5 things about Nasdaq-100 index futures. Part 1

Nasdaq-100 index futures belong to the category of index futures contracts, offered by the CME Group. These are the most popular index futures in the market. They are presented by various types of contracts, the first place among which in trading volumes and popularity is taken by E-mini Nasdaq-100 index futures contracts. E-mini Nasdaq-100 futures very similarly repeat dynamics of its underlying asset – Nasdaq-100 index, one of the leading US stock indices.

Compared to the E-mini S&P 500 index futures contracts (ticker: ES), the E-mini Nasdaq-100 index futures contracts are a little bit cheaper when we speak about the tick price. For example, the minimum price change (tick) for the S&P futures is 0.25 and its value is USD 12.50, while for the E-mini Nasdaq-100 contract, with the same tick size, its value is USD 5.00.

Intraday traders and investors may trade Nasdaq-100 futures contracts for speculative purposes or hedging risks relatively easy. All Nasdaq-100 futures contracts are settlement futures and do not envisage physical delivery.

So, let’s get acquainted with 5 things about the Nasdaq-100 index futures contracts any intraday trader should know.

In this article:

- What the Nasdaq-100 index is.

- Various types of the Nasdaq-100 futures available for trading.

What the nasdaq-100 index is?

The Nasdaq-100 futures contract is a financial derivative, the underlying asset of which is the Nasdaq-100 American exchange stock index. This index reflects the composite capitalization of 107 largest companies (not 100 as it might be assumed from the name), which stocks are traded on the Nasdaq exchange. It should be noted that there are no financial organizations among the Nasdaq-100 index companies, that is why it reflects the state of the real production sector very accurately, which makes it very different from the Dow Jones and S&P 500 indices. The Nasdaq-100 index is weighted by capitalization and has an obvious macroeconomic sense, that is why it could be used in macroeconomic forecasts.

The Nasdaq-100 index story started on January 31, 1985, from the mark of 250 points. Foreign companies were admitted to the index in 1998. Initially, requirements to them were strict but they became less strict in 2002. The historic high of above 4,700 points was reached by the index in 2000 on the wave of dotcoms. Apart from futures and options, the Exchange-Traded Fund (ETF) is also available for traders and in the Nasdaq case it is the most popular fund in the US – PowerShares QQQ ETF (ticker: QQQQ).

The Nasdaq Exchange has never had a trading floor with a crowd of brokers, since, originally, it focused on high technologies. It managed to attract to its platform such fast-growing companies as Microsoft, Apple, Cisco, Oracle and Dell, modernizing the Initial Public Offering (IPO).

Do not confuse the Nasdaq-100 index with the Nasdaq Composite index. The main difference between these two indices lies in the fact that the Nasdaq Composite index reflects total capitalization of all companies that are traded on the Nasdaq Stock Exchange, while the Nasdaq-100 index reflects total capitalization of only the first 107 companies, which are listed in the decreasing order on the basis of the size of their capitalization.

There are also other indices. For example, the Nasdaq Financial-100 index (ticker: IXF) reflects total capitalization of the financial sector companies, except for the banks and insurance companies, which have their own indices: Nasdaq Bank (ticker: IXBK) and Nasdaq Insurance (ticker: IXIS) respectively.

The Nasdaq-100 index is a sub-index in relation to the Nasdaq Composite index and each of them has its own ticker. The ticker of Nasdaq Composite is ^IXIC and of Nasdaq-100 is ^NDX.

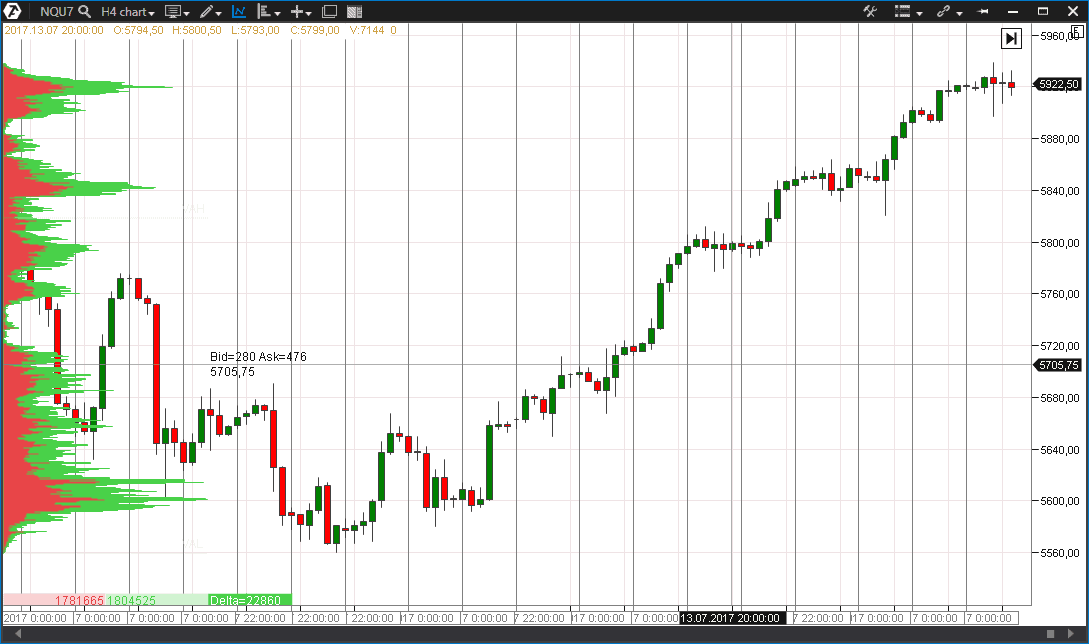

The chart below shows comparison of Nasdaq-100 and Nasdaq Composite. As you can see, there is a close direct correlation between them.

Various types of nasdaq-100 futures available for trading

When we speak about the Nasdaq-100 futures market, the first thing that comes to the mind is a Nasdaq mini contract. However, futures traders may select from a multitude of other contracts. For example, Nasdaq Biotech index futures (for medical and pharmaceutical companies) or standard and even ‘big’ Nasdaq-100 futures contracts.

Without doubt, E-mini Nasdaq-100 futures contracts are the most popular ones. These contracts are traded under the NQ ticker and have the lowest margin requirements, thus attracting many intraday traders. The minimum price change (tick) for the E-mini Nasdaq-100 futures contract is 0.25 and its cost is USD 5.

The day margin requirement for this mini contract is within USD 1,000 and may differ depending on the futures broker rules. At the same time, the CME margin requirements are USD 3,500 as a guarantee collateral and USD 2,800 as a supporting margin (the minimum balance on the trading account).

The second most popular one is the standard Nasdaq futures mini contract. This contract is traded under the QCN ticker. It is very similar to the E-mini Nasdaq-100 (NQ), but differs by the tick size and its cost. The QCN Nasdaq-100 contract is two times bigger than the mini contract, which means that its minimum price change (tick) is 0.50 and the tick cost is USD 10.00. Due to a big tick size and cost, the CME Group margin requirements are USD 4,000 as a guarantee collateral for a futures contract and USD 3,200 as a supporting margin (the minimum balance on the trading account).

Without doubt, the ’big’ Nasdaq-100 futures contracts (ticker: ND) are not very popular among intraday retail traders. As it follows from the name, these are really huge contracts, which are more suitable for major players or hedge funds rather than retail traders. The minimum price change (tick) for the ‘big’ Nasdaq-100 futures contract is 0.25 and its cost is USD 25. The CME Group margin requirements are USD 17,500 as a guarantee collateral for a futures contract and USD 14,000 as a minimum balance on the trading account.

Last, we would like to mention the profile biotech futures contracts, which are called E-mini Nasdaq Biotechnology futures contracts. They are traded under the BIO ticker (Globex) and very similarly repeat the Nasdaq Biotechnology index (ticker: IBB) dynamics. The minimum price change (tick) for the Nasdaq Biotech futures contract is 0.10 and its cost is USD 5. The CME Group margin requirements for this type of contracts are USD 3,750 as a guarantee collateral for a futures contract and USD 3,000 as the minimum balance on the trading account.

Check our blog for new publications in order to get more information about the Nasdaq index futures. See you soon!