5 examples of options hedging

Options are a sophisticated financial instrument that is why even if we try to explain what options are in simple terms, it would be quite difficult to understand it anyway. Especially when it comes to options hedging.

And we did our best in this article to give you easy-to-understand, interesting and useful explanation of:

- what options are;

- how options hedging works;

- what is an options buyer and how an options buyer is different from an options seller;

- why options income could be unlimited and risks are limited;

- what options hedging strategies are;

- how to buy or sell an option at a stock exchange.

The option or option contract (from Latin optio – choice or wish) is a contract, under which the option buyer acquires the right, but not the obligation, to buy or sell an asset (share, commodity or currency) by a certain price at a certain moment in future, specified in the contract.

According to the Chicago Mercantile Exchange, popularity of options grows every year by 5%. Thus, an average daily trading of the options market is around USD 4 million.

WHAT A UNIQUE FEATURE OF OPTIONS IS

It’s all about the option value. It is fixed at the moment of its buying and stays unchanged until execution of an option. However, the options sellers run very high risks, but we will speak about it later.

Options are forward contracts that is why every options contract has the last day of its validity – the expiration day. From this perspective, options resemble futures (what futures are). Weekly, monthly, quarterly and yearly options help to plan commercial activity.

Options could be of American or European style depending on a date of their execution:

- American options could be executed at any moment;

- European options cannot be executed before the date of expiration.

The option holder has the right:

- to execute the option, that is, demand from the option seller to deliver a security or commodity;

- to sell the option to another participant;

- to wait for expiration and get the remainder of its value.

The option seller:

- is obliged to execute the option upon demand of the holder, that is, to deliver assets by the price specified in the option;

- has the right to hand over the option to another participant who would assume an obligation to execute the option by the current price;

- is obliged to ensure a higher guarantee collateral, since the seller bears the risk of an unlimited loss.

WHY OPTIONS ARE REQUIRED

The main purpose of the option is its application as an insurance (hedging) from a negative scenario in the futures market of currencies, shares and commodities.

The underlying assets for options are:

– commodity futures;

– currency futures;

– equity futures;

– index futures.

Which means, if we deal with the option on the currency futures, the currency futures would be the underlying asset (UA) in this case.

The underlying asset price changes depending on supply and demand of traders, who wait for the UA price decrease or increase. However, their forecasts with respect to the future UA value can fail. And, in order to reduce the risk of loss, the options come to help.

Various hedging techniques will be considered closer to the end of this article.

HOW TO BUY AN OPTION ON THE EXCHANGE

To buy or sell an option is not more difficult than to deal with futures. The deal could be made through a broker. Having received your order for buying an option, the broker sends it to the exchange core.

If you send a limit order, it is posted in the order book at a specified price. The market order will be executed at the expense of offsetting orders. In order to reduce slippage of the market order, make sure that the order book is filled with offsetting orders, since some options have low liquidity.

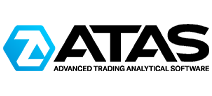

The order book in the options market has the same structure as on futures.

Sell orders are above the current price and buy orders are below it. A guarantee collateral in the amount of the option price plus broker’s commission would be required for posting the buy order

In order to open the option short position, a higher guarantee collateral, which is several times bigger than the option value, would be required.

The open position in the option results in a variation margin, that is, the state of deposit would change depending on the option value. In order to close the long option, it is sufficient to sell it. And vice versa, in order to close the short option position, it is necessary to buy it. In order to execute the option, it is necessary to send the option execution order to the broker.

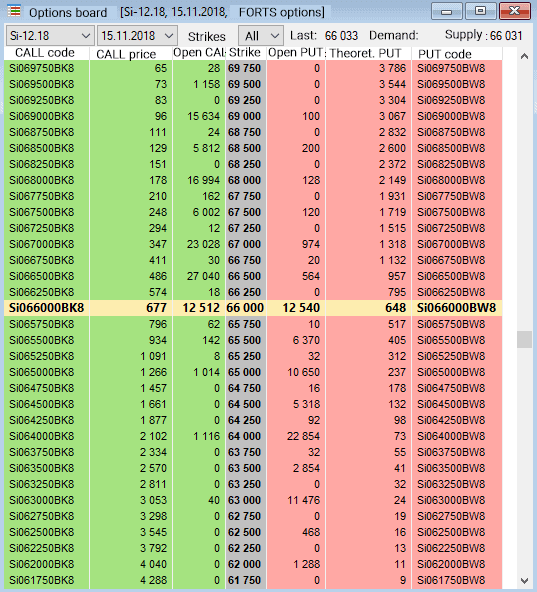

Take heed of the picture above. Si066000BW8 is a unique ticker code of a specific option. In order to have a better understanding of how options on the Moscow Exchange are coded, have a look at the code specification here: https://www.moex.com/s205.

WHAT A STRIKE IS

There are a number of options for one underlying asset, because various options display all possible prices of one and the same underlying asset. The market participant himself chooses the price by which he wants to buy the option.

For example, imagine that the Brent Oil futures price could be any within the range from USD 65 to USD 96 per barrel. The exchange breaks this whole range of possible prices down into graduation with the price pitch of USD 1. We get a price grid. Each price in this grid is called a strike. We have a grid of strikes: 65, 66, 67 … 95 and 96.

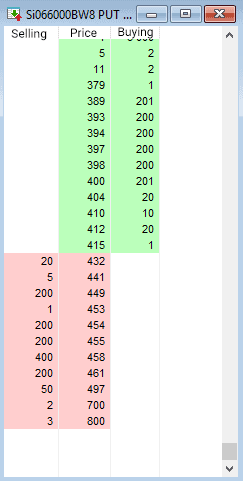

Then the exchange introduces two options – Call and Put – for each strike.

- the Call option insures against the UA price increase;

- the Put option insures against the UA price decrease.

Strike is an important concept, thereupon we will see how it works in more detail.

Strike is the price, at which the buyer has the right to execute the option, that is, to exchange the option into the futures contract. The option strike is fixed at the moment of buying the option and it stays unchanged during the whole option’s lifetime.

For the option holder, the strike is a pointer to the underlying asset price, at which he would like to buy the asset in future. The option buyer has the right to buy the option with any strike within the available range.

But there is a nuance. There are many strikes, but there is only one current strike.

What is a current strike?

The underlying asset price changes depending on supply or demand and always denotes the current strike.

Let us assume that if the oil price is USD 65.73, then the 66th strike is the current one. If the oil price goes down to USD 65.49, the 65th strike becomes the current one, and so on. That is why the current strike value is ever changing.

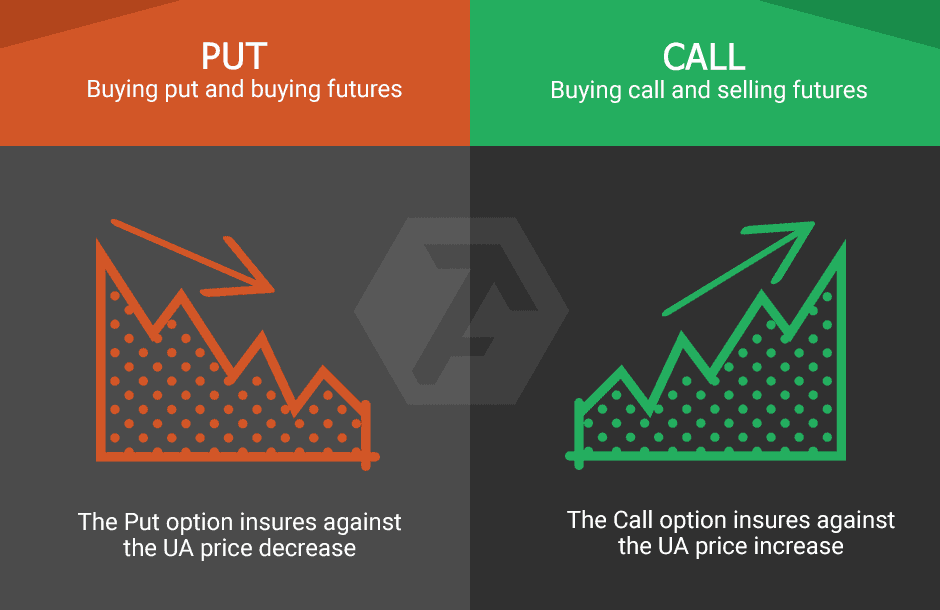

Let us provide a demonstrative example with the use of the Si underlying asset on the Moscow Exchange and option strikes

- the UA price from 65876 to 66125 belongs to the 66000 strike;

- the UA price from 66126 to 66375 belongs to the 66250 strike;

- the UA price from 66376 to 66625 belongs to the 66500 strike, and so on.

Figuratively speaking, we can say that the underlying asset price moves the current strike along the strike grid.

What options boards are

Let us take the gold market. In fact, there are several futures with different dates of expiration in the gold forward market. And there is a set of options with various strikes for each futures.

That is why options boards are used for more convenient and easier work with options. These boards are tables where one can adjust own parameters for displaying options, for example:

- option code;

- option price;

- number of open positions;

- strike.

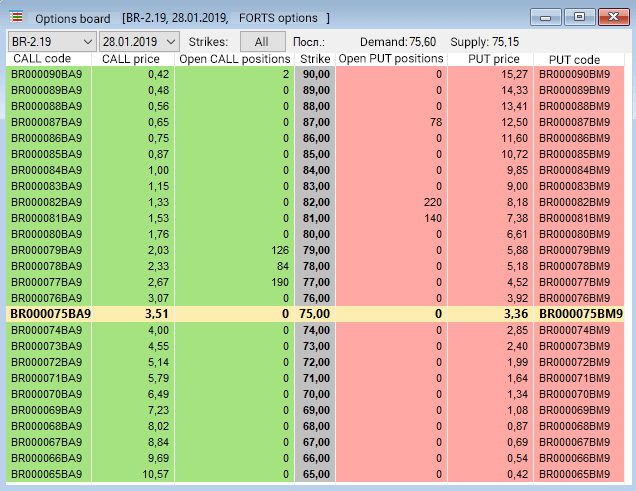

Let us consider an example. We take an options board for BR-2.19 oil futures on the Moscow Exchange with the execution date on January 28, 2019. 26 Call options and 26 Put options, with the price pitch between options of USD 1, are traded under this contract. A market participant selects options from the price range from USD 65 to USD 90.

For example, the current oil price is USD 75. If a market participant anticipates the price increase up to USD 80 and/or higher, he can buy the option with the BR000080BL8 code for USD 1.76. For the option holder the risk would be USD 1.76 from each contract and would stay unchanged until expiration. Another market participant also anticipates the increase, but he prefers to buy futures and to limit the risk with a stop-loss order. Major players can shift the price towards the area of accumulation of stop-losses for taking on the position. After that a major player will turn the market around and will support the further growth. Such manipulations are not dangerous for the option holder, however, the futures holder will fix his loss by stop-loss and will drop out with a negative result.

OPEN INTEREST AND OPTIONS

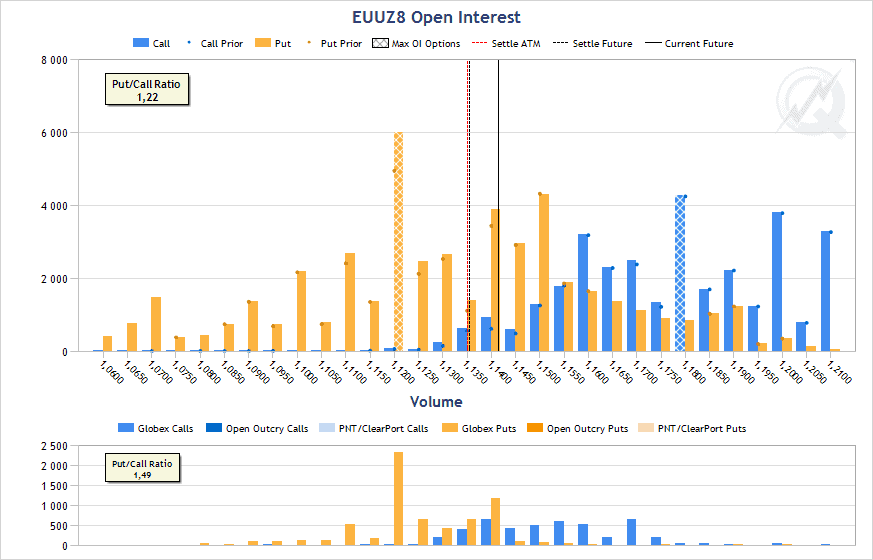

Open interest, which means a number of open positions between buyers and sellers, is formed in option contracts in the course of trading. Open interest is broadcast by exchanges. For example, open positions on EUR/USD options on CME look as follows:

Open interest on the Moscow Exchange could be analyzed using the options board. It is available at:

https://www.moex.com/ru/derivatives/optionsdesk.aspx.

WHAT “IN THE MONEY” OPTIONS ARE

According to the official terminology, options could be:

- in the money

- out of the money

- at the money.

The Call option will be in the money if the underlying asset price becomes higher than the strike.

The Put option will be in the money if the underlying asset price becomes lower than the strike.

The Call option is out of the money if the underlying asset price becomes lower than the strike.

The Put option is out of the money if the underlying asset price becomes higher than the strike.

The Call and Put options are at the money if the underlying asset price becomes equal to the strike or close to it.

Options in the money bring profit to its holder. In order to fix the profit, the option holder can sell it to another market participant, in which case the variation margin turns into income.

If you never traded options and read ads about option traders who make big money, you might decide that options ensure easy money, which is not true.

Options in the money always have high value, which means that a possible loss is quite high, although it is fixed:

We can see from the table that the current strike is the 66000 level, which means that the underlying asset is traded within the 65876-66125 range. All Call options below the 65500 level are in the money, all Call options above the 66500 level are out of the money and the options within the range from 66750 to 66250 are at the money.

Example. Let us assume that we buy one 66000 Call option and its price is RUB 677 per 1 contract. If we execute the bought option we would get an open long position on the futures at the price of 66000.

This deal will have no sense, since one can just buy a futures at a current price without paying a premium for the option (a premium for the option is an amount paid by the buyer to the seller). That is why we anticipate that futures will go up and hold the option. If our forecast is correct and the futures price in the nearest couple of days would reach the 67000 level, then the bought option will get up to approximately RUB 1,266. Now we can sell the option to other market participants and get profit. If the price will not go up in the nearest couple of days or, even worse, will start to go down, then the bought option will start to lose its value.

OPTION PRICING

Factors that influence the option price:

– supply and demand;

– underlying asset price;

– time until expiration;

– volatility of the underlying asset;

– interest rate (in case of currency options);

– dividends (in case of stock options).

The option price is calculated by the stock exchange and is a theoretical price. However, in practice, the current price could insignificantly differ from the theoretical one, since traders could change the option price in the process of trading.

If the underlying asset price changes the current strike, the theoretical price is recalculated by the exchange and the remained limits are satisfied by the market maker in order to level the current price with the theoretical one.

Time is always against the option holder and the option becomes cheaper day by day. The option seller wins in this case, keeping a part of the premium.

If the option is not in the money by the date of expiration, the seller would keep the whole premium, which was paid by the buyer. If the option is deep in the money, the seller would not only pay back the whole premium, but also would have to cover, at his own expense, the profit to the option holder.

There are strategies of making money on selling the options due to the time decay. The trader sells the option, waits for the price decay and keeps the premium.

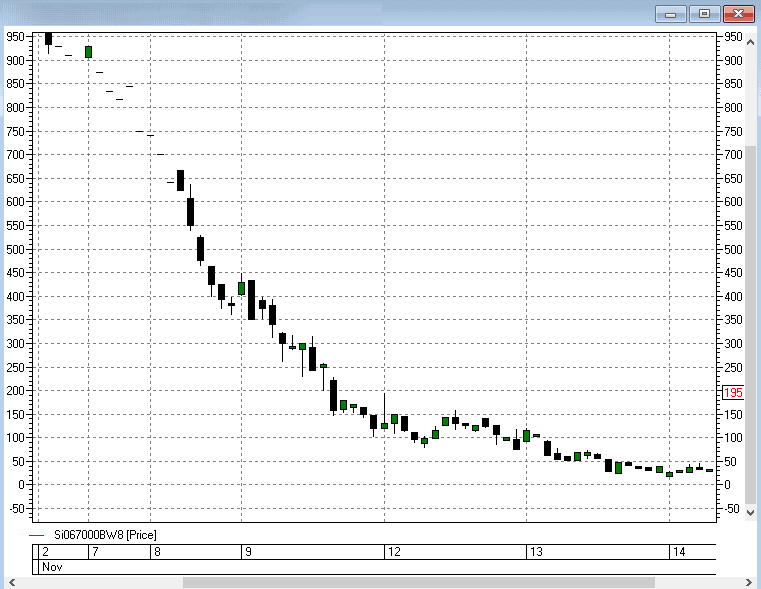

The time decay is included into the formula of determination of the theoretical price of the option. The more time there is until expiration, the more expensive the option is, and vice versa. Many options depreciate to zero by the date of expiration. This can be demonstrated by a chart in the low-volatility market.

However, there is a joke among traders: “do not sell Motherland, mother and options!” meaning high riskiness of this activity.

Why is the options selling considered to be a high risk trading?

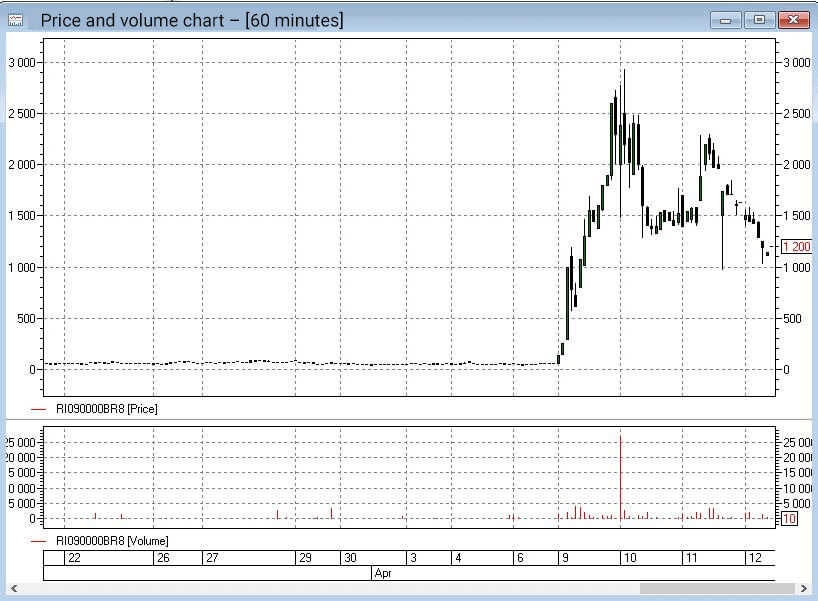

The answer to this question could be demonstrated by the chart.

Relatively recently, namely on April 9, 2018, the Russian market was shaken by the news about sanctions. In the chart you can see the Put option on the RTS index with the 90000 strike. This strike contained an anomalously big amount of the open interest. Losses of the sellers reached 2700% from the original premium.

That is why selling naked options (“naked” means that they do not have insuring positions) is the most risky trading.

Option expiration date

Option expiration date is a date, after which the option expires and the residual value is paid back to the holder if the option is not executed or not sold to another participant.

At the options expiration date:

- the rights and obligations of sellers and buyers are abrogated;

- the guarantee collateral is released;

- the clearing chamber redistributes the margin between buyers and seller.

Maybe you observed strange, unconditional and strong focused movements of the futures contract prices, which are beyond the classical technical or volume analysis. Often such unexplainable movements are a result of the expiration date approach. We will demonstrate what we mean at the end of the article.

Why does it happen this way? The matter is that the option sellers can accumulate a significant negative balance in the course of their activity. And in order to avoid fixation of this loss by the options expiration, these traders tend to get rid of such options. A major option seller is capable of moving the underlying asset to the level where losses for some options are compensated by premiums for other ones. The pressure on the market stops after expiration and the price continues its natural movement on the basis of supply and demand.

OPTION LEVELS

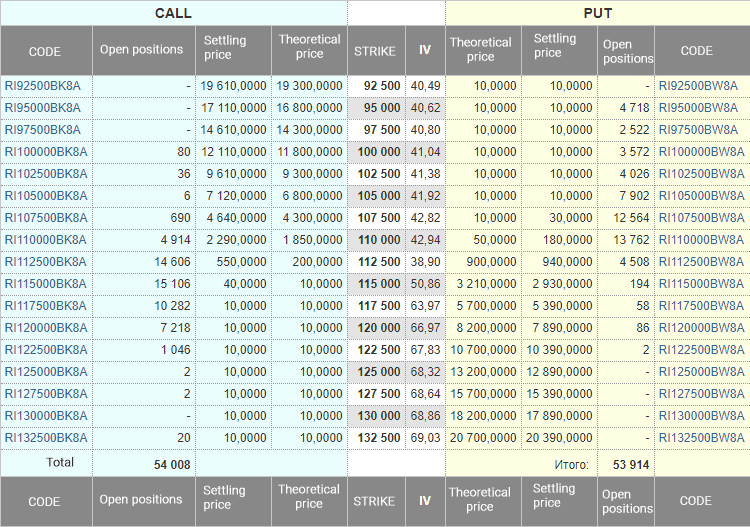

What are option levels and how do they influence the market? Let us explain it using an example. We take option contracts on futures on the RTS index:

Strikes with a maximum open interest form option levels, which, as a rule, are support or resistance levels. However, the maximum volume of the open interest on a specific strike does not mean at all that the price will turn back from the level – in each specific situation things unfold according to an individual scenario.

Use the following formula for determining the option level:

a strike with a higher interest + weighted average price of the option contract

The weighted average price takes into account only those trades, which resulted in increase of the open interest that is why the total volume of trades is not taken into account.

Why option levels work as a support and resistance

Why do option levels render support and demonstrate resistance and who is interested in holding the price? The answer lies in distribution of the rights and obligations among the option buyers and sellers.

The options buyer has only rights and the options seller – obligations. The risk of the options buyer is limited to the buying cost, and the risk of the options seller is not limited and could result in the loss of deposit. It follows that the seller is interested in holding option levels, however, his capabilities are not known in advance. A major market maker (most probably) would hold the level, but if there is a crowd of small speculators instead of one major market maker, the price, most probably, would break the level and go further.

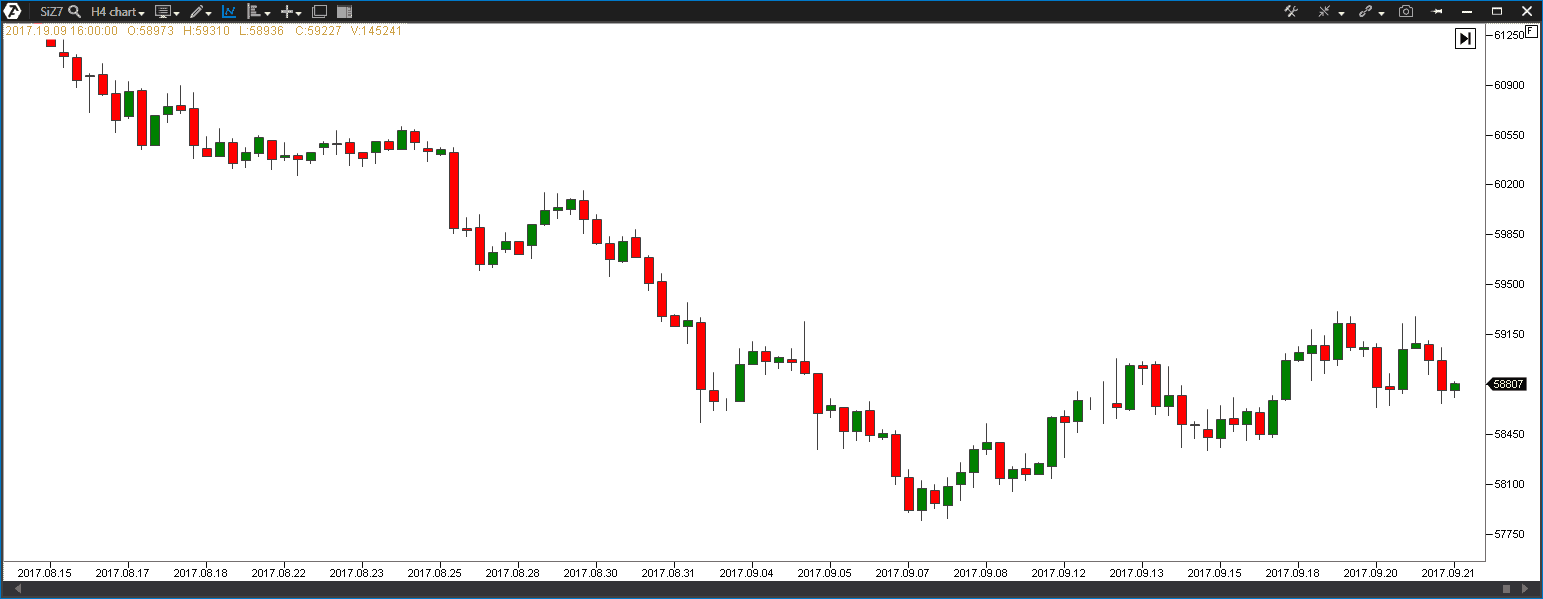

Let us see how option levels work using an example. We will use historical data that is why we go back to the not very distant past. We take the SiZ7 contract, traded on the Moscow Exchange, as a basis. This is a quarterly futures contract of December 2017.

We will take expiration of the August options contracts, which took place on September 17, 2017, as a base point. Note that the futures price was traded higher than the 60450 level before September 17. After expiration, the old option levels stop to work and the new levels come into force.

The calculation showed that the option resistance is at the 59300 level and support is at the 58000 level. The price started to decrease softly after the expiration. On September 1 the price broke the upper level of 59300 with the powerful downward movement and settled itself between the option levels until the next expiration on September 21, 2017.

This example clearly demonstrates the influence of option levels upon the futures market. If you have information about option levels, you will be able to understand market movements more objectively.

5 EXAMPLES OF OPTION HEDGING

As we already specified at the beginning of the article, the main purpose of options is insurance (or hedging) from unfavorable scenarios in the financial market. We will consider 5 basic examples of options hedging.

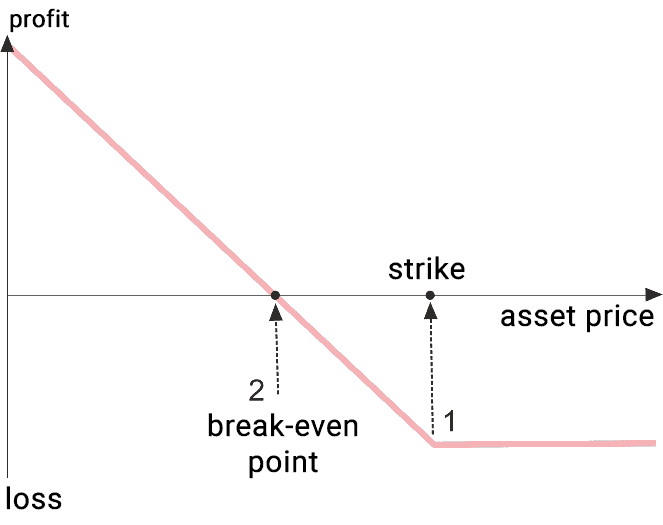

EXAMPLE 1. STOCK GROWTH STRATEGY.

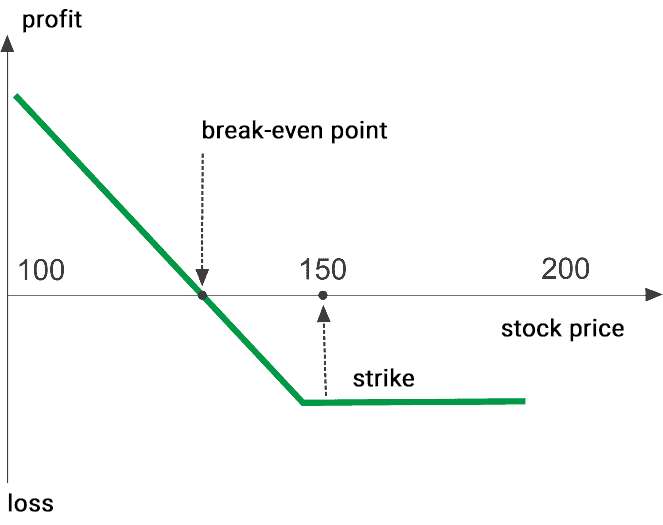

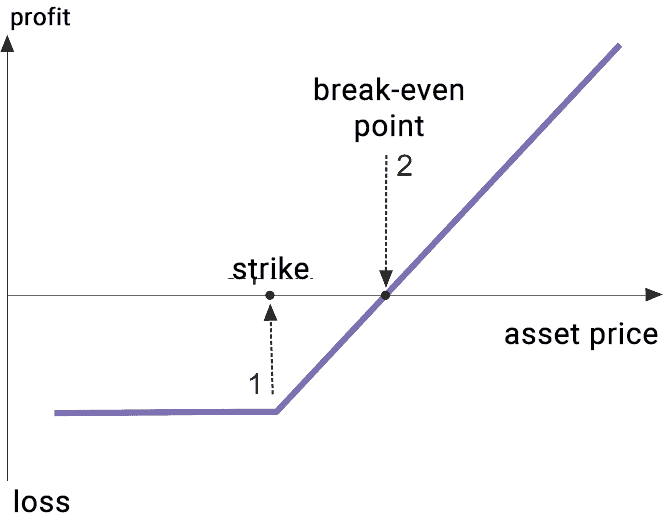

An investor wants to buy a company stock at the price of RUB 150 in anticipation of growth. In order to insure himself from the stock value decrease, the investor buys the Put option at a current strike. If the stock continues to grow, the option loss will be fixed and equal to the cost of buying. If the stock starts to go down, the bought option will start to bring profit to the investor after passing the break-even point. Under this strategy, the loss of the investor is limited and the profit is unlimited.

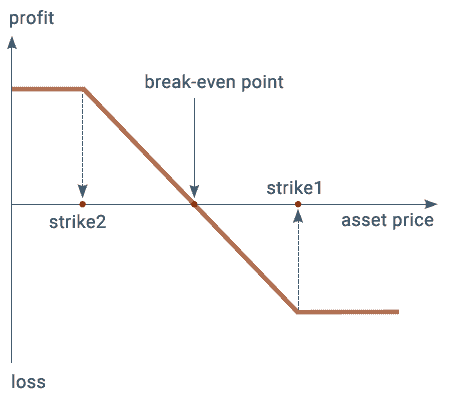

EXAMPLE 2. BEARISH STRATEGY. LONG BEAR PUT SPREAD.

The investor anticipates that the market would go down. This strategy envisages selling a Put option and buying a Put option with a higher strike. In case of using this strategy, both profit and loss of the investor will be limited.

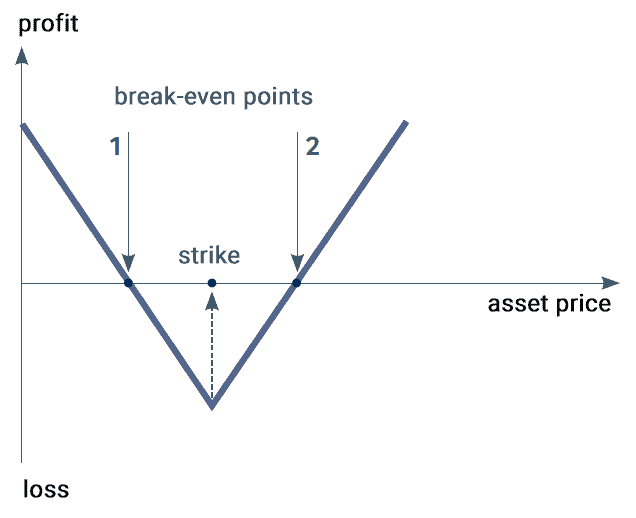

EXAMPLE 3. LONG STRADDLE.

Long straddle envisages simultaneous buying of the Call and Put options at one strike. Such a combination allows making money on volatility. Irrespective of where the market would go, the bought options will ensure profit. In the event of absence of volatility, the loss of the investor will be limited by the paid premiums.

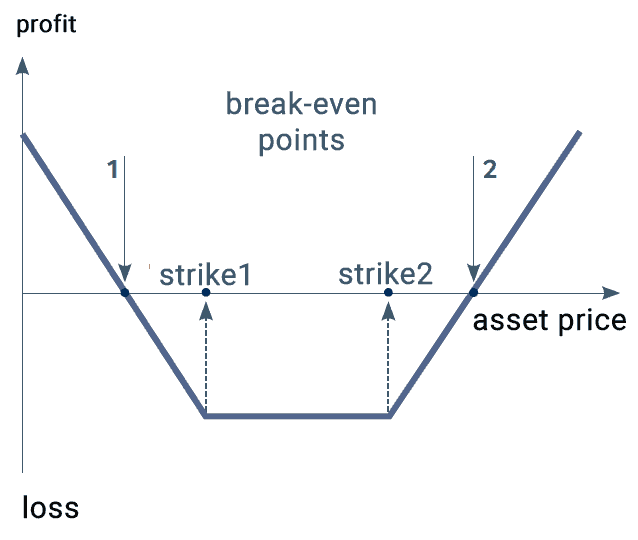

EXAMPLE 4. LONG STRANGLE.

EXAMPLE 5. CURRENCY RISK HEDGING.

Options, as well as futures, allow currency risk hedging. Insurance from the fall in the exchange rate of a foreign currency envisages buying the foreign currency and buying a Put option with the current strike.

- If the foreign currency becomes more expensive, the loss on options will be limited.

- If the foreign currency becomes cheaper, the options (after passing the break-even point) will bring profit to the holder.

As opposed to the futures hedging, which merely levels the risk balance, the options hedging can bring profit to the trader.

The opposite is true in this example. The investor keeps the national currency and buys the Call option with the current strike for hedging the foreign currency appreciation.

- In case of the foreign currency appreciation, the option (after passing the break-even point) will bring profit.

- In the event of the national currency strengthening, the option loss is limited by the cost of acquisition.

CONCLUSION

In conclusion we will show you a situation that took place in the Russian market at the moment when this article was being written. This article clearly demonstrates:

– how options expiration can influence the market;

– how market participants make mistakes;

– how patterns of technical analysis break down.

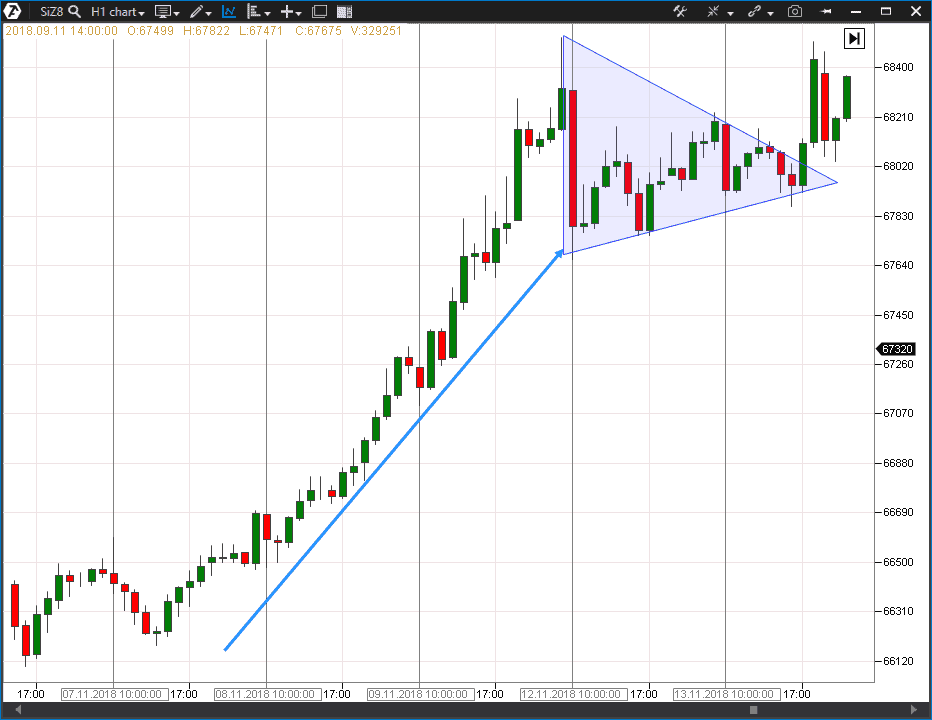

So, November 15, 2018, is the day of expiration of November options. The SiZ8 futures contract for the USD/RUB pair formed the pennant pattern in the chart – a classical model of technical analysis of continuation of the trend.

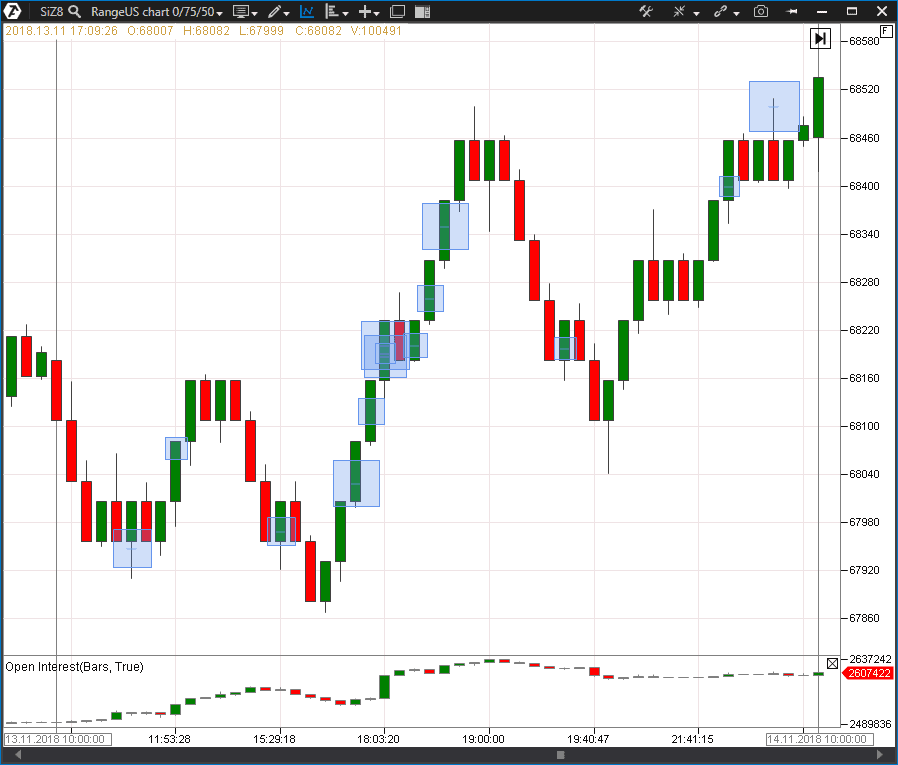

Let us analyze activity inside the triangle. For convenience we present a range chart as of November 13, which allows us elimination of the market noise and detection of important areas of accumulation of the large position.

There are two indicators in the presented chart – Cluster Search and Open Interest. Cluster Search searches for clusters with the volume of more than 2000 contracts with the bid-ask overweight of 80% (blue squares). Such settings of the Cluster Search indicator allow searching for clusters, in which the purchase volume exceeds the sales volume by 80% with the total purchase volume being not less than 2000 contracts.

Other examples of the Cluster Search indicator settings are in this article.

The chart in the RangeUS format with 0/75/50 settings filters out the market noise and clearly shows us horizontal ranges and trends.

The Open Interest indicator visualizes a change in the open interest by the instrument. The open interest value constituted 2 495 294 at the moment of the session opening and it increased by 104 824 by the session closing.

Combination of the RangeUS chart and Open Interest and Cluster Search indicators allow determination of areas, in which positions are gained.

Indicator readings could be interpreted as gaining long positions by an active major market player in the range of 67950-68220.

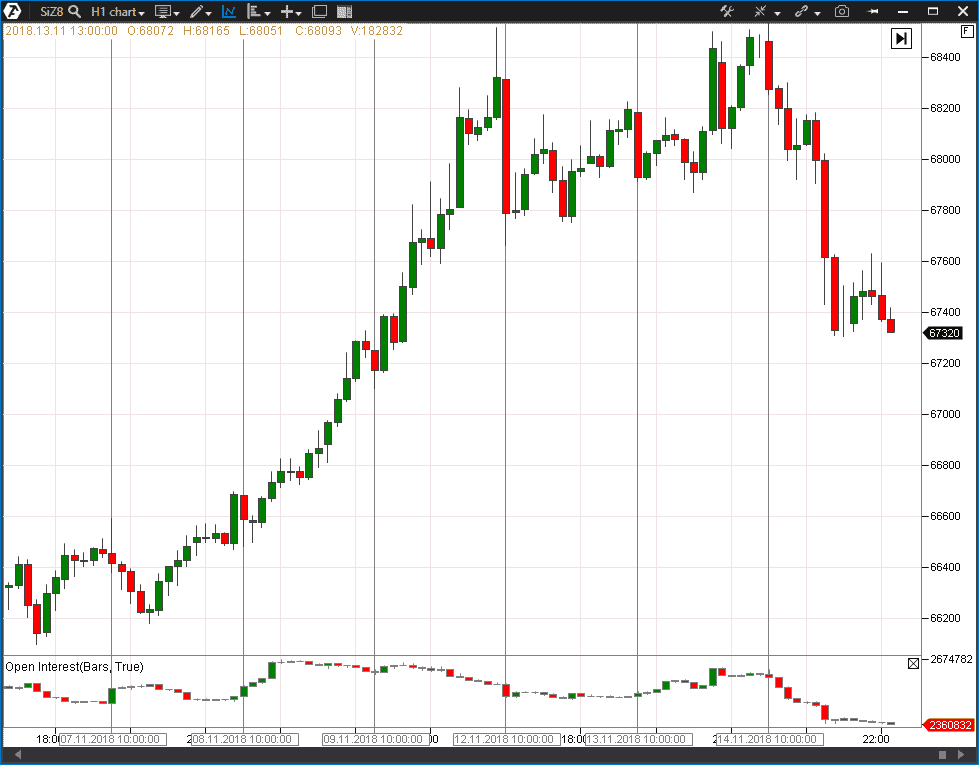

By the end of the session the price closed at the 68477 level. Now have a look at what happened the next day.

One day before the options expiration the price lost more than 1000 points and reached the 67320 level by the end of the session on November 14, 2018. The open interest value decreased by 241 080 in comparison to the previous session. We believe that the market participants closed their long positions with massive sales in a hurry.

If we look at the options board on the Moscow Exchange, we will see that a major volume was formed on 66000, 66500 and 67000 Call option strikes and the open interest in total exceeded 60 thousand of contracts. The average weighted price of this volume pointed at the 67500 level.

A rough estimate shows that if the price is 68500, the seller’s loss would be approximately RUB 30 million (60000/2*1000). We do not know who the options seller is and whether it is one participant or several, but his/their impact on the market is evident.

Take this into account in your trading, be extremely careful on the eve of expirations and do not tolerate drawdowns. Happy trading.

It’s truly a great and helpful piece of info. I am satisfied that you just shared this helpful info with us. Please keep us informed like this. Thanks for sharing.

Thanks for the feedback. Keep checking back on our blog every week.