Solana is a high-performance blockchain platform providing infrastructure for decentralized applications.

Solana (SOL) is also the platform’s namesake token.

In this article, you will learn:

What Is Solana?

Solana is a blockchain platform designed for hosting decentralized and scalable applications. The project was launched in 2017. It has open-source code and is managed by the Solana Foundation in Geneva, while the blockchain itself was created by Solana Labs in San Francisco.

A screenshot from the official website highlights the uniqueness of Solana:

The primary goal of Solana is to spread blockchain technology globally, providing developers with the ability to launch their projects in a fast and scalable ecosystem while keeping costs low.

SOL Cryptocurrency. What Is It?

SOL is the native cryptocurrency of the Solana network. It serves as a means of transferring value and ensures the blockchain’s functionality and security.

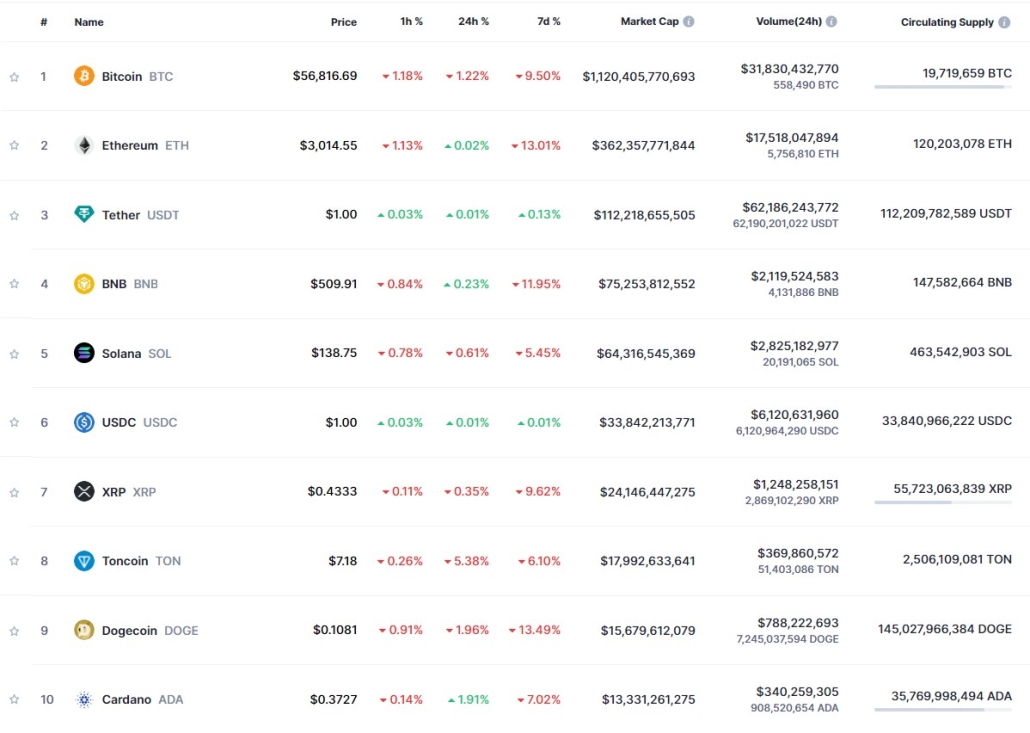

The SOL coin was launched in March 2020 and relatively quickly entered the top 10 cryptocurrencies by market capitalization.

SOL is used as collateral for conducting transactions on the network. These transactions include everything from confirming smart contracts to using Solana as a platform for selling NFTs.

As of summer 2024:

✔ SOL ranks 5th in market capitalization;

✔ Investors’ interest is fueled by information that, following the launches of Bitcoin ETF and Ethereum ETF, the next could be a Solana ETF – a fund that allows a wide range of individuals, including those in the U.S., to easily and officially invest in SOL.

The success of Solana is no accident, as the blockchain platform has a unique value.

Special Features of the Solana Blockchain

Solana’s architecture is designed to resist censorship, ensuring fast and secure transactions, which supports its global adoption.

Scalability. Solana can process between 50,000 and 710,000 transactions per second without needing additional scaling solutions, according to various sources.

Low Fees. Even under heavy load, Solana remains cost-effective, with an average transaction fee of just $0.00064 (as of July 2024).

Speed. Transaction confirmation takes only 400 milliseconds.

Created for developers. Solana supports interoperability between projects in its ecosystem through a unified global state, removing the need for integration with Layer-2 or other solutions. Additional features for developing applications on Solana include security and the ability to program in popular languages such as C, C++, and Rust.

History of the Solana Project

Solana was created by Anatoly Yakovenko, who has significant experience in developing distributed systems and previously worked at leading technology companies such as Qualcomm.

2017. The idea for the Solana blockchain was first introduced during the ICO boom.

2018. Yakovenko and Raj Gokal assembled a team of five people to implement the idea. One of them was Anatoly’s colleague from Qualcomm, Greg Fitzgerald, who became the project’s principal architect.

Initially, the project was named Loom. However, to avoid confusion with an Ethereum-based blockchain with a similar name, the team changed the name to Solana, honoring a small coastal town in Southern California where the co-founders lived.

In the summer of 2018, a public testnet was launched supporting bursts of up to 250,000 transactions per second (TPS). This network proved to be significantly faster than traditional blockchains like Bitcoin and Ethereum, which were experiencing scalability issues and could process only about 15 TPS at the time.

2020. In March, the main Solana network and the SOL token were officially launched. The first “genesis” block was created on March 16, 2020.

2021. In June 2021, Solana Labs sold SOL tokens totaling $314 million to a group of venture capital funds including Andreessen Horowitz and Polychain Capital.

One of Solana’s significant breakthroughs occurred in August 2021 when the Degenerate Ape Academy project on the Solana NFT market saw success. Within the first three weeks, the price of Solana surged from around $30 to $75.

Solana reached its record high (at the time of writing) in November 2021, with the price of SOL reaching nearly $260 during the peak of the cryptocurrency bull market.

2022. Despite its popularity, SOL experienced a downturn in the cryptocurrency market in 2022. In December, the asset’s market capitalization fell below $3 billion.

2023. In April, Solana’s subsidiary, Solana Mobile, began selling the Solana Saga: an Android-based smartphone preloaded with decentralized applications based on Solana.

In September, Visa announced support for the Solana blockchain for sending payments using the USD Coin (USDC) stablecoin instead of fiat currency through bank transfers. Payment processors Worldpay and Nuvei also joined the initiative.

By December 2023, Solana had processed over 253 billion transactions at an average cost of $0.00025 per transaction.

2024. In June, the firm VanEck filed an application with the SEC to launch a Solana ETF, aiming to allow a wide range of individuals to invest in SOL officially and securely.

How Solana Blockchain Works

Traditional transaction processing often requires centralization. For example, Visa relies on a vast network of computers to maintain high processing speeds. In contrast, the Bitcoin blockchain processes transactions slowly to preserve decentralization.

In simple terms, Solana aims to process transactions at speeds comparable to large centralized companies like Visa while maintaining decentralization akin to Bitcoin.

To achieve this, the Solana blockchain operates on a hybrid model combining Proof of History (PoH) and Proof of Stake (PoS) consensus mechanisms:

- PoS enables validators, who confirm transactions on the blockchain, to validate them based on the amount of coins or tokens they hold.

- PoH enables the rapid addition of timestamps to these transactions. PoH acts as a cryptographic clock, providing evidence that a message occurred before or after a known event. This is akin to a hostage photo in the latest newspaper issue, proving the hostage was alive after the newspaper’s publication.

All nodes in the Solana network are equipped with this cryptographic clock. This innovative process, where PoH operates in conjunction with PoS, efficiently tracks events and eliminates the need for validators to wait for transaction confirmations from others.

This significantly increases Solana’s throughput and speeds up block creation. Unlike other decentralized blockchains where increasing transaction volume slows down operations due to time differences between nodes, Solana addresses this issue.

Drawbacks of Solana

Security Issues:

In August 2022, a hacking incident targeted the Solana network, resulting in the compromise of over 9,000 wallets and the theft of approximately $8 million. However, the Solana Foundation rejected the allegations, stating that the breach was caused by a vulnerability in the code of the Slope Finance digital wallet.

Regulatory Challenges:

This primarily concerns the lack of regulation in the cryptocurrency market rather than the inherent drawbacks of Solana itself. On July 1, 2022, a class-action lawsuit was filed against Solana. The lawsuit accused the company of:

- selling unregistered securities in the form of SOL tokens;

- intentionally misleading investors about the total volume of circulating SOL tokens.

In June 2023, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Coinbase, alleging that Solana and 12 other currencies offered on the platform qualify as securities. Solana rejected the accusations, asserting that SOL is not a security.

Network Downtime Issues with Solana:

On September 14, 2021, the Solana blockchain went offline following a sudden surge in transaction volume, causing different validators to assess the network’s status differently. The network was restored the next day, with the downtime lasting approximately 17 hours in total.

On May 31, 2022, the Solana network stopped functioning due to an error in processing offline transactions by the blockchain. The interruption lasted about four and a half hours.

On October 1, 2022, the Solana network again experienced a six-hour downtime due to a consensus error in a validator client, which allowed a misconfigured node to publish multiple valid but different blocks.

These incidents represent a partial list of disruptions that have often contributed to the decline in the native SOL token’s value.

How and Why to Use Solana?

Solana was created to overcome limitations in scalability, speed, and costs. It can serve millions of users who can use the network in the following ways:

1. Creating Decentralized Applications (dApps)

Developers can use Solana to build applications across various niches:

✔ Decentralized Finance (DeFi): for lending, asset exchanges, and other financial services.

✔ Non-Fungible Tokens (NFTs).

✔ Games.

2. Using Smart Contracts

Solana supports smart contracts, enabling the automation of various agreements and operations, such as supply chain management.

3. Staking

Users can stake their SOL tokens to support the network’s operation and earn rewards in return.

Read more about the topic: What Is Cryptocurrency Staking

4. Investing and Cryptocurrency Trading

The Solana (SOL) coin can be used for investments and trading on cryptocurrency exchanges. It has high liquidity and is one of the largest by market capitalization. Investors can:

- Buy and HODL SOL crypto in anticipation of asset price growth.

- Actively trade SOL to profit from price fluctuations.

Is Solana a Good Investment?

Here’s how the price of Solana (based on cryptocurrency exchange data) has changed over the years:

| End of Year SOL Price, $ | Annual Change, % | |

| 2020 | 1.50 | 0.00 |

| 2021 | 170.30 | 11253.33 |

| 2022 | 9.96 | -94.15 |

| 2023 | 20.00 | 100.80 |

Factors contributing to the attractiveness of SOL include:

- prospects for approval of a Solana ETF;

- network advantages such as speed, scalability, and cost-effectiveness for application development;

- approximately 30 million unique wallets that have ever paid transaction fees;

- development of DeFi, NFTs, and GameFi;

- increased interest in the cryptocurrency market, starting from 2023.

Investment Risks in SOL:

- extremely high cryptocurrency market volatility;

- legal claims from regulators;

- risks of network hacks and outages.

Cryptocurrencies are highly risky investments. If you intend to buy Solana, be prepared to potentially lose your invested capital, even if you believe in its potential.

How to Become a SOL Trader?

High volatility presents excellent profit opportunities for traders. Here is an example of how the professional platform ATAS can assist in this.

Below is a chart of SOL/USDT from the BinanceFutures exchange. The chart includes DOM Levels and Delta indicators. Additionally, we have added a profile created for an arbitrary section of the chart.

Here is how ATAS tools help assess the situation. Numbers indicate:

(1) This candlestick shows a sharp surge in buying, but during the subsequent candles, the price drops close to the low of the candle (1). If this is a retracement, its depth should be a cause for caution.

(2) Similar phenomenon.

(3) A large level of sell orders (highlighted in yellow) indicates that bears have become more active, sensing uncertainty in demand. The price lacks the strength to overcome this resistance. Positive delta suggests a demand deficit around 00:45. Subsequent spikes in market sells (red bars on the delta indicator) indicate a shift in sentiment in the SOL/USDT market.

Price decline below the profile low confirms that bears have taken control. Testing the large volume level (4) could be used for a low-risk short position entry.

FAQ

What is the Sol cryptocurrency price?

The easiest way to find the price of Solana is through Google. An alternative option is to download ATAS and analyze price changes and volumes on charts created with precision down to each trade.

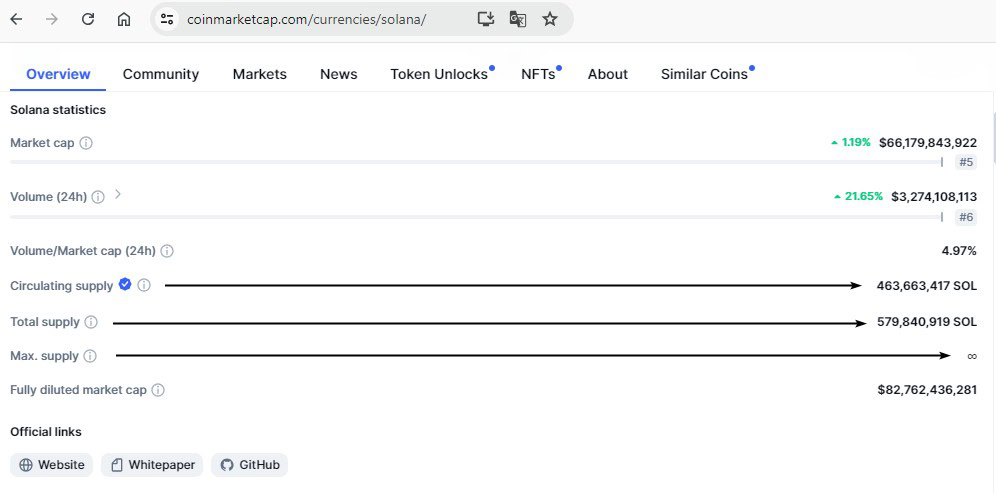

How many SOL coins are in circulation?

Solana cryptocurrency does not have limits like Bitcoin. Hypothetically, any number of coins can be issued. According to CoinMarketCap data as of mid-2024, around 463 million coins are in circulation out of the 579 million issued.

How to buy Solana?

To buy SOL, it is recommended to have an account on a cryptocurrency exchange (e.g., Binance – accounts.binance.com/register?ref=YO4MVRZB). With ATAS, you can find the most opportune moments to buy Solana.

What is the difference between Solana and Ethereum?

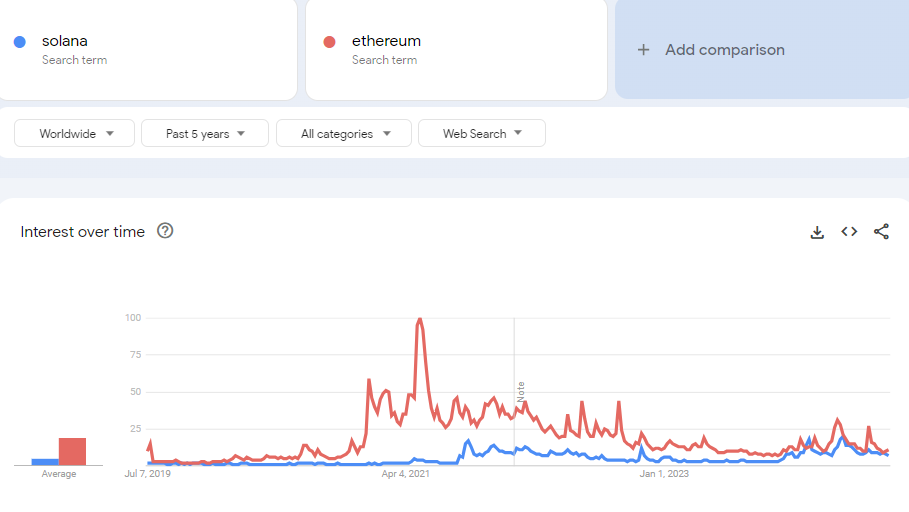

Ethereum and Solana both provide ecosystems for developing applications, they are competitors. However, Ethereum has been around longer, while Solana is the “up-and-comer” with technological advantages over Ethereum. Interestingly, in 2024, according to Google Trends, interest in both blockchains has equalized, partly due to a decline in interest in Ethereum.

What makes Solana unique?

Solana stands out for its low transaction fees and its ability to process between 50,000 and 710,000 transactions per second, thanks to its innovative Proof of History (PoH) consensus mechanism. This makes Solana one of the fastest and most affordable blockchain platforms, ideal for scalable decentralized applications.

Conclusions

SOL is one of the largest cryptocurrencies, consistently ranking in the top 10 by market capitalization. This is achieved thanks to the unique properties of the Solana blockchain: high speed, low costs, and the ability to create smart contracts and decentralized applications (dApps).

Developers can focus on building their applications, while traders can profit from the fluctuations in the price of SOL on cryptocurrency exchanges.

Download ATAS for free. With this software, you will get access to professional tools to trade SOL, as well as Bitcoin, Ethereum, and other cryptocurrencies.

Gain an edge over other traders by using:

- DOM Levels, market profiles, and other indicators;

- ATAS Smart DOM, ATAS Smart Tape;

- a Market Replay trader simulator;

- custom time frames, flexible settings, and much more.

Moreover, you can continue using the program for free even after the 14-day trial period is over, whether it is for cryptocurrency trading or volume analysis in futures markets.

Do not miss the next article on our blog. Subscribe to our YouTube channel, follow us on Facebook, Instagram, Telegram or X, where we publish the latest ATAS news. Share life hacks and seek advice from other traders in the Telegram group @ATAS_Discussions.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.