Read in this article:

- Difference between trading and hired work;

- Can you combine trading and hired work;

- What type of trading fits you better – positional or intraday;

- What are chances in trading;

- How to increase your chances to be successful in trading;

- How to increase your chances to open a profitable trading position.

Difference between trading and hired work

Trading is not a work, but a business process. When you work you receive payment in accordance with the volume of your input or wages, set by your employer. In trading, you make profit if you managed to make it. You do not know when you get money and whether you get it at all – this is the idea of entrepreneurship. Trading differs from hired work by scalability. It means that a potential income does not depend directly on efforts made. For example, the taxi driver’s income is limited by a number of clients he can drive during a working day. A trader can make dozens and hundreds of thousands in hours and minutes. However, this story has the other side. A taxi driver will always make living, while a trader can lose everything when a wide bar grows ‘in the wrong direction’.The main purpose of the stock market is to make fools of as many men as possible. Bernard Baruch

Unfortunately, chances to be successful work against a trader. We will speak about chances a bit later. Understanding a complex nature of trading makes you concentrate on survival and behave yourself carefully in the tough struggle between buyers and sellers. Conclusions, which we can make right now:

- Trading is good for people, for whom a possible loss of the trading capital will not critically affect the life quality (loss of a house, family, health, etc.);

- Trading is good for people who can make decisions under conditions of uncertainty;

- Trading is not a work or entertainment. Trading is a business process or entrepreneurship.

Can you combine trading and hired work

If your hired work brings you stable income and finishes at a certain time when you leave the office, perhaps, you can combine it with trading. This model has advantages and disadvantages: If you cannot make profit trading several hours a day when you are free from your hired work, do not entertain illusions that you will make profit if you quit your hired work and start trading the whole day. Most probably, the reason of losses is not in a number of hours you spend on trading, but in something different: strategy, tactics, psychology, discipline, risk management, etc.What type of trading fits you better

We can divide traders into two big groups:- Traders that trade within one day. These traders do not hold their positions overnight. They are called intraday traders. These people are capable to and are fond of making fast decisions.

- Traders that hold their positions from several days to several months or even years. They are called positional traders. They usually trade stock.

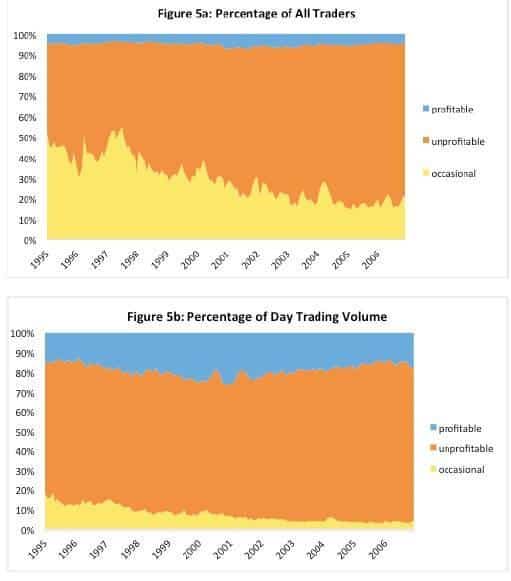

Many traders prefer intraday trading in order to get rid of uncertainty and potential losses when closing their positions. They are also interested in fast accumulation of their working deposits. There are quite a lot of intraday traders. Brad M. Barber and Terrance Odean published a study in October 2017 ‘Do Day Traders Rationally Learn About Their Ability?’, in which they analyze results of intraday traders on the Taiwan Exchange. According to the authors, about 29% of traders engaged in day trading on the Taiwan Exchange from 1992 until 2006. This share definitely increased during the past 15 years due to technology development and easier access to exchanges. The study provides interesting data, which deserve special attention. We believe that they are also true for other exchanges:

- traders that make a cumulative intraday profit for more than 10 days in a row – blue color;

- traders that make a cumulative intraday loss for more than 10 days in a row – orange color;

- traders that periodically make a cumulative intraday profit for 1-9 trading days in a row – yellow color.

The second chart compares trading volumes of different groups of traders. And we can see here that traders, who constantly lose, trade more often or with bigger volumes than those who win. It is ‘a crowd’. The following conclusions can be drawn from these charts:

- Majority of intraday traders do not make profit;

- It is not necessary to trade often and with big volumes in order to become a profitable trader.

Chances in trading

In our everyday life we assess our chances of anything approximately like in a joke about chances of meeting a dinosaur – 50:50. It is much more complex in trading. In order to make money on the exchange you need to assess the following chances beforehand:- chances of profitability of a specific trade. We will write how to increase your chances to open a profitable position in more detail a bit later;

- chances that your trading account will not be demolished by losses. An approximate loss sensitivity threshold is 20% of the trading account. As soon as losses go higher, traders start to behave themselves differently than before. They open trades to compensate losses, violate rules of the trading system and increase the number of traded lots. Monitor you trading account closely. If there are several loss-making trades in a row, stop trading and have a rest, say, until the end of the month. The harder your efforts were to earn the money you trade with, the more painful the losses would be. Just accept the fact that you can lose your initial capital for good from the start;

- chances that a trader will be able to restore after a row of loss-making trades. A trader can stop making losses if he is psychologically and materially ready to make a fresh start, instead of stubbornly trying to prove that he is right, holding loss-making positions. Another way to perfection is to learn from those who achieved the stage of stable profit-making and who uses advanced software;

- chances of a trader to become stably successful. We will discuss how to increase your chances of a stable success in the following section.

To assess a probability of any outcome in trading objectively is much more difficult than in the dinosaur case.

9 methods to increase your chances to become a successful trader

- Be patient

What is the main specific feature of any trader? You might think that it is agile mind, quick-wittedness and self-confidence. These are stereotype features. We think that the main feature of a trader is patience. Patience is required to:

- catch rare moments with the best risk-to-reward relation;

- fight the urge to enter a trade when the market is idle or there is no trading setup;

- allow the trading capital growing slowly and gradually;

- get used to risk.

- Be executive in trading. Strictly follow your trading strategy and do not try to improve it, ‘because you are great and smart’.

- Give yourself time to become successful. Learning trading and development of a trading strategy could take several years. Do not hurry. Nothing should be done in haste but gripping a flea, in all other cases it is better to pass additional training.

- Accumulate sufficient trading capital, the loss of which will not affect your life quality.

- Use modern methods of analysis and software – this will give you additional competitive advantage.

- Free your brain from preconceived opinion about a possible price movement.

- Be very attentive. Defocusing might result in missing a trading signal or, vice versa, choosing unformed trading signals.

- Do not look for trades on idle days with low volatility and volumes, for example, just before weekends or holidays.

- Get used to the fact that trading is connected with uncertainty. Anything can happen at any time.

How to increase your chances to open a profitable position

Theoretically, a trader can get in any trade:- big income;

- small income;

- big loss;

- small loss;

- breakeven.

In practice, your work should be organized in such a way so that to exclude item 3 from your results. The other variants are acceptable. Correctly execute each trading setup:

- assess (before a trade) what part of your capital you can put at risk, that is, identify protective stops beforehand;

- assess statistics of this trading setup using historical data and your trading log. The number of profit-making trades should be bigger than the number of loss-making ones;

- assess what occurs if you make a loss in this trade – will you be able to trade further and what happens with your trading account.

If you cannot answer at least one of these questions, do not open a trade, because your chances to make loss are bigger than to make profit.

Let us consider an example of a trading setup, based on horizontal volumes or Market Profile.

- Entry into a buy – a limit order is several ticks above the upper boundary;

- Stop behind the lower boundary of the balance area – point 2. We can post a stop directly on the lower boundary of the balance area, but we want to let the price ‘breathe’;

- It is difficult to identify take profit in initiative trades beforehand, that is why we decided to exit on the first big red candle in point 3;

- Number of contracts depends on the working capital size.

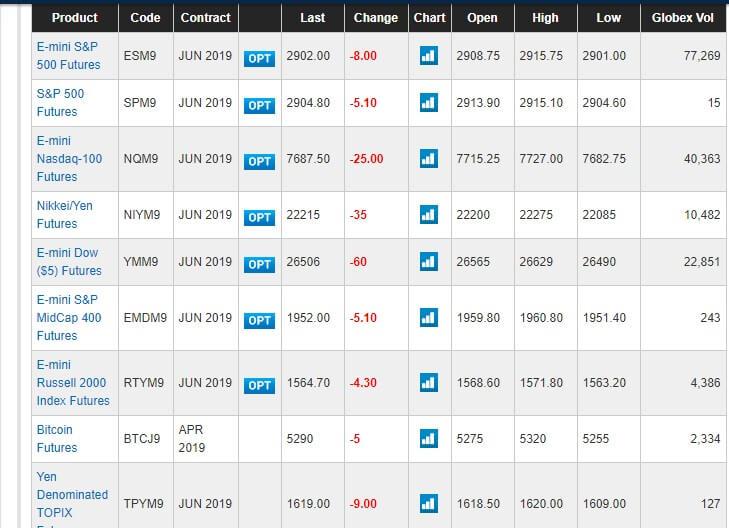

We identified all the above mentioned parameters beforehand, because the trade was slow. The balance area was formed during two days and we had time to double check and assess the amount of possible losses and profits, post limit orders and then move the stop to the breakeven level in the course of the trade. Do not trade in the markets, for which you do not have a sufficient capital. Choose other instruments. For example, you can find mini and micro contracts on CME, for which the collateral security margin is much smaller than for standard contracts.

- specifications of futures contracts;

- expiration date;

- guarantee collateral amount;

- price increment;

- news and reports that have influence on these instruments.

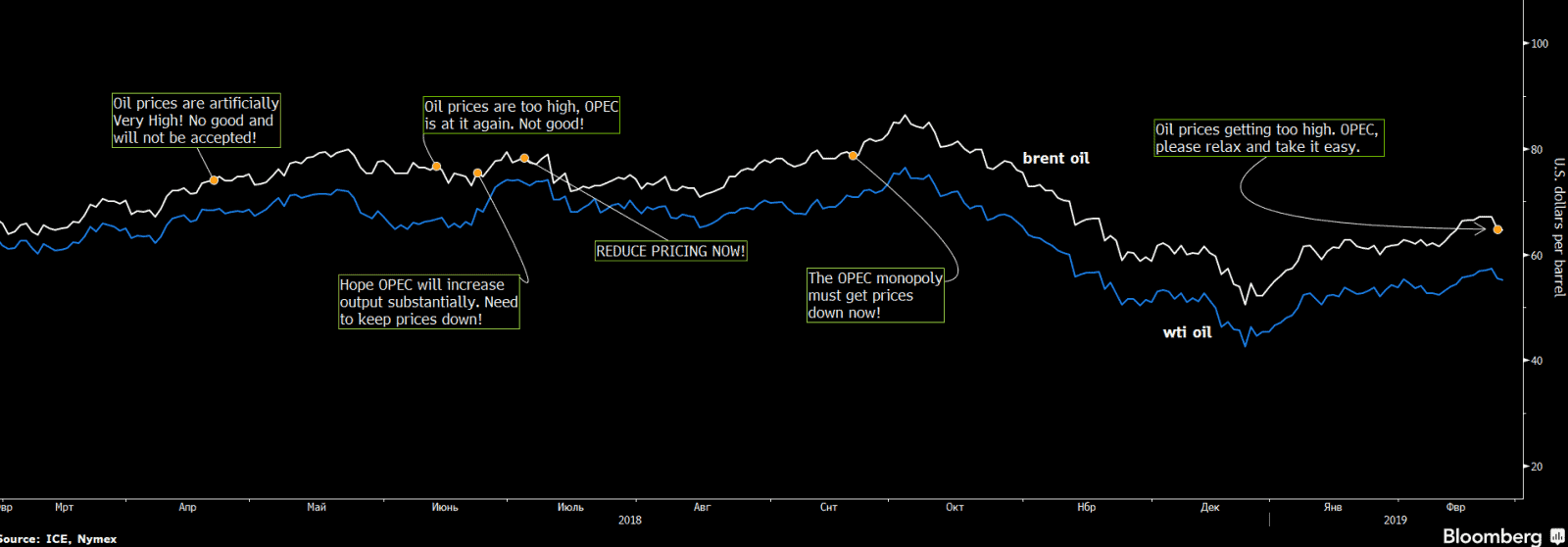

For example, weekly data about oil reserves, published by independent agency EIA, are important for oil futures contracts (interesting article about oil futures). Some traders take into account interrelation of tweets of the US President Donald Trump and oil futures prices.

Summary

Use systematic approach. Trading is a serious business in which you cannot win without stopping to think.- Study thoroughly both the computer and software you work with.

- Knowledge of basics of statistics and probability theory will help you to assess your chances and risks correctly.

- Remember that traders that can simply follow the rules achieve success more often than those who try to prove that they were right.

- Find a place for trading without jeopardising your living standards. It depends on you and your personal circumstances whether you combine your work and trading and engage in positional or intraday trading. On our part, we will help you with a modern trading platform and advice how to use it.