What you should know before investing in dividend stocks

What dividend stocks are and how to choose them correctly

For many investors, receiving dividends is the key incentive for buying stock. However, there are many nuances with respect to choosing such securities. For example, high dividend yield of stocks often means that investors are not sure about the company’s future, while the low one testifies to rather good prospects. So, read in our review how to find a balance between the yield and risks in order to compose a dividend portfolio.

What dividend stocks are

Dividend stocks are stocks of those companies, which regularly pay dividends. The dividend size depends on the company profit after taxes and is determined by the stockholders’ meeting. The payment frequency could be different – quarter, half a year and year.

Traditionally (but not necessarily), dividends are paid by big well-established companies, which already passed the development phase and can afford to spend a significant part of their profit not for the business development but for payments to stockholders. Good examples of dividend stocks in the United States are Coca-Cola (KO), Pfizer (PFE), JPMorgan Chase (JPM) and Exxon Mobil (XOM). These are companies with long histories and business models, which were formed long ago. They are also called dividend aristocrats.

On the contrary, relatively young companies from new and fastly growing economic sectors, such as Google (GOOG), Facebook (FB) and Amazon (AMZN), often do not pay dividends. They prefer to reinvest profits in development and purchase of new businesses. Usually, their financial indicators grow faster than average values in the market and investors receive income by means of the capitalization growth.

Those companies take the middle niche, which try to find a balance between the dividend payment and further development. Their dividend yield is not big and the rates of growth of financial indicators are still high. They include such technology giants as Apple (AAPL), Microsoft (MSFT) and QUALCOMM (QCOM).

Dividend yield of the US stocks

Dividend yield of stocks is always connected with the price and shows how much a company pays in percentage with respect to the real price. For example, if the stock price is USD 100 and the dividend size per one share is USD 5, the dividend yield would be 5%.

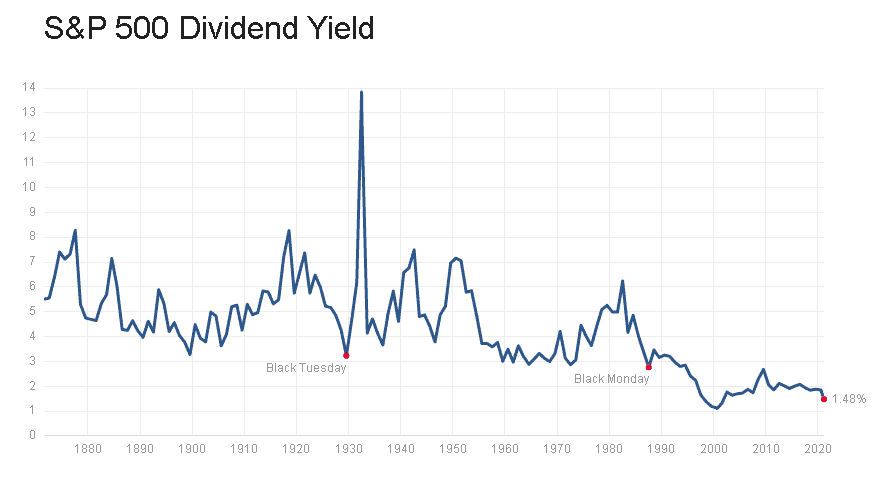

The historical average dividend yield of the US stocks, which are listed in the S&P 500 index, is about 4%. However, it has moved within 1.22%-2.2% during the recent two decades.

The average value includes both many companies, which do not pay dividends at all, and those companies, which dividend yield is significantly higher. The table below shows the dividend yield of some US blue chips, which we already mentioned above.

| Company | Current dividend yield |

| Coca Cola (KO) | 3.36% |

| Pfizer (PFE) | 4.54% |

| JPMorgan Chase (JPM) | 2.35% |

| Exxon Mobil (XOM) | 6.16% |

| Chevron (CVX) | 4.64% |

| Microsoft (MSFT) | 0.98% |

| Apple (AAPL) | 0.67% |

| QUALCOMM (QCOM) | 1.97% |

| Google (GOOG) | Doesn’t pay dividends |

| Amazon (AMZN) | Doesn’t pay dividends |

- all data as of March 4, 2021

You may notice that companies from the raw material economic sector (Exxon and Chevron) pay dividends of significantly higher value than average. It is a world trend since the raw material prices are rather unstable and the growth potential of such companies is limited. Consequently, high dividend yield of such stocks is largely explained by the low estimate of the company value.

The story about the technology sector is different. The potential of the business expansion of such corporations as Microsoft and Apple is still high, that is why the stock value is big and, consequently, dividends are small. Apart from dividends, investors expect the confident business growth from these companies.

Dividend stocks of Russia

Dividend yield of Russian stocks, on the average, is higher than American ones since the stock estimate is not high. To be fair, the similar tendency is observed not only in the Russian market but also in the majority of the world developing markets.

As estimated by the ATON investment group, the average dividend yield of Russian stocks, which are listed in the RTS index, was about 7% in 2020. About 20 liquid stocks can offer 8-12%. Besides, as it is in the US, many technology companies, such as YANDEX (YNDX) do not pay dividends at all.

According to ATON, it is expected in 2021 that 30 biggest dividend stocks of Russia would have a yield from 6% to 14%.

How to choose dividend stocks

The dividend stock choice depends on many factors. Before starting to analyse the market and buy stock, it makes sense to understand why you do it. It will mostly depend on your goal: what the structure of your portfolio, stock market and expected yield would be. Let’s consider several popular variants.

Long-term investments with the horizon from 5 years and more

In the event of long-term investments, it is reasonable to give precedence to companies with stable financial indicators and regular dividend payment. These could be companies from basic economic sectors, the demand on the produce of which is rather stable.

Examples of such companies in the US could be Pfizer (PFE), Coca-Cola (KA) and other financially stable companies from low volatility economic sectors. Even if a serious crisis will come, people will continue to buy medicines and food.

Middle-term income

If you want to find a profitable ‘parking place’ for your capital for the period of 1-5 years, you should take into account not only the company’s long-term stability, but also middle-term economic trends.

For example, a big dollar issue at zero interest rate is expected in the world in 2021-2022 and it would probably push raw material prices up along with the fast recovery of the global economy. Consequently, it would be a proper time to pay attention to companies from the raw material sector of the economy – production of oil, natural gas and various ores. Apart from the good dividend yield, there is also a potential to make money on the stock price growth.

However, dividend investment combined with a speculative approach is more risky. There is always a chance to make a wrong guess about a trend.

Short-term speculations – up to 1 year

Short-term speculations with dividend stocks make sense if you are an experienced player in the financial markets. However, such a tactic is unacceptable for a majority of investors.

Which market to select

Average yield of Russian dividend stocks is higher. However, you should understand that the majority of Russian companies directly or indirectly depend on raw material prices and this is a significant risk. The Russian economy is less predictable, that is why the rouble is a volatile currency. Many investors prefer a smaller but dollar yield, especially if we speak about long-term savings.

You should also take into account the difference in interest rates between the United States and Russia. Thus, the rate of the US Central Bank is 0-0.25% at the beginning of the year 2021, while it is 4.25% in Russia. Consequently, in the Russian market, investors can receive the rouble yield in the amount of 6-10% from alternative sources, such as corporate bonds and bank deposits. The dollar yield in debt instruments is, practically, absent with such a rate or such instruments are very risky.

The conclusion could be the following. Russian dividend stocks could be a good variant for playing on middle-term raw material trends. For long-term savings, it is better to focus on more stable stocks from the American market.

Risks of dividend stocks

Dividend company stocks are subject to classical market risks. A company may start to lose its market share or make wrong acquisitions, and then volatility of financial markets could lead to the stock value fall. However, on the average, indicators of classical dividend companies are less volatile and the chances that things would go wrong are lower than those of young competitors.

You can fight risks using traditional methods through diversification of your portfolio between companies from various industries. Moreover, dividend stocks usually are a part of a wider portfolio of assets, which also includes instruments with fixed yield, such as bonds and bank deposits.

How to buy dividend stocks

There are several variants of buying dividend stocks. Quite a lot depends on how deep you are ready to submerge into the topic. The most affordable variants for regular investors are purchase of stock personally through a broker or purchase of ETF.

Variant 1. Independent portfolio formation

It will suit more advanced investors who understand financial indicators of companies. In this case you need to:

- Open an account with a brokerage company.

- Conduct market analysis.

- Select a portfolio in accordance with your investment goals.

- Buy stock by yourself through a trading platform.

Dividends will be paid to your brokerage account. You can reinvest these funds (buy more stock) at any time or move them to your banking account.

The main pro of this variant is that you are free of formalism of funds and have more freedom in making decisions. Moreover, you do not have to pay a commission for management.

A con is that this variant doesn’t suit low-skilled investors. Besides, the entry threshold is higher here. You need at least USD 10-15 thousand to form a small dividend portfolio in the US market.

Variant 2. Purchase of dividend ETF

There are many ETF (Exchange Traded Funds) in the world markets, especially in the US market, which specialise in dividend stocks from various sectors. You can also buy their shares, opening a brokerage account with a company, which has access to the US market.

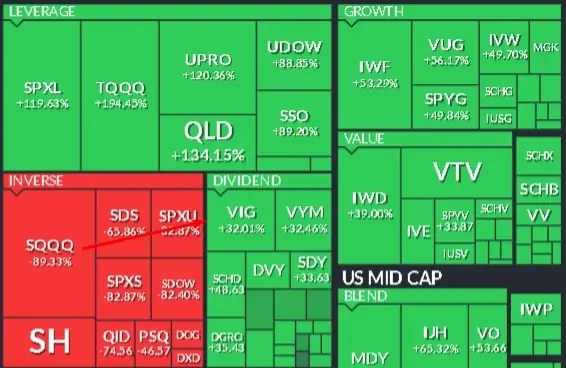

As you can see in the picture below, in a good year they can show, apart from dividends, a good yield due to the stock value growth.

ALT: The US dividend ETF (Source: Finviz)

An undoubtful pro of this variant is affordability for a wide range of investors. You do not need to conduct a deep assessment of financial indicators of companies and form and balance your portfolio. Professional managers from funds will do it for you. Moreover, you can buy an ETF share even for a small amount of money. The entry threshold may actually start from USD 1-2 thousand.

A con of such funds is their management commission. However, it is not big and is up to 1% a year.

Conclusion:

Purchase of dividend stocks could be a rather good variant in case of formation of long-term savings. Even if the market saw better years, you can rely on a constant source of income. Of course, dividend investing also has risks. Even the most stable companies may start to lose. However, having formed your portfolio or having invested in the ETF, you will be able to increase stability by means of diversification.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.