This material is based on the story of a real trader.

The goal of the article is not to explain formulas of calculation of volatility and not to teach how to trade using indicators. The most important is to show how the understanding of long-term risks and correct psychological mood with respect to the business are crucial for trading. Perhaps, this article would turn the readers against the wish ‘to catch big fish’ in high volatility and, in doing so, would save a lot of nerves, time and money.

Read in this article:

- His Majesty Risk requires respect.

- The story of one ‘blow up’. How I lost everything coming across a market anomaly.

- The mistake of a survived. Why the wrong risk assessment leads to losses.

- Trading psychology in the times of a volatility splash.

- Why the ‘wrong decision loop’ is dangerous.

- Why it is better to read books than to blow up money. Rules, which would help you to preserve the capital.

- Risk management in the times of jumps of volatility.

His Majesty Risk requires respect

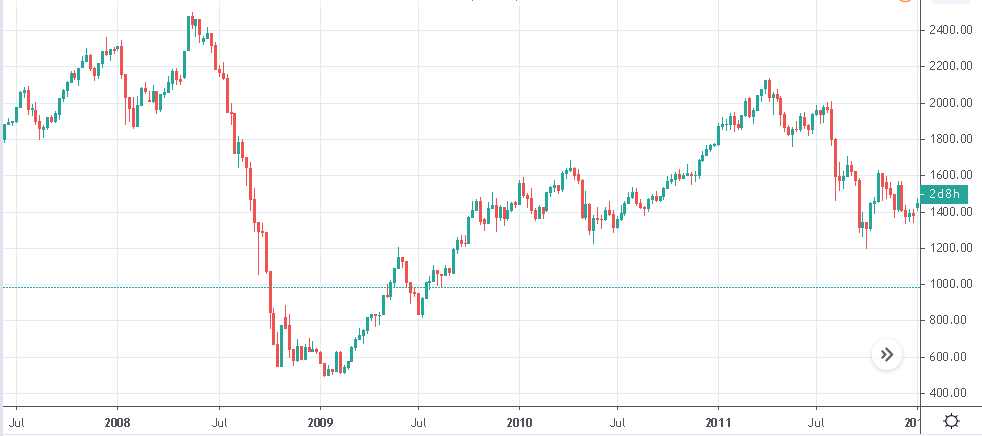

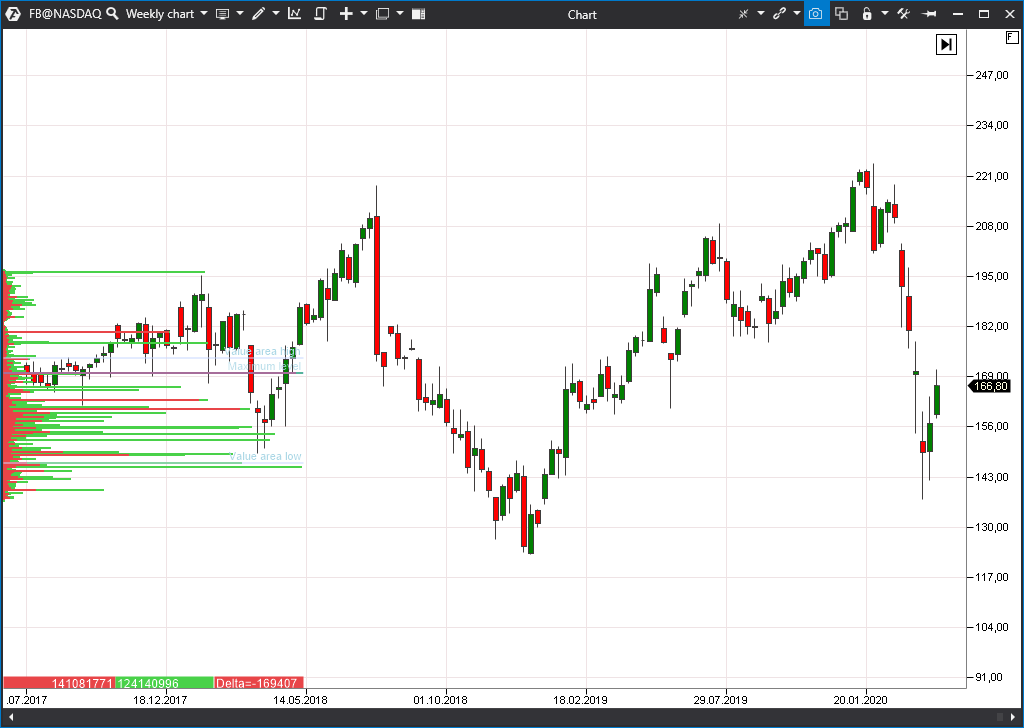

The events, which take place in spring 2020 in the world financial markets, are exceptional without exaggeration. Never before the financial world has experienced such a crash due to an infectious disease pandemic:- Stock indices – from the American S&P 500 to the Russian RTS – showed in March the fastest rates of fall in their history.

- The Brent oil barrel price crashed to the low of the past 13 years.

- The Volatility IndeX (VIX) in the US stock market reached the record-breaking values for the whole period of its calculation, exceeding the records of the 2008-2009 crisis.

So, it is extremely important for all traders and investors, in such an extraordinary situation, to preserve the thinking sobriety and understanding that a bottom is a conventional concept, as well as a high. A situation may go much further than we just can imagine.

The story of one blow up

First of all, I’d like to share a personal story with you about my acquaintance with high volatility and deposit blow up, which made me reconsider my attitude to trading and investing.The writer of these words started to trade soon after the 2008-2009 crisis.

The worst situation for the markets was far behind by the second half of 2009. Central banks printed money without rest and the world economy indicators started to grow along with the stocks, oil and gold.

My strategy was wickedly simple. I bought several shares, waited for their price increase by 20-30% on the general growth and sold them, after which I bought something again. It wasn’t a business, it was a dream! I was on vacation in April 2010, when the Greek debt crisis crashed the markets. That case, instead of giving a valuable lesson, just strengthened my confidence in my mission to trade and in my luck.

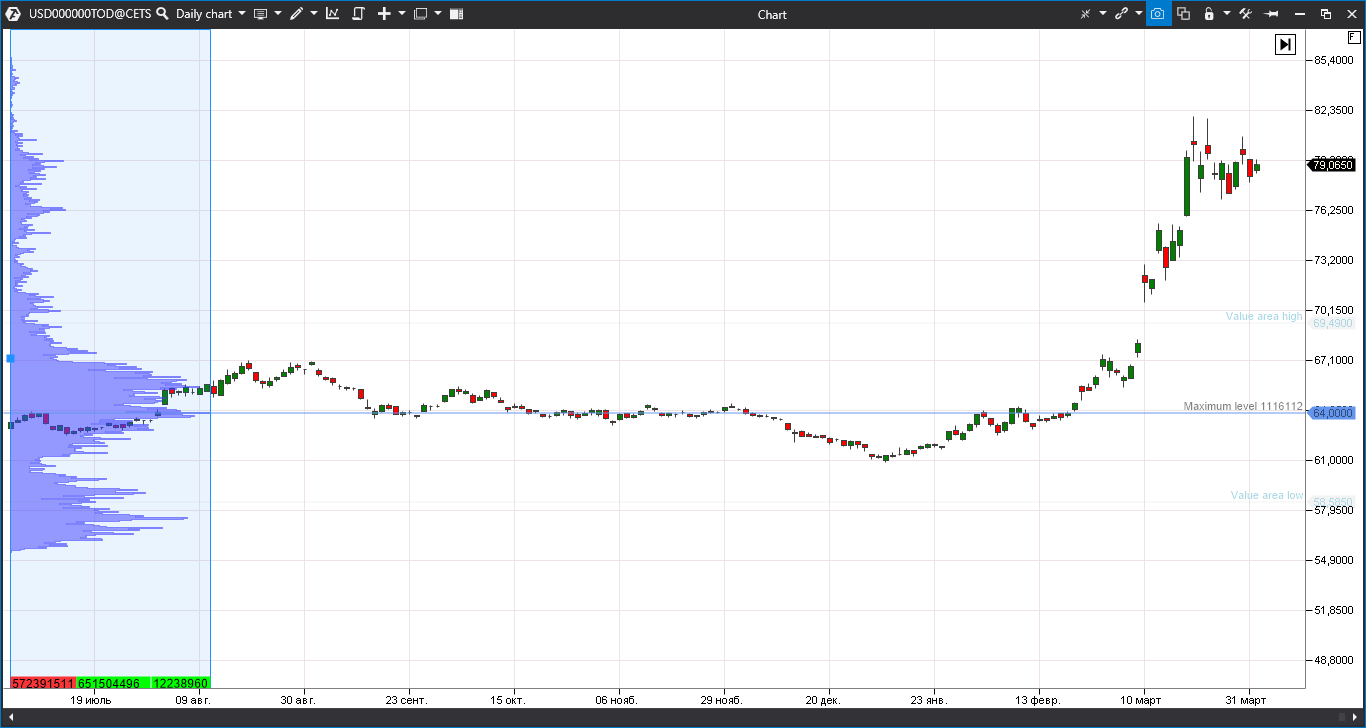

First, I carefully bought dollars and made a little money. But then, all of a sudden, I had an insight that the rouble cannot move above 40 and started to short USD/RUB…

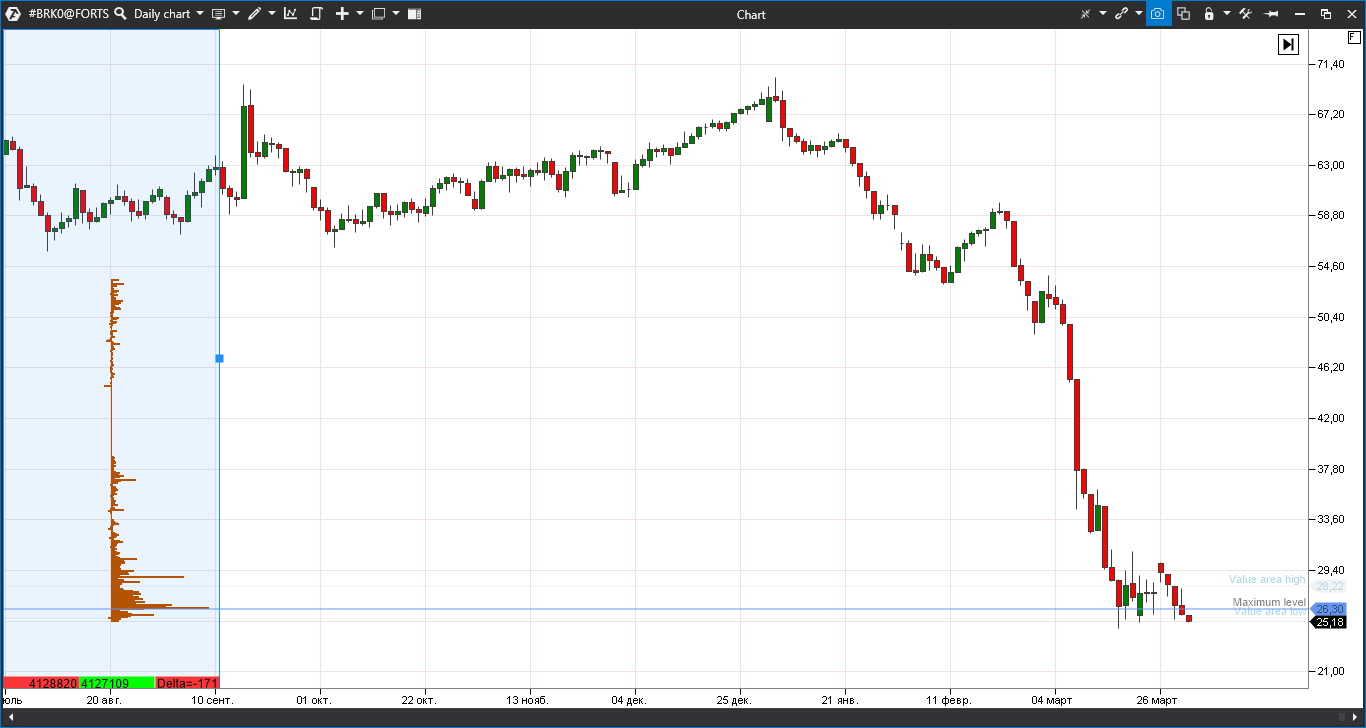

I saw such a volatility of the rouble for the first time in my life. I was absolutely sure that the trend would sharply reverse soon: I shorted, averaged, shorted, averaged, cut the loss and shorted again. And the most sad thing is that when my account significantly lost its weight, I started to increase the leverage in the hope to retrieve my losses. In the result of the crisis of the second half of 2014, the dollar value jumped from 33 roubles to 80 and I blew up my deposit.

The mistake of a survived. Why a wrong risk assessment leads to losses

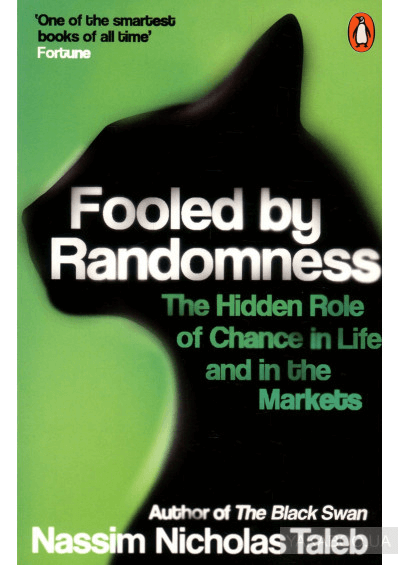

Only years afterwards I read the book of Nassim Taleb ‘Fooled by Randomness. The Hidden Role of Chance in Life and in the Markets’. A professional option trader and risk philosopher – Nassim Taleb – convincingly shows how often we undervalue the role of rare and poorly predicted events.

You should always keep in mind that more than 70% of the companies, which were included into the index 30 years ago, either ceased to exist or lost a significant portion of the market. Look – Google, Facebook and many other leaders of the modern market didn’t exist in 1990. This nuance underlines once again the fact that if you buy the ‘bottom’, there is always a high risk to receive the second bottom ‘as a gift’. If you buy on historic highs, you should keep in mind that there is a probability that these highs would be broken many times.

People also systematically make the ‘mistake of a survived’, perceiving accidental combinations of circumstances as the evidence of their rightness and exceptionality.

Taleb describes stories of two traders and neighbours in a prestigious New York area – Nero and John. Nero is well-acquainted with the mathematics of risk and he is cautious and patient. His income is above the average in the US but he cannot afford a personal aircraft and yacht. John is successful and overconfident. He is a Wall Street star, lives in high style, buys high-risk bonds with a big leverage and likes to average, which brings a huge profit to him and his company.

This parity lasted until fate stepped in. Nero is still successful. John blew up everything during the default of one of the countries, on which bonds he put too much money. He just refused to believe that the bonds could become even cheaper after the fall by 80% and that they just may lose all their value and it killed him. Absence of understanding long-term risks, cost John his career.

Investor psychology in the times of volatility splashes

In order to avoid losses during the volatility jumps, it is very useful to adopt the correct attitude to trades. You should learn one very simple to understand but very difficult to use rule – you should always open a trade with a thought that you may be absolutely wrong.

“The lesson I learnt from Soros is to start every meeting convincing each other that we are a set of idiots who do not know anything and are subject to mistakes, but we possess a rare privilege to know it”, – the words of a man who knows Soros.

What the ‘wrong decision loop’ leads to

I blew up my deposit in 2014 not because I didn’t know that it was dangerous to trade against a trend. I faced the situation, which I call the ‘wrong decision loop’ in the event of the volatility splash. I relied on my experience in trading. There were no situations in my memory that the rouble may crash 2-3 times, from which I made the erroneous conclusion that it wasn’t possible at all. Moreover, I didn’t have a willpower to timely recognise my mistake.

It is better to read books than to make losses

Here are three life-hacks for the 2020 crisis, which are based on the experience of many traders. At some point they helped the writer of these words to change the attitude to trading and to start making money again:- It is better to read books than to make losses. Volatility splashes often result in anomalous behaviour of financial instruments. No doubt, there will be situations when it would be difficult to believe that such a crash is possible at all. The exit from all positions and temporary refusal to execute trades help a lot. This approach allows preserving the capital for the future and saving a multitude of nerve cells.

- Learn to think in the long-term manner. Statistical analysis shows that only a few survive in the strategies of high acceptance of risks, especially when the volatility grows. You shouldn’t accept the behaviour of bold spirits in the market as heroism. Very often a temporary success is caused by pure luck. On the contrary, the one who intends to run a long distance will achieve significant financial successes with a higher probability.

- Psychological practices. Meditation and other awareness improvement techniques really allow developing a quiet attitude to the market travails and avoiding the tilt. It is a very useful quality for a trader.

Risk management in the times of jumps of volatility

Risk management is the ability, without which you cannot survive in the market for a long period of time. In the absolute majority of cases, traders make losses not because they trade badly, but because they cannot control their risks. The risk management rules should be made stricter in the times of high volatility, while many traders make a mistake by reducing them.I have never used leverage in the relation bigger than 1 to 2 and never tried to trade against the market after the painful blow up in 2014. The lesson was learned. Moreover, my priorities nowadays are long-term investment strategies and only once in a while I am engaged in speculations.

Although, it should also be noted that, by themselves, short-term strategies are not bad. They bring money to many traders. It is important how proficiently you can keep discipline, being in the market every day.

Here’s one illustrative example. In the event of the growth of the standard deviation of the price from the average value from 5% to 15%, in relative numbers, the risk grows disproportionately. The risk management rules, which are applied in the inactive market, cannot be applied in such a situation. For example, you usually trade aiming at the potential risk to reward ratio in every trade of 1 to 4 and higher. This difference allows you to cover even several loss-making trades in a row with one profitable trade.

I would recommend the following to the traders in such a situation:

- Do not use leverage until the volatility returns to the average values.

- If you cannot keep the risk-reward ratio during trading, take no chances and go away from the computer monitor.

- If your strategy allows it, do not rollover your trades overnight. Morning gaps, when you cannot undertake anything, produce the biggest risks in the volatile market.

Conclusion

It is not an exaggeration that a big crisis is a big luck for a trader. It is really so. The earlier you manage to learn the lessons of self-control and risk management during the volatility jumps, the more money you will preserve in the future. The writer of these words meets the 2020 crisis without major emotions and shock from the market fluctuations. It really transformed into a good investment opportunity rather than a threat for the capital.Good luck trading!

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.