Graphical patterns for your trading

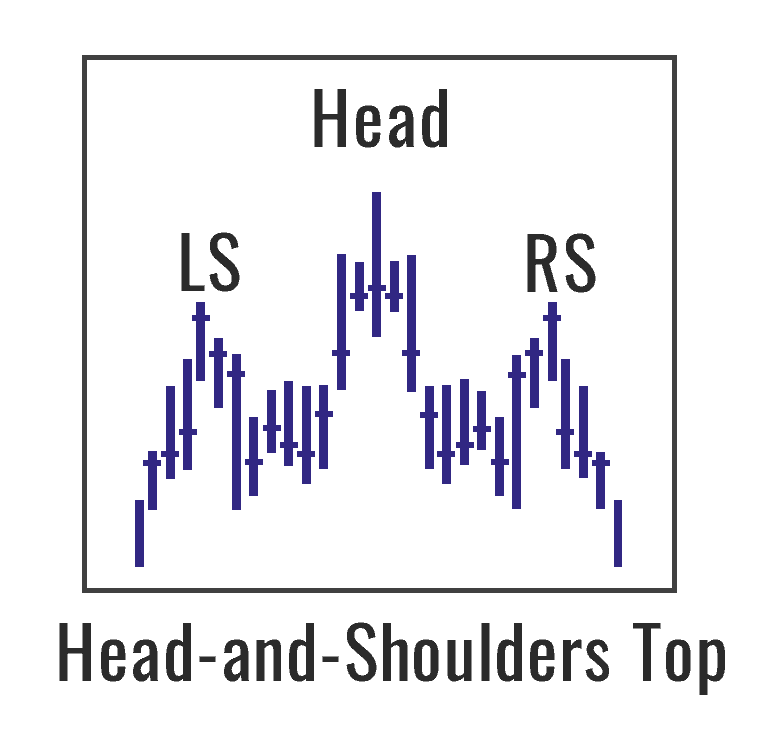

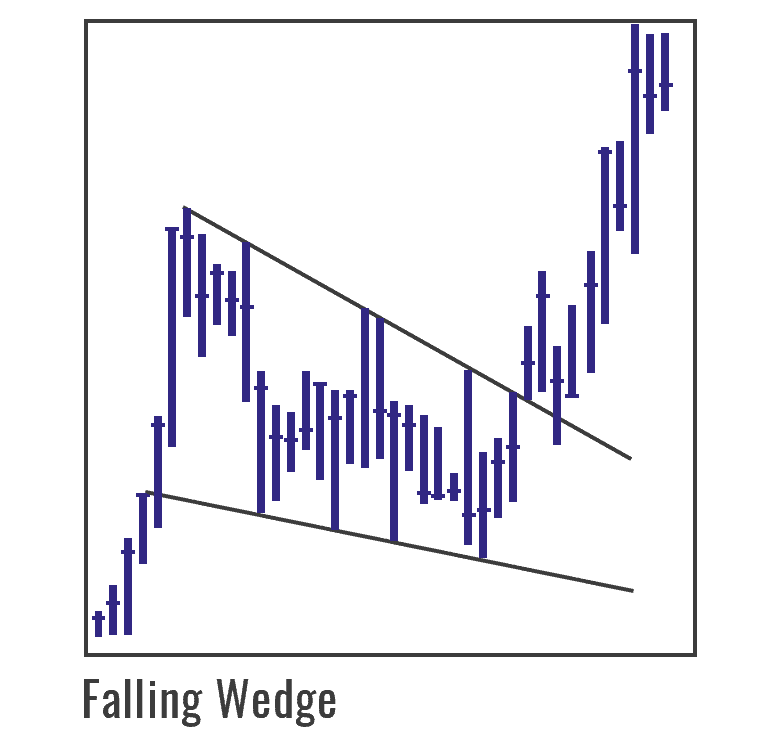

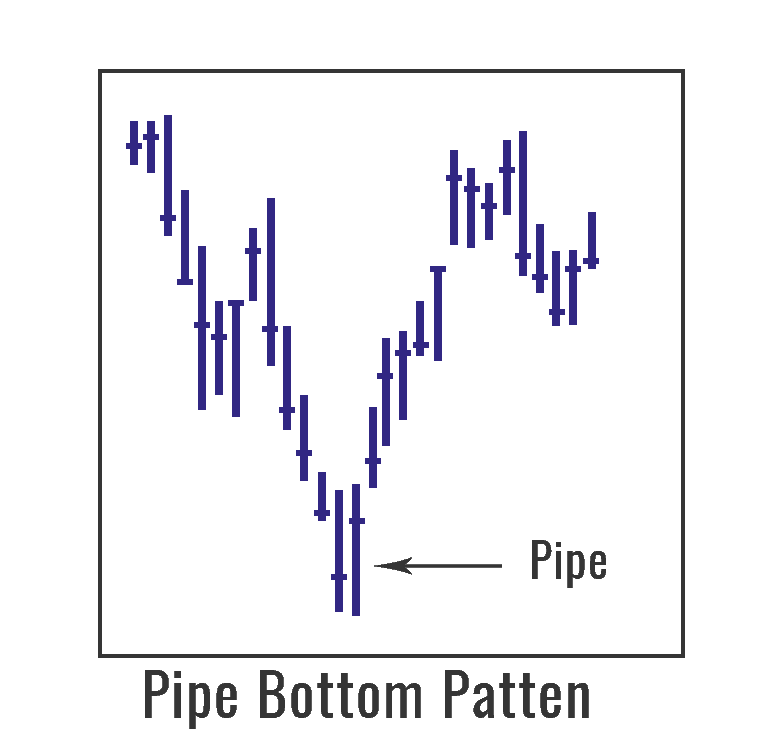

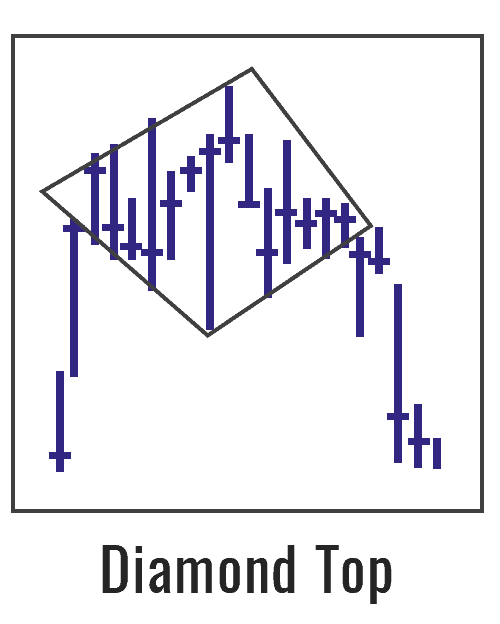

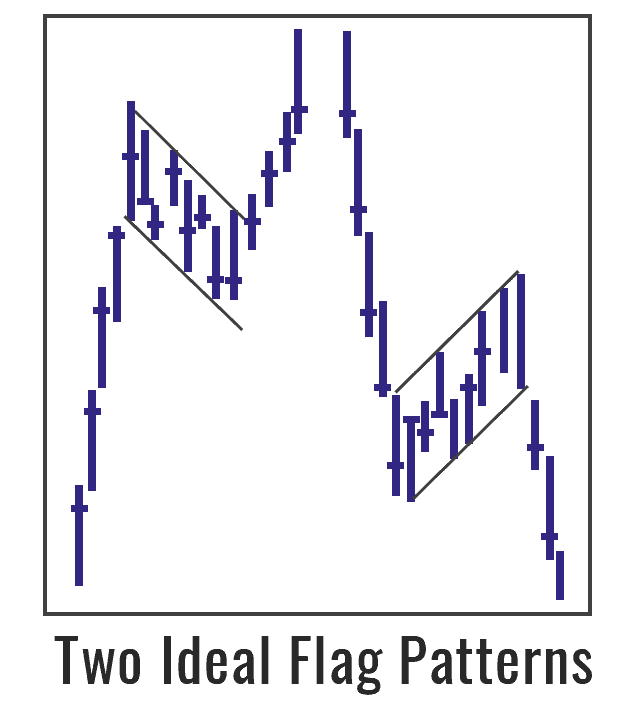

Chart patterns are a classical approach to analysis of the financial markets. It was widely used in the XXth century and is still used due to visual simplicity of chart patterns. However, is it wise to use today what was good long ago?

“The fundamentals always looked good, but the technicals were signaling a trend change just as I was about to pull the trigger” Thomas N. Bulkowski.

“How to identify a reversal chart pattern for achieving success?” Thomas wondered. He lost his job at the age of 36 and started to study trading. This sharp U-turn in his life brought him success and he became one of the most competent authors of valuable hands-on books for traders.

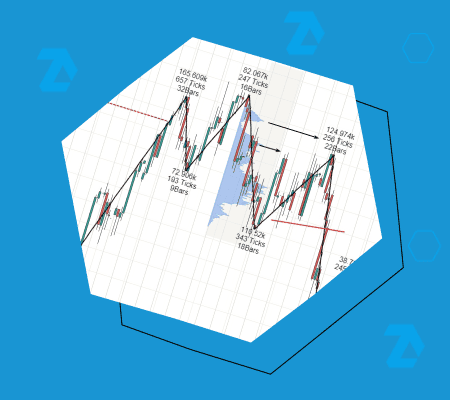

The second edition of his complete encyclopedia of chart patterns with statistical data was published in 2005. In this edition, Bulkowski managed to use the data of the bearish market that started in 2000. The author had done an outstanding job – the total number of chart pattern samples he found was 38,500! He tested the samples in the charts of 500 American companies from 1991 until the middle of 1996 and charts of different 500 companies from 1999 until 2004.

Bulkowski calls chart patterns the footprints of the smart money and divides them into:

- bull market patterns;

- bear market patterns;

- event patterns – price changes that take place after publication of a financial report, change of the owner or taking over another company.

In this article: