

The seriality phenomenon is closely connected with statistics and probability. It turns out that ‘the black stripe follows the white one’ in trading just like it is in real life. It is important that the white stripe lasts longer and the final profit exceeds losses:

It is very important for a trader to take into account seriality, since there is no way around it. It also has a serious importance from the point of view of trading psychology.

Let’s consider an example. Suppose, a trader trades in accordance with a new system on small volumes and enters a white stripe – a series of profitable trades, which lasts for 1 month. The trader becomes confident and increases trading volumes… And immediately after that a black stripe starts with a series of loss-making trades.

The trader is disappointed. He reduces trading volumes without exiting the drawdown, starts to change his trading system and everything starts from the beginning. This could happen for years. The trader moves in a circle, gradually wasting his deposit.

So, what should be done? It is necessary to carry out adaptation.

How to adapt a trading system to the seriality principle

The following 8 steps will help you in it:

- Algorithm. Formalize the system in the form of an action algorithm. It will be impossible to test the trading system without a clear algorithm.

- Test. Conduct several tests of the trading system on various historic periods, including the most recent one. It is desirable that every test has more than 100 trades, so that it would be possible to calculate objective statistics.

- Statistical indicators. Assess efficiency of the trading system using main statistical indicators:

- Sharpe ratio,

- Average profitable trade,

- Average loss-making trade,

- Recovery factor,

- Profit factor,

- Mathematical expectation,

- Maximum drawdown,

- Maximum series of loss-making trades,

- The maximum loss in a series.

- Comparison. Compare statistical test indicators on various time periods. Indicators should be similar, which testifies to a stable work of the trading system in various periods of time.

- Capital management method selection. After you have tested the trading system stability, select the capital management method, which will not lead to a crucial drawdown on the account even in the event of the longest series of loss-making trades.

- The trading system safety degree. Make an assumption that the trading system would give you such a long series of loss-making trades in a row, which you haven’t had before. Set a safety degree, reducing the working capital by 30-50% in order not to exceed the acceptable drawdown even in the worst case.

- Maximally acceptable drawdown. Recheck the risk. You need to select such a working volume, so that the maximally acceptable drawdown wouldn’t exceed 20-30%, since a lengthy drawdown would exert a negative influence on the trader’s state.

- Psychology. Believe in your success. Having accomplished the previous steps, you will become confident. For example, you know that this system allows 7 loss-making trades in a row. So, if you have a series of 5 loss-making trades in a row, you should calmly continue to work out entry points, because ‘everything is under control’, and you shouldn’t start to panic and change your system.

Accomplishment of these 8 steps will help you to successfully adapt your trading system to the seriality effect.

How to maximize your profit

Seriality in trading is not an enemy or a friend. This is just the way things are. Besides, you have a choice:

- not to pay attention to it (a not-so-great variant);

- take it into account (this is what the 8 steps plan above is about);

- use the seriality to your benefit.

Indeed, you may maximize the profit due to the seriality effect. We will apply a special capital management method for this purpose – pyramiding.

We already wrote about it in our Pyramiding in trading article. Let’s speak about it now, because it produces an effect.

We want to remind you that pyramiding is a capital management method, which envisages that the working volume trade size increases after every profitable trade.

The logic of this approach is that, in the event of a series of profitable trades, the working capital increase leads to the profit growth.

Let’s consider an example:

Let’s assume that a trader analyses movement of the maximum POC volume (marked with numbers in the chart above) with the help of the ATAS platform.

If POC moves up, it gives ground to assume that there is a bullish trend in the market and the price growth would continue. Then the trader decides to execute a buy trade.

He opens the first trade with one contract and closes it with a profit the next day. The trend continues and the trader receives the second signal. He applies the pyramiding method and buys two contracts in order to build up on success.

How to apply pyramiding in practice

Pyramiding allows traders to significantly maximize their profits in strong trends. However, it is not possible to apply pyramiding efficiently without a thorough testing of the trading system.

Pyramiding is considered to be an aggressive capital management method, that is why you should use only trustworthy statistical sampling in order to calculate:

- how often trade series occur;

- how long series usually are;

- how long it makes sense to increase the working volume;

- how much the profit may increase if pyramiding is used;

- what risk management system should be applied in a combination with pyramiding;

- what risk level is acceptable in the first and last trade of a series.

You can apply pyramiding in real trading only after you find answers to all these questions.

Conclusions

- Seriality is an integral part of trading.

- Lengthy loss-making trade series could occur periodically. You should be ready for this.

- Conduct detailed testing of your trading system in order to correctly adapt your risk management and capital management system to a series of loss-making trades.

- You may maximize your profit with the help of pyramiding based on sufficient experience and trustworthy statistical data.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.