The most common mistakes made by beginners. TOP 9

“Any man can make mistakes, but only an idiot persists in his errors”

Marcus Tullius Cicero

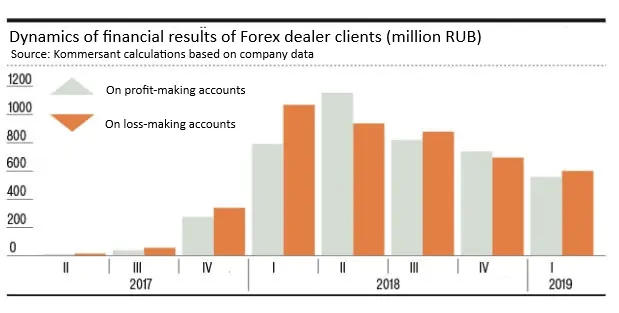

There are more and more people wishing to make money through exchange trading, however, only 23% of the traders achieve a positive result (average readings on American forex brokers for 2016). What are the reasons of such a disappointing outcome? What are the main mistakes of beginner traders? And, the most important, how to avoid them?

We conducted a small research. We spent:

- 48 cups of coffee, analyzing Google top 100 articles on the “main mistakes of beginner traders” subject

- 289 minutes, speaking with experienced traders who agreed to share their experience

Do you guess to which surprising conclusion we arrived?

It turned out that all mistakes of beginner traders could be split in three main groups:

Fundamental mistakes

Psychological mistakes

Money management mistakes

Let us consider in detail each group of mistakes.

Each group has three mistakes. Total – 9. In this article we will describe each group, their reasons and efficient means of elimination. This would help to take less knocks on the way from a beginner to a profitable trader.

Fundamental mistakes of beginner traders.

First of all, they appear due to lack of knowledge of the basics of the fundamental, technical and volume analysis.

First of all, they appear due to a lack of knowledge of the basics of fundamental, technical and volume analysis. At first sight, this problem could be easily solved: Internet and bookstores are full of books that promise you to help to make one million dollars in one year. However, methods of well-known traders and investors often contradict each other.

- Warren Buffet believes that investments should be concentrated, not diversified;

- Peter Lynch advises not to buy on breaks;

- Jim Rogers does not think that a trend is the best way to make money.

It is obvious that there is no golden key or magic Grail in making money on the exchange. Success depends not only on what methods you use, but also on whether these methods are good for you and how advanced they are. Our information materials will help you to learn how to use various modern methods of analysis and how to avoid mistakes.

The next fundamental mistake is the use of outdated instruments of technical analysis represented in a trading platform.

Technical analysis is a set of instruments that help you to understand what happens in the market and where the prices move. A cluster analysis is the most modern and high accuracy method of price forecasting based on detailed elaboration of traded volumes. It gives a three-dimensional representation of the price, volume and time, in which these volumes are traded.

Please, compare Pictures 1 and 2. Don’t you think they look like a smartphone and a push-button phone? That trader will make more money who will grasp the market situation faster and clearer.

A trading platform should have enough instruments to create competitive advantages over other traders. Here is a suggested list of instruments of volume analysis, which would ensure 100% transparency of the market even for beginners.

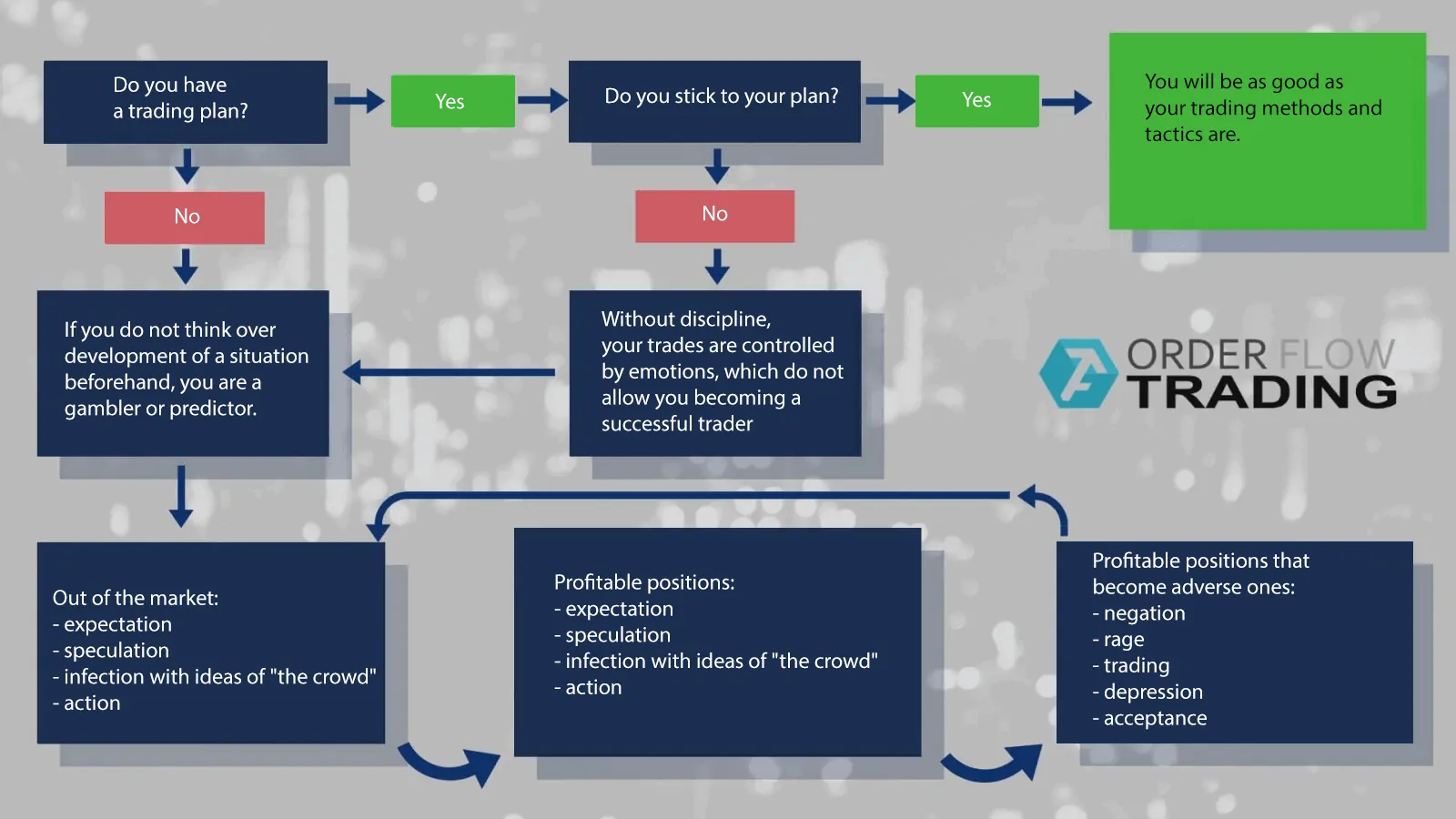

Each trader should have a trading system or trading plan for making specific decisions.

Their absence is the next fundamental mistake of beginner traders.

A trading system is a set of clearly formulated rules of application of the technical cluster analysis for:

- entering a market position

- exiting a market position

- limiting money losses

This is not a forecast of the market movement, these are elaborated instructions that describe your actions depending on what happens in the market.

For example, you take a car to get to work when it is raining or have a walk if the weather is nice.

It is the same in trading. You decide to sell a futures if, for example, a negative delta appears on a new high and the maximum volume goes down. If you do not follow these conditions, you are out of the market.

A TRADING SYSTEM:

- arranges trader actions

- identifies points of entering or exiting beforehand

- limits losses

- adds comfort and order into activity of a beginner trader

WITHOUT A TRADING SYSTEM BEGINNER TRADERS:

- get nervous and mess around

- suffer big losses

- make emotional trades

- make psychological mistakes, which we would discuss below

Psychological mistakes of beginner traders.

Absence of a trading system turns a trader into a gambler or predictor.

- A gambler is a person who wants to have fun in the first place and, maybe, make money. Trading for this person is like placing stakes on sports events or in a casino. Such traders do not bother to analyze the market or develop a trading system. They just buy and sell bleeding red thick and fast.

- A predictor is a trader who took a certain position with respect to the future market movement and longs to be the first one.

For example, a trader will become bullish while waiting for a publication of a weekly report about decrease of oil reserves in the USA. As soon as the trader becomes positive about the next market movement, he starts looking for supportive facts and ignores all contradictive ones. Conscious logical thinking and a wish to make money become secondary factors. The biggest desire is to be correct in the own forecast. The desire to be correct also explains a human tendency to focus on why the market moves upwards or downwards instead of focusing on where it moves. In order to understand where the market moves, it is necessary to pay attention to major levels.

Taking their losses and profits too hard, the traders make the following mistake – they personalize successes and failures.

Personalization of a success is an equation of the profit with own abilities only, although it could be a mixture of:

- good luck

- concourse of circumstances

- volume/technical analysis

- right place

- right time

Such traders believe that their presence alone will make a trade profitable. I am a special one, I am better in trading than others and turn everything into gold as the king Midas. Do you remember the end of the Midas story?

Personalization of losses is an inclination to consider yourself a looser due to market losses. However, market losses are external and objective losses and only our attitude makes them personal.

There are no correct or incorrect decisions in trading. There are weighted decisions and emotional ones.

Each beginner trader passes 5 stages when suffering losses:

- negation – no, it’s just can’t be true

- rage – you go off on your family due to your position

- trading – if the market turns my side I will close the position immediately

- depression – you lose weight and do not sleep well

- acceptance – most often a forced closing of a position by your broker due to absence of sufficient funds on your account

These stages could replace each other, rotate and repeat. Only limitation of losses, envisaged by a trading system, will save a beginner trader from sufferings and will help to limit losses to the planned level.

By the way, you can use a programmatic method to limit your losses https://support.orderflowtrading.ru/knowledge-bases/2/articles/398-avtomaticheskie-zaschitnyie-strategii-exit-strategy

The next psychological mistake are emotional decisions.

A trader is a human being and emotions are natural for him. But a trader should avoid emotional decisions during trading, since such decisions will inevitably lead to losses.

There are two basic models of emotional behavior:

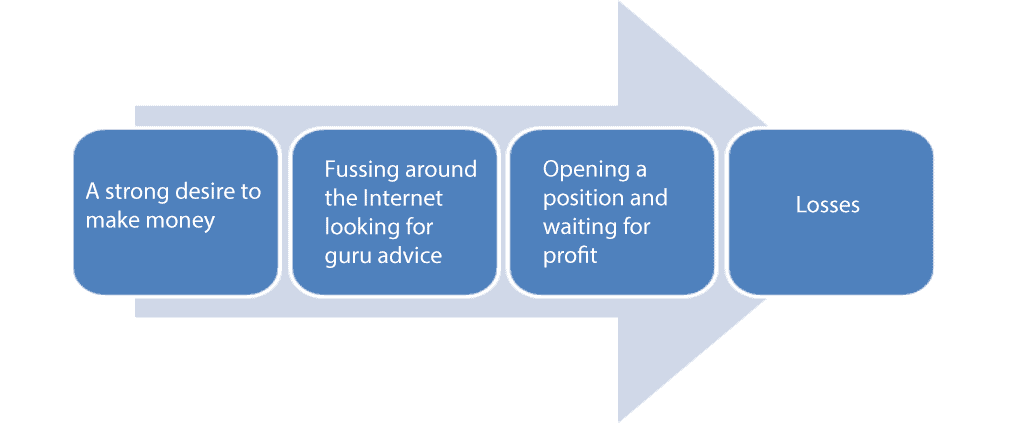

The deception model. A trader is willing to make money, he reads multiple exchange bulletins, books, news and makes decisions on the basis of advice, he opens a position and is waiting for a profit. The deception model describes a process of involvement of emotions before making a decision on opening a trade.

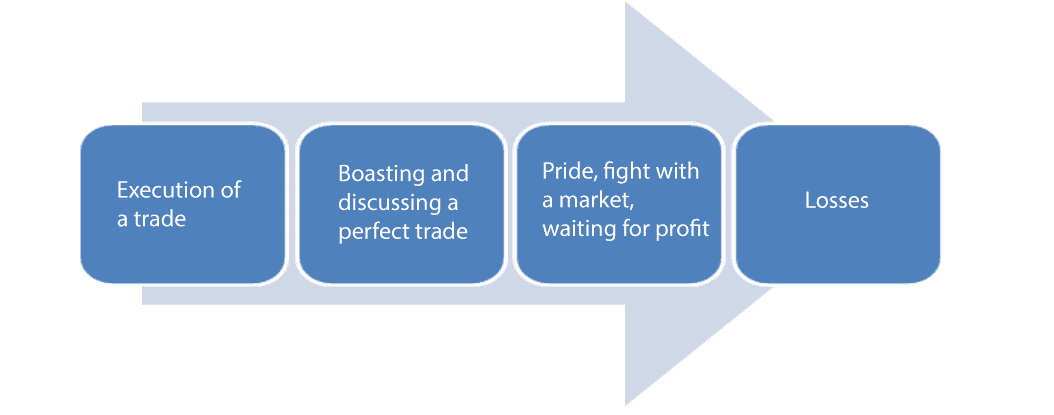

The illusion model. A trader makes a decision, executes a trade and tells everybody how smart he is if the position moves towards him. If a position goes against the trader, he starts to fight with the market, since the market is wrong. And all around admire the firmness of the trader with an adverse position. This model describes a process of involvement of emotions after execution of a trade.

Do not forget to check from time to time whether you are a part of one of the above models, and you will avoid emotional decisions.

Psychological mistakes of beginner traders are shown schematically in Picture.

The last type of beginner trader mistakes – money management mistakes.

- Trading on borrowed or the last money immediately involves emotions, such as fear and greed, in trading. Emotional decisions cannot make a beginner trader a professional one (see psychological mistakes of the traders).

- Expectations of high income: it is impossible to calculate a probability of receiving income beforehand. A trading system controls losses and does not forecast profit.

- Opening very big positions inevitably involves emotions.

Conclusions.

Trading is a business with an uncertain future. When working with uncertainty each person has a choice:

- to try to anticipate a situation from the point of view of an engineer, that is to understand and take into consideration a majority of variables in your activity;

- to act as a gambler, that is to derive pleasure from it in the first place;

- to act as a trader, that is to apply a system analysis, knowledge and planning. A trader thinks over possible scenarios of development of future events and determines the order of his actions for each scenario. His goal is to make money.

Successful trading and investments are a result of successful speculations using a progressive trading platform.

And remember: “Trial and error is freedom” Nassim Nicholas Taleb