The advantages and disadvantages of online trading. Part 2.

We learnt in the first part of the article:

- why the following skills are vitally important for a trader: speed of thinking, learning ability, computer skills, consistency, discipline and intuition;

- what unique market analysis means allow looking “inside” the exchange chart and see real events that take place there;

- how major players manipulate the crowd opinion;

- how to organize online trading in order to increase chances of making profit.

Where to find money for online trading on the exchange

There is an opinion that trading is for wealthy people only. And an average person would need to pawn a flat or car in order to start trading on the exchange. Let us see whether it is so.

So, in order to trade on the exchange you will need a minimum amount of money equal to the guarantee collateral (GC). Put this amount on your trading account and your broker will open you access to trading operations. Guarantee collateral is set by the exchange for each financial instrument and can differ depending on the asset value or popularity. For example, at the time of writing this article, you need to have RUB 16,725.48 on your account for one RTS index futures contract and the cost of one EUR/USD futures contract is USD 2,300 according to the Chicago Mercantile Exchange. These amounts might seem too big to put them at risk for someone, but no need to despair – there are cheaper financial assets. For example, one PAO Sberbank common stock futures contract is assessed by the exchange in the amount of RUB 2,993, while its volatility is not less than that of the instruments with bigger GC. A beginner trader needs to have RUB 14,965 for trading 5 PAO Sberbank common stock futures contracts without regard for the brokerage and exchange commissions. Volatility of this instrument is, in an average, 500-700 points a day.

Thus, the myth about a huge amount of money, which is required to start trading on the exchange, stays a myth. In fact, in order to start online trading you will need an amount, which is not more than a half of an average monthly salary.

Still, what to do if your pockets are empty? You can get a small startup capital borrowing money from your friends or getting a small loan. However, this is a dangerous way. We recommend you to trade on borrowed funds only if you have a clear strategy and positive results of applying it for, at least, half a year.

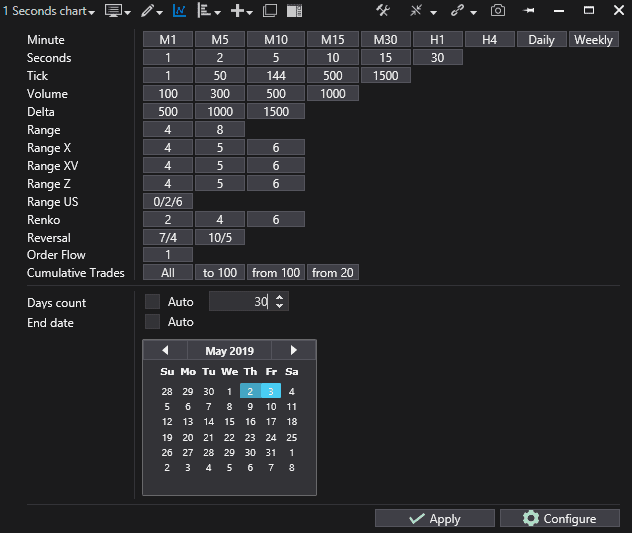

Trading platform. Review of instruments for a successful trader

Are you a beginner trader and want to get trading advantage over other traders? Do you have some online trading experience but want to move further in understanding the market?

Try ATAS – a platform for trading and market data analysis. One of the main advantages you get when using the platform is a possibility of footprint analysis.

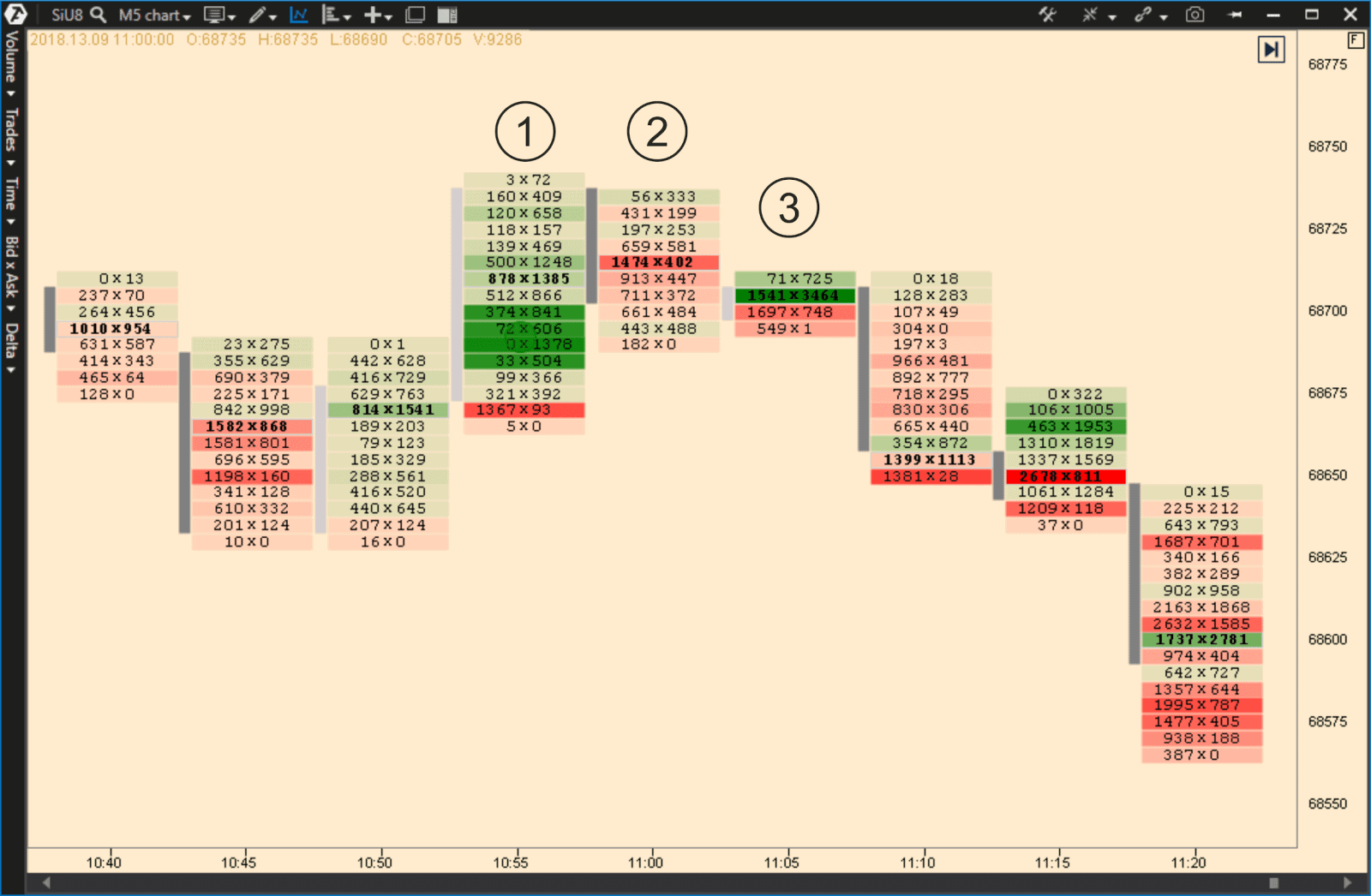

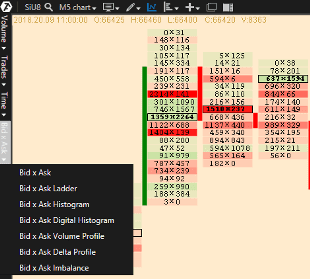

The term footprint consists of two words – foot and print – which means a trace or mark. These traces conveniently show details of the executed trades in the chart:

- at what time exactly they are executed;

- by bid or ask;

- buy or sell volume;

- delta change.

Footprint helps you to find answers to the questions: who took the initiative, what it lead to and, most important, how to trade in harmony with the market?

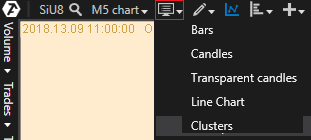

If you used to analyze a chart in the form of Japanese candles, you can compress footprint clusters into the candle format or expand candles to see each candle’s structure with one mouse move. It is very useful, because further moves secretly originate namely in candles.

Footprint makes it possible to detect an initiative trader or group of traders and gives understanding of initiative directed at the price movement or holding and also a possible stop of the price and beginning of its reversal.

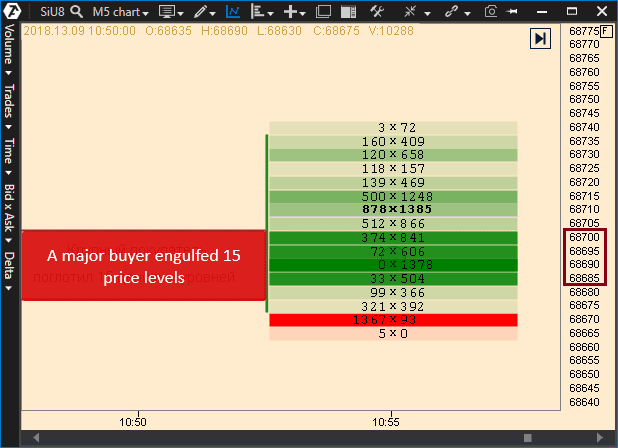

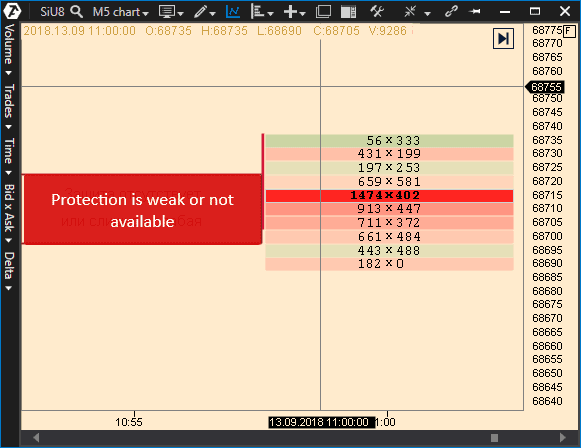

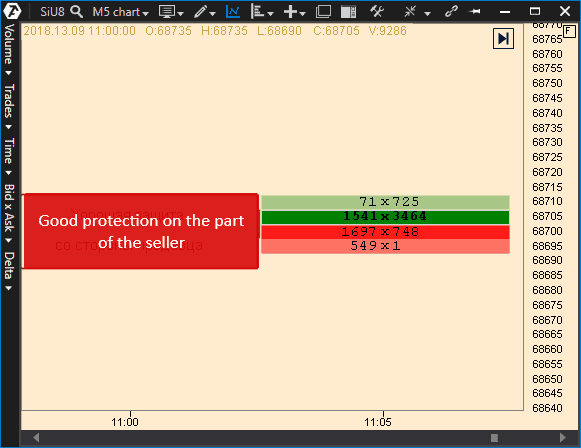

How does it look like? Let us consider it in the chart below.

Cluster Chart is another name of Footprint. This example uses a Moscow Exchange futures contract (SiU8) chart. In order to set your chart as it is above, you will just need to make three mouse clicks in the ATAS platform.