So, let’s see how to compile a stock portfolio correctly, what important things you should pay attention to and we will give you some practical examples of efficient stock portfolios in 2021 from the world leading investors.

How to form a stock portfolio: 4 important rules

Not every portfolio will bring real benefit to its owner if it was composed with mistakes. We prepared several useful rules for you, which will help to make investing more efficient.Rule 1. Buy only those companies which you understand

“Investing without research is like playing stud poker and never looking at the cards” – this is what a legendary investor Peter Lynch thinks. He is sure that if you cannot explain the stock purchase idea to a fifth-grade secondary school student, your investment is destined for failure.

A thorough study of stocks is the foundation of the portfolio approach. You need to identify prospects of the company business development, how fair its value is compared to competitors, whether it conducts a reasonable borrowing policy and whether it pays dividends.

When investors form a list, they are mainly based on fundamental analysis. The most popular methods are based on Benjamin Graham books The Intelligent Investor and Security Analysis. An investor Warren Buffett, whose personal capital reached USD 100 billion in 2021, applied them most successfully.

It is also useful to read the Beating the Street book by the above mentioned Lynch, where he explains methods of selecting high-grade companies, which he developed for decades of being in the investment business, in a simple and clear language.

Rule 2. Portfolio should be diversified

You can buy a big set of stocks but it will not be a portfolio. The main task of portfolio investment is to reduce risks of individual stocks and industries by means of diversification.

Diversification means that your portfolio is split between various companies from various industries. However, a portfolio should not be just split, it should take into account correlation. The less a correlation between individual stocks, the lower your risks and higher the chances to make money. This is what the founder of one of the most successful hedge funds of the world Ray Dalio says. There are several useful videos on the Internet, in which Ray Dalio explains everything in simple terms.

Nobody will tell you for sure how many stocks should be in your portfolio for good diversification. The general rule says that a beginner should select 10-20 very good and easy-to-understand companies rather than 40-50 of all in sight.

Rule 3. Not only stocks should be included in an investment portfolio

However good you are in selecting stocks, correlation between them should stay rather high. It happens quite often in the US stock market when up to 90% of all stocks are in a downtrend or uptrend simultaneously. In view of this, it makes sense to study capacities of other instruments, such as options, gold and bonds.

Rule 4. Take into account cash flows

You can have great ideas, but the stock market rules are dictated by the central bank policy and liquidity flows in the world. While huge volumes of money are printed in the world and interest rates are at the zero level, more risky positions in a portfolio could be justified. In the event of the plans to raise interest rates, the priority may switch to the real economy companies and banks with stable dividends and stable business models.

A simple stock portfolio alternative: a lifehack for a beginner

Of course, not every person is ready to go deep into financial analytics. Also, not every beginner has sufficient capital for composing a sound portfolio. But what to do if you still want to have a stock portfolio? Various ETF, which allow a significant simplification of the process and reduction of expenditures, will help you to do it.Warren Buffet also recommends unprofessional investors not to enter into details and invest in ETF. Not even all professional investors in the world manage to consistently outplay the wide S&P 500 stock index. There are a lot of cheap ETF in the US stock market.

- ETF significantly simplify the possibility to invest in indices. You can do it just clicking your mouse button several times.

- You can buy an ETF as easy as a regular stock. Nearly all major brokers provide access to it.

- There is a huge variety of industry-specific ETF. There are funds that invest in highly profitable start-ups, indices, raw material companies, precious metals, banks, bonds, etc.

- ETF provide a possibility to invest in leading dividend stocks.

- The market entry threshold goes down from USD 15-20 thousand to USD 2-5 thousand.

- Professional managers deal with ETF rebalancing.

- A nominal fee for management – usually 0.1%-1%.

As you can see, there are many advantages and they are rather strong. This allows calling an ETF a real present for beginners and the best alternative to an individual portfolio composition.

Stock portfolios of Warren Buffett and Ray Dalio in 2021

Copying stock portfolios of successful investors is yet another good variant for beginners. Stocks of many well-known investment companies are traded on the stock exchange that is why they publish composition of their portfolios in their financial reports on a quarterly basis.Copying the Berkshire Hathaway (a holding and investment company managed by Warren Buffett) portfolio is especially popular among investors.

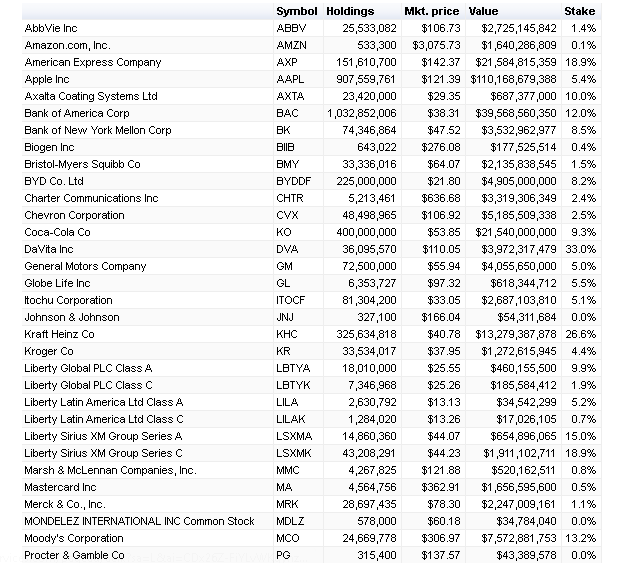

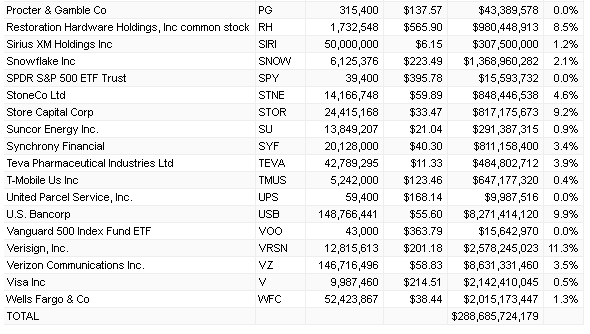

The Buffett portfolio consists of 42.2% of Apple stock (AAPL) in 2021. The portfolio also includes significant stakes of the Bank Of America (12.8%), Coca-Cola Co (7.3%) and American Express (7.3%). Companies from the production and financial industries take more than ⅔ of the portfolio.

You can also get acquainted with the complete list of the Buffett portfolio with specification of the Berkshire Hathaway stake in a company and market symbol (ticker). In total, it has 49 positions, including an S&P 500 index ETF.

It also makes sense to pay attention to the portfolio of the Bridgewater Associates hedge fund, headed by Ray Dalio. His portfolio contained 53 positions at the beginning of 2021, however, the biggest of them is an S&P 500 index ETF, stocks of developing markets and gold. It is not difficult to buy them. Also, Wal-Mart, Procter And Gamble and Alibaba Group take significant shares in the Dalio portfolio.

A could-be yield of a stock portfolio

A stock portfolio yield will depend on how good you were in composing it and on general market tendencies. However, there is no guarantee since investing is always risky, although, some guidances do exist.For example, let’s take the most popular case when you invested in an index ETF. The average annual yield of the S&P 500 index for the past decade was about 13.6% and about 10% for the past 50 years.

However, you should understand that this is an average value for several decades. It means that sometimes the stock market fell and sometimes the growth was above 30%.

Conclusion:

Composing a stock portfolio might seem too difficult for a beginner but only at first glimpse. The modern financial markets offer a big number of possibilities to significantly simplify the task. Purchase of regular index ETFs for any amount available or copying the biggest positions from portfolios of well-known investors will help you to solve the problem.In the event you believe that you are able to outperform leading indices and financial gurus, the field of study is huge. You will need both deep knowledge of the portfolio theory and practice and intuition of a manager for your professional development.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.