Have you ever imagined that investing and trading on the exchange would be as easy as, for example, to buy clothes or shoes and that transfer of a successful trading profit to a plastic card would take a couple of minutes?

The online trading world became easily available to anyone with a computer and Internet access due to development of financial markets and trading technologies. You can assume that a typical exchange trader lives and works in New York, London or Hong Kong, but it is not so. According to brokernotes.co data for the year of 2018, 95% of online traders trade far away from the major financial centers.

Online trading on the exchange is an attractive but extremely risky business. By the way, you will see an interesting chart below. It will show a specific example of how ordinary traders lose their deposits.

This article is devoted to pros and cons of online trading. It consists of two parts and you will learn from it:

- why a trader vitally needs to have such skills as speed of thinking, learning ability, computer skills, consistency, discipline and intuition;

- what deposit you need to open your first exchange trade;

- what unique market analysis means allow looking “inside” the exchange chart and see real events that take place there;

- how major players manipulate the crowd opinion;

- how to organize online trading in order to increase chances of making profit.

What you need to know before starting online trading

“90-95% of exchange traders lose money” is a standard statistics of failures of beginners in the financial markets. They say that this statistics is based on brokerage reports. If we look for more information on the subject, we will find interesting facts which confirm high probability of failure of those who make their first steps on the exchange.

Thus, according to the research of Terrance Odean from the University of California:

- losses of traders are 2% of GDP in Thailand;

- 60% of beginners continue to trade after the first month, 13% after three years and 7% after 5 years;

- an average investor loses 1.5% to the market index a year.

You can find more confirmations that an exchange beginner usually fails. The share of failed beginners would have been less if all beginners would have possessed the qualities required for online trading.

5 trader skills

If you decided to try your luck in this business, you would need the following skills:

- speed of thinking;

- thirst for new information;

- computer skills;

- systematic approach for market analysis;

- discipline and intuition.

Let us consider each of them in detail:

Speed of thinking. Specifications of traded instruments, brokerage tariffs, statistics publication date, futures expiration, software settings, psychology skills, price and volume patterns and values of important levels of support and resistance – a trader needs to keep a lot of constant information for exchange trading. Besides, the chart shows even more variable information – price quotes, trading volume splashes and indicator signals – every minute.

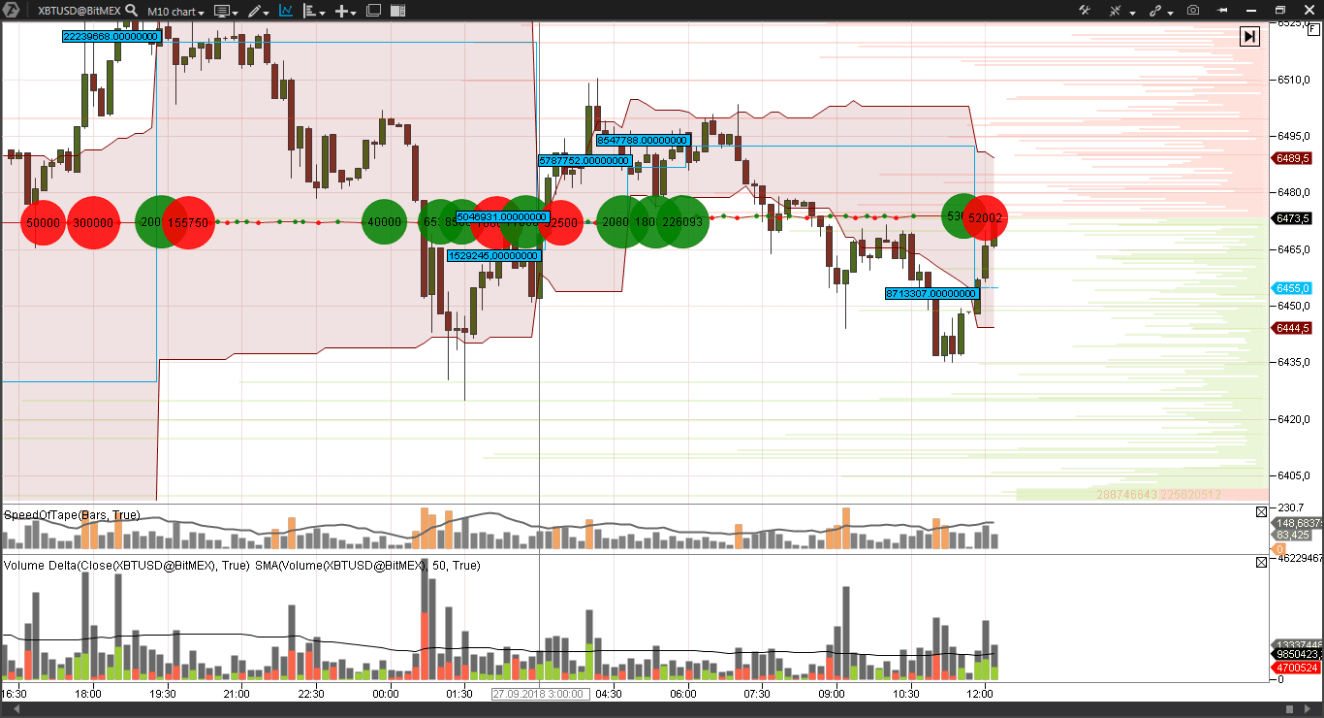

10-minute chart of the BitMex cryptocurrency exchange with the Speed of Tape, Order Flow, Dynamic Levels, Volume Delta indicators) allows:

- not only adapting to the changing market situation, but also …;

- filtering out from this avalanche those data only, which are of real value and which provide a background for making entry/exit decisions.

A former military pilot, who is a successful trader today, Lance Beggs says that decision making in the quickly changing market resembles piloting a fighter at jet speeds.

Thirst for new information. There are 14 million traders in the world. A trader needs to upgrade his skills constantly in order to be among successful traders under conditions of a constantly growing competition.

Leadership and learning are indispensable to each other. John Kennedy

So, what is a trader on the exchange? Let us assume that an average John read in a popular book that trades could be long or short and also got some understanding of the MACD indicator and head and shoulders pattern of the technical analysis. He thinks it’s sufficient. Why should this knowledge be sufficient for successful trading?

Look through our blog before your first test of online trading. You can find there practical topics, which are only slightly touched in popular trading textbooks:

- order book analysis;

- order flow analysis (watch in-depth video below);

- buy and sell volume splash analysis;

- tricks of market professionals.

Computer skills. Business Insider forecasts that the size of assets, managed by robot advisers, would increase up to USD 8.1 trillion in 2020. The rate of growth of the robot share on the exchange is more than 10 times during 4 years. More and more ‘alive’ traders use special software in their work. Thus, dynamics of technological and technical requirements to a success in the market is directed upwards only. A trader needs to follow this trend and have own ‘digital aces’ in order to survive in exchange battles of the 21st century.

The ATAS platform is one of such aces, which has high speed algorithms of the order flow analysis, flexible filters, alerts and settings for convenience and market analysis. ATAS will turn your computer into a universal electronic warrior who will fight for your profit.

In order to install the platform on your computer, download the setup file from https://atas.net/atas-download/, launch it and follow instructions of the setup wizard. It will not take more than 3 minutes. Check your email box after installation. There should be a message with login and password for access to ATAS.

Systematic approach. Money to spare needs good care. To account profit and loss, commissions and probabilities – all these are necessary for building, testing and optimising your own trading system.

If a trader has a system, it means that he:

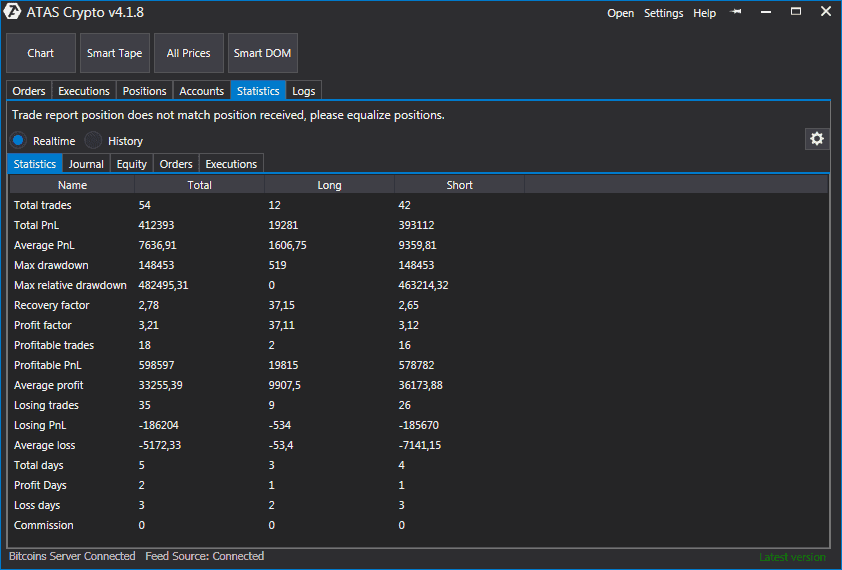

- tracked his position entry/exit points on the history, and each point has certain justification confirmed by statistics (the picture below shows how the ATAS platform built-in statistics module looks like);

- assessed a negative scenario and prepared methods of limiting losses for all occasions.

Namely the systematic approach allows focusing on important market data, controlling emotional component and expecting to succeed on a long-term run.

An exchange trader, who trades according to a system, will always be a step ahead of a trader, who does not have a trading system.

Discipline and intuition. What is a difference between a beginner trader and exchange professional from the point of view of self-control?

Inexperienced trader is often led by emotions. He jumps into trades like into a departing train in fair of not receiving profit. There is a special term for such market participants in trading forums – FOMO-traders (Fear Of Missing Out). As a rule, FOMO-traders make losses.

A professional player has complete understanding of such human drawbacks as fear and hunger for profit. He not only controls them inside himself but can ‘read’ emotions of players from the chart and use it in his own favour.

The stock market is designed to transfer money from the active to the patient. Warren Buffett.

It is important to be patient in trading and not to worry when you are out of the market. Remember that it is impossible to make loss when you are out of the market and an untimely trade increases the risk of making a loss.

However, sometimes, being out of the market, an exchange trader starts to feel an unexplainable urge to enter the market. His intuition tells him to do it.

Experience of the greatest speculator Jesse Livermore is well-known, when his inner voice told him to open a short position on the stock of railroad companies shortly before a ruinous earthquake. As they say, Warren Buffett imaginatively swallows files with investment proposals to feel how they are digested. Good digestion means profit. Indigestion means that it is not worth investing.

Natural intuition helps a person to make fast decisions in critical situations, and critical situations are quite frequent in trading. A trader can, all of a sudden, start worrying about an open profitable trade, feeling that the market will reverse soon.

Register and analyze your experience connected with intuition and remember your inner feelings. If the results of your intuition are positive, we recommend you to listen to your inner voice.

Can a beginner trader control risks?

- The first trader’s rule is to avoid losses;

- The second trader’s rule is to follow the first rule.

Exchange trading is very similar to gambling. To enter a long is to put on black. To enter a short is to put on red.

Beginner traders are inclined to gamble due to absence of experience. Having experienced disappointment from a stop loss activation, they do not want to experience that feeling again. “No stop loss – no loss”. Such an ignoring of risk control is a direct way to completion of the just started trader’s career.

In fact, risk control is reduced to two actions:

- limitation of possible losses through posting stop loss orders;

- or a set of hedging positions.

However, risk hedging is a domain of experienced traders that manage big portfolios. A beginner should just decide what amount he is ready to lose in case of a failure. Usually, the threshold of acceptable loss does not exceed 3% of the deposit amount.

In order to improve accuracy of posting a stop loss order, it is useful to have a platform, which would tell you:

- where a major player was noticed;

- where stop orders of minor traders are;

- where maximum volume levels are.

Also, it will automatically post stop loss immediately after opening a trade. The module of Protective Strategies in the Chart Trader will help you in this.

You should admit that it is rather stupid to post stop loss at the level with the main body of minor traders. It is more efficient to hide stop loss behind the levels, which do not attract hunters for your deposit. Another practice is to post a stop behind the level, which will be protected by a major trader.

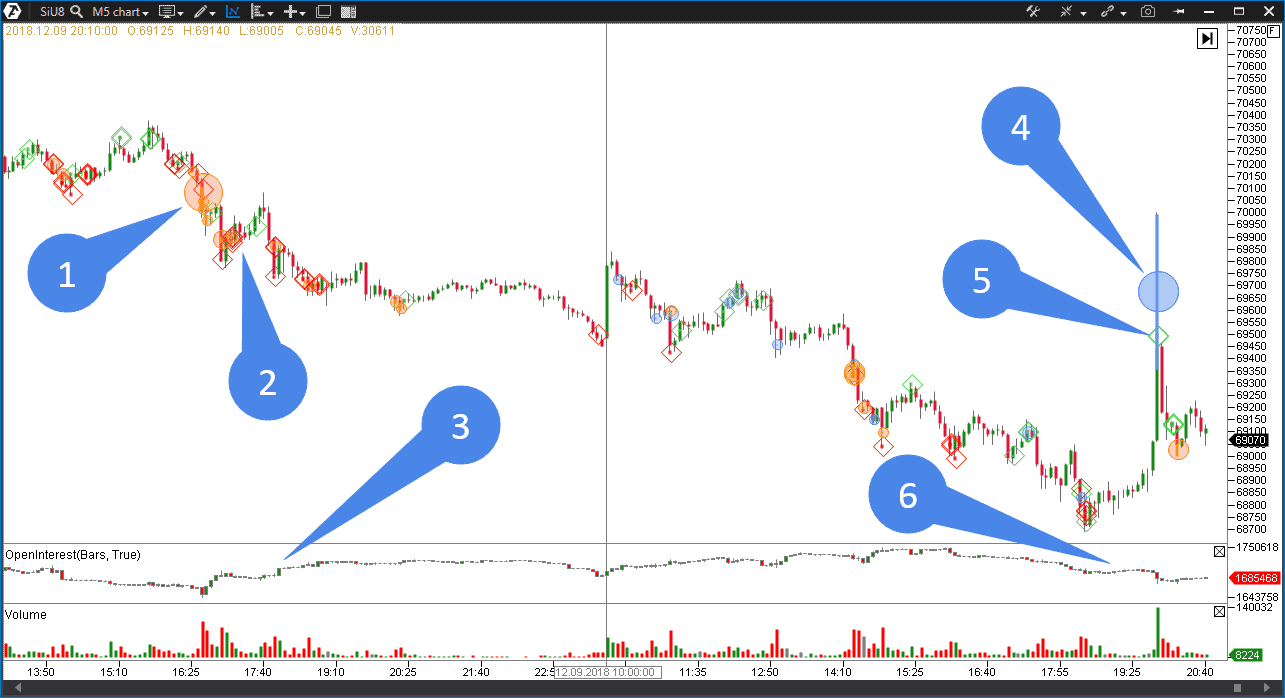

The following example clearly shows a situation where a very strong trader deliberately pushes the price to the area of accumulation of stop loss depriving smaller participants of the opportunity to make money on the descending trend.

We registered an initiative major selling trade, which broke the support level and sent the price down, in the chart in point 1.

A big number of minor selling trades is observed in point 2, which is shown by the Cluster Search indicator, being visualized in the chart in the form of rhombs. The Open Interest indicator shows us increase of the open interest in point 3, which could have been a result of entering of sellers into the market at the breakout of an important support level.

However, a major buying trade was registered the next day in point 4, which pushed the price into the price area of 69,900. Namely there we registered a set of short positions the previous day.

ATAS registered a big number of trades in point 5 and reduction of open interest in point 6. However, a major trade in point 1 was never tested. Namely point 1 would have kept your stop loss untouched and a protective order should have been posted behind it in this situation.

It is obvious that such an experience would help you to post stops based on a real-life situation. Thanks to ATAS, trading is not gambling any more.

Read in the second part of the article:

- Destruction of the myth. What deposit size you need to open your first trade on the exchange;

- Chart analysis with the help of Footprint;

- Dangers of advice at traders’ forums;

- How to use a trader’s diary to increase own efficiency.