Basic knowledge for finding investors

Imagine that we deal with a reasonable trader who trades on positive territory. However, he cannot make decent income just because he does not have a sufficient trading capital. All his profits are disproportionate to his efforts and do not cover even vital requirements. What to do?

To take a credit on property? Well, we already decided that we deal with a reasonable trader! There is another variant – to attract an investor.

Today, we will speak about 2 things a trader, who wants to take capital into management, should know.

- What issues investors are interested in.

- How to attract investors.

Introduction.

Of course, trading with the use of your own capital has a number of important advantages:

- Independence in selecting instruments and making decisions. You can have a day-off any day and go to the beach or (much better!) to read the ATAS blog.

- Nobody ‘eats your brain’ and the angry investor does not kick your entrance door.

- There are no legal issues you have to deal with.

- The whole profit goes into the trader’s hands.

But there is a disadvantage – a funding shortfall. If so, it makes sense to look for investors.

Serious money is accumulated on bank deposits and bring passive income, which, usually, is a few percent higher than inflation. But it does not mean that a big capitalist is not inclined to take risks. But he does it wisely.

An investor can, within the framework of management of his portfolio, send a certain portion of his funds into the projects with higher risk but also with a probability to get higher profit. That is why he is ready to support different strategies and funds under management of perspective traders.

What should you know and be able to do in order to get money from an investor? There are 2 basic things, which we would discuss further.

Point 1. What issues investors are interested in.

Of course, you need to have positive statistics. If you have a profitable strategy (trading strategies for trading in the market), which proved its profitability during, at least, one year, you can offer this strategy to investors.

Main issues an investor is interested in:

- what hypothetical profit he can gain;

- what risks he can face.

As a rule, the majority of investors prefer to give money into management of such a manager, who offers a low annual income but who has a low circulating capital drawdowns. It is connected with the fact that the first priority for major investors is the capital preservation, while making profit goes next.

Low-income strategies are, as a rule, long-livers, because they have a minimum risk.

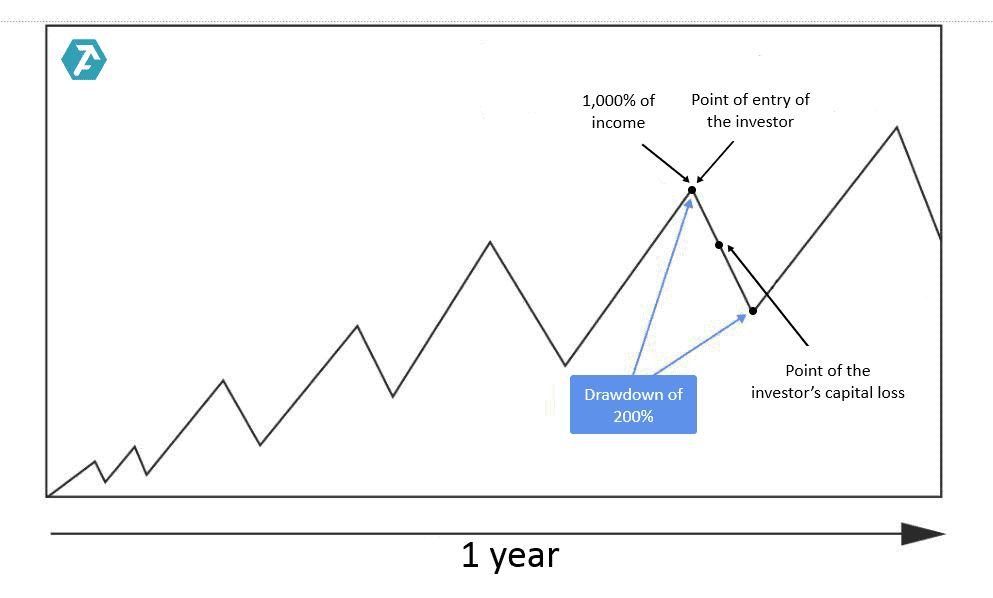

The most risky strategies are ready to offer 1,000% annual, but their maximum drawdowns can reach 100% of the invested capital. An investor has a chance to get into a situation when a managerial account produces a drawdown of 100% or more immediately after beginning of co-operation. These 100% will not spoil the overall picture of the account profitability, but opened positions of the new investor will have losses, which means the loss of his capital.

Major investors, as a rule, do not invest in such extreme strategies, because drawdowns in one hundred and more percent would finally lead to the loss of the whole capital.

Point 2. How to find an investor

There are two ways:

- You can directly send your offers to professional investors, who are ready to give money into management. You can google them using ‘prop trading’, ‘take money into management’ and similar queries. We will not publish specific names for obvious reasons. If you choose this way, be ready for serious ‘screening’. Most probably, you will have to prove yourself on a demo account.

- You can attract a big number of small investments from non-professional investors – regular folks. Contact your broker and find out whether he allows opening public accounts for accepting investments. It could be organized in the form of trade copying services, PAMM (Percent Allocation Management Module) and other formats. Having opened an account, which would allow accepting investments, you would be able to focus on trading. Since the positive public statistics on your account is the best advertisement for attracting investments. Nevertheless, you can accelerate fundraising through promoting your account in social networks, thematic blogs, on forums and through context advertising.

Summary.

In the end we should note that exchange trading using own funds is much simpler. You are free to choose instruments and risks and you do not have to write reports and deal with legal issues.

Search for investors is a proper step for profitable traders, who do not have a sufficient personal capital. When working with the investment capital, you would move up to a new level of development as a trader. And the trading and analytical ATAS platform will be your reliable assistant in this undertaking.