Tag Archive for: Futures in trading

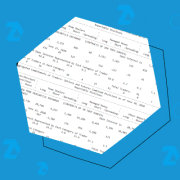

Top 9 most liquid CME futures. Part 2

/in Market TheoryDear traders! We continue describing 9 most liquid CME futures. We hope that you enjoyed our previous review. This one will also be interesting. Read the first part of this article in TOP 9 most liquid CME futures. Part 1. Read in this article: 30-Year Treasury Notes (ZB). Gold (GC). Euro FX futures (6E). JPY […]

Negative oil prices: what did actually happen?

/in Fundamental Analysis, Market TheoryDear friends! A historic event took place on April 20 – the May WTI oil futures traded at negative prices, reaching the level of minus USD 40. Yes! The oil price was MINUS FORTY dollars. Buying oil at such a price in real life would mean that you receive money for taking oil from the […]

Gold futures: 5 things you should know. Part 1

/in Market TheoryAlthough people cannot eat gold, it attracts them as a magnet since the dawn of time. It is a universal metal in its essence. Gold was used in the monetary circulation even in the previous century, since the coins made of it didn’t become rusty. Gold is widely used as an industrial material today, one […]

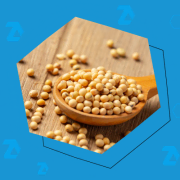

Soybean futures: 6 things you should know. Part 1

/in Market TheorySoybeans are oil crop and not grain crop, used, first of all, for producing oil which is contained in its beans. Soybean futures are among the most popular contracts in the commodity futures market. Soybean trading has an international character and the product itself is highly valued in Asia as a natural food. There is […]

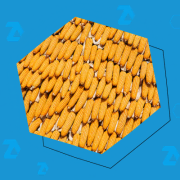

Corn futures: 7 important things you should know

/in Market TheoryTrading corn futures attracts many traders who are interested in the grain market. Corn futures practically do not differ from other grain futures, since the factors that influence the grain crop market in general are practically the same. However, if we look deeper, we can detect several factors, which distinguish corn futures from other agricultural […]

Nasdaq-100 index futures: 5 things you should know. Part 1

/in Market TheoryNasdaq-100 index futures belong to the category of index futures contracts, offered by the CME Group. These are the most popular index futures in the market. They are presented by various types of contracts, the first place among which in trading volumes and popularity is taken by E-mini Nasdaq-100 index futures contracts. E-mini Nasdaq-100 futures […]

Bitcoin Futures. Frequently Asked Questions

/in Crypto Trading, Volume AnalysisStarting from December 2017, the bitcoin rate has increased by more than 40% and its capitalization increased USD 200 billion for the first time in its nearly nine-year history. The bitcoin established a new historical high and reached the mark of USD 14,000 per cryptocoin. Analysts believe that one of the reasons for such an […]