Who are the Professional participants on the stock exchange?

It is not difficult to become a securities market participant nowadays. We explained how to become a rightful participant of exchange trades in the following articles:

- How to become a trader from scratch. Interview with a professional trader;

- How to become an intraday trader: three steps for a beginner;

- 5 failures and 5 successes. 3 years on the way to a dream. The story of a real trader.

These articles tell stories of physical persons (regular people) who participate in trading. Today we will speak about legal persons or those who are called professional participants of the securities market.

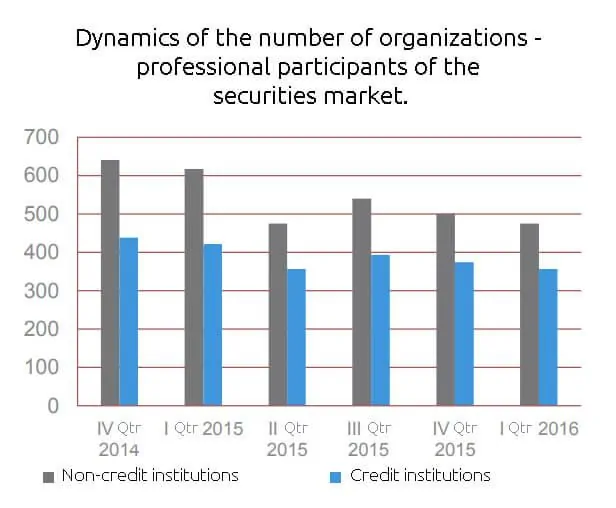

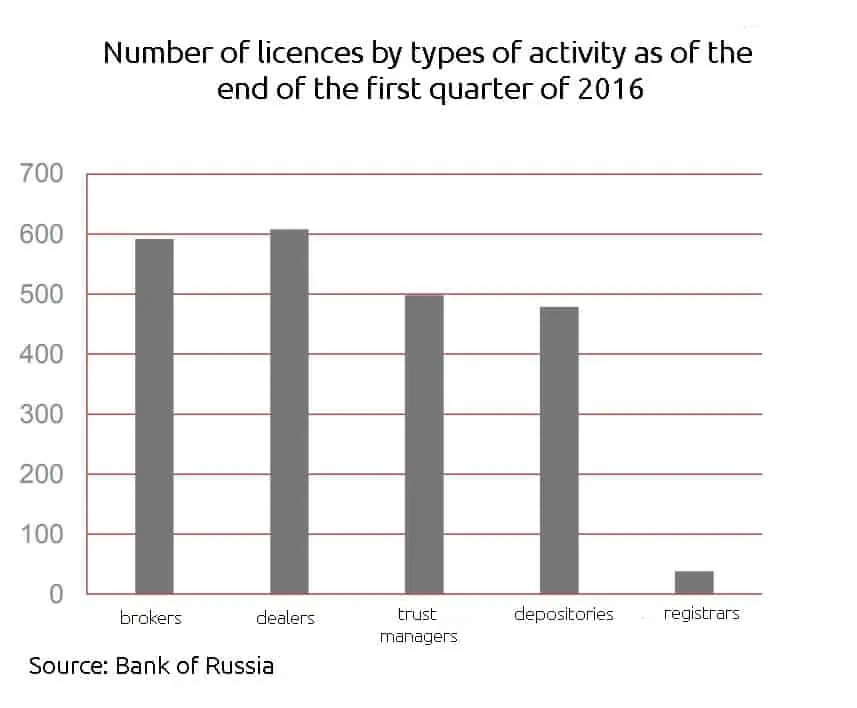

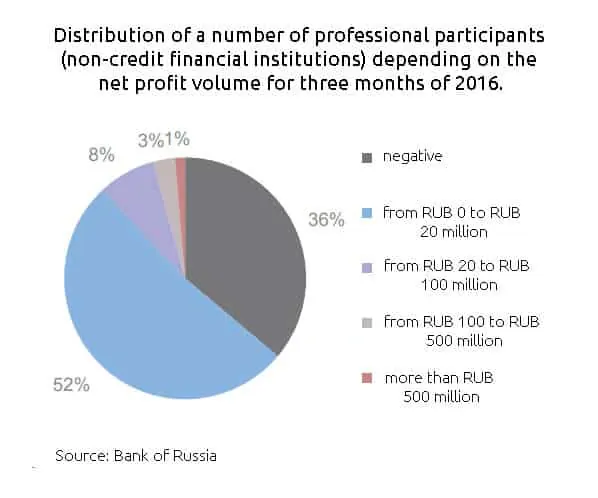

We will consider market participants using the Moscow Exchange example and will use official CB reports for 2015-2016. The data is not fresh but they give sufficient understanding of the subject.

As a rule, professional participants of the securities market are links of the organizational structure of the stock exchange.

Professional participants that trade securities are companies which are:

- providers of brokerage services;

- dealers (we will speak about them later);

- professional capital managers;

- clearing companies (which carry out settlements by the trading results);

- structures that keep a register of securities with specification of their owners;

- exchange structures that are responsible for the organization of a complex process of buying and selling securities.

Securities trading participants could be (by their organization):

- credit institutions (CI);

- non-credit institutions (NCI).

You can find the essential list of traders on the Moscow Exchange website.

The CB regulates, licenses and monitors activity of the professional participants. Apart from everything else the Bank of Russia establishes:

- the procedure of carrying out professional activity in the market;

- the procedure of issuing and cancelling a licence.

Types of professional traders

In general, we can divide professional traders on the stock exchange into 4 main types:

- Issuers – companies which issue securities into circulation;

- Investors – securities holders. Both investment funds and physical persons can acquire stocks;

- Stock market intermediaries – licensed companies. They are required to connect issuers with investors. These intermediaries are brokers and dealers. The difference between them is that brokers conduct trading operations only at the customer’s expense and take a commission. Dealers trade at their own expense and bear all risks themselves;

- Infrastructure, regulation and control organizations.

Let’s consider briefly each type of the participants.

Issuers

Issuers – are those securities market participants, who:

- first, issue securities in circulation. For example, a company issues stocks. In most cases it is done through Initial Public Offering – the first selling of stocks to an unlimited circle of the market participants;

- second, are liable to those who bought their securities. For example, a company pays dividends by the results of its economic activity.

In fact, issuers create an exchange commodity and are the initial sellers of this commodity. Issuers receive money for their securities and assume certain liabilities for them. Correspondingly, a buyer (investor), in his turn, acquires certain rights connected with a respective security.

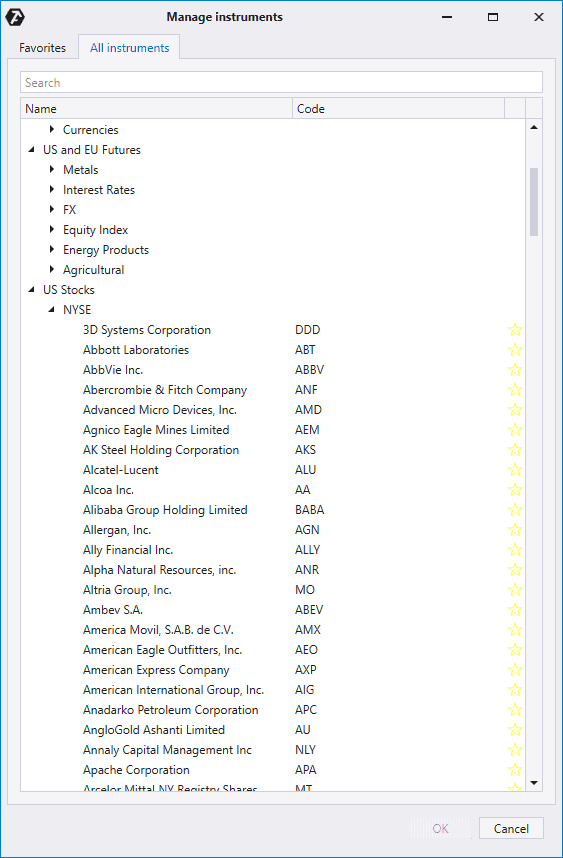

Please go to the Manage instruments section of the trading and analytical ATAS platform and go to the US Stocks > NYSE subsection and you will see a list of companies. These are issuers the stocks of which are traded on the New York Stock Exchange.

Issuers are usually big companies (legal persons), however… It’s interesting but some types of securities could be issued into circulation by regular citizens (physical persons).

Investors

Investors are those securities market participants who invest own funds into securities.

That is, initially investors provide their capitals to the issuers and receive securities instead. However, it doesn’t mean that investors can only play the role of a securities buyer. In the course of time, an investor could decide to sell a security.

Here’s an example from the Gazprom stock market (let’s consider a cluster chart with a weekly period).

Note green clusters in week 1. It is a splash of buying activity. Let’s assume that you, as a private investor, noticed this activity in the chart and bought a stock at the level of about RUB 150.

Later you noticed active sells in point 2 at the level of 233. You decided to close your investment position and received 50% of the profit.

Intermediaries in the securities market

Let’s distinguish here 3 groups of professional participants:

- Brokerage companies. You execute a contract with them and can trade in the securities market. However, it is more correct to say that your broker would trade at your expense after your orders (orders or requests for exercise – these terms mean the same action in this context). Brokerage companies take commissions for executing your orders.

- Dealers. Commercial companies which are legal persons. As a rule they are major speculators, hedge funds, investment funds and stock intermediaries, which have a direct access to the exchange and trade big volumes. They make their profit from selling high and buying low.

- Management companies. These are participants which deal with trust management of securities. If you have a free capital, which you can risk, give it into trust management. A professional capital manager may bring you significant profit if he trades securities in your interests.

Infrastructure, regulation and control organizations

Organizationally we can allocate 2 main groups in the securities market infrastructure:

- Multi-market. These are general organizations which work with a big number of markets. For example, legal departments, official governmental bodies, digital information systems and so on.

- Single-market. These are specialized organizations which work with one specific market only. For example, a settlement center (keeps accounts of market participants), depository (stores securities) or registrar (keeps records of securities owners).

Organizers of the civilized market of securities are:

- stock exchanges like, for example, Moscow Exchange or NYSE;

- off-exchange market organizers.

Regulation, supervision and control over the securities market activity are carried out by the respective governmental bodies, CB and committees of the market participants themselves.

Summary

As a rule, when they speak about a professional securities trader, they mean such a participant of exchange trades who makes a stable profit sufficient to make a living.

However, it doesn’t mean that professional participants do not make losses.

Use the progressive trading and analytical ATAS platform in order to increase your chances for success. Download the free test version and visit our YouTube channel to learn how to get a competitive advantage trading in the market using the ATAS platform.