Time stop: how to use it in trading?

The time factor in trading is often undervalued. Theoretically it may help traders to make more efficient trading decisions, move up the bottom level of profitability and facilitate an immediate closure of loss-making positions. The time factor could be used by different types of traders for improving the decision making process regardless of the trading style or trading system. Simply speaking, it is yet another component of the trading system, which could be used along with a standard stop loss.

In this article:

- The time stop concept.

- Entry into the market.

- ‘Cut’ losses as a professional.

- In pursuit of profit.

Time stop – introduction

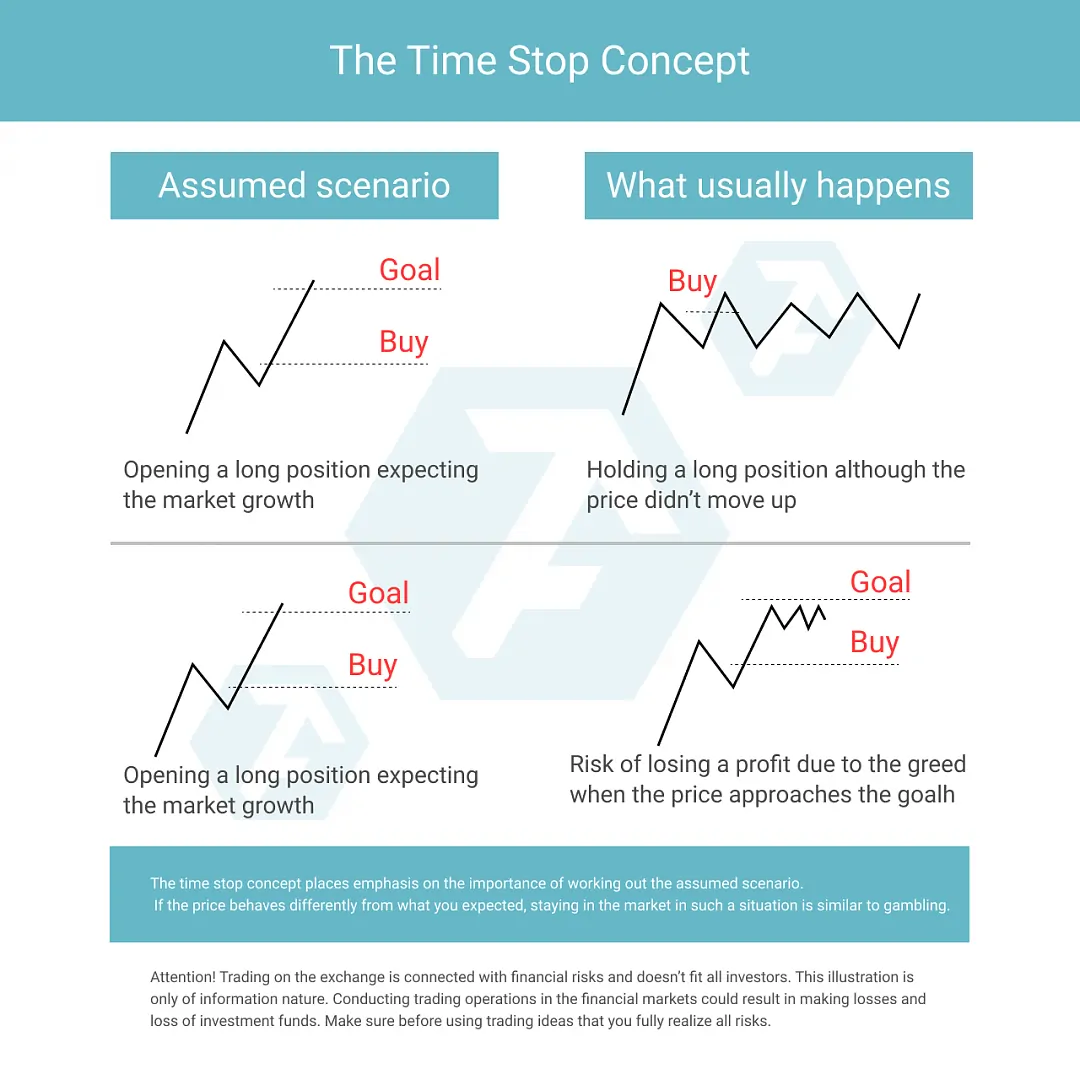

The time stop concept makes the market developments dependent on time and assesses price movements on the basis of the speed with which they take place or do not take place at all (when there is no focused movement in the market and the price makes no progress). There are three main variants of application of time stops and all of them could be used for improving the quality of your trades.

Entry into the market

How often do you execute trades, after which nothing occurs in the market and the price continues to stay at the same price levels for hours? It happens quite often but traders perceive it as something which is inherent in the price without paying due attention to the analysis of influence of such price behaviour on their trades.

Just imagine that a buy setup, which corresponds with your trading system, emerged in the market. You execute a trade after which the price doesn’t move in your direction. What would you do? The majority of traders would simply wait hoping that the price would still make the forecasted move.

If your trading idea envisages a focused upward movement and the price behaves differently, it is better, as a rule, to exit the trade. If the price fluctuates in a narrow range, it is similar to gambling to continue to stay in the market in such a situation.

‘Cut’ losses as a professional

The next example describes a scenario when you execute a trade and the price immediately goes against you. Often traders find themselves in a trade when the price fluctuates within the range between the trade entry point and stop loss. They do not like to ‘cut’ losses only because they continue to believe (hope) that the price would reverse and they would, nevertheless, make profit.

Being in the above described situation, try to refresh the initial trading idea in your memory – quite often traders, having executed a trade, completely forget about their trading plans and give way to emotions. If you are sure that the price should go up, after which it fluctuates within a lower price range, it means that the number of buyers in the market is insufficient for the upward movement and you should analyze your trading idea again. Just to stay in the loss-making trade hoping to move it into the breakeven is a demonstration of your unprofessionalism, which you should get rid of. ‘Cut’ losses and do not risk even more if the market situation changes against you. You’d better move to another trade.

In pursuit of profit

The third variant describes a scenario when traders are in a profit-making trade but the price stops before the take profit. What to do? To wait and hope that the price would continue its movement towards you and risk the profit? To close the profit-making trade and get a smaller profit? Or to protect your trade?

Traders become very greedy too often and risk the major part of their profit hoping to get a bit more and prove correctness of their trading ideas. Or they are afraid of closing their trade prematurely and lose a potential profit. As you can see, the answer to the question how to work with a non-realized profit is not that simple.

The time stop concept assumes exiting a trade when the price doesn’t do what you expected it to do. It is unwise to stay in the market hoping that the price would pass some points more. If the price doesn’t move, it demonstrates a balance of the buyer and seller forces and a lack of confidence of the market participants. In such a case, the futures price movements become unforeseeable and the hope to make additional income becomes gambling.

As you can see, the time stop concept is universal and could be used by different traders. This is a wonderful supplement to your approach in trading.

Share your opinions in the comments! See you soon, dear friends!