We already wrote about principles of the financial exchange. We will consider this subject in more detail today. We will speak about the stock exchange structure concept in this information article for beginners:

- what a stock exchange is;

- its functions;

- interesting facts and the history of the establishment of exchanges in the world;

- organizational structure of the stock exchange through the example of the Moscow Exchange;

- how to connect and start trading.

What a stock exchange is?

A stock exchange is a financial institution where one can buy and sell various securities. Quite often market and exchange are synonyms in the traders’ community.

Depending on the types of securities, the markets can be:

- stock (company stocks and their derivatives are traded here). The stock exchange deals with the initial public offering (companies issue their stocks) and also organization of the secondary security market;

- currency (currency based financial instruments are traded here);

- commodity (instruments, which are based on commodity assets – futures on oil, gold and other metals and agricultural products, are traded here);

- others (for example, markets where government bonds or cryptocurrencies are traded).

It is a simplified classification. We will consider a more accurate structure of the markets through the example of the Moscow Exchange further below.

Exchange functions

All exchanges perform similar functions, such as:

- Set fair prices for financial instruments and assess the whole market through the stock index indicators.

- Attract funds to the financial market.

- Organize the process of a transfer of the right of ownership on securities. Circulation of funds and assets is strictly regulated. The exchange has its strict rules.

- Ensure maximum transparency.

- Guarantee execution of each trade in accordance with the Delivery Versus Payment (DVP) principle. This principle assumes simultaneous settlement by the parties.

- Trading is conducted only through licensed participants. All the other persons are their clients.

Emergence of exchange trading

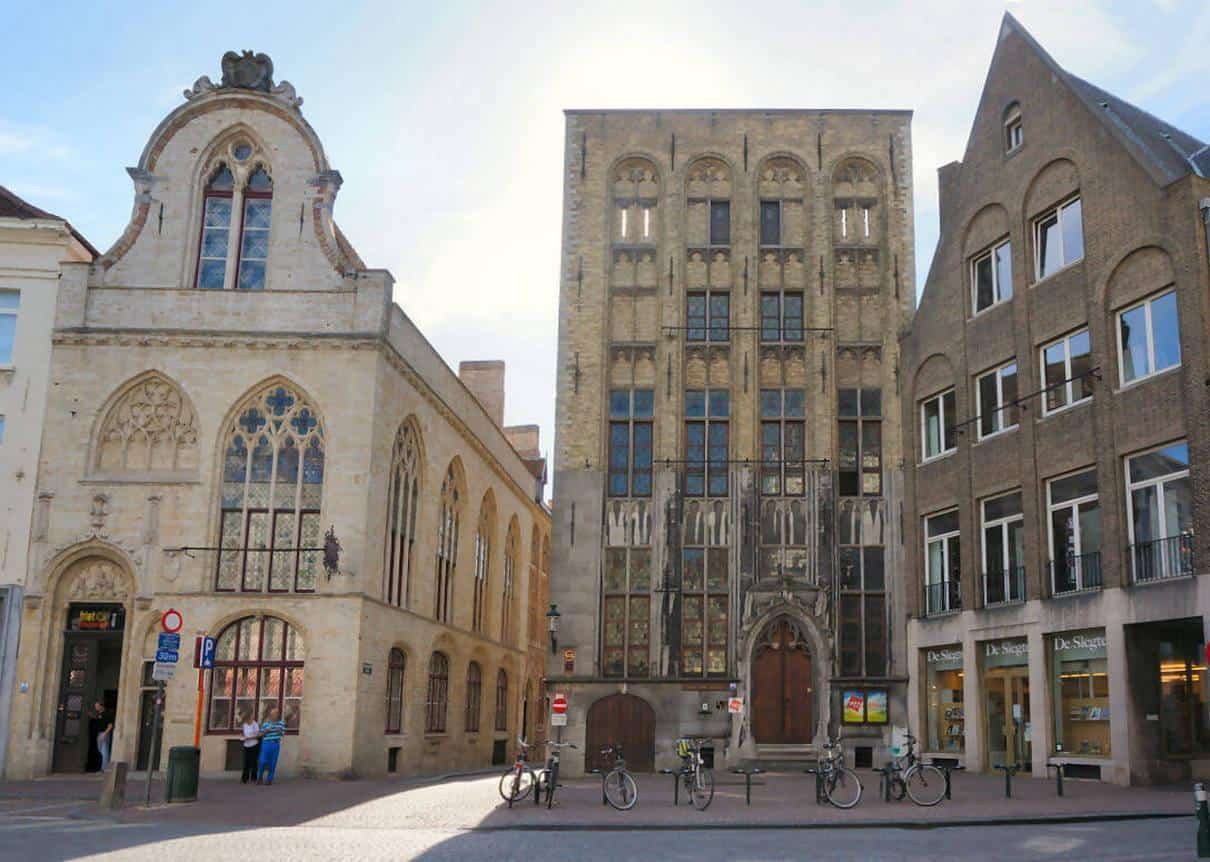

Securities trading was started at the exchange bill trade fairs, which started to be held in as early as the XII-th century, first, in the biggest Italian cities such as Venice, Florence and Genoa and then in London and Brugge.

The term ‘exchange’ sounds the same in nearly all European languages (apart from English) and originates from the second name of the Van der Beurze family – owners of two hotels in Brugge, which stood on the opposite sides of a square where traders traded. There were three purses on the coat of arms of the family and their second name itself originated from the Latin word ‘bursa’, which means a ‘bag’ or ‘purse’.

The picture above shows that very square in Brugge. From left to right: Genoese Lodge (Frietmuseum today), Huis ter Beurze hotel (belonged to Van der Beurze) and the former Venice Consulate (a book store today).

Namely the Brugge exchange gave birth to the important tradition: a bell strike which announced beginning of trading. This tradition is still kept by some exchanges (NYSE, for example).

The Amsterdam Exchange became the main European exchange at the beginning of the XVII-th century (the picture below shows its courtyard). Mostly government bonds of maritime powers and stocks of companies that dealt with assimilation of the colonies were traded there. For example, stocks of the Dutch East and West India companies were traded there.

Another major exchange of that time was the Royal Exchange in London – it was founded in 1571 and it started to perform operations with securities by the end of the XVII-th century. It is believed that namely there emerged such concepts as ‘bulls’ and ‘bears’.

Both these exchanges survived and exist now, however, the Amsterdam Exchange was united with the Paris and Brussels exchanges in 2000 and now forms a part of Euronext NV, while the London Exchange was united with the Milano one in 2007. We should note that the process of unification of exchanges is characteristic for the modern trend for globalization.

The most famous and biggest exchange as of today is the New York Stock Exchange, which officially started its operation 1817, however, securities had been traded in the Wall Street before.

For example, there is the famous ‘Buttonwood Agreement’. It was signed by 24 brokers on May 17, 1972, under a spreading buttonwood in front of the Tontine Coffee House on the Wall Street. The goal of the agreement is organization of the securities trading.

Exchange structure through the example of the Moscow Exchange

All modern exchanges are structured similarly, that is why it is sufficient to learn how one of them is structured to be able to approximately understand the structures of other exchanges. Let’s consider, as an example, the Moscow Exchange (ME, moex.com).

Total capitalization of all traded securities on the Moscow Exchange was RUB 45.48 trillion or USD 719.55 billion in the 2nd quarter of 2019. It is a hefty amount of money but even this amount was insufficient to be among twenty biggest exchanges in the world.

The Moscow Exchange Group was founded in the result of an exchange merger, a typical phenomenon in recent decades: two biggest Russian exchanges – the Moscow Interbank Currency Exchange (MICEX) and Russian Trading System (RTS) – were united into one, which got this name.

The ME itself became a nucleus of the established Group, which also includes:

- National Clearing Centre (NCC). It deals with clearing and the Central Counteragent (CC) option. Clearing is a settlement of similar reciprocal liabilities between the participants of exchange trading. Clearing is usually carried out after a trading session, but it can also split a session. A net position is identified during clearing, the deposit of securities and writing off amounts from the buyer accounts are carried out, and vice versa: writing off securities and deposit of amounts to the seller accounts.

- National Settlement Depository (NSD) registers transfer of ownership rights in accordance with the results of trading.

The Central Counteragent (CC) function means that the National Clearing Centre (NCC) of the Moscow Exchange bears the default risks. The NCC plays the role of the seller for a buyer or the buyer for a seller in all trades on the Moscow Exchange.

Structure of the Moscow Exchange as a Joint-stock company

The Moscow Exchange itself should function as a Joint-stock company (JSC) in accordance with the Russian legislation, which means that it has its own corporate management with a structure similar to other domestic JSC.

Here’s the exchange structure with ranking by importance:

- general meeting of shareholders – the highest management body;

- supervisory board – manages the exchange in basic issues, apart from those that should be decided at the level of the shareholders’ meeting;

- exchange board – carries out the current management.

You can read about the real composition of shareholders on the exchange website.

The next element of the ME structure are markets in which trades are going on.

Securities are traded in the:

- stock market. Stocks, investment fund shares, bonds and depository receipts are traded here;

- forward market. Options and futures are traded here.

These two markets are considered to be the key ones. Some additional markets function along with them:

- Monetary market is used for repo trades, the assets of which are federal loan bonds. A repo trade represents two trades, which are united in one contract, moreover, it assumes a compulsory buyback of a security at a set price on a set date. In fact, this is a loan on securities.

- Market of standardized Derivative Financial Instruments (DFI) – derivatives are traded here.

- Sector of securities with an identified investment risk – it is required for trading securities, which the exchange counts as the securities of the third level of listing (we will speak about listing further below).

- Unified Trading System (UTS) of off-exchange trades – allows to perform trades in the off-exchange market.

An important part of the structure - the Exchange Council and section committees.

The task of the Exchange Council is to represent the interests of the market participants. It is an advisory body, which consists of 15-26 members. It is supplemented by the section committees. Some sections could have 2-3 committees. For example, there are separate committees of stock and bond issuers, committee on the debt market indicators, index committee and so on. New committees are established when required.

Exchange listing and security list

Listing is a list of procedures for inserting securities into the list of the instruments traded on the exchange. Sometimes, the list of instruments itself is called the listing.

The mechanism of passing and holding of securities in the exchange listing, and also changing the listing level, is regulated by the listing rules in considerable detail. For example, the ME rules have 196 pages.

The exchange listing is divided into three levels. The first and second levels are the quoted part of the listing, while the third one is a non-quoted part, trading of which is carried out in the sector of securities with a non-identified investment risk.

Independent from the level, the following listing conditions should be met:

- Papers should correspond to legislative requirements.

- Their issue prospect should be properly registered.

- Issuers should disclose all necessary information in accordance with the legislative requirements.

- They should pass registration in the Settlement Depository (in the context of the ME it is the National Settlement Depository).

Then goes division into listing levels: there are some restrictions for the papers of the first and second levels with respect to capitalization of the organization, number of shares in free circulation, term of activity and reporting. The third level of the listing doesn’t have these restrictions.

For a security to stay at the first or second level it is necessary that every quarter its trading volume should reach a certain minimum size. Besides, the circulation should be supported by at least two market makers (this is how key market participants are called who support liquidity actively trading the paper). Such restrictions also do not act at the third level.

Structure of participants of exchange trading

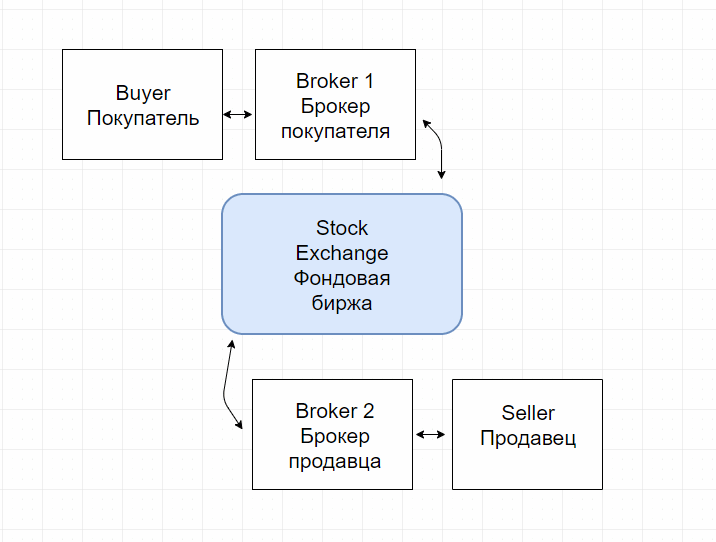

So to speak, the participants of exchange trading refer to one of two groups: exchange members (for example, brokers) and customers (regular traders).

The first group, as a rule, is small. It includes qualified and professional traders and legal persons. It is necessary to get registration on the stock exchange to get into this group.

Customers (anyone who wants to trade) can trade only with the help of the exchange members, for which they execute a contract with them: most frequently it is a brokerage servicing contract.

Thus, usually a buyer and seller interact with each other through their brokers and not directly. The central counteragent, which is the National Clearing Centre in the context of the ME, controls trades. The Guarantee Fund is used for minimization of risks.

How to start taking part in trades

In order to have a possibility to trade on the exchange, you will need:

- To select a broker – a registered exchange member. You should remember that each of them has access to certain markets only.

- Execute a contract with them. We already explained how to select a broker for trading futures.

- Open a trading account with your broker, which you would use for exchange trading.

- Install the required software, which you would use for trading. Download the analytical and trading ATAS platform free of charge.

- Deposit money or securities on your trading account.

The trading account (it is also called the brokerage account) allows keeping both money and securities, since it combines in itself a money account and securities account, which is opened by your broker in the depository. That is, in fact, it consists of two different accounts, but you can use them as one. Ask the following questions when you open a trading account:

- Are the account funds insured?

- Can you lose more funds than you have on your account (this could happen when you trade with leverage)?

- How is the profit by these accounts taxed?

Summary

Beginner traders (and also those who have a small experience in trading on the exchange) often have a vague idea of such notions as clearing, depository and exchange structure. The reason is that they get their first experience trading through such a terminal as, for example, MetaTrader 4. In this case the trades are hardly transferred to the real official exchange and the trading scheme is not transparent.

We (and our client-traders in their interviews) recommend you not to use the services of ‘grey brokers’ but to trade on the official exchange using advanced software such as ATAS. This will:

- protect your capital;

- increase transparency of trading (you will be able to see how your trade was executed on the smart tape);

- improve your efficiency and competitiveness (learn about the trading strategies on the basis of the volume analysis).