The computer era opened the world of trading for regular citizens, having changed the approach to investing all over the world. Each stage of trading from the sequence of posting orders to the method of their submission to the broker and then to exchange as well as methods of their further execution – all depends now on modern computer technologies.

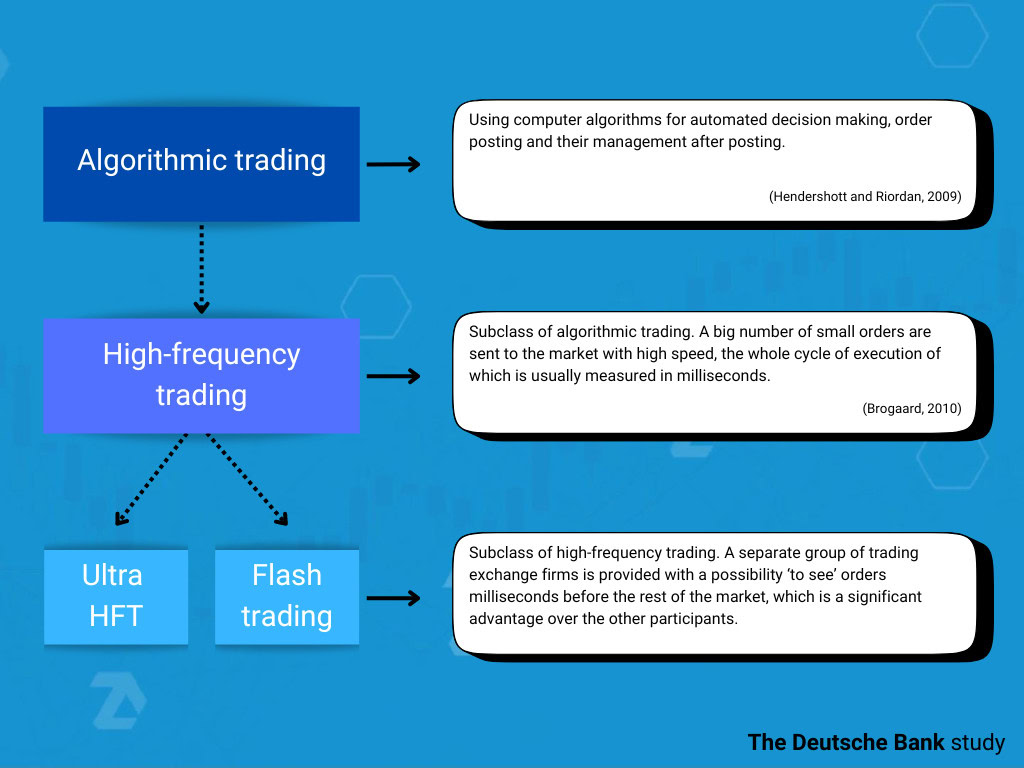

Algorithmic trading has become one of the most discussed breakout technologies in recent years. Nevertheless, it is not something new in the financial world and has existed for several decades already. Algo-trading has been known under such names as Automatic/Algorithmic Trading Systems (ATS) or trading robots (black box trading). It is a process of using computer software for buying or selling an asset in accordance with certain rules.

In this article:

- What is algorithmic trading?

- Introduction into high-frequency trading.

- High-frequency trading (HFT) and its influence on the market.

What is algorithmic trading?

Algorithmic trading, as the name implies, is a program code, which carries out trading in the market in the automatic mode. Treat algorithmic trading as a set of logical rules, a software program should follow.Automatic trading originates from mechanical trading systems. It is easier to write the code of a mechanical trading system than a discrete one, since it has an integral and self-sufficient set of rules and doesn’t have a subjective estimate of the market situation, which is inherent in discrete systems.

There are the following types of algorithmic trading systems (ATS):

- Momentum: ATSs, which are based on momentum, focus on trend assets, which move on high volumes, primarily in one direction. ATSs on the basis of this method consider entries into trades in the direction of a stable trend, holding a position for several hours or days before it is closed with a profit;

- Mean Reversion: this ATS type is built on the concept, which assumes a regular reversion of the price to some average value. The main task of such systems is identification of the expected level of the price reversion. Usually, an average value in the price series is achieved in the interval from 50 to 200 bars (or candles). Such ATSs show the best results during the periods of consolidation, when there is no explicitly identified one-direction trend in the market;

- Valuation: some advanced ATSs track the stock value and identify stocks that are traded below their face value executing trades on them. A typical example of such a strategy is ‘Dogs of the Dow’, in which, at the beginning of every year, they select 10 stocks from the Dow Jones index with the highest dividend yield and expectation that they would determine both the index in general and the average indicator of the index stock yield;

- Seasonality: this type of automatic trading systems studies seasonal behaviour of the financial instrument and initiates trades in accordance with it. For example, sell in May or buy natural gas futures in winter months;

- Sentiment: ATSs on the basis of this method conduct analysis of the crowd behaviour or trader psychology. An example of this ATS would be a famous saying: ‘buy the rumor, sell the fact’.

Introduction into high-frequency trading

People often confuse High-Frequency Trading (HFT) with algorithmic trading. In fact, the high-frequency trading or HFT is a subclass of algorithmic trading.

According to some estimates, more than 70% of trading volumes of only the American stock market and approximately 50% of the European stock market fell on HFT in April 2016. The HFT share in the currency futures market is approximately 80% and 2/3 of volumes in the futures markets of interest rates and US Treasury Notes.

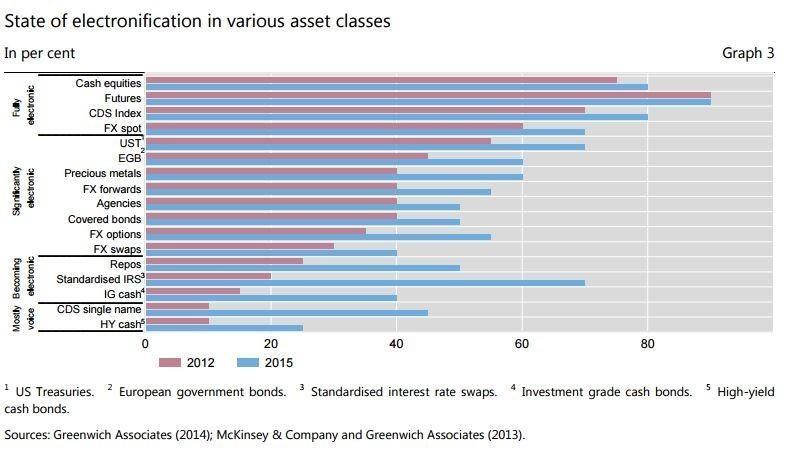

HFT trading in percentage relation in the context of various classes of assets (Source: Want to be a trader in 2020? Look at these charts)

High-frequency trading (HFT) and its influence on the market

Two concepts lie in the basis of the high-frequency trading: speed and information.- Speed or delay identifies how fast orders could be executed;

- Information identifies how fast any new information could be interpreted and processed by HFT machines.

In order to understand how fast HFT works, imagine the following. A human being needs from 300 to 400 milliseconds to wink an eye. One millisecond is one thousandth of a second (1,000 milliseconds = 1 second).

HFT needs 1 microsecond (1 microsecond = 0.001 millisecond) to execute an order. In general, HFT may execute 7,000 trading operations within the 300-400 millisecond period of time (time-frame).

HFT took automatic trading to a completely new level, since, as of now, very powerful computers can, on top of everything else, ‘read’ market news. Some of the most widespread arguments, which support high-frequency trading, are high liquidity and volume and also narrow spreads.

Liquidity is the most important element of any trading system or exchange. Algorithmic trading increases efficiency of all markets. Due to huge HFT trading volumes, the general expenses on trades reduce owing to narrow spreads and assets are less exposed to the influence of other market participants (not HFT) due to the market depth. Liquidity is also important because it helps to cushion consequences of market upheavals better if compared with non-liquid markets, which adds strength to the financial system. And last but not least – liquidity plays an important role in transparency of price formation, which is an important aspect of the market.

Exchanges especially ‘like’ HFT firms due to a number of trades executed with the help of HFT software. A big number of the trades executed by them forms a huge trading volume, which, in its turn, increases the commission income of exchanges. The New York Stock Exchange (NYSE) was fined in March 2016 for USD 5 million when it was found out that it created special and most favourable conditions for operation of HFT firms.

It is interesting that any of the above-mentioned benefits, connected with high-frequency trading, could be easily proved wrong!

Dear friends, if you have found the present article interesting, check our blog for its continuation! In the next part of the article, we will speak about survival of retail traders in the world of algorithmic and high-frequency trading. Leave your comments and share the article in social networks! Do not miss the next article on our blog. Subscribe to our YouTube channel, follow us on Facebook, Instagram, Telegram or X, where we publish the latest ATAS news. Share life hacks and seek advice from other traders in the Telegram group @ATAS_Discussions.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.