7 important things about euro futures. Part 2

Dear friends! We continue our EUR futures review. You will learn from this publication what macroeconomic factors influence this trading instrument, what tendencies are observed during the periods of various seasons and also how to follow major market participants using the publicly available information from the COT reports.

In this article:

- Macroeconomic factors that influence EUR.

- Seasonality of the EUR futures.

- Speculative operations – following the managed money.

5. Macroeconomic factors that influence EUR.

19 out of 28 European Union countries use the Euro currency. That is why, day after day, the regional macroeconomy plays the leading role exerting influence on the EUR volatility, which is also known as the common currency. Nevertheless, there is no necessity to track the state of economies of all 19 countries. Out of them, Germany, France and Italy are the largest eurozone economies, among which the German indicators exert direct influence on the common currency, which is considered to be the driving force of the whole euroblock of 19 countries.

The Eurozone is not a novice in regional crises, which regularly try to plunge it into a financial chaos. The readers might know about a number of crises, which took place in the eurozone, such as: Cyprus Bank’s Bailout, the Greek sovereign debt crisis and also recent sharp increase of anti-european moods, which resulted in the growth of popularity of the parties, which are strictly against the common currency idea.

EUR is also a permanent front-runner as a currency, which, according to many, doesn’t cope with its tasks in the large-scale monetary and economic policy. While winter months for EUR are usually quiet, the eurozone is inclined to crisis in summer months and traders should take it into account.

Apart from the factors described above, the European Central Bank (ECB) policy is also important. Today, the ECB softens the monetary policy using its own quantitative easing program trying to pull out the eurozone economy from the years of slow growth and weak inflation. ECB is the only body of the monetary regulation among all 19 regional central banks, which act as the ECB branches. Thus, the ECB monetary policy often influences the economies of all 19 countries, which use the common currency.

6. Seasonality of the EUR futures

Seasonality in the commodity markets is often characterized by production and consumption cycles. For example, the harvest of agricultural crops, which requires 3 to 6 months from sowing till cropping, results in the fall of prices during the period of expected growth of supply and vice versa. The currency markets are also inclined to the seasonal character of behaviour and EUR futures are not an exception.

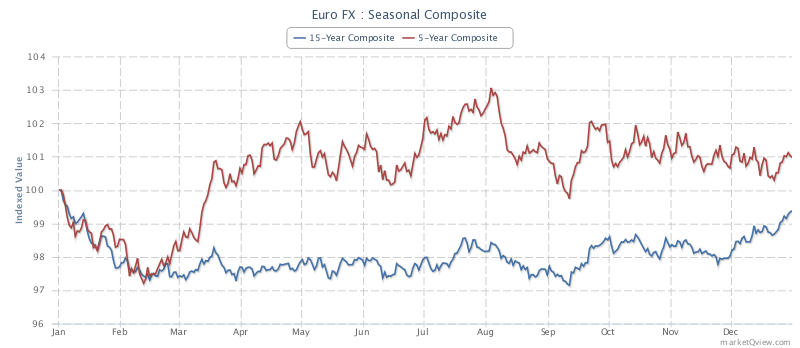

EUR is inclined to demonstrate stable dynamics in winter, first of all, due to the price growth from December until January inclusive. The local low, as a rule, is formed during February-March, after which the prices demonstrate a strong rally again until the beginning of summer. EUR starts a bearish cycle approximately during June-July, the low of which falls on October-November.

The upper chart demonstrates 15- and 5-year composite review of the EUR futures market seasonality. Day traders may use this seasonality for identifying trends based on the month during which they trade, holding certain positions in the market.

7. Speculative operations – following the managed money

One of the biggest advantages in trading the currency futures over their Over-The-Counter (OTC) analogs lies in the fact that the futures contracts are regulated and standardized, which allows a typical retail day trader to use reliable information, which is accessible to all market participants. The Commitment Of Traders (COT) report, which is widely used in the commodity futures markets, also plays a leading role in the currency futures markets. The weekly analysis of this report and monitoring positions of major players could provide you with a huge advantage.

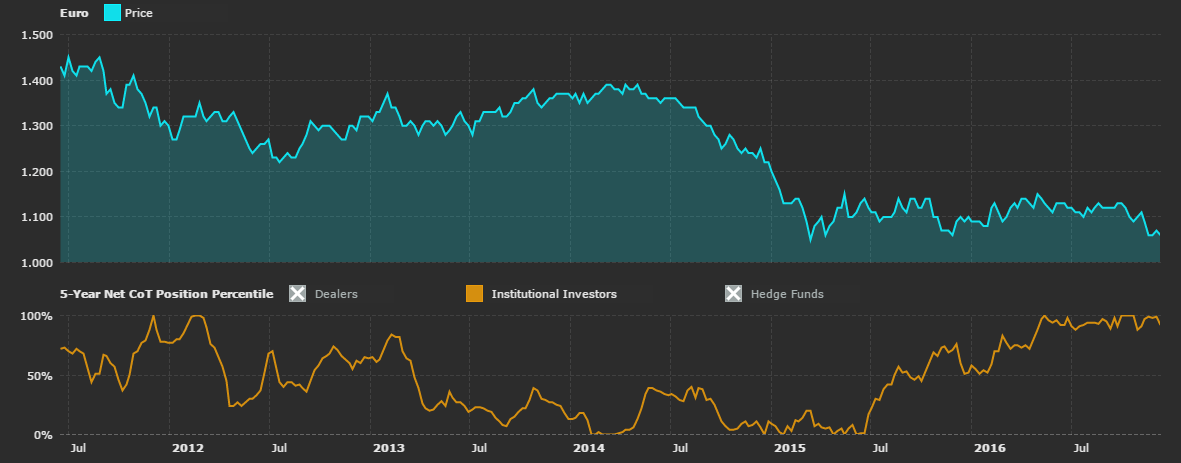

One of the simplest ways to benefit from this information is to find peaks and valleys in the positions of major players, specified in the COT report. From time to time, the managed money turns out to be on one side of the market. Using a relative comparison (usually, a 5-year period), the market overstocking with net long or short positions often results in the backward price movement.

The upper chart shows a continuous interaction of the EUR futures price in the upper part and institutional investor positions in the lower part. Approaching 0% boundary means that there are more short net positions of institutional investors in the market than it was during the past 5 years. And vice versa, approaching 100% boundary tells us about record-breaking long net positions. In general, values above 90% or below 10% are considered to be 5-year extreme points. You may observe how the prices are inclined to move in the opposite direction every time the managed money registers record-breaking values of net long or short positions. This information, in combination with other factors, such as the technical and fundamental analisis, could bring you a good income in the short-term perspective.

And finally, the EUR futures stay above all other futures from the category of currency futures in terms of trading volume indicators, which have a positive impact on the level of their trading activity. Having low day margin requirements, traders may easily trade standard or mini contracts just paying a commission without additional fees. You can use the advantages of trading futures or hedging risks of your trading portfolio, or use volatility of the EUR currency futures for making a speculative profit.