Reading brokerage statements is, surely, not one of the most entertaining activities, but it is important for the sound capital management. If you do not read or do not understand brokerage statements, which you receive by email in the end of the day, you might leave unnoticed dangers that threaten your portfolio, mistakes or even downright fraud, which might be hidden from a fleeting glance.

“When people take out a mortgage or buy a gas grill, they take time to figure it out. But when it comes to investing, it can be a big pain in the neck. And people are busy with their lives, and their kids, and watching the ball game,” said Steve Sass, the program director of the Financial Security Project at Boston College’s Center for Retirement Research.

So, when you receive an email message from your broker, do not discard it, but open and read attentively. It is true, reading brokerage statements is not very entertaining, but very important, so, you need to read attentively every single piece of information. If you come across something inappropriate, do not hesitate to ask your broker to give explanations or, if necessary, contact regulatory authorities, such as FINRA (Financial Industry Regulatory Authority), which control the brokerage industry.

Example of reading a brokerage statement

Let’s take one of the standard daily statements, received by a trader who trades futures and bonds in the American markets.

The statement structure is the broker’s preference. Our example statement may look similar or differently from another broker’s statement. But important and basic information must be present in a statement in one form or another.

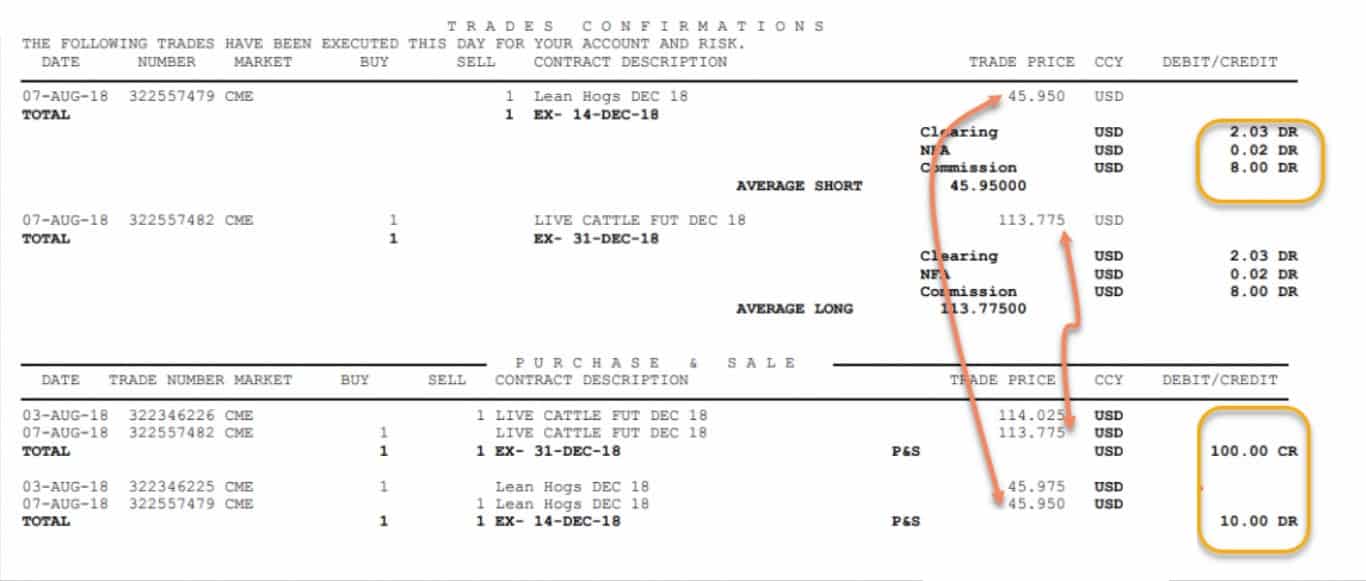

The brokerage statement we use in our example starts with the Trades Confirmation section. As it is clear from its name, it contains a list of executed trades with all commissions.

The second section is Purchase & Sale, which reflects the financial result of the executed operations.

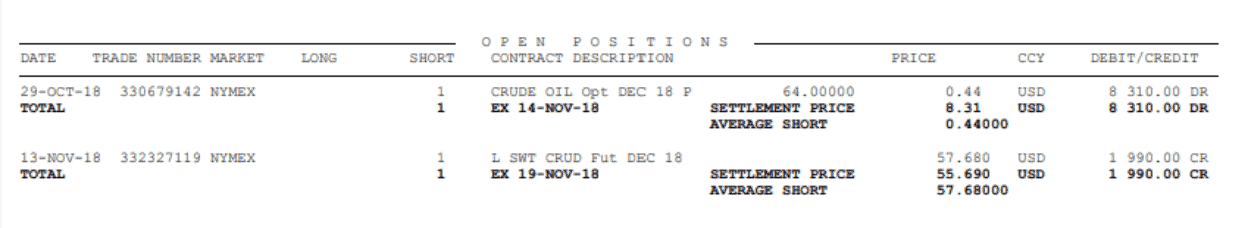

The Open Positions section contains detailed data about current positions. If you bought a contract and haven’t sold it yet, it will be reflected in this section.

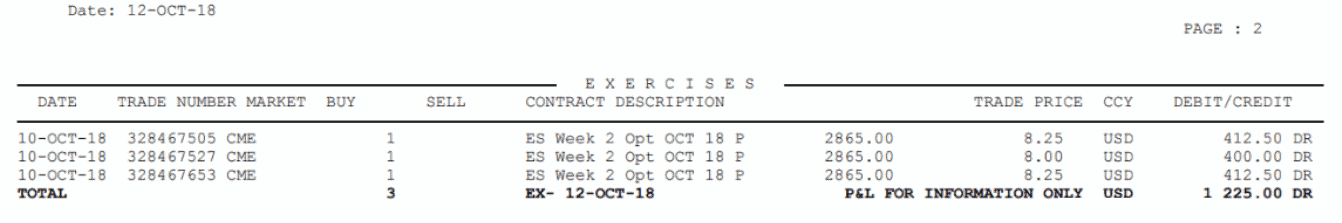

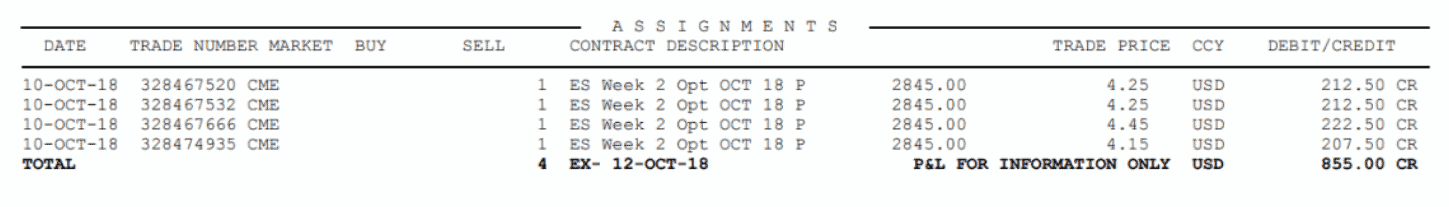

The Exercises and Assignments sections reflect data of the options, which are under expiration.

In the event of expiration of the long option “in cash”, there will be the EXERCISES section. Herewith, the premium paid during the purchase is charged in favor of the option seller. In our case the 1,225.00 DR note appears.

In the event of expiration of the short option, the ASSIGNMENTS section appears. Herewith, the total premium is charged in favor of the option seller. In our case the 855.00 CR note appears.

Summary

If you detect inaccuracies or discrepancies in a brokerage statement, contact your manager or brokerage firm as soon as possible. If they cannot solve the problem, prepare a complaint and file it with a regulatory authority.

Maybe you do not like reading financial documents, but when it comes to brokerage statements, your negligence could be extremely dangerous.