How the market has changed with the advent of the coronavirus

Earlier, the mass media spoke about the influence of the coronavirus on exchange markets only hypothetically. However, the S&P index futures fell by more than 15% in the last third of February. Coronavirus was named to be the main reason. Its influence on stock indices and other assets became real. What’s next?

Read in this article:

- About the coronavirus.

- Examples from history.

- Influence on economy, oil and stock prices.

About the coronavirus

Pandemic is a disease, which ‘spreads’ all over the world, because people do not have immunity to it. Viruses that resulted in pandemic were spread, most often, by animals. Such viruses are especially dangerous for elderly people and people with chronic diseases, because complications occur in this group more often. Young and healthy people could be ill but without symptoms and without feeling ill.

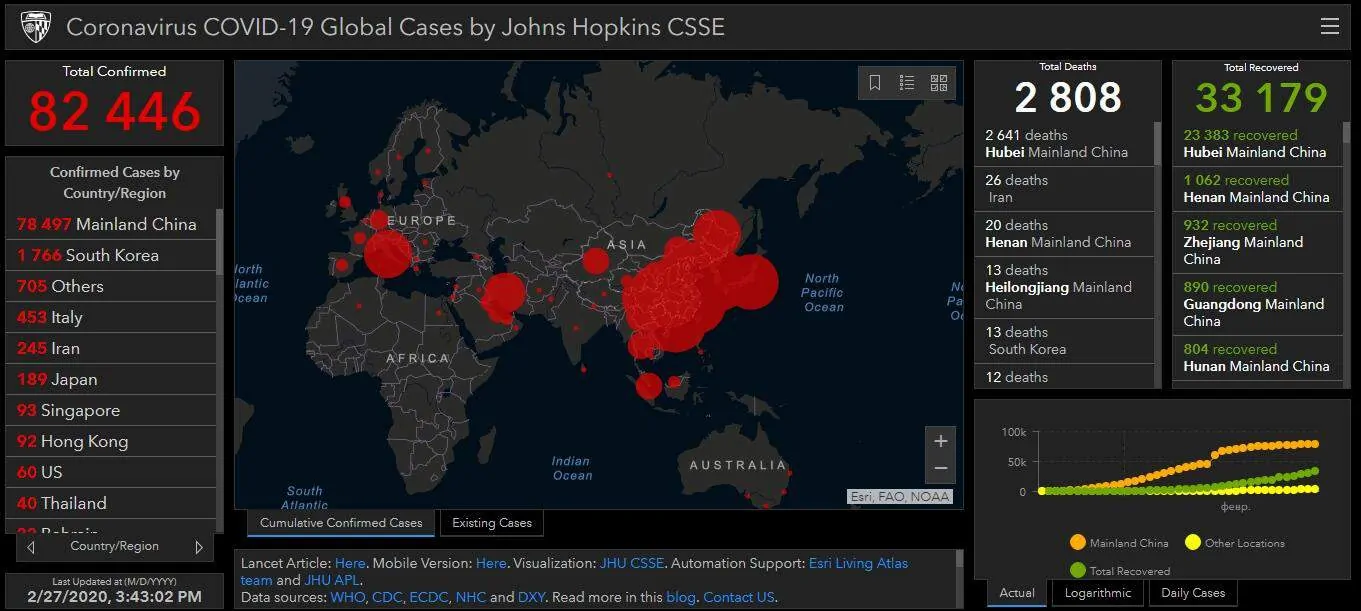

The virus which spreads all over the world at the beginning of 2020 is called coronavirus or COVID-19. The first infections were registered in China in December 2019. About 80,000 people from 34 countries of the world got sick as of February 26, 2020. About 97% of all infected are in China. It is quite probable that the coronavirus will transform into pandemic. See Picture 1.

Historical facts about pandemics

The most recent pandemic of the current century was in 2009-2010. It was the swine flu virus A/H1N1. The vaccine was developed during the first year. The mortality rate during the first year was from 100,000 to 400,000 people.

The most serious pandemic in the observable past took place in 1918. The virus was called the Spanish flu. From 20 to 50 million people died during one year.

What you should pay attention to

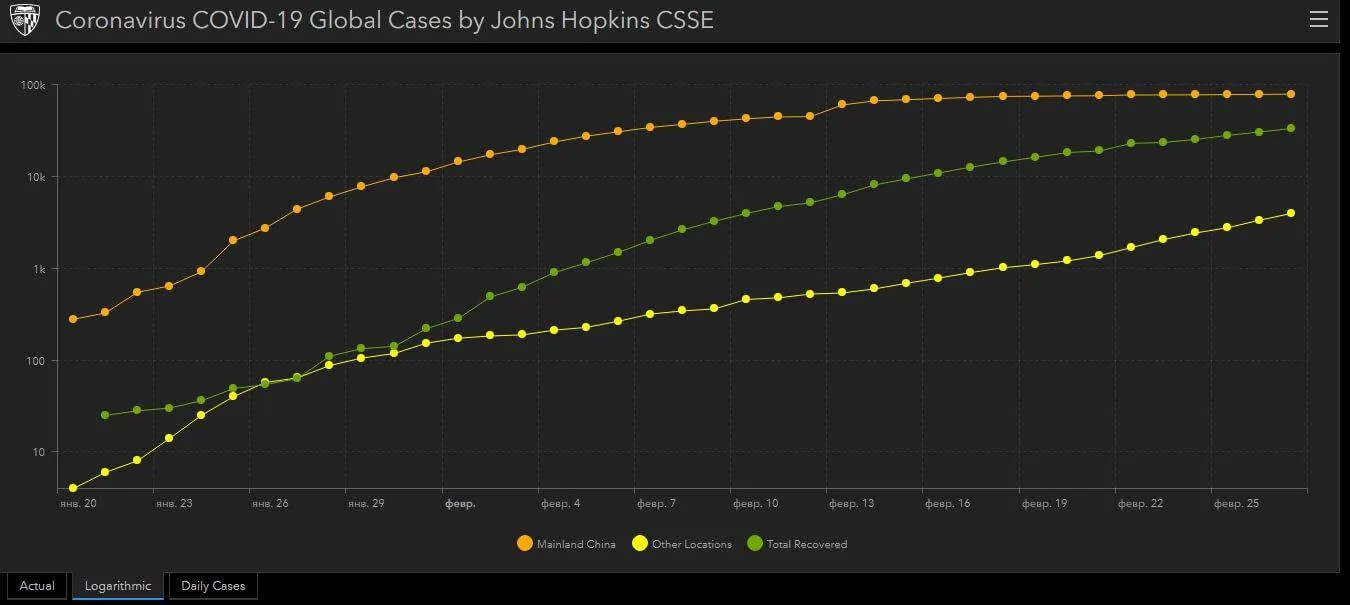

The virus will run its course when the number of infected people will start to consistently decrease. You can find charts of infected in the logarithmical or standard form on various Internet resources. We used the Johns Hopkins University data. Donald Trump used this resource during his press-conference. See Picture 2.

Influence on the economy

Coronavirus influences the world economy stronger that the previous virus outbreaks for a number of reasons:

- Nowadays, the Chinese economy is the second (according to some data – the first) biggest economy in the world after the US economy. Reduction of the Chinese GDP for 1% will result in reduction of the world GDP for 0.4%.

- China consumes very many raw materials, that is why the problems of the Celestial Empire decrease the prices on energy products, metals and agricultural products.

- China produces electronic components and spare parts for productions all over the world. If their shipments are delayed, processes in many countries start to slow down.

- Analysts started to speak about a recession and bearish market already in 2019, since the world economy was in the growing cycle for more than 10 years.

- Many beginner investors came to the stock markets during the recent couple of years, since Central Banks reduced the key rates and investors were looking for a more interesting yield. Investors withdrew money from the funds, which were managed by professionals, and invested into risky instruments without diversification and risk assessment.

Influence on oil

Oil consumption sharply fell in China because factories do not operate, people do not drive cars and the number of air flights, according to the Bloomberg data, reduced by 80% as of the middle of February. However, despite the production recession, oil imports into China increased because the Chinese government builds up its oil reserves, which also may reduce demand in future.

Analysts disagree in forecasts how oil consumption could be decreased, but it’s quite probable that the demand on oil in 2020 would decrease for the first time for the past 10 years.

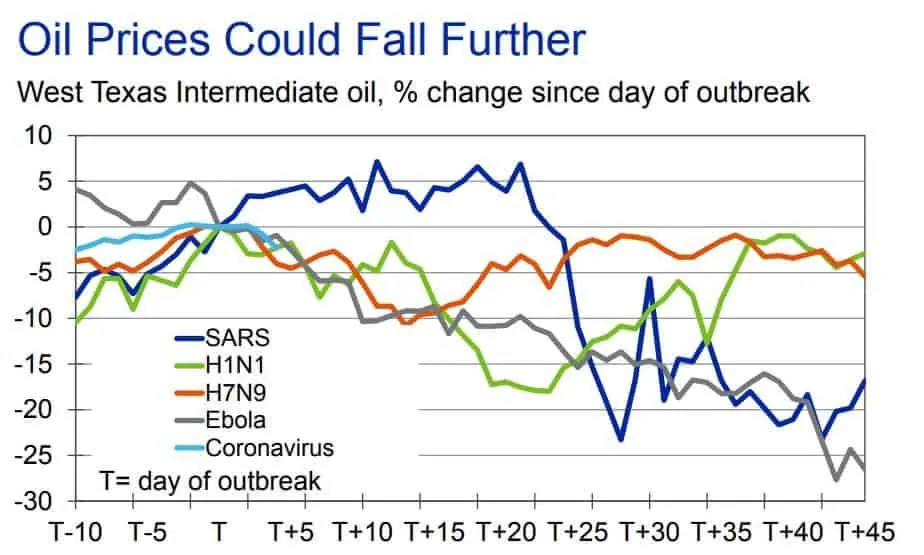

The Moody’s agency developed a chart of the WTI oil prices behaviour during major virus infections. The chart tracks the oil price fall or growth during 45 days after the virus outbreak. The vertical axis is the percentage of the price change, while the horizontal axis is the time of outbreak of the disease. See Picture 3.

The biggest oil price fall took place during the Ebola virus.

Influence on consumption and services

According to Bloomberg, 20% of all tourist income falls on Chinese tourists. China is the 4th most popular place among travellers.

Museums, restaurants and festivals will get much less profit this year. Some American companies officially announced reduction of their yield.

Influence on the stock market

Stock markets all over the world significantly fell during the past week of February 2020. The S&P Index fell by approximately 15% during one week.

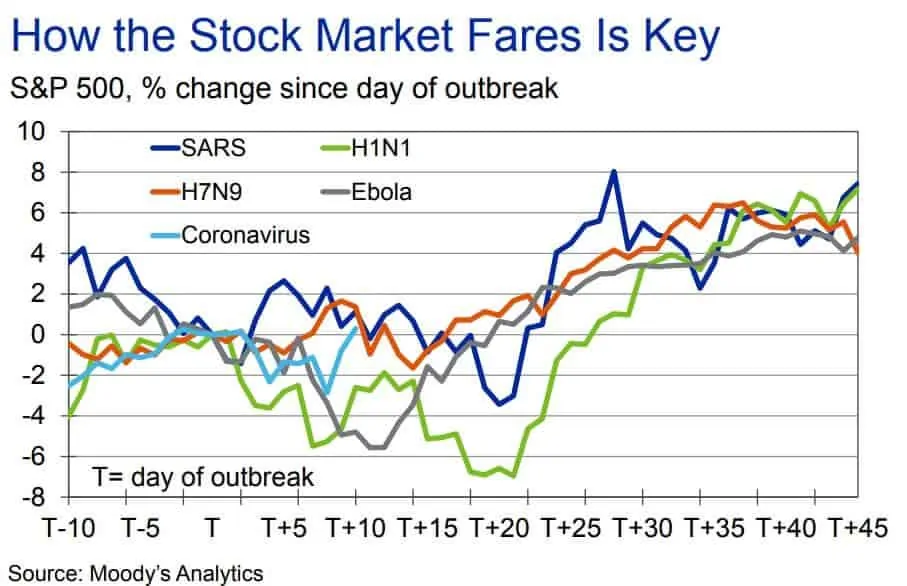

Moody’s developed the same chart for the index as they did for the oil. See Picture 4.

The biggest fall of the S&P 500 Index was during the swine flu, however, the index used to come back to its original value during 45 days after all major virus infections and even exceeded that value by 4-6%.

Not all stocks fell in the stock market. Stocks of the companies that deal with air transportation, oil production and processing, tourism, etc. significantly fell.

Stocks of the companies that deal with medical issues and gold production fell insignificantly and even grew.

For example, the picture below shows the PAO Polus stock chart to the right and PAO Aeroflot stock chart to the left. See Picture 5.

In order to reduce risks, an investor could hedge risks through buying futures contracts. Of course, futures contracts are available not for all companies, they are available mainly for blue chips. However, in the event of a strong positive correlation between stocks, one could use futures contracts of correlated securities.

The general scheme of hedging is simple – it is necessary to open an opposite trade in the futures contracts for the same amount as in stocks. In other words, if an investor bought 100 Sberbank shares, it is necessary to sell 1 Sberbank stock futures. Then, if the stock prices fall, the investor will get profit under futures contracts and vice versa.

It’s interesting that the Chinese FXCN exchange fund feels quite well. See Picture 6.

What Trump is doing

Due to the panic in the American markets, Trump held a press-conference where he said that the virus would not exert big influence on the US, because “the borders are closed and the situation is monitored”.

Twitter users posted this comic map after Trump’s press-conference. See Picture 7.

None of panic

The virus quickly spreads all over the world and elderly and very ill people are in the high risk group. However, there’s no reason for panic, since media forecasts (media always look for sensations) could be wrong. For example, Forbes wrote that the number of infected would be 180,000 by February 4, but, in fact, the number of infected was twice as less on February 26. See Picture 8.

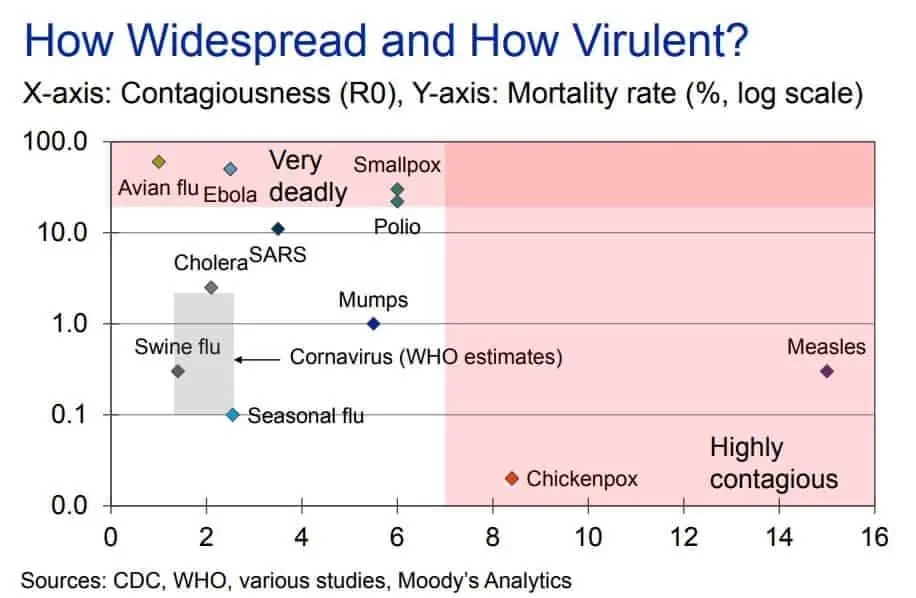

Moody’s published mortality and contagiousness statistics of the previous viruses (see the picture below).

The vertical axis is the mortality rate in ascending order and the horizontal axis is the contagiousness in ascending order. Coronavirus, at a rough estimate, is in the lower part compared to other unexpected viruses. See Picture 9.

Coronavirus and exchange trading

Volatility and volumes significantly increased in the market – it is a huge advantage for traders. However, the market is very sharp – much less volumes are traded at each price level that is why stops are more vulnerable.

At such times, one could make big money but also lose everything. Traders not only sell, but also buy the falling market.

The picture below is a filtered (of more than 25 contracts) Time & Sales of the Moscow Exchange Index futures as of the morning of February 28. See Picture 10.

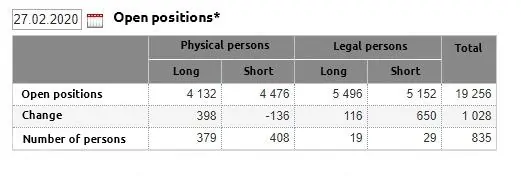

It is interesting that despite the investors’ panic, the number of Moscow Exchange index futures long positions didn’t fall. See Picture 11.

Summary

The coronavirus influence on the situation in the world is unquestionable. First of all, we wish you good health.

Possibilities to make money on price fluctuations, caused by emotional moods of the public, emerge regularly. Trade with profit and do not surrender to panic!