What are the securities markets

In this article we will speak about the exchange and off-exchange markets:

- What the differences are?

- What specific features are?

- How and what they trade?

- Examples.

We will start from an interesting fact. Everyone knows about the American exchange called NASDAQ. Namely there they trade stocks of companies such as Amazon and Apple.

However, not many people know that NASDAQ (National Association of Securities Dealers Automated Quotation) was founded namely as an off-exchange trading system. However, the differences between the exchange and off-exchange markets are more and more levelled out with the development of electronic trading. As of today, NASDAQ is considered to be one of the three main US stock exchanges (which means it is an exchange market), although it also has signs of an off-exchange market.

Trading in the exchange and off-exchange markets

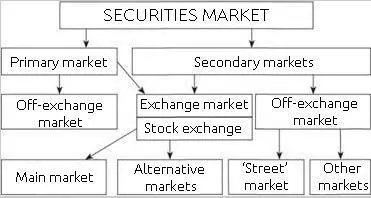

First, let’s consider the general scheme of interaction of the exchange and off-exchange securities markets.

The structure of the general securities market looks approximately as follows:

Let’s discuss in more detail:

- off-exchange market;

- Russian off-exchange market;

- US off-exchange market;

- Forex;

- exchange securities market.

Off-exchange market

Initial sells of securities to the buyers are carried out in the primary market. Securities change hands in the secondary market. If you look attentively at the scheme above, you will see that the majority of initial securities offerings takes place in the off-exchange market.

Moreover, one can buy those securities in the off-exchange market, which are not allowed for exchange trading. The matter is that the issuer should follow certain requirements to be listed on the official exchange – for example, disclose reports for the past several years. And if the company doesn’t want or is not able to follow these requirements, it may attract funds for development in the off-exchange market.

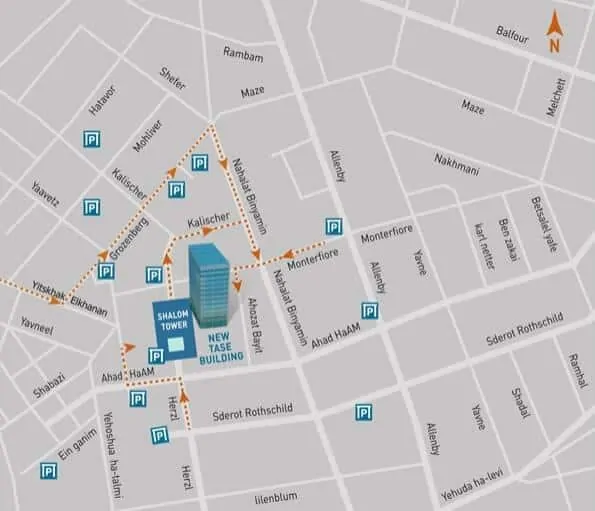

You will not be able to find the off-exchange market on the map or from the satellite. It works in the electronic form only. The exchange market also works in the electronic form but an exchange has a specific physical address. For example, the Tel Aviv Stock Exchange is located at the address: Ahuzat Bayit St 2, Tel Aviv-Yafo, 6525216, Israel.

Main participants of the off-exchange market:

- dealers;

- brokers;

- major banks and funds.

Private investors can buy and sell securities in the off-exchange market through their brokers. As a rule, the off-exchange market participants have money that is why the volume of trades is not limited. There are also no restrictions with respect to a number of lots as long as there are buyers and sellers.

As regards the number of sold/bought securities, the off-exchange market is bigger than the exchange one. However, the volume of the exchange market is bigger in monetary terms due to speculative trades.

You will have to call your broker by phone in order to buy securities in the off-exchange market since not all price quotes are included into the electronic trading system.

The off-exchange market is divided into:

- Organized, where there are clear rules and the market participants are licensed professional intermediaries. This type of the off-exchange market is close to the stock exchange. Trades are carried out through electronic systems.

- Unorganized, which is presented only by brokers. This type of market is only slightly regulated and there is no information about trades. A trade can take place only if a broker finds a couple of customers who want to buy and sell respectively. The unorganized off-exchange market is often called the ‘street’ market.

Russian off-exchange market

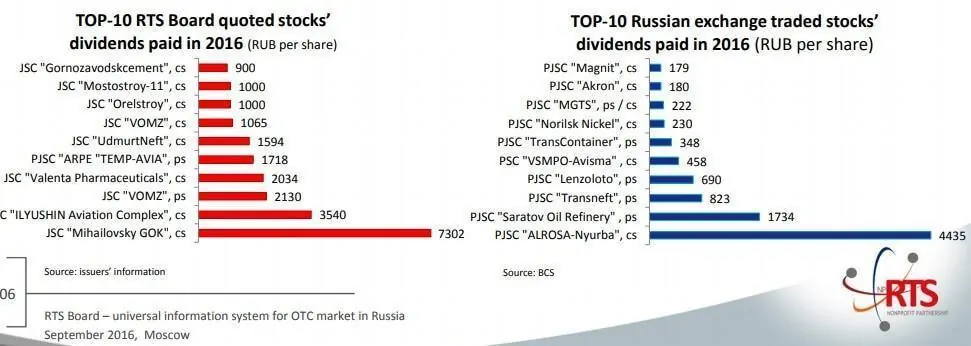

The organizer of the off-exchange trades in Russia is the Russian Trading System (RTS) non-profit organization. The electronic system with price quotes is called RTS Board.

Advantages of the Russian off-exchange market

- Securities of new companies appear in the off-exchange market. Investors can get acquainted with perspective companies at the stage of their establishment and preparation for the listing on the exchange. For example, Alrosa and PJSC Magnitogorsk Iron & Steel Works started in the off-exchange market.

- One can buy and sell any number of securities, if there is offering, without restrictions in lots.

- A wider coverage of industries than on the stock exchange.

- The dividend yield of stocks is higher than on the stock exchange.

Disadvantages of the Russian off-exchange market

- Scarce information about issuers. They are not obliged to disclose their reports and significant facts about their activity. Consequently, it is difficult to assess the potential of growth and risks.

- Low liquidity.

- Registration of trades takes more time than on the stock exchange.

- High commission payments.

American off-exchange markets

The American off-exchange market is more developed and bigger than the Russian one. It is called OTC – Over The Counter Market. The market trades securities of big holdings and small companies from all industries – from banks and oil-and-gas companies to biotechnology and utility companies. All securities are divided into 3 groups depending on their financial qualities:

- OTCQX – global, stable and developing companies. Issuers should follow the requirements of the securities commission and have certain indicators of financial development.

- OTCQB – developing companies which haven’t yet achieved the OTCQX level, consequently, there are less requirements here.

- Pink – the broker-dealer market for trading all securities. These could be foreign securities or problem companies which do not want to disclose their reports. There are no common requirements for report submission.

Several words about NASDAQ which we already mentioned at the beginning of this article. In fact, it is a complex electronic system of price quotes. As of now, you can find price quotes of more than 3,300 stocks on NASDAQ.

Price quotes are available at different levels:

- the first level is accessible to all and shows the best buy and sell prices;

- the second level is accessible to dealers and shows all public quotes of market makers;

- market makers post their orders and quotes at the third level.

Advantages of NASDAQ:

- practically immediate trade execution;

- participants can be from different countries – they just need an access system;

- the market is completely electronic.

Disadvantages of NASDAQ:

- price offerings are limited for those securities which are provided by several market makers;

- the price policy could be different for securities of small companies.

Off-exchange Forex market

Forex is also an off-exchange market but with certain specific features.

- First, price quotes and spreads are different with different brokers on Forex.

- Second, you will not find traded volumes. It is considered in the majority of cases that Forex traders trade against their brokers rather than against other market participants. How high is the probability that brokers wish to lose their money? Correct, a broker wants to make money, which means that there is a high probability that someone else would lose his money (how about a Forex broker’s customer for a change).

Forex is a risky and not very transparent off-exchange market. However, Forex is popular due to minimum requirements to the start-up capital and massive advertising.

Do you want to become a trader from scratch? Read the interview of a professional trader and our customer who started to trade CFD (Contract For Difference) with a Forex broker but then moved to trading futures (what futures are).

Exchange market

A company should observe certain rules in order to be listed on the exchange. Here are some of them:

- a company should publish financial reports for the past several years;

- a number of shares in free circulation should not be less than a certain number;

- in some cases there could be requirements with respect to the company’s corporate management and term of its existence;

- in some cases there could be requirements to capitalization.

However, it is fair to say that some of these requirements are available in the off-exchange market.

Specific features of the exchange securities market:

- One can buy stock in the exchange market only in certain lots.

- Trades could be stopped on the exchange if some force-majeure events take place (for example, the price of a certain stock changes for more than 20%).

- The exchange market is strongly regulated by the state, that is why it is more reliable and transparent.

Off-exchange and exchange markets. Summary

Trades in the off-exchange market could be more risky for private investors if they work with new or not very transparent companies. However, the choice of both securities and instruments is rather wide in the off-exchange market.

The following is important for intraday traders that trade securities:

- speed of trade execution;

- small commissions;

- a big number of volatile trading instruments.

Investors look for fundamental reliability of a company and potential of the growth of the value of its securities.

Where to trade securities – in the exchange or off-exchange market?

Decide where and what to trade on the basis of your goals. The most important thing is to have a trading advantage.

Watch on our YouTube channel how ATAS will help you to find the correct time for buying or selling securities in the exchange market.