In this review article, we will briefly describe the basic concepts, a trader should know about bonds. Read in this article:

- what bonds are;

- what forms and types of bonds are;

- bond properties;

- pros and cons of bond trading.

What bonds are?

Bonds are debt securities. When an investor buys them, he lends money.

For example, the Sberbank bonds (code: SberB B12R) are issued for 3 years with the nominal yield of 7.60%. It means that an investor lends money to Sberbank for 3 years with the annual interest of 7.60%. Thus, bonds are a financial instrument with a fixed income, that is why an investor knows beforehand when the debt will be repaid and what would be his income.

By the trading volume, bonds are the biggest investment instrument in the world. They seem to be more complex than stocks due to a big number of forms and parameters.

Bond properties

There are three main bond properties:

- repayment – an investor counts upon return of the debt;

- maturity – an investor lends money to the bond issuer for a limited period. However, there are non-maturing bonds, but they are rather exceptions from the rules;

- payment of interest – an investor plans to receive interest payments for the loan.

All bonds have:

- Face value since we speak about a loan. The face value is specified in the bond programme and an investor receives it after the bond maturity. The face value changes in the process of trading depending on demand and supply. And then it is not the face value any more but the current value. Unlike the stocks, the current value is specified in percentage of the nominal value. For example, the face value of the Sberbank bonds SberB B12R is RUB 1,000. As of December 23, their current value was 102.76%, which means it was more than RUB 1,000.

- Coupon rate is a share of the face value, which the issuer pays as the interest.

- Maturity date is the date of the latest payment and repayment of the nominal value.

- Payment frequency is the order of payment under obligations.

- Currency is the currency of bond payments.

- Options availability shows whether there is a possibility to settle the bond before maturity. If the bonds are noncallable, neither the investor nor the issuer can settle them before maturity. The issuer can settle the callable bonds with the call option beforehand. The investor can settle callable bonds with the put option beforehand. The early repayment conditions are known from the very beginning since they are specified in the bond programme.

What forms and types of bonds are?

There are coupon and discount bonds.

Buying discount bonds, an investor makes money on the difference between the face value and buying value. He doesn’t receive any other payments. Buying coupon bonds, an investor receives regular payments – coupons. They could be fixed – in this event an investor knows beforehand when and how much money he would receive.

However, sometimes an issuer issues bonds for 10-20 years. The issuer cannot promise a certain yield for such a long period, that is why it fixes coupons for the first several years and later it could change them. The bond programme contains information on how exactly the issuer can change coupons. The issuer’s bond programme and financial reports can be found on its official web-site.

Depending on the issuers, bonds could be:

- state;

- municipal;

- corporate.

State bonds are issued by states. Such bonds are called OFZ or federal loan bonds in Russia and they are issued by the Ministry of Finance of the RF. You can find detailed information about all issues on the official web-site.

Such bonds are called Treasury bonds in the United States and they are issued by the US Department of the Treasury. Information about the bonds can be found on the special web-site, where you can also buy them. This web-site is managed by one of the divisions of the US Department of the Treasury.

The state bond yield is often considered by investors as the minimum risk-free yield of the financial instruments. It is connected with the fact that the state securities are secured by the state assets and its ability to print money.

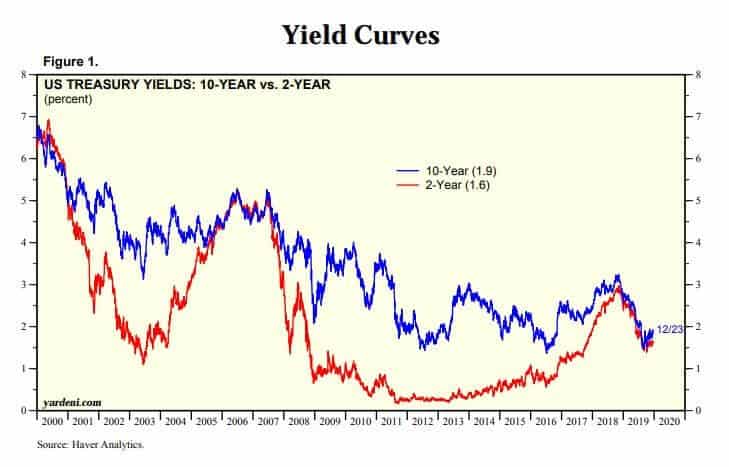

In the growing economy, the yield of long-term state bonds exceeds the yield of short-term bonds. When situation changes, investors start to feel nervous and expect crises or slowdown of the economy.

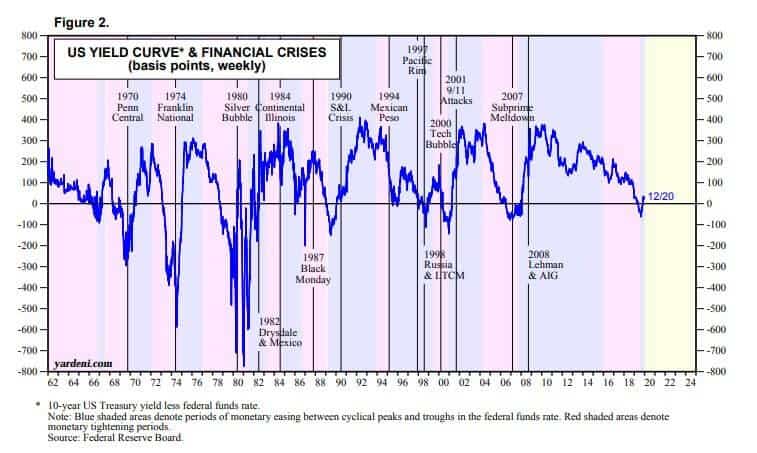

American analysts combined the weekly 10-year bond yield chart and the chart of financial crises.

Municipal bonds are issued by the cities and regions. Russia also has a sub-federal debt, issued by the RF subjects. The probability of bankruptcy of the issuers of such bonds is higher than that of the state but lower than that of corporations.

Corporate bonds are issued by private companies. Their yield, as a rule, is higher than that of the state or municipal bonds but risks are higher. Private companies go bankrupt more often than cities and states.

What eurobond is?

Eurobonds are issued when issuers diversify their debt denominating it in different currencies. Despite the name, eurobonds are not necessarily issued in EUR. They could be issued in any other than the national currency and are placed outside the home country.

Bond yield

The bond yield could be different because there are coupon payments and nominal bonds.

Current yield is a relation of the coupon yield to the market price. The current yield could be calculated for the coupon bonds only because the discount bonds do not have any current income except for a discount.

Yield to maturity could be received by an investor if he holds the bond until maturity and invests again all the received coupons. This yield is mostly theoretical since an investor might not reinvest coupons and not wait until the repayment.

Realized yield could be received if an investor sells the bond in the secondary market before its maturity. It is a real yield.

Estimate of the bond yield will take much time if done manually. That is why there are online calculators. For example on the Moscow Exchange web-site.

Interrelation of the yield and price

The bond yield and price are inversely related. If the price grows, the yield falls and vice versa.

This dependence could be explained from a mathematical standpoint.

When an issuer issues bonds, it fixes the face value and coupon yield in RUB. However, in respect of percentage, the coupon size could change with respect to the current price depending on economic situation.

For example:

- the bond’s face value is RUB 1,000;

- the coupon rate is RUB 100 or 10%.

Let’s assume that the current bond’s price increased up to 105% or RUB 1,050, but the coupon should stay at the level of RUB 100. In order to keep the RUB size of the coupon in relation to the new current bond price, it should be decreased in percentage terms down to 9.5%.

9.5% = RUB 100 / RUB 1,050 * 100%

The same inverse relation exists between the bond yield and interest rates in the economy. If the key rate reduces, the money become cheaper in the country. The deposit rates decrease and investors start to look for a more interesting yield in the stock market. The inflow of money on the exchange increases demand and stock prices.

When the rates decrease, the stock prices increase. In such times it is profitable to buy long-term bonds. If it is difficult to forecast the change of the base rate, it makes sense to pay more attention to the issuer’s reliability.

What bonds to invest in?

There are corporate bonds with 15% annual yield on the Moscow Exchange as of December 2019. However, such a yield is connected with a high level of risk for an investor. Thus, the most profitable bonds simultaneously bring the highest risk for an investor. The portfolio diversification will help to minimize risks.

Bond risks

An investor needs to assess risks of bonds as financial instruments in order not to lose money.

We can specify two main risk types:

- the market risk is a risk type, which is connected with the bond price change due to the change of the economic situation in the market;

- the issuer’s risk of default. A default takes place when the issuer cannot pay the bond coupon liabilities.

You can insure against these risks only if you thoroughly select bonds.

How to buy bonds profitably?

Use progressive software, such as ATAS, for analyzing the bond markets.

ATAS has futures on Russian OFZ and American and European bonds. You can choose the most profitable moment for their buying or selling with the help of the cluster analysis and individually tailored technical indicators.

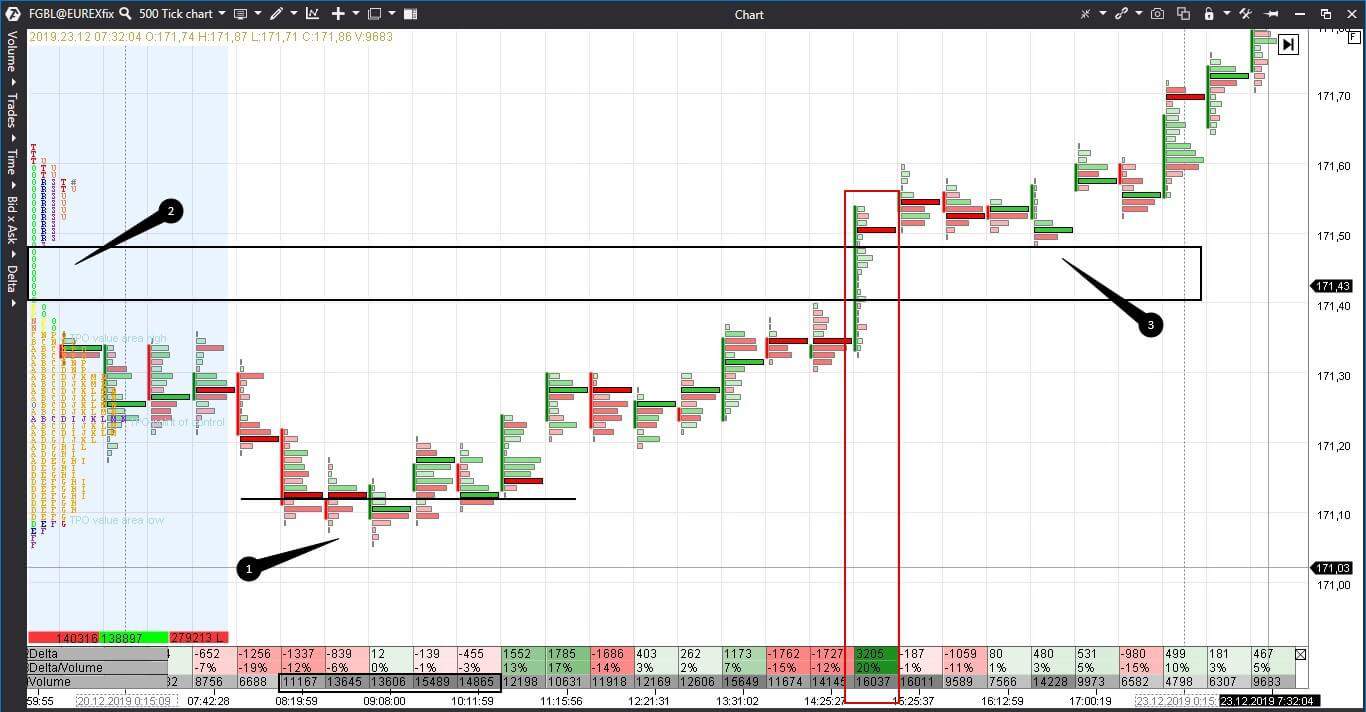

Let’s consider one example in the 500-tick Euro Bund futures (FGBL) chart.

We added the Cluster Statistics indicator and the fixed TPO/Market Profile to the chart. Most probably, there was an absorption in the area of point 1:

- small-sized bars;

- the volume increases but despite the fact …

- … the price doesn’t fall.

We marked the coinciding levels of the maximum volumes of several bars with a black line – a local support level was formed here. Long positions with a stop behind the day’s low could be opened from here.

We marked the single print in the profile with number 2 – the price jumped here. Single prints often serve as the support/resistance levels because the traders, who failed to enter into a trade, will try to do it if the price comes back to this level.

This is what happens in point 3, which is a good place for opening a new long position or for increasing the existing one.

Summary

If a trader understands the situation, this brings confidence to him and increases the number of profitable trades.

Bond trading brings the same risk as the other trading types do. Make sure you have a competitive advantage and your trading strategy has a positive expectation before you start trading bonds.