7 IMPORTANT THINGS ABOUT COFFEE FUTURES

According to the International Coffee Organization (ICO), coffee futures in the developing countries are the second most popular (after crude oil) traded commodity, which plays the role of the source of the foreign currency supply.

Speaking about the history of coffee, we should say that, according to the existing data, the first coffee shop was opened in 1457 in Constantinople (the territory of modern Turkey). The coffee market was overregulated in the system of the world trading until 1989 by a number of international trading agreements directed mainly at the management of demand and supply and maintenance of stable prices. In the course of time, these agreements between the countries were completely canceled and the coffee prices started to be set by the free market since 1990. The prices of coffee lost more than 75% of its value during the next 5 years in the result of such changes falling down to USD 0.77 per pound by 1995, while in 1989, at the height of its value, they paid USD 1.34 for one pound of coffee.

Coffee futures fall into the category of soft primary commodities, which contains all types of primary commodities, except for mineral products, metals and oil, and their prices are subject to significant fluctuations. Based on the tick size of these futures contracts, traders need to be very careful with their trading. In this article, we will describe seven main things you should know before starting to trade coffee futures.

In this article:

- Types of the coffee futures.

- Specifications of the coffee futures contract.

- Tendencies in the coffee production.

- Seasonality of the coffee production.

- Influence of weather on the coffee futures.

- Economic reports that influence the coffee futures.

Sentiment indicators (Commitments Of Traders or COT reports).

Types of the coffee futures

If you decide to trade coffee futures, it is important to know that only 2 out of 60 types of coffee trees are grown on industrial scale. These are Robusta and Arabica. Coffee futures are traded on different exchanges. For example, mainly Robusta is traded on the Singapore Commodity Exchange (SICOM) and Arabica is traded on the Brazil’s Commodity and Futures Exchange (BM&F), while both are traded on the Tokyo Grain Exchange (TGE).

Coffee futures are traded in the US on the Intercontinental Exchange (ICE), which earlier was called the New York Board of Trade (NYBOT).

As well as in the case with the brands of crude oil, which is divided into heavy oil and light oil (known as ‘sweet light oil’), coffee is classified by brands on the basis of the grain characteristics. Arabica grains have a rich taste with bright acidity, while Robusta grains are more harsh and regular to the taste with pronounced bitterness. However, Robusta has twice as much caffeine as Arabica does.

Arabica is mainly produced in the subtropical climate and requires fertile soil, shadow and sunlight. It is a fact that more than 70% of coffee in the world is Arabica. This brand is most vulnerable to agricultural pests and cold weather and is grown at the heights from 600 to 2,000 meters. As a rule, it is sold in specialized coffee shops and supermarkets.

Specifications of the coffee futures contract

As of today, the coffee futures of the Intercontinental Exchange (ICE) are the most popular among the market participants. The price of this futures contract is set in Cents for one pound of coffee with a minimum price change (tick) of 0.05 US Cents for 1 pound (0.4536 kg), which is USD 18.75 for 1 contract. The margin requirements of ICE for this type of contract may change and are USD 2,970 as a guarantee collateral for a futures contract and USD 2,700 as a minimum balance on the trading account. In general, there are five contract months: March (H), May (K), July (N), September (U) and December (Z). Take heed of the limited trading hours, since this commodity is not traded 24 hours a day.

The table below shows the specifications of the base international contract on Arabica delivered from 19 different countries.

| Contract name | Coffee C Futures |

| Ticker | KC |

| Coffee brand | Arabica |

| Trading period | Monday – Friday: London 09:15 – 18:30 New York 04:15 – 13:30 Singapore 16:15 – 01:30 It is the local time for each city. |

| Minimum price step | 37,500 pounds (approximately 250 sacks) |

| Step price | USD 18.75 |

| Contract months | They are quoted during five months starting from March: (March (H), May (K), July (N), September (U) and December (Z)). |

The coffee futures price change for USD 0.01 is equivalent to USD 375.

Robusta coffee futures (ticker: RC), also known as No. 409, are traded on the Euronext exchange. The price of this futures contract is set in USD for a metric tonne of coffee and its size is 10 tonnes. Robusta is traded the most efficiently on the London International Financial Futures and Options Exchange (LIFFE), a subdivision of NYSE, where the coffee futures contract price is set in GBP. The price of other coffee grains, traded on the Tokyo Grain Exchange (TGE), is set in JPY, however, the volumes of sales in the Japanese market are of small account.

Tendencies in the coffee production

Production of coffee and its cycles are very different from those of traditional grain cultures. For example, it often happens that there is a big coffee crop one year and a smaller crop the next year. However, the coffee production steadily grew in the course of years with episodical falls from time to time. The highest level of the coffee production was registered during 2012-2013 at the level of 145.1 million sacks.

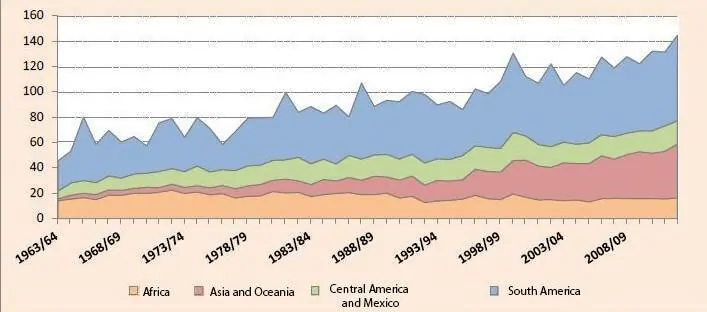

Tendencies in the coffee production (1963-64 – 2012-13). (Source: ICO.org)

Coffee is mainly produced in Africa, Asia and Central America.

Although the coffee production was started in Africa, the published data of the International Coffee Organization tell us that this continent demonstrates a stable decrease of its production during the past 50 years. According to the data available, the African share in the coffee production fell during this period from 25% to approximately 14%. As of 2012-2013, the coffee production in Africa was 16.7 million sacks.

Coffee production in such African states as Kenya and Cameroon (and others but with the exception of Ethiopia) is in stable decline.

Coffee production constantly grows in Asia due to the actions of Vietnam, which consistently increases its market share. Vietnam is followed by India and Indonesia.

Costa Rica, Brazil and Mexico are among the largest coffee producers in Central and South America.

Seasonality of the coffee production

More than 90% of all trades on coffee are executed on green or unroasted grains. Seasonal factor plays an important role in the coffee production and influences its futures prices. While there are no peaks in the coffee production during any period of the year, its consumption falls by 12% in an average during summer. On the other hand, the coffee grain import is reduced during spring and summer months while the demand on them increases during the fall and is consistently high in winter.

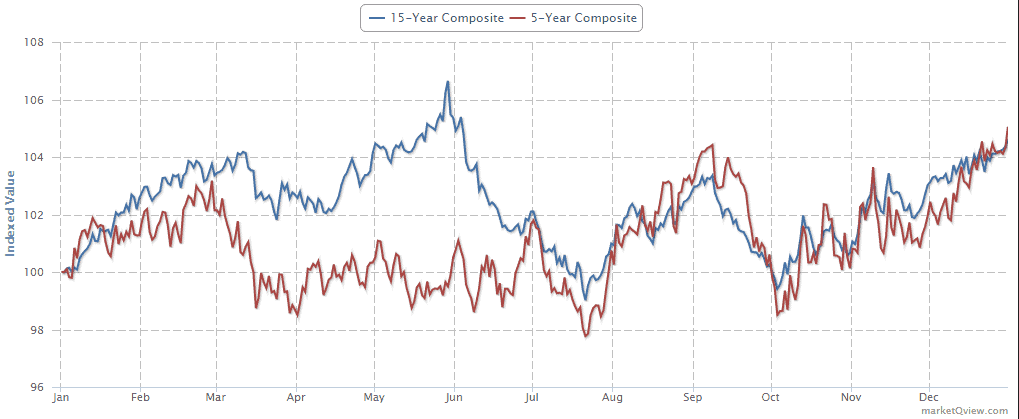

The chart above demonstrates 15-year and 5-year overall review of seasonal coffee tendencies. On the basis of the above mentioned demand and supply, the coffee prices usually grow from August until September inclusive, forming the bottom during October before they start to grow consistently. Usually, the coffee prices are of the bullish nature and form the peak during June and July, mainly due to the weather influence on the crop in Brazil and winter months in the Southern Hemisphere. The harvesting of the Brazilian coffee starts in May and lasts for several weeks.

Low coffee prices usually create problems for the coffee producers. When prices fall below the production costs, the economic incentives of its production vanish. The coffee production suspends during such periods due to high overhead expenditures. This results in the situation when coffee trees bring less grains since less labour is used for their treatment and also due to a lesser use of fertilizers, which, in its turn, influences the quality of the produced coffee.

This influences the Arabica coffee grains, which grow at big heights and, due to this, the whole cycle of their growth and treatment is much more expensive.

Influence of weather on the coffee futures

The largest Arabica coffee grain producer is located in a small Brazilian state of Minas Gerais. It produces 25-30 million sacks of coffee every year. The coffee volumes, produced in the state of Minas Gerais, are bigger than in some other countries such as Columbia or Indonesia. The weather in this region could often inflict significant damage on the coffee industry and significantly influence the farmers’ decisions with respect to the coffee growing. They say that local farming enterprises tend to keep the dried and treated grains in storehouses and sell them only when the market situation is favourable for them.

As a rule, Brazil has cold winters in an average once in 5 years and it may seriously damage the coffee production process. It is very important for intraday traders who trade in the coffee market to track weather reports and forecasts in order to be ready for any news, which could increase the volatility of the coffee futures prices. Coffee prices were extremely volatile during the whole history of coffee production. It depends on breaks in supplies, connected, for example, with freezing weather in high mountain regions and emergence of new exporters in the market, who managed to take a certain share due to low prices as it was with Vietnam at the end of the 1990s – beginning of the 2000s. The intraday volatility of the Coffee C futures contracts (ticker: KC) is also high, which made this contract popular among intraday traders in the course of time.

Economic reports that influence the coffee futures

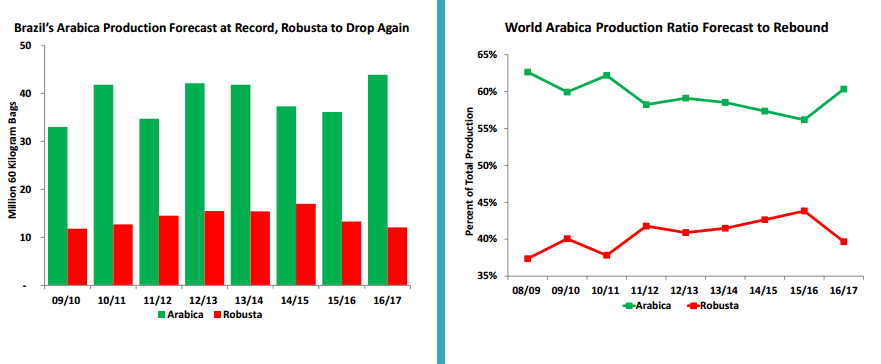

There are many reports, published by various independent organizations. They track the demand and supply and develop forecasts for this type of commodity. The US Department of Agriculture (USDA) regularly publishes special reports on coffee, which may be of important economic character and influence the coffee futures prices in the short-term perspective.

The coffee market report is published by the US Department of Agriculture twice a year

The US Department of Agriculture report on world markets and trading covers Arabica and Robusta coffee trading and provides an assessment of its production and supply volume. It includes information on exports and production of coffee in such key countries as Brazil, Vietnam, Central America, Mexico and India.

The coffee market report also provides analytical information on the future demand and supply and gives a general assessment of the coffee production, export volumes and its final reserves. This report is published twice a year in June and December and may exert a big influence on the coffee prices in the short-term perspective.

You can get acquainted with the reports of the US Department of Agriculture here.

Sentiment indicators (commitments of traders or cot reports)

While the semi-annual report of the US Department of Agriculture gives an idea of middle-term and long-term trends of the coffee production, the Commitments Of Traders (COT) report provides information about the short-term volatility, which the intraday traders could use for making profit. Thus, the short-term speculators could use, during the periods between the semi-annual reports, the weekly COT report, which is published every Friday by the Commodity Futures Trading Commission (CFTC). It presents values of the Open Interest of major players and producers in the coffee futures market as of the closure of the Tuesday of the same week (that is the data are published with a 3-day delay), but, nevertheless, it allows to analyze the market significantly deeper.

Traders could either follow the Open Interest of the speculative capital every week or wait until the market is overbought/oversold in order to take the opposite position in it.

So, the coffee futures could become an interesting supplement for futures traders. However, intraday traders should be extremely careful due to a high volatility of this trading instrument. Before you start trading, it is necessary to conduct extensive work on studying this market in order to understand whether there are any key short-term trends in the market. Attention to the coffee market seasonality also helps traders to stay on the correct side of the market.