Silver often stays in the shadow of its more famous brother – gold. Despite the fact that gold is in high demand from the side of the financial market participants, silver managed to hold its position and become the second most popular traded precious metal. It is not a surprise that silver is often called ‘gold of the poor’, in other words a precious metal, which is more affordable, since not all people have big financial funds for buying the investment gold. Depending on who of the market participants you ask about silver, you would get different answers. Silver provides better results for some investors, while gold is a more preferable asset out of the precious metal category for others.

According to the data available, silver mining started 5 thousand years ago and the first coin was minted 3000 BC in Anatolia (the territory of modern Turkey). As years went by, popularity of silver only grew especially starting from 1200 BC when its production moved to Greece and later to Italy, which became the biggest silver producer after a decade and which imported it from its multiple colonies.

What differs silver from gold are different ways of its application, which are beyond the limits of some sectors of the processing and jewelry industries. Silver is one of the most widely used types of industrial raw materials in comparison to gold, that is why it is widely used both at the industrial and commercial levels.

Before you start trading silver futures, it is important to know characteristics of this precious metal, factors that influence demand and supply and also specifications of the futures contracts. A series of two articles, the current one being the first of them, describes 7 things you should know before you start trading these futures contracts.

In this article:

- Demand on silver constantly exceeds supply.

- Specifications of the silver futures contracts.

- Trading what silver futures contracts would fit an intraday trader better?

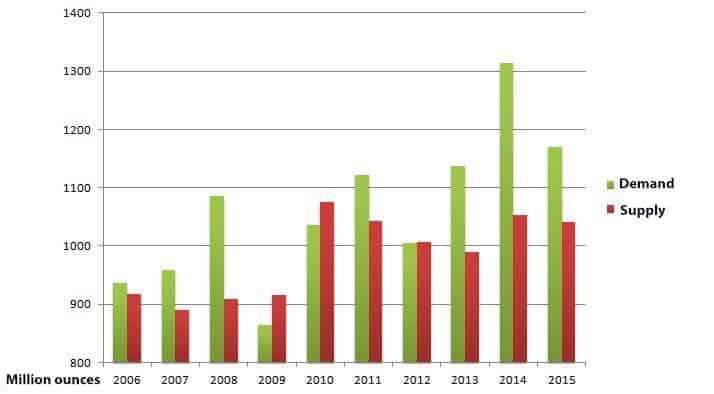

Demand on silver constantly exceeds supply

In general, statistics show us that the long-term demand on silver constantly exceeded its supply, which testifies to a big significance of this rarely traded precious metal.

Statistics of the long-term demand and supply (Source: Silverinstitute.org)

It is also clearly seen in the long-term dynamics of the silver price, which, as you can see in the following chart, constantly increased during the period from 2006 until 2012, after which, truly speaking, it started to decrease.

Since long-term trends do not influence the short-term trading, the silver futures could become an alternative to the gold futures trading for intraday futures traders. As regards the financial and political uncertainties, silver has qualities of a shelter asset and its price, during such periods, as a rule increases as well as the gold price does. At the same time, there are a number of minor differences between the silver and gold futures.

Specifications of the silver futures contracts

Silver futures are available in the form of standardized and regulated exchange contracts. These contracts are mainly traded on the New York Mercantile Exchange (NYMEX), Commodity Exchange (COMEX) and Tokyo Commodity Exchange (TOCOM) under the SI ticker and are delivery futures. The prices of these futures are set in US Dollars and Cents per 1 troy ounce (1 kg = 32.15 troy ounces) of 999 purity silver.

Trading is carried out during the current month; the next two calendar months; any January, March, May and September within 23 months, any July and December within 60 months starting from the current month. Contract trading ends three days before a new contract month starts.

The volume of one standard silver futures contract is 5,000 troy ounces (about 155.5 kg). Its alternative is a settlement miNY Silver mini contract (ticker: QI) with the volume of 2,500 ounces and a delivery 1,000-oz. Silver mini contract with the volume of 1,000 ounces, which are traded during the same months as the standard one is, and also another E-mini Silver mini contract (ticker: XSN) of the settlement type with the volume of 1,000 ounces.

The table below shows specifications of a standard silver futures contract.

| Contract name | Silver Futures Contract |

| Ticker | SI |

| Trading period | CME Globex: Sunday – Friday: 17:00 – 16:00 of the next day Central Standard Time (Chicago) with a daily 60-minute break from 16:00 |

| Contract size | 5,000 troy ounces |

| Minimum price step | USD 0.005 or 0.5 US Cents per ounce |

| Step price | USD 25 |

| Contract months | They are quoted during the current month; the next two calendar months + January (F), March (H), May (K), July (N), September (U) and December (Z) |

The price movement of such a contract for USD 1 is 1,000 points, which is equivalent to USD 5,000. Margin requirements for a standard contract are USD 12,375 as a guarantee collateral for a futures contract.

Among various types of the silver futures contracts, the miNY Silver mini contract (ticker: QI) motivates trading better than the others due to a smaller margin size and smaller minimum price change (tick). The price of this futures contract is set in US Dollars and Cents per 1 troy ounce. The volume of such a futures mini contract, offered by the Chicago Mercantile Exchange (CMT) – one of the largest and most popular futures exchanges, is 2,500 troy ounces, which is equal to a half of the volume of the standard futures contract.

The table below shows specifications of a mini silver futures contract.

| Contract name | E-mini Silver Futures Contract |

| Ticker | QI |

| Trading period | CME Globex: Sunday – Friday: 17:00 – 16:00 of the next day CST (Chicago) with a daily 60-minute break from 16:00 |

| Contract size | 2,500 troy ounces |

| Minimum price step | USD 0.0125 or 1.25 US Cents per ounce |

| Step price | USD 31.25 |

| Contract months | They are quoted during January (F), March (H), May (K), July (N), September (U) and December (Z) |

The price movement of such a contract for USD 1 is 1,000 points, which is equivalent to USD 2,500. Margin requirements for a standard contract are USD 6,187.50 as a guarantee collateral for a futures contract.

While speaking about silver mini contracts, it is necessary to note a relatively new 1,000-oz Silver futures contract traded on the Chicago Mercantile Exchange under the SIL ticker. Its price is set in US Dollars and Cents per 1 troy ounce. The volume of such a contract is 1,000 troy ounces of silver and unlike the other earlier described mini contracts it is a delivery futures contract.

It offers traders one of the variants of participation in the precious metal market with an even lower margin and smaller risk. This contract started to be traded on June 15, 2013, and its volume is 1/5 of the volume of the standard futures contract, which is available on CME/COMEX. It allows traders to trade in the futures silver market with the margin requirements for a futures contract of only USD 2,475 (compared to the standard contract margin of USD 12,375) and a minimum price change (tick) of 1 US Cent, which is USD 10 per 1 contract. Moreover, the new mini contract offers a lower amount of commissions compared to its standard brother.

Trading is carried out during the current month; the next two calendar months; any January, March, May, July, September and December within 12 months. Contract trading ends three days before a new contract month starts.

The table below shows specifications of a mini silver futures contract.

| Contract name | 1,000-oz. Silver Futures Contract |

| Ticker | SIL |

| Trading period | CME Globex: Sunday – Friday: 17:00 – 16:00 of the next day CST (Chicago) with a daily 60-minute break from 16:00 |

| Contract size | 1,000 troy ounces |

| Minimum price step | USD 0.01 or 1.0 US Cents per ounce |

| Step price | USD 10 |

| Contract months | They are quoted during the current month; the next two calendar months + January (F), March (H), May (K), July (N), September (U) and December (Z) |

Текст №2

The price movement of such a contract for USD 1 is 1,000 points which is equivalent to USD 1,000.

Trading what silver futures contracts would fit an intraday trader better?

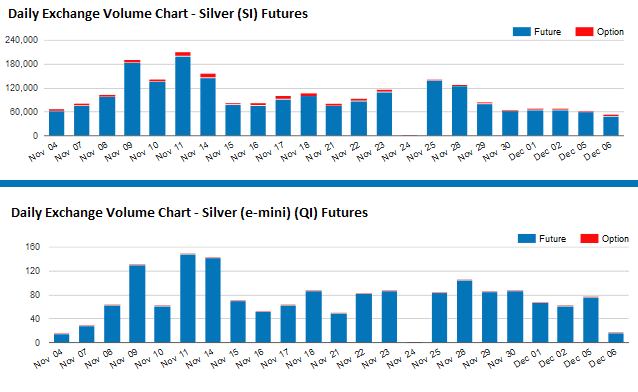

Whereas, silver futures are less demanding of the margin and allow controlling smaller contract sizes, if comparing trading volumes of standard and mini contracts, the standard or, as they are also called, big contracts are traded much more actively.

Comparing day trading volumes of SI and QI futures (Source: CME Group)

It means for an intraday trader that big futures contracts are a more efficient variant of trading. Liquidity, which comes with them, allows intraday traders to trade quickly in the futures market with relative ease. Since silver futures mini contracts are less liquid and their prices could be susceptible to the volume of executed trades, it hampers their efficient trading during a day.

You can read the second part of the SILVER FUTURES: 7 THINGS YOU SHOULD KNOW article here.