Read in this article:

- what Martingale is;

- what Anti-Martingale is;

- how to trade using these strategies (and should you?).

Martingale

Method or principle of Martingale is a method of managing stakes in gambling. Initially, it was used in casinos to play roulette. The stake doubled after every loss and stayed the same after a win.The following assumptions lie in the basis of the method:

- there are only two outcomes – a gambler either wins or loses;

- there is a series of losses and a series of wins;

- the probability of a win is equal to the probability of a loss, that is 50/50.

Theoretically, such a system would allow to win back the lost capital sooner or later.

There is no exact information about where this term originates from. There are a number of versions. For example, there is a version that the term originates from the French geographical region Martigues. They say that the region was populated by people who buttoned their trousers in the back and behaved differently from other people. That is why the Martingale method could mean strange behaviour. And it is really rather strange to double the bet after losing.

There is information in some sources that Casanova successfully traded by Martingale. See Picture 1.

| Series of games | How much you should put at stake to get back what was lost | Accumulated loss |

| 1 | -10 | -10 |

| 2 | -20 | -30 |

| 3 | -40 | -70 |

| 4 | -80 | -150 |

| 5 | -160 | -310 |

| 6 | -320 | -630 |

| 7 | -640 | -1,270 |

| 8 | -1,280 | -2,550 |

| 9 | -2,560 | -5,110 |

| 10 | -5,120 | -10,230 |

| 11 | -10,240 | -20,470 |

And now let’s assume that we have the same series of wins and the stake is again USD 10. Then, the win will increase by the stake in every next game.

| Series of games | Win in every game | Accumulated profit |

| 1 | 10 | 10 |

| 2 | 10 | 20 |

| 3 | 10 | 30 |

| 4 | 10 | 40 |

| 5 | 10 | 50 |

| 6 | 10 | 60 |

| 7 | 10 | 70 |

| 8 | 10 | 80 |

| 9 | 10 | 90 |

| 10 | 10 | 100 |

| 11 | 10 | 110 |

We have a ground to assume that 11 losses in a row and 11 wins in a row have equal probabilities. Which means 50% by 50%. However, the relation of financial results is 20,470 / 110 = 204.27, or 0.5% by 99.5% in favour of losses.

We can say in support of the Martingale followers that such sequences are very rare in casinos. However, the Martingale strategy brings significant risks to those who apply it in the financial markets, which are characterized by trend movements.

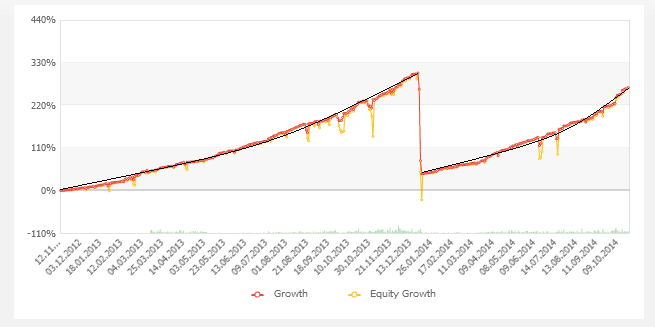

Here’s a typical dynamics of funds on the account of a trader (automatic or mechanic) who applies the Martingale principle.

Martingale calculator

Minimum, three problems arise when the Martingale Calculator is used in gambling:- if a loss-making series lasts long, the start-up capital could come to its end before the gambler is able to win it back;

- as a rule, casinos limit the maximum size of stakes. That is, if a loss-making series is long, the gambler will not be able to win back everything he has lost;

- the loss increases exponentially while the win increases arithmetically.

New problems arise when the method is transformed to the futures markets:

- it is difficult to identify the size of stakes. The size of a stake could be equal to the contract, but then it would be impossible to trade expensive contracts like S&P 500. If the size is made equal to the guarantee margin, losses could be much bigger than the guarantee margin. James Ferguson offered to use the average loss of a trading system or the average of three maximum losses as a stake. But it is not clear here losses of what periods should be taken – for example, we can take 100 trades, but it is a short period of time for active traders.

- win chances depend on the trading system and, as a rule, they are not 50/50, that is why the method cannot work correctly.

- it is necessary to take into account commission fees which increase losses.

significant drawdowns are possible under such capital management. Traders are not recommended to go into minus for more than 4-6% a month and more than 2-3% in one trade in the futures and stock markets. Large drawdowns cause psychological discomfort, which prevents a trader from trading and creates the tilt risk.

Anti-Martingale

Those who traded by the Martingale strategy and lost the deposit (maybe even several times) might have an idea – ‘what if to do everything on the contrary?’This is how the Anti-Martingale Strategy came to life. The main idea of such strategies lies in increasing the stake size in the event of a win and decreasing the stake size in the event of a loss. In fact, the capital increases exponentially in the event of wins.

Globally, such strategies are divided into three main classes:

- the risk size depends on the start-up capital. When the capital increases, the trader increases the number of traded contracts.

- the risk size depends on the traded instrument. If volatility increases, the size of traded positions decreases. This method is very topical nowadays when volatility is sky high.

- the risk size depends on the efficiency of the trading method.

Let’s consider one example – Larry Williams (we wrote about him in our article about famous traders) during the famous contest, where he reached the profitability of more than 11,000%, increased the number of traded contracts using the next formula:

The size of the capital used for trading = ((relation of profit-making and loss-making trades + 1) * profitability of the trading system – 1) / relation of profit-making and loss-making trades

In other words, if the trading system is profitable in 40% of cases and the relation of profit and loss making trades is -2.5, you may risk 16% of your trading capital.

0,16 = ((2.5+1)*0.4-1)/2.5

Consequently, if the trading system is profitable in 63% of cases and the relation of profit and loss making trades is not less than 2.5, you may already risk 48% of your capital.

This formula is called the first Kelly formula – you can find a more detailed mathematical description of it in The Mathematics of Money Management book by Ralph Vince. It is important to remember that this formula works only if:

- there are only two outcomes of events;

- and all wins are always equal and all losses are always equal.

Trading in the futures and stock markets is much more complex, that is why Ralph Vince improved this formula.

You should also remember that Larry Williams lost hundreds of thousands of dollars several times during one trading month of that famous contest and after that he reduced the number of traded contracts.

You can even find the Anti-martingale calculator on the web-sites devoted to Forex trading. There are also a multitude of robots, alternative strategies and other methods, which are based on the same Martingale principle. This direction is rather popular and the reason for this popularity is quite clear.

- You do not need a lot of money to start trading on Forex.

- The Martingale strategy allows you to see how the account is growing.

Traders hope to quickly ‘speed up’ the start-up capital and calculate their profit beforehand on the Forex calculator. The minimum requirements for trading in the futures market are higher, that is why it makes sense to select the capital management methods more prudently.

Pyramiding and the use of trailing stops could be called specific cases of the Anti-Martingale methods, because the position size increases as soon as the stop moves to the breakeven point level and higher. That is, as soon as the trader risks a potential profit rather than the start-up capital, he could increase the position size.

Summary

We recommend you to be very careful about the Martingale strategies. In the event you decide to use it in any form, consider the variant of withdrawing profit in order to preserve a part of the capital if the ‘price moves wrong way’.We want to remind you that automatic protective strategies, which help traders to preserve their capitals, are realized in ATAS. And there is no Martingale there.